by Russell Noga | Updated August 26th, 2023

Are you seeking comprehensive coverage for your healthcare needs without breaking the bank? Look no further than American Republic Medicare Plan G.

Are you seeking comprehensive coverage for your healthcare needs without breaking the bank? Look no further than American Republic Medicare Plan G.

This plan offers extensive coverage for gaps in Original Medicare, including hospital costs, blood transfusions, hospice care, and skilled nursing services, making it an affordable alternative to Plan F.

Join us as we explore the features, background, and enrollment process for American Republic Medicare Supplement Plan G for 2024.

In this article, you’ll learn about the coverage and benefits of American Republic Medicare Plan G, its advantages over other Medigap plans, the company’s history and financial stability, as well as how to enroll and save on out-of-pocket costs.

Get ready to discover a healthcare plan that meets your needs and budget.

Short Summary

- American Republic Medicare Plan G is a comprehensive and affordable health insurance plan.

- It covers most expenses not covered by Original Medicare, with the exception of the Part B deductible.

- American Republic offers additional Medigap plans to help beneficiaries find the best coverage for their healthcare needs and financial situation.

Understanding American Republic Medicare Plan G

American Republic Medicare Plan. G is a popular choice for individuals who require frequent medical assistance due to its comprehensive coverage and affordability. The cost of American Republic Medicare Supplement Plan G varies depending on factors such as location and age, but it typically ranges from $100 to $300 per month.

American Republic Insurance Services is well-regarded for providing quality health insurance, including Medigap coverage and exemplary service.

Plan G Coverage

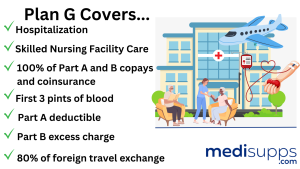

Plan G is a Medicare supplement plan that covers a broad range of healthcare costs, including hospitalization, skilled nursing facility care, as well as Part A deductibles and coinsurance. This comprehensive plan covers most expenses not covered by Original Medicare, providing peace of mind through its extensive Medicare coverage.

However, it’s important to note that Plan G does not encompass the Part B deductible.

Comparing Plan G to Other Medigap Plans

American Republic Medicare Plan G strikes a balance between affordability and comprehensive coverage, making it a favored selection among beneficiaries.

It includes coverage for Medicare Part A and Part B coinsurance, copayments, and deductibles, as well as additional benefits such as emergency medical care while traveling abroad.

When compared to other Medigap plans, Plan G is generally more cost-effective. For example, Plan F offers a greater range of benefits but is more costly.

In summary, Plan G is widely admired for its combination of affordability and comprehensive coverage among Medicare Supplements, making it a popular Medigap plan choice.

Discover 2024 Plans & Rates

Enter Zip Code

American Republic Insurance Company Background

American Republic Insurance Company Background

Founded in 1929, American Republic Insurance Company has a long history of providing health and accident insurance to seniors in 33 U.S. states. With over 85 years of experience, American Republic has become a trusted name for Medicare Supplement services.

The company’s commitment to remaining customer-centric and market-oriented has allowed it to continuously adapt and offer supplemental Medicare plans that cater to the changing needs of beneficiaries.

This dedication to servicing seniors has made American Republic a top choice for Medicare Supplement insurance.

Financial Strength and Stability of American Republic

A strong financial rating is crucial for an insurance company, as it reflects competitive rates and reliable claim processing. While specific information about American Republic’s Financial Strength Rating is not available, making your request unsuccessful, it is important to consider this aspect when choosing a Medicare Supplement plan.

Consulting a certified insurance agent or broker representing American Republic can provide more information on the company’s financial stability and offer a free quote.

How to Enroll in American Republic Medicare Plan G

Enrolling in American Republic Medicare Plan G is a straightforward process. A licensed insurance agent can guide you through eligibility requirements and enrollment periods, ensuring a smooth experience.

These agents can also provide coverage information on American Republic and other options for your consideration.

Eligibility Requirements

Eligibility Requirements

To be eligible for American Republic Plan G, beneficiaries must be at least 65 years old and enrolled in Medicare Parts A and B. This plan is available to Medicare beneficiaries in Missouri who meet these requirements.

By ensuring you meet the eligibility criteria, you can confidently proceed with enrolling in American Republic Plan G.

Enrollment Periods

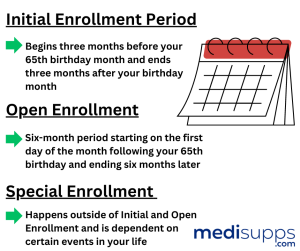

Various enrollment periods exist for American Republic Medicare Plan G. The Initial Enrollment Period is a seven-month window that begins three months before the month of your 65th birthday, includes the month of your birthday, and ends three months after your birthday month.

Various enrollment periods exist for American Republic Medicare Plan G. The Initial Enrollment Period is a seven-month window that begins three months before the month of your 65th birthday, includes the month of your birthday, and ends three months after your birthday month.

The Open Enrollment Period is a six-month period starting on the first day of the month following your 65th birthday and ending six months later.

