by Russell Noga | Updated December 22nd, 2023

When it comes to Medicare Supplement plans, it’s important to save as much money as possible each year.

That means knowing your options when applying to change Medigap plans in your state in order to save money. Each state has different rules when it comes to qualifying for approval into a new Medigap plan.

One such rule that has garnered significant attention in recent years is the Medicare Supplement Birthday Rule.

Why is this rule so important?

In essence, it provides Medicare beneficiaries with a unique opportunity to switch their Medigap plans without medical underwriting during a specific time frame, offering them a chance to reassess their coverage and potentially save money.

In this article, we will embark on a thorough exploration of the California Medicare Supplement Birthday Rule, delving into its benefits, limitations, and comparisons to similar rules in other states.

By the end of this post, you will be well-equipped with the knowledge to take full advantage of this rule and make informed decisions about your Medicare Supplement coverage.

Short Summary

- The California Medicare Supplement Birthday Rule provides residents with a 90-day window to switch their Medigap plans without medical underwriting.

- Other states such as Oregon, Idaho, Illinois, and Nevada have variations of the rule with distinct eligibility criteria and regulations.

- To take advantage of the Birthday Rule, beneficiaries must review their plan within 60 days following their birthday in order to avoid medical underwriting or premium increases.

Compare Medigap Plans

Enter Zip Code

What Benefits Do You Get with Medicare Supplement Plans?

Medigap plans have standardized benefits set by the CMS, a Federal agency. The benefits of each policy are the same across all providers.

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply)

- Unlimited coverage for all out-of-pocket costs.

Plan F isn’t available for seniors eligible for Medicare after January 1, 2020. If you’re eligible after this date, Plan G offers you the best alternative to Plan F.

Medigap plans don’t cover the costs of preventative treatments at the physiotherapist, acupuncturist, or chiropractor. They also don’t cover prescriptions, stays at long-term nursing homes, or private-duty nursing.

Medigap doesn’t cover hearing, vision, or dental services. However, some insurers offer access to discounted rates with partners or charge a small fee for an additional policy covering your hearing, dental, and vision services.

The California Medicare Supplement Birthday Rule Explained

At its core, the California Medicare Supplement Birthday Rule allows residents to switch their Medigap plans with equal or lesser benefits up to 60 days after their birthday without undergoing medical underwriting.

In other words, this gives Medicare beneficiaries in California a 60-day window to reevaluate their Medigap coverage and potentially change plans without the risk of being denied coverage or facing increased premiums due to pre-existing conditions.

The rule was introduced on July 1, 2020, with the primary goal of providing Medicare enrollees in the state with more flexibility and freedom when it comes to their Medigap coverage.

By eliminating the need for medical underwriting during this time period, the California Birthday Rule removes a significant barrier to switching plans and empowers beneficiaries to take control of their healthcare coverage.

Benefits of the California Birthday Rule

One of the most notable advantages of the California Birthday Rule is the opportunity it presents for Medicare Supplement members to change their insurance plan or provider during a 60-day open enrollment period annually, without medical underwriting and irrespective of any pre-existing conditions.

This means that individuals with chronic health issues or other pre-existing conditions can switch to a plan with a lower premium that still provides the same level of medical coverage, ultimately saving them money and ensuring they receive the care they need.

Moreover, the California Birthday Rule can be particularly beneficial for older Medicare beneficiaries who may otherwise struggle to find affordable coverage due to their age or health status.

By allowing them to switch plans without undergoing medical underwriting, the rule effectively levels the playing field and ensures that all beneficiaries have access to the coverage they need, regardless of their health or medical history.

Can You Change Medigap Plans?

You can change Medicare plans or providers at any time during the year. However, you must use the open or annual enrollment period to avoid medical underwriting. Medical underwriting is a process insurers use to assess the risk you present to their Medigap scheme.

If you have a pre-existing condition, you’re a higher risk because they assume they’ll have more treatments to cover. As a result, they compensate for this risk by increasing your premiums or instituting a waiting period when you join a plan.

If you have a severe chronic health disorder, the insurer might decide you are too high of a risk to cover and refuse you a Medigap plan. California also has “The Birthday Rule,” where you can change plans or providers without undergoing medical underwriting.

What is the Medicare Supplement Plan Birthday Rule?

