by Russell Noga | Updated August 24th, 2023

Can I Change Medicare Supplement Plans Anytime

Navigating the complexities of Medicare Supplement plans 2024 may seem daunting at first. But with the right guidance and information, you can make informed decisions to improve your healthcare experience.

In this blog post, we’ll explore the ins and outs of Medicare Supplement plans, addressing the common question, “Can I change Medicare Supplement plans anytime?”, changing options, and providing helpful tips for navigating the process.

Let us help you take control of your healthcare and make the most of your Medicare coverage.

Short Summary

- Understanding Medicare Supplement Plans and changing options involves familiarizing oneself with the nature of these plans as well as regulations, state-specific rules, and enrollment periods.

- It is possible to change Medicare Supplement plans during certain enrollment periods with certain conditions. Medigap Open Enrollment Period provides an ideal time for plan changes.

- Researching available plans thoroughly & consulting experts can help ensure a successful transition when changing a Medicare Supplement plan.

Understanding Medicare Supplement Plans and Changing Options

Medicare Supplement plans, also known as Medigap policies, serve as a lifeline for many individuals by covering costs not included in Original Medicare.

These plans, offered by a Medigap insurance company, provide valuable financial assistance for copayments, coinsurance, and deductibles, ensuring comprehensive health coverage without breaking the bank.

But just like any insurance plan, there may come a time when you wish to change your Medicare Supplement plan. Perhaps you desire better benefits, lower premiums, or you’re facing a discontinued policy. To make an informed decision, you first need to fully understand the nature of these plans and the reasons for changing them.

What is a Medicare Supplement plan?

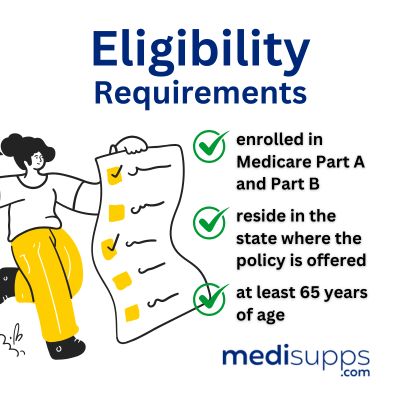

A Medicare Supplement insurance plan is designed to fill the gaps left by Original Medicare, offering additional coverage and financial support. The optimal time to enroll in a Medigap policy is during your initial enrollment period, which is when you turn 65.

But even if you’re already enrolled in a Medigap plan, you might feel the need to switch Medigap policies. This could be due to various reasons, such as better benefits, lower costs, or even a policy discontinuation. It’s important to consider all your options and weigh the pros and cons before making any changes.

Reasons for changing Medicare Supplement plans

There are several reasons you might want to change your Medicare Supplement plan:

- enhanced benefits

- decreased premiums

- or terminated policies are some common causes for switching Medigap plans

However, it’s essential to know that changing plans may come with certain challenges, such as medical underwriting and waiting periods.

To ensure a smooth transition and avoid any unpleasant surprises, it’s important to be aware of the federal regulations and state-specific rules that govern changing or switching Medigap plans.

Compare 2024 Plans & Rates

Enter Zip Code

Can You Change Medicare Supplement Plans Anytime?

Can you change Medicare Supplement plans anytime? The answer is yes and no. While it’s possible to change plans throughout the year, certain conditions must be met, such as guaranteed issue rights or passing medical underwriting.

Changing plans may also be easier during specific enrollment periods when additional protections are available. Let’s delve into the details of when and how you can change Medicare Supplement plans.

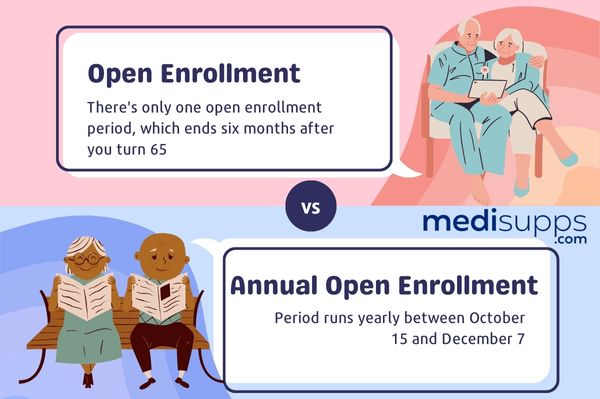

Medigap Open Enrollment Period

One of the best times to change Medicare Supplement plans is during the Medigap Open Enrollment Period. This 6-month window allows you to change plans without undergoing medical underwriting, making the process easier and less stressful.

The Medigap Open Enrollment Period begins the month you turn 65 and are enrolled in Medicare Part B. During this time, insurance companies cannot reject your application or exclude any pre-existing conditions, making it the perfect opportunity to switch plans and explore your options.

Changing plans outside the Open Enrollment Period

Changing plans outside the Open Enrollment Period is possible, but it comes with potential challenges. You may have to undergo medical underwriting, which can lead to increased premiums, limited plan options, or even denial of coverage.

