by Russell Noga | Updated June 19th, 2023

Are you looking for a comprehensive and affordable Medicare Supplement plan to fill the gaps in your Original Medicare coverage?

Look no further, because Aetna Medicare Supplement Plan N might be the perfect solution for you.

In this article, we will delve into the details of Plan N, its coverage, eligibility requirements, pricing, and additional benefits, as well as how it compares to other Aetna Medicare Supplement plans.

Then you will have a clearer understanding of whether Plan N is the right choice for your healthcare needs.

Short Summary

- Aetna Medicare Supplement Plan N provides comprehensive coverage in 44 states and Washington, D.C., including Part A and B coinsurance/copayments, the first three pints of blood, and hospice care coinsurance.

- It is more affordable than Plan F but does not cover the Medicare Part B deductible or excess charges. It offers lower premiums with higher copays compared to Plan G.

- Enrollment Periods include Initial Enrollment Period (IEP), Annual Election Period (AEP) & Special Election Period (SEP).

What Does Aetna Medicare Supplement Plan N Cover?

Aetna Medicare Supplement Plan N is designed to cover most of the gaps in Original Medicare, including Part A coinsurance and copayments, Part B coinsurance and copayments, and the first three pints of blood.

As a well-established health insurance company, Aetna offers Aetna Medicare Supplement Insurance plans in 44 states and Washington, D.C., providing the same standard benefits as other Medicare Supplement Insurance companies, but with the added advantage of being an Aetna member.

The focus of Aetna Health Insurance Company, a subsidiary of a prominent life insurance company, Aetna Life Insurance Company, is on empowering its members to make informed decisions about their healthcare, ensuring they choose the most suitable plan for their needs.

With Aetna’s favorable ratings compared to other carriers and a high percentage of premiums spent on member benefits, you can be confident in your decision to select Aetna Medicare Supplement Plan N.

Coverage Details

Aetna Medicare Supplement Plan N has earned an A rating from AM Best and a 73/100 score from the American Customer Satisfaction Index, reflecting the company’s commitment to providing excellent coverage and customer service.

With Plan N, you can expect coverage for Medicare Part A coinsurance and copayments, Part B coinsurance and copayments, and the first three pints of blood.

In addition to these standard benefits, Plan N also covers hospice care coinsurance, which is part of the Original Medicare benefits.

It’s important to note that Plan N does not cover the Medicare Part B deductible or excess charges. However, the overall coverage provided by Aetna Medicare Supplement Plan N ensures that you can have peace of mind knowing that the majority of your healthcare costs are covered.

Eligibility Requirements

To be eligible for Aetna Medicare Supplement Plan N, you must be enrolled in both Medicare Part A and Part B and reside in the service area of the plan.

Aetna offers a six-month enrollment window to their new Medicare members for Medicare Supplement plans. This window allows enrollees to join the plan without having to answer any health-related questions. It is commonly referred to as the Aetna Senior Supplement.

This period begins six months before your Medicare Part B becomes active and ends six months after you turn 65 years of age. Enrolling in an Aetna Medicare Supplement plan after the open enrollment period has concluded may require answering certain medical questions.

This is dependent on the state where you live.

View the Plans

Comparing Aetna Medicare Supplement Plans

When choosing a Medicare Supplement plan, it’s essential to compare your options to ensure that you get the best coverage at the most advantageous price.

A Medicare Supplement Insurance Plan, such as Plan N, is a more affordable option than Plan F and Plan G but does not cover the Part B deductible or excess charges.

In the following sections, we will compare Aetna Medicare Supplement Plan N to other Aetna plans, including Plan F, Plan G, and Plan D, to provide you with a clear understanding of the differences between each plan and help you make an informed decision.

Medicare Plan N vs. Plan F

The primary differences between Aetna Medicare Supplement Plan N and Plan F are that Plan F covers the Medicare Part B deductible and Medicare Part B excess charges, while Plan N does not.

However, it’s important to note that Plan F is not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020, due to the Medicare Access and CHIP Reauthorization Act of 2015.

In terms of cost, Plan N is more affordable than Plan F, yet it does not provide coverage for the Part B deductible or excess charges.

If you are eligible for Plan F and are willing to pay higher premiums for more comprehensive coverage, Plan F may be a better choice for you.

