by Russell Noga | Updated August 30th, 2023

It’s essential for seniors to have Medicare to help them with the burgeoning healthcare costs as they age. Medicare Parts A & B cover your hospital and medical costs, but they only offer 80% coverage for these expenses.

It’s essential for seniors to have Medicare to help them with the burgeoning healthcare costs as they age. Medicare Parts A & B cover your hospital and medical costs, but they only offer 80% coverage for these expenses.

A Medigap plan provides partial, near-comprehensive, or comprehensive coverage of the remaining 20% of healthcare expenses not paid by Original Medicare.

The three most popular Medigap plans are Plans F, G, & N. The average Medigap policy cost across all Kansas City plans and providers is $137 per month.

- Plan F averages $243.74 per month

- Plan G averages $152.30 monthly

- Plan N has a monthly average premium of $138.20.

This article looks at the top-rated insurers for each plan, and our website can give you the exact rates in your area for each plan.

Compare 2024 Plans & Rates

Enter Zip Code

Medicare Supplement Companies in Kansas City

Medigap policies are available from private healthcare insurers in Kansas City. Our research shows that the following companies offer the best deals on Medigap plans.

- Cigna

- Aetna

- Liberty Bankers

- Assured Life

- Atlantic Coast Life

- Bankers Fidelity

- Blue Cross Blue Shield of Kansas City

- Central States Health and Life Co. of Omaha

- Colonial Penn

- Federal Life

- GPM Health and Life

- Globe Life

- Americo

- GTL

- Humana

The Best Provider for Medicare Supplement Plan G Kansas City – Cigna

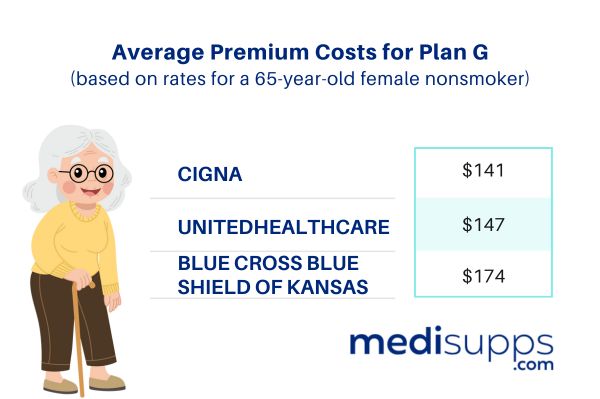

There are 43 insurers offering Medicare Plan G in Kansas City. The average market premium for Plan G is $177.80 per month across all providers. Cigna typically has affordable premiums, averaging around $141 per month. Blue Cross Blue Shield of Kansas often has the most expensive average rate at $174 monthly.

The following are average premium costs for Plan G, based on rates for a 65-year-old female nonsmoker. Your rates may differ depending on your risk profile.

*Rates above are examples and vary by zip code and company

What Does Plan G Cover?

Medicare Plan G is the most comprehensive plan available for beneficiaries joining Medicare after January 1, 2020. You get the same coverage as Plan F but without the Part B deductible cover. However, the savings you make on Plan G premiums usually cover the cost of the Part B deductible when compared to premiums for Part G Plans.

Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits expire.

Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits expire.- Part B coinsurance or copayments.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B excess charges.

- 80% of foreign travel exchange (up to plan limits).

Plan G is available in a high-deductible version from select providers in select states. Taking a High-deductible plan can save you up to 80% on the standard Plan G premiums. However, your Part A deductible increases from $1,600 to $2,700.

Popular Insurance Companies for Medicare Supplement Plan F Kansas City

There are 43 insurers offering Plan F to qualifying beneficiaries in Kansas City, with the average monthly premium being $255 across all providers. Cigna often has affordable rates, though companies such as Allstate and Mutual of Omaha now have competitive rates as well..

What Does Plan F Cover?

Plan F is the most comprehensive Medigap plan, but only available to seniors qualifying for Medicare before January 1, 2020. Contact us if you’re eligible for Medicare before this date to see if you have guaranteed issue rights.

Plan F is the most comprehensive Medigap plan, but only available to seniors qualifying for Medicare before January 1, 2020. Contact us if you’re eligible for Medicare before this date to see if you have guaranteed issue rights.

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits expire.

- Part B coinsurance or copayments.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B deductible.

- Part B excess charges.

- 80% of foreign travel exchange (up to plan limits).

Plan F is also available in a high-deductible version.

Companies Offering Medicare Plan G in Kansas City

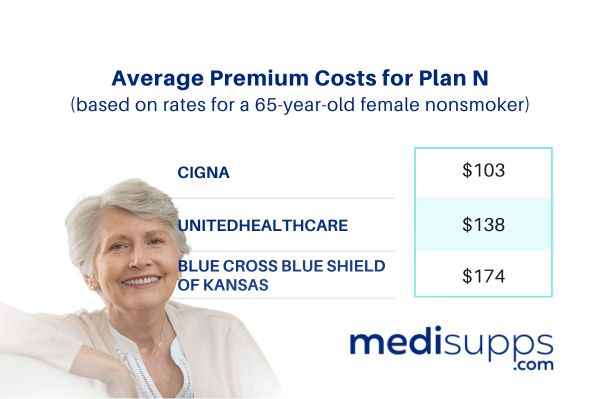

There are 41 insurers offering Plan N in Kansas City, with an average market premium of $161.90 monthly across all providers. Cigna has average premiums for Plan N at $103 per month, and Blue Cross Blue Shield of Kansas is more expensive with average monthly premiums of $174.