However, there are some exceptions, such as the “trial right” for Medicare Advantage plans, which allows you to try an Advantage plan and switch back to Original Medicare and a Medigap plan within one year.

Additionally, certain states may have expanded guaranteed issue rights for individuals under 65 with Medicare due to disability or medical conditions.

Guaranteed issue rights

Guaranteed issue rights are protections that allow you to change Medicare Supplement plans without medical underwriting in certain situations.

These rights apply during specific enrollment periods, such as the Special Enrollment Period, or under certain conditions, like loss of employer coverage or moving to a new state.

By taking advantage of guaranteed issue rights, you can change plans with ease and confidence, knowing that your health status and medical history won’t hinder your ability to obtain the coverage you need.

The Medical Underwriting Process

As you navigate the world of Medicare Supplement plans, you may encounter the term “medical underwriting.” This process plays a crucial role in determining your eligibility for certain plans and the premiums you’ll pay.

Let’s dive deeper into the medical underwriting process and how it affects your ability to change Medicare Supplement plans.

What is medical underwriting?

Medical underwriting is the process used by insurance companies to evaluate an applicant’s health status when applying for health insurance coverage.

Medical underwriting is the process used by insurance companies to evaluate an applicant’s health status when applying for health insurance coverage.

It involves examining your medical history to determine your eligibility for coverage and set the appropriate premiums.

This assessment helps insurance companies manage their risk by identifying applicants who may be more likely to incur higher healthcare costs due to pre-existing conditions or other health factors.

How it affects your ability to change plans

The medical underwriting process can have a significant impact on your ability to change Medicare Supplement plans. If you’re required to undergo medical underwriting, you may face higher premiums, limited plan options, or even denial of coverage based on your health status and medical history.

However, there are exceptions, such as the Medigap Open Enrollment Period and guaranteed issue rights, which allow you to change plans without medical underwriting in certain situations. It’s essential to be aware of these protections and opportunities when considering a change in your Medicare Supplement plan.

State-Specific Rules and Regulations

Each state has its own unique rules and regulations governing Medicare Supplement plans and the process of changing them. Understanding these state-specific rules can help you make informed decisions and ensure a smoother transition when changing plans.

Let’s explore some of the most common state-specific rules that may impact your ability to change Medicare Supplement plans.

States with expanded guaranteed issue rights

In 41 states, expanded guaranteed issue rights offer additional protections for individuals looking to change Medicare Supplement plans. These states have implemented state-specific periods and rules that allow you to change plans with guaranteed issue rights, making it easier to switch without the need for medical underwriting.

Some examples include Maine, where residents can switch plans anytime throughout the year if they have continuous Medigap coverage and no lapses exceeding 90 days, and Missouri, where you can change companies annually during the 30 days before and after your policy’s anniversary date.

The “Birthday Rule” in select states

In six states, the “Birthday Rule” allows individuals to change their Medicare Supplement plans during the month of their birthday without undergoing medical underwriting. This rule applies to Connecticut, Maine, Massachusetts, New York, Rhode Island, and Vermont.

The “Birthday Rule” provides an opportunity for individuals in these states to explore and potentially switch to different Medicare Supplement plans without the hurdles of medical underwriting, giving them more flexibility in managing their healthcare coverage.

Compare Medicare Plans & Rates in Your Area

Switching Between Medicare Advantage and Medicare Supplement Plans

In some cases, you might find yourself considering a switch between Medicare Advantage and Medicare Supplement plans. While both types of plans offer valuable benefits and coverage options, there are specific processes and timing considerations you need to be aware of when making the switch.

Let’s explore the ins and outs of switching between these two types of healthcare coverage.

When to switch from Medicare Advantage to Medicare Supplement

The best time to switch from Medicare Advantage to Medicare Supplement is during the Medicare Advantage Open Enrollment Period, which occurs annually between January 1 and March 31.

The best time to switch from Medicare Advantage to Medicare Supplement is during the Medicare Advantage Open Enrollment Period, which occurs annually between January 1 and March 31.

This period offers a prime opportunity to switch plans without the complications of medical underwriting.

Additionally, if you’re not satisfied with your Medicare Advantage Plan, you have a 12-month trial period to switch back to Original Medicare and enroll in a Medigap policy with guaranteed issue rights.

When to switch from Medicare Supplement to Medicare Advantage

If you’re considering switching from Medicare Supplement to Medicare Advantage, the ideal time to make the change is during the Medicare Advantage Open Enrollment Period. This period occurs annually between October 15 and December 7.

By switching during this time, you can explore new Medicare Advantage plans and make an informed decision about your healthcare coverage while avoiding the potential complications of medical underwriting.

Tips for Changing Medicare Supplement Plans

Successfully changing your Medicare Supplement plan requires careful consideration, research, and expert guidance. To ensure a smooth transition and avoid any potential pitfalls, keep the following tips in mind when navigating the process of changing Medicare Supplement plans:

- Research your options thoroughly. Research the various plans offered and compare their prices. This will help you choose the best one suited to your needs.