Special enrollment periods refer to intervals outside of the Initial and Open enrollment periods when you can enroll in a Medicare plan. These periods are contingent on individual circumstances, such as losing employer-sponsored coverage or moving to a new service area.

Out-of-Pocket Costs and Savings with American Republic Plan G

While out-of-pocket costs associated with American Republic Medicare Plan G may vary depending on the specific plan and location, it generally covers the same benefits as traditional Medicare and has a limit on out-of-pocket costs.

While out-of-pocket costs associated with American Republic Medicare Plan G may vary depending on the specific plan and location, it generally covers the same benefits as traditional Medicare and has a limit on out-of-pocket costs.

Once the out-of-pocket threshold is reached, the plan will cover all additional costs for covered services. This can help provide financial security and predictability in your healthcare expenses.

American Republic Plan G can aid in decreasing out-of-pocket expenses for beneficiaries, providing considerable savings in comparison to other Medigap plans.

For more detailed information regarding out-of-pocket expenses, it is suggested to contact American Republic directly or consult their official website.

Customer Reviews and Testimonials

Customer reviews and testimonials for American Republic Medicare Plan G can be found on various websites, including:

- ConsumerAffairs

- Expert Insurance Reviews

- Medicare Advantage

- Glassdoor

- Trustpilot

These reviews offer valuable insights into the experiences of other beneficiaries, helping you make an informed decision about your healthcare coverage.

Many customer reviews highlight American Republic’s commitment to providing exemplary customer service, competitive rates, and comprehensive coverage options. By considering the experiences of others, you can feel confident in choosing American Republic Medicare Plan G for your healthcare needs.

Compare Medicare Plans & Rates in Your Area

Additional Medicare Supplement Insurance Options from American Republic

In addition to Plan G, American Republic offers a variety of Medicare Supplement Insurance options, including Plans F and N, to cater to the diverse needs of beneficiaries. By exploring these additional options, you can ensure you choose the best Medicare Supplement plan for your unique healthcare requirements and financial situation.

With a range of Medicare Supplement Plans available, finding the right coverage has never been easier.

Summary

In conclusion, American Republic Medicare Plan G offers comprehensive coverage and affordability, making it an ideal choice for individuals seeking to bridge the gaps in Original Medicare.

With its extensive coverage, competitive rates, and strong reputation, American Republic Insurance Services stands out as a top choice for Medicare Supplement insurance.

Take control of your healthcare expenses and secure your peace of mind by considering American Republic Medicare Plan G for your healthcare needs.

Take control of your healthcare expenses and secure your peace of mind by considering American Republic Medicare Plan G for your healthcare needs.

With the help of a licensed insurance agent, you can easily navigate the enrollment process and make the best decision for your health and well-being.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is American Republic Medicare Plan G?

American Republic Medicare Plan G is a comprehensive Medicare supplement insurance plan offered by American Republic Insurance Company. It helps cover the gaps left by Original Medicare, including deductibles, copayments, and coinsurance, providing individuals with greater financial security for their healthcare needs.

How does American Republic Medicare Plan G differ from other plans?

American Republic Medicare Plan G offers extensive coverage, including coverage for Medicare Part A and B deductibles, skilled nursing facility coinsurance, and excess charges. This makes it a popular choice for individuals seeking comprehensive coverage.

What medical expenses does American Republic Medicare Plan G cover?

Plan G covers Medicare Part A hospital coinsurance, Part B medical coinsurance, blood transfusion costs, hospice care coinsurance, and more. It also covers 80% of foreign travel emergency expenses.

Can I visit any doctor or hospital with American Republic Medicare Plan G?

Yes, Plan G allows you the freedom to choose any doctor or hospital that accepts Medicare patients. There are no restrictive networks, giving you flexibility in your healthcare choices.

Is there a network restriction for American Republic Medicare Plan G?

No, Plan G does not require you to use a specific network of healthcare providers. You have the freedom to see any doctor or specialist that accepts Medicare.

How does the pricing structure of American Republic Medicare Plan G work?

The pricing for Plan G can vary based on factors such as your age, location, and health status. Premiums are typically paid monthly, providing you with consistent coverage throughout the year.

Is American Republic Medicare Plan G available in all states?

American Republic Medicare Plan G availability may vary by state. It’s essential to check with the company or a licensed insurance agent to confirm whether the plan is available in your state.

Can I switch to American Republic Medicare Plan G from another Medicare plan?

Yes, you can switch to American Republic Medicare Plan G from another Medicare plan, but it’s crucial to consider the timing and any potential waiting periods. Consult with an insurance expert to navigate the process seamlessly.

Are prescription drugs covered under American Republic Medicare Plan G?

Prescription drug coverage is not included in Plan G. If you need prescription drug coverage, you may want to consider enrolling in a separate Medicare Part D prescription drug plan.

How do I enroll in American Republic Medicare Plan G?

To enroll in American Republic Medicare Plan G, you should contact American Republic Insurance Company directly or work with a licensed insurance agent. They will guide you through the enrollment process and provide you with all the necessary information to make an informed decision about your healthcare coverage.

Find the Right Medicare Plan for You

Finding the ideal Medicare plan doesn’t have to be stressful. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!