by Russell Noga | Updated May 8th, 2023

Are you looking for a Medigap supplemental insurance plan? It’s a good move. Medigap can assist you with covering the shortfalls in medical expenses left behind by Original Medicare Parts A & B. Unlike Medicare, a Federally funded program, Medigap insurance is available as supplemental over from private healthcare insurance companies.

That means that while the Federal government regulates the benefits offered in plans from private insurers, they don’t have any say in how insurers set premiums or offer plans.

Each insurance company offers the exact same Medicare Supplement plans and benefits, yet they all charge different rates for them.

If you’re wondering where to buy Medicare Supplement insurance online, then you’ve come to the right place! We’ve helped people for over 15 years with their Medigap insurance.

Use our FREE Quote Engine

There’s only one way to shop for Medicare supplement insurance online. You’ll need to get quotes from several companies in your state and assess the coverage and additional benefits they offer before settling on the right firm for your policy.

By entering your zip code anywhere on this page, you can see quotes for the most popular Medigap plans in your area.

Or, call us now at 1-888-891-0229 to speak to one of our licensed agents today.

What Is Medigap & What Does It Cover?

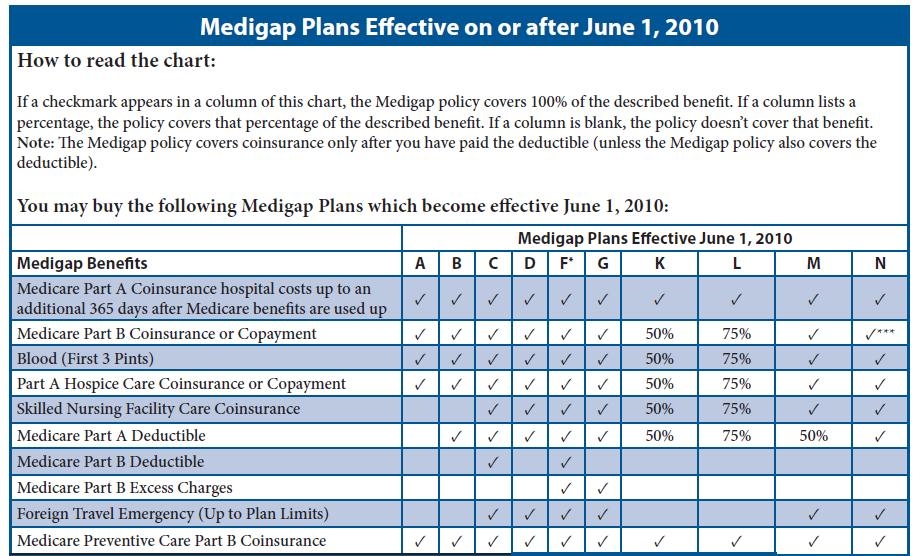

Medigap plans come in ten different options. All plans offer varying levels of coverage for your inpatient and outpatient medical expenses not fully covered by Original Medicare. Some plans are more comprehensive, so they come with more expensive monthly premiums.

Medicare Supplement Insurance Companies

Below are just a few of the top insurance companies that we represent. We’re an independent agency that shops companies in your area each year to make sure you don’t over pay on your coverage.

And our service is entirely FREE.

United Healthcare

Discounts – Discounts for household members, ETF transfers, and annual premium payments.

Additional Features – Online mental health program.

AARP (UnitedHealthcare) is the leader in low-cost Medigap plan providers, with excellent third-party ratings for financial strength and customer satisfaction. You get the best pricing on the standard plan G in most states, with the high-deductible plan available.

Pros

- The highest NCQA rating of all Medigap providers.

- AM Best A+ financial strength rating.

- 24/7 nurse line.

- Generous household discount.

Cons

- Medigap plans are only available to AARP members.

- No options for high-deductible plans or Plans M & D.

Blue Cross Blue Shield

Discounts – 5% household discount and Wellness programs.