However, if you prefer lower premiums and can manage the additional out-of-pocket costs for the Part B deductible and excess charges, Plan N could be a more suitable option.

Medicare Plan N vs. Plan G

When comparing Aetna Medicare Supplement Plan N to Plan G, the main difference is that Plan N offers lower premiums but higher copays than Plan G.

While Plan N does not cover the Part B deductible or excess charges, it is still a more affordable option than Aetna Medigap Plan G.

The most suitable plan for you depends on the frequency of your medical visits and your personal preferences regarding premiums and copays.

If you prefer lower premiums and are comfortable with higher copays, Plan N might be the right choice for you. On the other hand, if you are willing to pay higher premiums for a plan with lower copays, Plan G could be a better fit.

Medigap Plan N vs. Plan D

Aetna Medicare Supplement Plan N and Plan D both provide coverage for the Medicare Part A deductible, coinsurance for Parts A and B, including Medicare Part B coinsurance, three pints of blood, and 80% of medical costs incurred during foreign travel.

However, Plan N does not cover the Medicare Part B deductible, and its copays do not contribute to meeting the Part B deductible, unlike Plan D.

In terms of cost, Plan N offers lower premiums and higher copays, while Plan D is a mid-cost alternative that covers most Medigap benefits. Depending on your healthcare needs and budget, you can decide which plan is the most suitable for you.

Pricing and Rate Increases

As mentioned earlier, the average monthly premiums for Aetna Medigap Plan N can range from $75 to $200, depending on various factors such as state, age, and gender.

For example, a 65-year-old female nonsmoker may have an average monthly premium of $100, but this amount may be different for someone of a different age or residing in another state.

It’s crucial to understand that these average costs are just an estimate and that your specific premium may be higher or lower depending on your individual circumstances.

To get a more accurate estimate of your potential monthly premium for Aetna Medicare Supplement Plan N, it’s best to speak with a licensed insurance agent who can provide personalized quotes based on your situation.

Rate Increases

Rate increases for Aetna Medigap Plan N are not set in stone and can fluctuate year to year, with the potential for increases of up to 10% annually. These rate increases can be unpredictable, making it essential for you to be prepared for potential changes in your monthly premium.

Rate increases for Aetna Medigap Plan N are not set in stone and can fluctuate year to year, with the potential for increases of up to 10% annually. These rate increases can be unpredictable, making it essential for you to be prepared for potential changes in your monthly premium.

Understanding the possibility of rate increases can help you budget for your healthcare expenses more effectively and ensure that you are prepared for any fluctuations in your premium costs.

It’s also helpful to regularly review your plan and compare it to other options available to you to ensure that you continue to have the best coverage at the most advantageous price.

Additional Benefits and Discounts

In addition to the standard benefits provided by Aetna Medicare Supplement Plan N, the plan offers a variety of additional benefits and discounts to enhance your healthcare coverage. These include discounts on hearing and vision exams, hearing aids, eyewear, and wellness products.

Aetna also offers household discounts for eligible applicants, providing an opportunity for you and your spouse or other adult household member to save on your monthly premiums. These additional benefits and discounts can make Aetna Medicare Supplement Plan N an even more attractive option for those seeking comprehensive and affordable healthcare coverage.

Wellness Programs

While the Aetna Medicare Supplement Plan covers Medicare and Medicaid benefits, Plan N does not specifically offer wellness programs.

While the Aetna Medicare Supplement Plan covers Medicare and Medicaid benefits, Plan N does not specifically offer wellness programs.

Medigap Plan N does provide coverage for essential healthcare services and discounts on additional benefits such as hearing and vision exams, hearing aids and batteries, eyewear, and other health and wellness products.

By taking advantage of these additional benefits, you can enhance your Medicare coverage and enjoy a more comprehensive healthcare experience.

Household Discounts

Aetna Medicare Supplement Plan N provides a premium household discount of up to 7% for eligible applicants.

Aetna Medicare Supplement Plan N provides a premium household discount of up to 7% for eligible applicants.

To qualify for this discount, you and your spouse, civil union partner, or other adults with whom you have resided for at least 12 months must both enroll in or already be enrolled in an Aetna Medigap plan.

This household discount can help make Aetna Medicare Supplement Plan N even more affordable and appealing for those seeking comprehensive healthcare coverage for both themselves and their loved ones.