The following are average premium costs for Plan N, based on rates for a 65-year-old female nonsmoker. Your rates may differ depending on your risk profile.

* Rates above are for examples only. Use our FREE online quote engine to check rates in your area

What Does Plan N Cover?

Plan N is a good choice for seniors who rarely visit the doctor or emergency room. You get good coverage for Parts A & B and affordable monthly premiums.

Part A coinsurance and hospital costs up to an additional year after Medicare benefits expire.

Part A coinsurance and hospital costs up to an additional year after Medicare benefits expire.- Blood (first 3 pints).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- 80% of foreign travel exchange (up to plan limits).

Plan N requires a $20 copayment when visiting the doctor and a $50 copayment if you aren’t admitted to the hospital when receiving care at the emergency room. Plan N also doesn’t cover excess charges when a practitioner charges more than Medicare-approved rates.

What Do Plans F, G, & N Not Cover?

All Medigap plans only cover Part A & B expenses. If Medicare doesn’t cover it, they won’t either. The standardized benefits of Medigap don’t include coverage for private-duty nursing, stays at nursing homes, or prescription medications. The plans don’t cover preventative or cosmetic treatments like physiotherapy or teeth whitening.

Medigap standardized benefits also don’t cover vision, hearing, or dental services. However, some providers offer add-on plans for an additional monthly fee. Or they offer discounted rates on these services if you use partner network providers.

What are the Best Alternate Medicare Supplements in Kansas City?

Other less comprehensive Medigap plans are available from Kansas City healthcare insurers. UnitedHealthcare is the best choice for affordable premiums on Plans A, B, C, K, and L. However, Blue Cross and Blue Shield of Kansas, and Cigna also provide competitive rates on plans. Speak to us, and we’ll ensure you get the best rate on any plan.

Here are the average rates for monthly premiums based on a 65-year-old female nonsmoker. Your rates may vary depending on your risk profile.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Supplement plans?

Medicare Supplement plans, also known as Medigap plans, are private health insurance policies that help cover the gaps in Original Medicare. They can help pay for out-of-pocket expenses such as deductibles, coinsurance, and copayments.

What is the difference between Medicare Plan G and Plan N?

Medicare Plan G and Plan N are both popular Medigap plans. Plan G offers comprehensive coverage, including coverage for Medicare Part A and Part B deductibles. Plan N has cost-sharing requirements, such as copayments for certain services. The difference in coverage helps determine the cost difference between the two plans.

What factors should I consider when choosing the best Medicare Supplement plan in Kansas City?

When choosing the best Medicare Supplement plan in Kansas City, consider factors such as the coverage benefits, premium costs, provider networks, and customer service reputation of the insurance companies offering the plans. Additionally, consider your specific healthcare needs and budget.

Can I change Medicare Supplement plans in Kansas City?

Yes, you can change Medicare Supplement plans in Kansas City. However, it may be subject to medical underwriting if you are outside your Medigap Open Enrollment Period. It’s important to compare plan options and consult with one of our licensed insurance agents who can guide you through the process.

Are there any specific Medicare Supplement plans recommended for Kansas City residents?

The best Medicare Supplement plan for you may depend on your individual needs and preferences. However, some popular plans in Kansas City include Plan G, Plan N, and Plan F. It’s important to compare the coverage and costs of these plans and choose the one that aligns best with your healthcare needs and budget.

When is the best time to enroll in a Medicare Supplement plan in Kansas City?

The best time to enroll in a Medicare Supplement plan in Kansas City is during your Medigap Open Enrollment Period. This period starts on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge you higher premiums based on your health condition.

Can I get help with choosing the best Medicare Supplement plan in Kansas City?

Yes, you can get help with choosing the best Medicare Supplement plan in Kansas City. Licensed insurance agents who specialize in Medicare can provide personalized guidance and help you compare plan options, coverage, and costs. State Health Insurance Assistance Programs (SHIPs) can also provide free, unbiased assistance.

Are there any local resources in Kansas City that can provide information about Medicare Supplement plans?

Yes, there are local resources in Kansas City that can provide information about Medicare Supplement plans. The Kansas Department for Aging and Disability Services and local Area Agencies on Aging can offer guidance and resources related to Medicare and Medigap plans.

Where can I find reviews or ratings for Medicare Supplement plans in Kansas City?

You can find reviews or ratings for Medicare Supplement plans in Kansas City through reputable sources such as Medicare.gov, independent insurance rating organizations, and consumer review websites. These resources can provide insights into the quality and customer satisfaction of different insurance companies offering Medigap plans.

What should I consider besides cost when choosing the best Medicare Supplement plan in Kansas City?

Besides cost, it’s important to consider the coverage benefits, provider networks, customer service reputation, and stability of the insurance company when choosing

Use Us to Find the Best Medicare Supplement in Kansas City

Call our fully licensed agents for advice on Medigap plans in Kansas City. We’re available at 1-888-891-0229 for a free consultation and quote on any plan. If you can’t call us right now, leave your details on our contact form, and we’ll get in touch with you. Or you can use the tool on our site to get a free automated quote on any Medigap plan.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.