by Russell Noga | Updated August 24th, 2023

Are you struggling with choosing the right Medicare supplement plan (Medigap Plan) for your healthcare needs? You’re not alone. Many seniors find the difference between the plans confusing.

Are you struggling with choosing the right Medicare supplement plan (Medigap Plan) for your healthcare needs? You’re not alone. Many seniors find the difference between the plans confusing.

If you take a policy with too much coverage, you’ll end up over-insured and paying more in premiums without using all your benefits.

If you take a plan that doesn’t offer enough coverage, you could end up underinsured, facing huge medical bills for your Part A & B care and treatments.

Understanding the benefits available in each Medigap plan gets you closer to knowing which policy is right for you.

Our Medicare supplement reviews give you everything you need to know about plans, benefits, and premiums.

What Benefits Do You Get with Medicare Supplement Plans?

Let’s start by looking at the benefits offered by Medigap policies in 2024. Each of the ten plans has varying levels of coverage.

Some, like Plan F, are fully comprehensive, leaving you with no out-of-pocket expenses for Original Medicare Parts A & B, others, like Plans K & L, have a cost-sharing model, and plans A, B, & D have limited benefits.

Plan N or high-deductible Plans F & G give you affordable premiums with higher deductibles or copayment responsibilities.

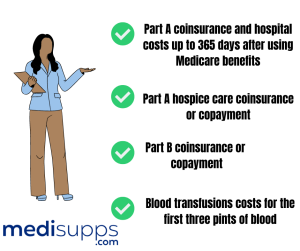

All Medigap plans offer the following benefits.

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is available for seniors eligible for Medicare before January 1, 2020.

Find 2024 Plans Now & Rates

Enter Zip Code

Fully Comprehensive or Near-Comprehensive Medigap Plans

A “comprehensive” plan covers all the Part A & B out-of-pocket expenses Original Medicare leaves behind. So, you get “first dollar coverage,” meaning there’s no financial responsibility other than your monthly premiums.

Plan F is the only policy in the range offering first-dollar coverage. It’s the only plan covering you for the Part B deductible of $226 in 2023.

Plan G provides “near-comprehensive” coverage. You get the same benefits as Plan F but don’t have coverage for the Part B deductible.

However, Plan G is more affordable, with lower monthly premiums than Plan F. On average, you save around $40 per month by going with Plan G over Plan F.

Therefore, the annual savings you make on your monthly premiums account for the Part B deductible.

Medigap Plans for Healthy Seniors

If you’re a healthy senior, you probably don’t visit the doctor more than once or twice a year.

So, why go for a fully comprehensive plan if you don’t need the coverage?

So, why go for a fully comprehensive plan if you don’t need the coverage?

That would mean you’re “over-insured” and spending more money than you need to on your Medigap plan.

In this case, you could go with the “High-Deductible” versions of Plan F or G. The HD plans to increase your annual Part A deductible from $1,600 to $2,700.

However, you get much lower monthly premiums while retaining the same benefits as the original plans. Typically, HD premiums are around 75% to 80% cheaper than the standard versions.

However, HD plans aren’t available from all providers or in all states.

Another great option for healthy seniors is Plan N. Plan N has great benefits for Part A & B.

However, you pay lower monthly premiums. You’ll also have to make a $50 copayment at the emergency room when not admitted and a $20 copayment at the doctor.

If you use practitioners charging more than the “Medicare Assignment” rate, you’ll be responsible for those “excess charges” with Plan N.

Cost-Sharing Medigap Plans

Medigap plans K & L operate on a “cost-sharing” model.

With Plan K, you pay 50% of Part B expenses; with Plan L, you pay 25%. Plan M offers good coverage for Part A & B services and pays half the Part A deductible.

Medigap Plans for Seniors on a Budget

Medigap plans A, B, and D offer good coverage for Part A expenses but are limited.

As a result, they’re a good choice for seniors living on a fixed income who don’t have the extra money to spend on one of the other plans.

Compare Medicare Plans & Rates in Your Area

Understanding How Medigap Premiums Work

Understanding How Medigap Premiums Work

Medigap policies are available from private healthcare insurers. While the Federal government (CMS) regulates the benefits in the plans, they don’t regulate the policy pricing models used by insurers.

As a result, the insurer can charge whatever they want for the premium. The premium is your monthly contribution to remain a beneficiary of the plan. The premiums can vary between providers and by state.

For instance, Humana might be the cheapest option for Plan G in Illinois but the most expensive provider for Plan N. However, in New York, it might be the other way around, with it being the most costly option for Plan G and the least expensive option for Plan N.

That’s why it’s a smart idea to get quotes from several insurers in your state when considering a Medigap plan.

Insurers also base your monthly premium on other risk factors like your gender and smoking status.

Men are more expensive to insure than women due to their higher risk of developing chronic health conditions like heart disease and diabetes. Smokers are also more costly to insure than nonsmokers.

Your age and health status also play a role in setting your premiums. If you have pre-existing health conditions, you must sign up for Medigap during the “Open Enrollment” period in the six months after your 65th birthday.

If you miss the open enrollment window, the insurer requires you to undergo medical underwriting. In this case, they can charge you above-average premiums or deny you a plan if you have pre-existing conditions.

Get a Free Consultation and Quote on Medigap Plans

Our fully licensed Medigap agents are available to take your call at 1-888-891-0229.

We offer a free consultation to discuss which plan is right for you.

We provide professional advice and source you the cheapest quote on any Medigap policy.

If you can’t call right now, leave your details on our contact form, and we’ll get someone on our team to call you back.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Supplement Plans, and why are reviews essential in understanding them?

Medicare Supplement Plans, also known as Medigap plans, are private insurance policies that help cover the gaps in Original Medicare (Part A and Part B). Reviews are essential in understanding them as they provide insights into policyholders’ experiences, helping potential beneficiaries make informed decisions.

How can I find Medicare Supplement Plan Reviews for different insurance companies?

You can find Medicare Supplement Plan Reviews on official Medicare websites, insurance company websites, consumer review platforms, and reputable healthcare review websites.

What benefits can I expect from Medicare Supplement Plans?

Medicare Supplement Plans offer various benefits, such as coverage for copayments, deductibles, and coinsurance. Some plans also cover additional benefits like foreign travel emergency healthcare.

Do Medicare Supplement Plan Reviews cover details about plan benefits?

Yes, Medicare Supplement Plan Reviews often include information about the benefits offered by specific plans, helping you understand the coverage options available.

How do I interpret the ratings given in Medicare Supplement Plan Reviews?

Medicare Supplement Plan Reviews usually come with a rating system, often represented by stars. Higher ratings indicate higher customer satisfaction and a positive overall experience.

What factors affect Medicare Supplement Plan premiums?

Several factors impact Medicare Supplement Plan premiums, including your location, age, gender, tobacco usage, and the plan’s level of coverage.

Can I switch Medicare Supplement Plans based on Reviews?

Yes, you can switch Medicare Supplement Plans at any time during the year. Reviews can help you identify better plans that suit your needs, enabling you to make an informed switch.

Are there any drawbacks to consider when relying on Reviews?

While Reviews are helpful, they may not fully represent every individual’s experience. It’s essential to consider the overall consensus and weigh multiple factors when making a decision.

Can I leave my own Review for a Medicare Supplement Plan I have used?

Yes, you can leave your own Review for a Medicare Supplement Plan on official Medicare websites, insurer platforms, or reputable consumer review websites, contributing to the pool of valuable feedback for others.

Find the Right Medicare Plan for You

Finding the ideal Medicare plan doesn’t have to be stressful. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us now at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.