If you’re shopping for Medicare supplement plans then you came to the right place!

Each year the Medicare supplement plan comparison chart is put out, and each year I get a number of people asking me to help them read it!

Yes, it’s not the easiest chart to read. And for 2024 thank goodness there are no changes taking place to any of the benefits of each plan.

But you still need to know what each plan letter covers, so if you decide to change plans you have a good idea of the benefits of each of them.

Click the video below to learn more!

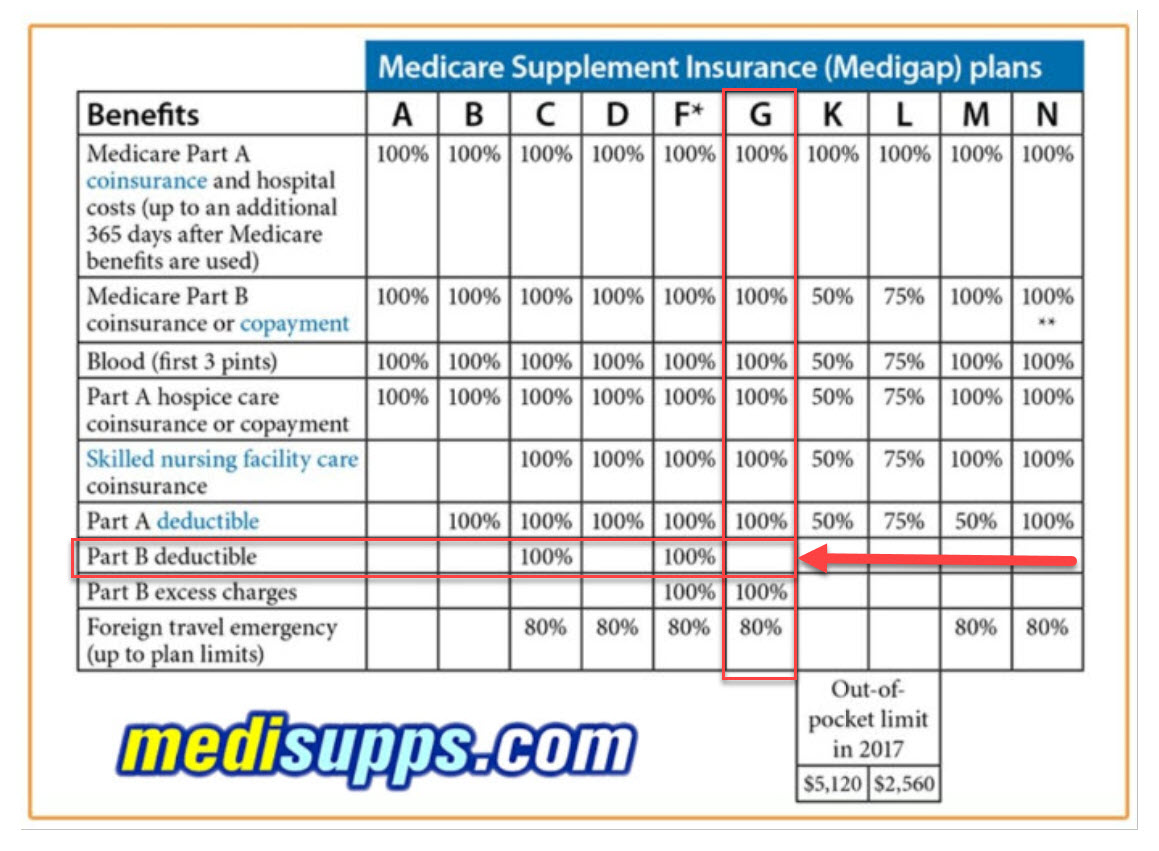

Now what you’ll see at the top of the chart are 10 different Medigap plans put out by Medicare. Some of these letters may seem familiar to you, especially if you have watched any of my other videos.

Although there are 10 different plans, most of them do not make sense and you will never enroll in them.

Although there are 10 different plans, most of them do not make sense and you will never enroll in them.

In fact, you may have been saying to yourself “how the heck am I to learn about all 10 plans?”

While don’t worry, there are just a few different plan letters we will look at today because they’re the ones that most people enroll in.

These plan letters are:

- Medigap Plan F

- Medigap Plan G

- Medigap Plan N

You might be asking “Russell, what about all the other plan letters? They must have their uses?”

In reality, they really don’t have much use. The exception to this is Medicare plan A, only because in some states for people under 65 on Medicare this is all they are allowed to get.