The “Birthday Rule” is an additional enrollment period during the year where you can change plans or providers without the need to undergo medical underwriting. Six US states offer the birthday rule to residents, and California is among them. The Birthday Rule is an enrollment period for a specific timeframe around your birthday.

The California Birthday Rule Medicare Supplement Plans

California was among the first states to institute the Birthday Rule for Medicare and Medigap beneficiaries. The rule debuted on July 1, 2020, allowing beneficiaries to switch providers or plans in the 60 days after their birthday, regardless of their age, as long as they’re over 65.

You must meet the following criteria to qualify for the Birthday Rule.

You must meet the following criteria to qualify for the Birthday Rule.

- Be a resident of California.

- Have a Medigap policy.

- Change to a Medigap plan with equal or lesser benefits.

- Make the change within 60 days of your birthday.

The California Birthday Rule also extends the enrollment window thirty days before your birthday. So, you have a total of 90 days to change your Medigap plan or provider around your birthday.

If you switch plans or providers in the 30 days before your birthday, the new policy comes into effect on the day after your birthday. If you change in the 60 days after your birthday, the new policy comes into effect 60 days after your application date.

Compare Medicare Plans & Rates in Your Area

Limitations and Restrictions

While the California Birthday Rule offers significant benefits, it also comes with certain limitations and restrictions that must be considered.

Firstly, the rule is only applicable to plans that have been accepted by the California Department of Insurance, meaning it does not encompass all Medicare Supplement plans available in the state.

As such, beneficiaries must carefully review their options and ensure that the plan they wish to switch to is indeed eligible under the rule.

Additionally, it is important to note that the California Birthday Rule only allows beneficiaries to switch to a plan with equal or lesser benefits.

This means that if an individual wishes to upgrade their plan or obtain additional coverage, they will not be able to do so under the rule and may still be subject to medical underwriting and potential premium increases.

Nevertheless, for those looking to maintain their current level of coverage or downgrade to a more affordable plan, the rule remains an invaluable tool in navigating the complex world of Medicare Supplement insurance.

Comparing the California Birthday Rule to Other States

While California’s Birthday Rule has garnered significant attention, it is not the only state in the U.S. with such a rule in place.

In fact, other states such as Oregon, Idaho, Illinois, and Nevada have implemented similar regulations, allowing Medicare beneficiaries in those states to switch their Medigap plans under specific conditions and timeframes.

However, each state’s birthday rules differ in their specifics and eligibility criteria, making it essential for beneficiaries to thoroughly understand their state’s regulations before attempting to make any changes to their coverage.

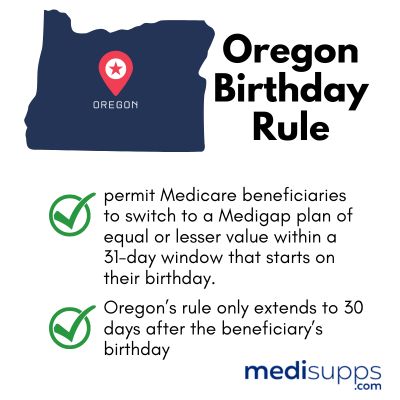

Oregon

The Oregon Birthday Rule shares similarities with California’s rule, permitting Medicare beneficiaries to switch to a Medigap plan of equal or lesser value within a 31-day window that starts on their birthday.

The Oregon Birthday Rule shares similarities with California’s rule, permitting Medicare beneficiaries to switch to a Medigap plan of equal or lesser value within a 31-day window that starts on their birthday.

However, unlike California’s 60-day post-birthday timeframe, Oregon’s rule only extends to 30 days after the beneficiary’s birthday, giving them a slightly narrower window to make changes to their plan.

Despite this difference in timing, the Oregon Birthday Rule still offers significant benefits for Medicare beneficiaries in the state, providing them with the flexibility to reassess their coverage and make necessary changes without the burden of medical underwriting and the potential for increased premiums.

Idaho

Idaho’s Birthday Rule also allows residents to switch their Medigap plan to one with equal or lesser benefits, offering them the opportunity to reevaluate their coverage and potentially save on premiums.

While the specific details and timeframes for Idaho’s rule may differ slightly from those in California, the core concept remains the same: providing Medicare beneficiaries with increased flexibility and freedom when it comes to their Medigap coverage, without the need for medical underwriting.

Illinois

Illinois has implemented a Birthday Rule that is similar to California’s but with a few notable differences.