How to Enroll in Aetna Medicare Supplement Plan N

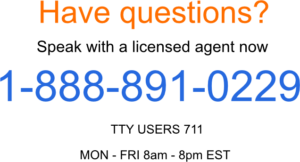

Enrolling in Aetna Medicare Supplement Plan N is a straightforward process. To begin, simply call us today at 1-888-891-0229 to speak with one of our licensed insurance agents who will help you find the plan that best suits your needs.

You can enroll in Aetna Medicare Supplement Plan N during your Initial Enrollment Period (IEP), which spans seven months, starting three months before your 65th birthday and ending three months after.

If you miss this enrollment window, you may still have an opportunity to enroll depending on your current situation. We can help.

Enrollment Periods

Understanding the various enrollment periods for Aetna Medicare Supplement Plan N can help ensure that you enroll at the most advantageous time.

As mentioned earlier, the Initial Enrollment Period (IEP) lasts for seven months, starting three months before your 65th birthday and ending three months after.

In addition to the IEP, there is the Annual Election Period (AEP) held annually from October 15 to December 7, during which you can make changes to your plan.

Lastly, there is the Special Election Period (SEP), which allows you to make changes to your plan outside of the IEP and AEP if you experience a qualifying life event, such as moving to a new state or losing coverage from an employer.

Frequently Asked Questions

What is Medicare Plan N?

Medicare Plan N is a type of Medicare Supplement plan that provides coverage for out-of-pocket costs not covered by Original Medicare. It offers a comprehensive set of benefits, including coverage for hospitalization, medical services, skilled nursing facility care, and more.

Who can enroll in Plan N?

To be eligible for Medicare Plan N, individuals must already be enrolled in Medicare Part A and Part B. Generally, anyone who meets the requirements for Medicare Supplement plans can enroll in Plan N, regardless of their health condition or pre-existing conditions.

What is the difference between Plan G and Plan N?

The main difference between Medicare Plan G and Plan N lies in how they handle certain costs. Plan G covers all Medicare Part A and B deductibles, while Plan N requires beneficiaries to pay the Part B deductible and copayments for certain doctor visits and emergency room visits. Plan G offers more comprehensive coverage than Plan N.

What is the difference between a Medicare Advantage plan and Plan N?

Medicare Advantage plans, also known as Medicare Part C, are an alternative to Original Medicare and Medicare Supplement plans. Unlike Plan N, Medicare Advantage plans are not Medicare Supplement plans but instead, they provide all-in-one coverage that combines hospital, medical, and sometimes prescription drug coverage in a single plan.

What companies offer Plan N?

Many insurance companies offer Medicare Supplement Plan N, including well-known companies such as Allstate, Cigna, Blue Cross Blue Shield, Humana, and Mutual of Omaha. It’s important to compare plans and prices from different insurers to find the best Plan N for your needs.

Does Plan N cover prescription drugs?

Medicare Plan N does not include coverage for prescription drugs. To obtain coverage for prescription medications, beneficiaries need to enroll in a standalone Medicare Part D prescription drug plan. This will help cover the costs of prescription drugs.

Can I use my Medicare Plan N coverage when traveling outside the United States?

Medicare Plan N provides limited coverage for emergency medical services received during foreign travel. It covers 80% of emergency care received outside of the U.S. after meeting a deductible, up to the plan’s limits. However, it’s advisable to check with your specific insurance provider regarding the coverage details and limitations for foreign travel emergencies.

Are pre-existing conditions considered when enrolling in Plan N?

During the Medigap Open Enrollment Period, insurance companies cannot deny you coverage or charge higher premiums based on pre-existing conditions. However, if you apply for Plan N outside of this period, insurance companies may consider your pre-existing conditions and could charge higher premiums or impose waiting periods.

Can I switch from a Medicare Advantage plan to Plan N?

Yes, if you are currently enrolled in a Medicare Advantage plan and wish to switch to Medicare Plan N, you have the option to do so. However, it’s important to note that you need to disenroll from your Medicare Advantage plan and return to Original Medicare before you can enroll in a Medicare Supplement plan like Plan N.

Does Plan N require referrals or prior authorization for specialists?

No, Medicare Plan N does not require referrals or prior authorization to see specialists. You have the freedom to choose and visit any specialist who accepts Medicare patients without the need for a referral or obtaining prior authorization. This provides flexibility and convenience in managing your healthcare needs.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.