But most of the other plan letters actually provide less coverage and are as expensive as the ones all be talking about.

Remember unpopular plans equal higher premiums.

So today will look at the most popular plans which are Medicare plan G and Medicare plan N, as well as plan F if you still have one.

What I mean by that is on January 1 of 2020 Medicare eliminated plan F from the  lineup. This means if you’re not eligible until on or after that date for Medicare, you cannot enroll in plan F.

lineup. This means if you’re not eligible until on or after that date for Medicare, you cannot enroll in plan F.

Are you missing anything? Not at all.

Medicare plan G and plan N have lower rates and lower rate increases and still offer great coverage.

For anyone who still has a Medigap plan F, I highly encourage you to take a good look at plan G and consider changing plans. The reason is there is very little difference in the benefits between the two plans, however, the premiums are far higher for plan F.

I will explain more in a minute…

Medicare supplement plans comparison chart 2023

Now, looking at the chart again, even though it reads letter A-N you will find a few letters missing.

This is because Medicare removed a couple of letters back in 2010 and added a few.

Medicare Supplement Plan G

If you look in the column for plan F, you will see 100% coverage all the way down. The benefits are listed on the left in a column of the chart.

If you look in the column for plan F, you will see 100% coverage all the way down. The benefits are listed on the left in a column of the chart.

And yes, 100% coverage is great. However, if you look at the column to the right of that, you will see Medicare supplement plan G.

Plan G pays everything 100% except for the part B deductible for Medicare. In 2023 this amount is $226, and it will go up slightly in 2021.

But in reality, you will pay far more than $226 in premiums to have plan F rather than plan G. Often this amount exceeds $400 a year more in premiums.

That means you’re paying substantially more money for them to just write the deductible check for you, with your money!

This is why I suggest you look at plan G if you still have Medicare plan F because your premiums will be lower and you’ll have substantially lower rate increases each year as well.

Click below to learn more!

Medicare supplement plan N

Medicare supplement plan N is nearly identical to plan G and you pay the part B deductible yourself as well.

Medicare supplement plan N is nearly identical to plan G and you pay the part B deductible yourself as well.

However after that deductible is met, you might have some additional out-of-pocket expenses with plan N.

In exchange for these out-of-pocket expenses, your monthly premiums will be lower than plan G.

What are these out-of-pocket expenses?

With Medicare Plan N:

- You pay the annual part B deductible

- After that, you might have up to a $20.00 co-pay per doctor’s visit

- If you visit the emergency room and plan N and you’re not admitted there is a $50.00 copay

- Plan N does not cover Medicare part B excess charges

Co-pays with Medicare plan N

All discuss the co-pays first because that usually wants on everybody’s mind when they are considering a Medicare supplement plan N.

After your part B deductible is paid, you might have small co-payments per doctor’s visit with plan N. This includes specialists as well.

This co-pay is billed to you after your visit, and it can never exceed $20.00 per visit. Often is actually less than $20.00, and can actually be nothing. It just depends on what you go for.

Emergency room co-pay

With the emergency room co-pay, you are required to pay a $50.00 co-pay if you’re not admitted to the hospital. This is to keep people out of the emergency room for non-emergency situations.

Again you’ll be billed for this co-pay if you’re not admitted.

Medicare part B excess charges

These are quite rare, in fact, if you Dr. Take see assigned rates for Medicare you will never be billed the part B excess charge.

Or these are only charged by doctors who do not accept Medicare assignments for  their entire practice.

their entire practice.

In many cases, larger clinics like mayo clinic and Andy Anderson hospital may not take the assigned rates, so in those situations, you could be charged excess charges.

In reality, the charges when only equal 15% higher than what Medicare would pay. You would then be required to pay a percentage of this. So even if you got one, they would be relatively low.

Just ask your Dr. If they accept the assigned rates for Medicare and you know your Dr. Will never charge these.

The following states do not even charge excess charges by law. They are:

- Connecticut

- Minnesota

- Ohio

- Pennsylvania

- Rhode Island

- Vermont

- Massachusetts

- New York

Click below to learn more!