Additional Features – Plan G “Plus” for vision, dental, and hearing coverage.

Blue Cross Blue Shield offers an inclusive range of Medigap plans covering all categories. You get access to a Wellness Program for additional benefits, discounts, and decent rates on most plans in most states.

Pros

- Offers all Medigap plans.

- Optional hearing, dental, and vision coverage through Plan G+

- Excellent discount programs.

Cons

- Availability of plans varies by state.

Mutual of Omaha

Discounts – Discounts on hearing, vision, and fitness programs.

Up to a 12% household discount in many states

Additional Features – Dental insurance provided.

Mutual of Omaha is one of the lowest-cost providers of Medigap plans, but it’s only available in select states. It offers the best pricing on the high-deductible Plan G.

Pros

- Offer the high-deductible Plan G in most states.

- Excellent financial strength rating from AM Best.

- Offers beneficiaries dental insurance, Part D prescription coverage, and discount programs.

Cons

- Customer support is only available during business hours, Monday to Friday.

- Only available in select states.

Compare Medicare Plans & Rates in Your Area

Humana

Discounts Available – Household, automatic payments, and online discounts of up to 6% are available.

Additional Features – Live chat for customer support 24/7,

Humana is one of the best options for the high-deductible Plan G. The company also has a generous discount for enrolling online. However, online enrollment is challenging in some states.

Pros

- Lower-than-average pricing on the high-deductible Medigap Plan G.

- Discount for enrolling online.

Offers

- a wide range of Medigap plans.

- Part D plans covering prescriptions available.

- Live support chat.

Cons

- Higher than average pricing for the standard Medigap Plan G.

Aetna

Discounts – not readily advertised online.

Additional Features – High levels of customer satisfaction.

Aetna is one of the best-rated firms for Medigap cover. It has excellent financial stability and reinvests most of the premiums it collects into member benefits.

Pros

- The highest AM Best financial strength rating.

- Fewer complaints than average from consumers, as per data from NAIC.

- Competitive premiums

Cons

- Limited access to information without an agent guiding you.

Allstate

Discounts – Up to 25% stackable discounts

Additional Features – High levels of customer satisfaction.

Allstate is one of the most well-known names in the insurance industry. It has excellent financial stability with an A+ A.M. Best Financial rating

Pros

- The highest AM Best financial strength rating.

- Massive stackable discounts

- Highly competitive premiums

Cons

- Limited access to information without an agent guiding you.

A Step-By-Step Guide to Buying a Medigap Policy

Step 1 – Settle on the Right Plan for Your Healthcare Requirements

The first step in the process is deciding on the right Medigap plan to suit your healthcare requirements. Our team offers you a free consultation to discuss your needs. We’ll match your requirements with the right plan to ensure you’re not over or under-insured.

Step 2 – Assess the Insurers in Your State

There are dozens of private insurers offering premiums in states across America. Some providers don’t operate in all states. So, you’ll need to uncover the insurers operating in your region and get quotes from them. We’ll assist you with this task.

Step 3 – Compare Premiums for Leading Insurers

Every insurer offers a different premium for the plan you want. Your age, gender, and smoking status play a role in your premium costs. However, where you live in the US also factors into your premium costs. That’s why it’s important to shop around and get multiple quotes. Leave it to us, and we’ll get you the best premium in your state.

Step 4 – Buy Your Medigap Policy

After making your decision on the right Medigap provider and plan, buy your policy. If you apply in the “Open Enrollment window” in the first six months after your 65th birthday, the insurer has to accept your application.

You get a Medigap plan, even if you have a pre-existing medical condition. The insurer might subject you to medical underwriting if you wait outside this window. If they discover you have a pre-existing condition, they might increase your premium, deny your coverage, or make you endure a waiting period before activating your coverage.

Speak to us, and we’ll ensure you get the best plan and optimal enrollment for your Medigap policy.

Frequently Asked Questions

What is the ideal timing to purchase a Medicare Supplement plan?