Research and compare plans

Before making any changes to your Medicare Supplement plan, it’s crucial to conduct thorough research and compare the various plan options available to you. This includes evaluating coverage, costs, and benefits, as well as considering your current and future healthcare needs.

By carefully weighing your options, you can make an informed decision that best meets your healthcare needs and financial situation.

Consult with experts

Seeking professional guidance can make all the difference when it comes to making informed decisions about your Medicare Supplement plan. Consulting with a Medicare specialist or insurance agent can provide you with valuable insights and personalized advice to help you find the most suitable plan for your needs.

Don’t hesitate to reach out to experts for assistance in navigating the complex world of Medicare Supplement plans.

Consider the Free Look Period

Lastly, take advantage of the Free Look Period when changing Medicare Supplement plans. This 30-day window allows you to try a new plan and switch back to your previous plan if needed, without any additional fees or penalties.

Lastly, take advantage of the Free Look Period when changing Medicare Supplement plans. This 30-day window allows you to try a new plan and switch back to your previous plan if needed, without any additional fees or penalties.

The Free Look Period provides a safety net, ensuring that you can make a confident decision without any regrets.

Prescription Drug Coverage and Medicare Supplement Plans

In addition to your Medicare Supplement plan, you may also need prescription drug coverage to help manage your healthcare costs. Combining prescription drug coverage with Medicare Supplement plans can be a viable solution for many individuals.

Let’s explore the options available for adding prescription drug coverage to your healthcare plan.

Medicare Part D

Medicare Part D is a voluntary outpatient prescription drug benefit program provided through private plans that contract with Medicare. It is designed to help cover the cost of prescription drugs and reduce your out-of-pocket expenses.

While it is not included as part of the standard Medicare coverage, it can be an invaluable addition to your healthcare plan, especially when combined with a Medicare Supplement plan.

Medicare Supplement plans are designed to help cover the gaps in Medicare coverage, such as cops.

Combining prescription drug coverage with Medicare Supplement plans

While it is possible to combine prescription drug coverage with Medicare Supplement plans, it’s important to note that not all plans will include this coverage. In some cases, you may need to purchase a separate Medicare Part D plan to ensure you have adequate prescription drug coverage.

Be sure to research and compare plans carefully to find the best combination of coverage for your healthcare needs.

The Impact of Discontinued Policies on Your Medicare Supplement Plan

Discontinued policies can have a significant impact on your Medicare Supplement plan and the coverage it provides. Understanding the implications of discontinued policies is essential for making well-informed decisions about whether to change plans or stick with your current coverage.

It is important to research the different policies available and understand the implications of discontinuing a policy.

What happens when a policy is discontinued?

When a policy is discontinued, it means that the insurance company has decided to stop offering the plan to new enrollees or is no longer in business. However, if you’re already enrolled in a discontinued plan, you can typically keep your coverage as long as you continue to pay your premiums.

It’s important to carefully consider the pros and cons of staying with a discontinued plan versus switching to a new one.

Weighing the pros and cons of changing plans

Before deciding whether to change Medicare Supplement plans due to a discontinued policy, it’s crucial to weigh the pros and cons.

Consider factors such as:

- coverage

- costs

- and potential waiting periods for new benefits

Also, keep in mind that switching to a new plan may require medical underwriting, which could lead to higher premiums or denial of coverage. Ultimately, the decision to change plans should be based on your individual healthcare needs and financial situation.

Summary

Navigating the world of Medicare Supplement plans can be a challenging and complex process. However, by understanding the intricacies of these plans, the rules and regulations governing them, and the best practices for changing plans, you can make well-informed decisions that cater to your healthcare needs and financial situation.

With the right guidance and information, you can confidently take control of your healthcare and make the most of your Medicare coverage.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

When can a person switch their Medicare Supplement plan?

As a Medicare enrollee, you can usually switch your Medicare Supplement plan, such as Plan G, during your 6-month Medigap Open Enrollment Period. In certain situations, such as with guaranteed issue rights, you may also be able to switch plans outside this period.

However, you will need to go through medical underwriting in order to do so.

What states allow you to change Medicare Supplement plans without underwriting?

Several states, such as California, Oregon, Illinois, Idaho, Louisiana, Nevada, Connecticut, New York and Missouri, allow you to switch your Medicare supplement plan without needing to answer medical underwriting questions. No medical underwriting is required to switch plans in these states, making it easier to find the best plan for your needs.

What is the Medigap Open Enrollment Period?

The Medigap Open Enrollment Period is a 6-month window which allows individuals to change their health plans without having to go through any medical underwriting.

During this period, individuals can switch to a different Medigap plan, or switch from a Medigap plan to a Medicare Advantage plan. This period is designed to give individuals the opportunity to make changes to their health coverage without having to worry about it.

Is it possible to combine prescription drug coverage with Medicare Supplement plans?

Yes, it is possible to combine prescription drug coverage with Medicare Supplement plans. However, in some cases, you may need to purchase a separate Medicare Part D plan for adequate coverage.

Find the Right Medicare Plan for You

Finding the right Medicare Supplement Plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about changing Medicare Supplement Plans anytime, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!