Medicare supplement rates comparison

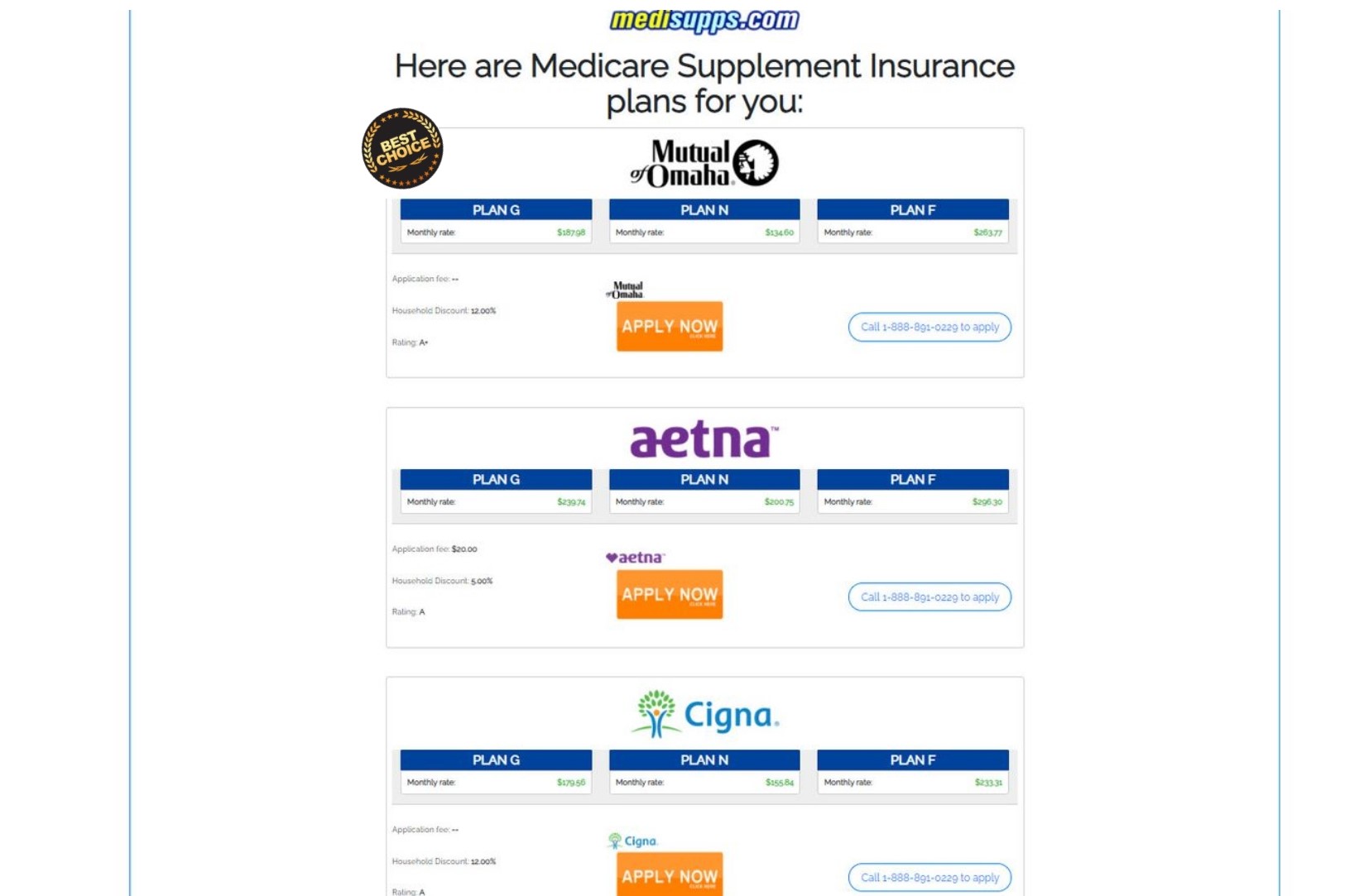

To enroll in a Medicare supplement plan you have to work with an agent. There’s no way around it.

Even if you go directly to the insurance carrier, a licensed agent will still be signing you up. However, if you do go direct, you will get one rate, from one company. Guaranteed.

At Medisupps.com we show you the rates!

We’re an independent agency that shops for all the top companies and offers these plans at the same exact costs.

What’s the difference?

If you allow us to help, you get to see all of the different rates from all the carriers. And, our service is FREE!

So you might be saying “Okay that sounds great Russell, I want you to be my agent! But how much do these plans cost?”

Well, Medicare supplement plans vary in cost based on a number of factors such as:

- Zip code

- Age

- Tobacco use

- Gender

- Household discounts

Many insurance companies offer a household discount if a spouse is also applying. Other ones give a household discount if you live with someone age 60 or over, and some give the household discount just if you live with somebody, regardless of their age!

We can help find you the lowest premiums and discounts available to help save you money.

The best way to do that is just to call us now at 1-888-891-0229.