The optimal time to buy a Medicare Supplement plan is during your Medigap Open Enrollment Period. This six-month window begins on the first day of the month you turn 65 or older and are enrolled in Medicare Part B. During this period, you have the benefit of guaranteed issue rights, preventing insurance providers from refusing coverage based on health status or charging more for pre-existing conditions.

Why should I use your website to compare Medicare Supplement plans?

Our website provides a comprehensive comparison of various Medicare Supplement plans from multiple insurance companies. Using our platform, you can easily evaluate different plans based on coverage, cost, and additional benefits, ensuring you get a plan that best suits your healthcare needs and budget.

How can your agents assist me in choosing a Medicare Supplement plan?

Our knowledgeable agents can provide personalized assistance, helping you navigate the complexities of Medicare Supplement plans. They can answer your questions, provide information about different plan options, and guide you through the application process, making it easier for you to make an informed decision.

How can I save money on a Medicare Supplement plan?

You can save money on a Medicare Supplement plan by comparing quotes from various insurance providers on our website. Each insurance company sets its own premiums, so prices for the same plan can vary significantly. Shopping around and comparing rates is one of the best ways to save. As well, we can help compare all the various discounts available from companies to save you the most money.

What factors should I consider when shopping for a Medicare Supplement plan?

When looking for a Medicare Supplement plan, you should consider the level of coverage you need, the cost of premiums, and the insurance company’s reputation. Our agents can help you evaluate these factors and choose the plan that best meets your needs.

Can I change my Medicare Supplement plan if I find a better rate?

Yes, you can change your Medicare Supplement plan at any time. However, switching outside of your Medigap Open Enrollment Period may result in medical underwriting, potentially leading to higher premiums or denial of coverage based on health conditions.

Why is it essential to compare Medicare Supplement plans from different companies?

Since the coverage for Medicare Supplement plans is standardized, the main difference lies in the cost. Each insurance company can set its own premiums, so the price for the same plan can vary significantly between companies. Comparing plans on our website can help you find the best rate for your chosen coverage.

What is the difference between Medicare Advantage and Medicare Supplement plans?

While Medicare Advantage plans to serve as an alternative to Original Medicare and often include additional benefits, Medicare Supplement plans to enhance Original Medicare by covering extra costs such as deductibles and coinsurance. Our agents can help you understand the differences and choose the right plan for you.

Are Medicare Supplement plans going to change in 2024?

Medicare Supplement plans in 2024 are not changing in benefits, and no new plans are being added. It’s likely that companies may change their premiums, but they do not typically raise or lower them just because it’s a new year.

Can I have a Medicare Supplement plan and a Medicare Advantage plan at the same time?

It’s not possible to have both a Medicare Advantage plan and a Medicare Supplement plan simultaneously. If you have a Medicare Advantage plan and want to switch to a Medicare Supplement plan, our agents can guide you through the process during specific enrollment periods.

Can I buy a Medicare Supplement plan at any time of the year?

While you can apply for a Medicare Supplement plan at any time, the best time to buy is during your Medigap Open Enrollment Period. After this period, you may face medical underwriting and potential coverage denial or increased premiums based on your health status. Our agents can help you understand the best times to buy and switch plans.

Let us Help!

Doing due diligence on the Medigap insurers in your state can be a cumbersome and frustrating process. Why go to the hassle when you can have us do it for you? Our team of fully licensed, professional agents works with all the Medigap insurers. We’ll do the work for you and find the Medigap plan you want with the lowest premiums in your state.

Reach out to us right now at 1-888-891-0229 to connect with an agent. We’ll discuss your healthcare needs, recommend a Medigap plan to suit your requirements and source you the lowest cost premium on your Medigap plan.

Or you can use the calculator on our site to get an automated quote for your Medigap plan. If you don’t have time to call right now, fill out the contact form on this site. We’ll have a qualified agent call you back to discuss your needs.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.