Illinois has implemented a Birthday Rule that is similar to California’s but with a few notable differences.

To take advantage of the Illinois Birthday Rule, beneficiaries must be between the ages of 65 and 75, and any changes made to their plan must be within the same insurance company, albeit possibly through a different subsidiary.

Furthermore, the rule grants beneficiaries a 45-day window starting from their birthday to make the switch to another Medigap plan with equal or lesser benefits.

While these slight differences may impact the overall flexibility offered by the rule compared to California’s version, the Illinois Birthday Rule still provides a valuable opportunity for eligible Medicare beneficiaries to reassess their coverage and potentially switch to a more suitable plan without the risk of increased premiums or denied coverage due to pre-existing conditions.

Nevada

Similar to California, Nevada’s Birthday Rule allows Medicare beneficiaries a 60-day window to switch their Medigap plan to one with equal or lesser benefits, starting on the first day of their birth month. However, one key difference between the two rules is that in Nevada, coverage cannot be made effective prior to the beneficiary’s birthday, and any changes must be made within 60 days from the date of application.

Despite these slight variations, the Nevada Birthday Rule still offers a valuable opportunity for Medicare beneficiaries in the state to reevaluate their coverage and make necessary changes without the burden of medical underwriting and the potential for increased premiums.

How to Utilize the California Birthday Rule

To make the most of the California Birthday Rule, it is crucial for beneficiaries to first assess their current plan, research alternative options, and make the switch within the specified 60-day window. By following these steps, Medicare beneficiaries can ensure they are taking full advantage of the rule and making informed decisions about their Medigap coverage.

Assessing Your Current Plan

To effectively assess your existing Medicare Supplement plan, it is essential to compare the associated benefits, costs, and coverage options of different plans. By doing so, you can gain a clear understanding of how your current plan stacks up against other options available in the market.

Additionally, it is important to consider factors such as the quality of customer service provided by your current carrier, as well as your plan’s benefit level, to ensure you are receiving the best possible coverage for your needs.

Once you have thoroughly evaluated your current plan, you can then make a more informed decision about whether to switch to a different Medigap plan that may offer more suitable coverage, lower premiums, or better customer service.

Remember that the California Birthday Rule gives you the opportunity to make these changes without the risk of being denied coverage or facing increased premiums due to pre-existing conditions, so it is worth taking the time to carefully assess your options.

Researching Alternative Plans

When researching alternative Medicare Supplement plans, it is crucial to compare the coverage, costs, and benefits of each policy in order to identify the plan that best suits your needs and lifestyle.

This may involve consulting online Medigap quotes, comparing policies from various providers such as Cigna and Health Net, and even contacting Senior65.com for guidance and support.

As you research different plans, keep in mind that the California Birthday Rule only allows you to switch to a plan with equal or lesser benefits, so be sure to focus on plans that meet this criterion. By thoroughly comparing your options and seeking expert advice when needed, you can increase your chances of finding a plan that offers the best possible coverage and value for your needs.

Making the Switch

Once you have evaluated your current plan and researched alternative options, it is time to take advantage of the California Birthday Rule and make the switch to a new Medigap plan.

Once you have evaluated your current plan and researched alternative options, it is time to take advantage of the California Birthday Rule and make the switch to a new Medigap plan.

To do so, you will need to contact your insurance agent or the insurance company directly and inform them of your intention to switch plans under the rule. Remember, it is imperative to make the switch within the 60-day window following your birthday in order to avoid medical underwriting and any potential premium increases.

After you have successfully switched plans, be sure to carefully review your new coverage, benefits, and costs to ensure that the new plan meets your expectations and requirements.

By staying informed and proactive about your Medigap coverage, you can continue to take advantage of the California Birthday Rule in the future and ensure that you always have access to the best possible coverage for your needs.

The Future of the Medicare Supplement Birthday Rule

As more states, including Oregon, Idaho, Illinois, and Nevada, adopt their own versions of the Medicare Supplement Birthday Rule, it is possible that additional states may follow suit in the future.

This could lead to an expansion of the rule’s benefits to even more Medicare beneficiaries across the country, providing increased flexibility and freedom when it comes to choosing and switching Medigap plans.

The potential widespread adoption of the Birthday Rule could have significant implications for those with pre-existing conditions, who often face challenges in obtaining affordable and comprehensive coverage due to medical underwriting and increased premiums.

By expanding the rule to more states, these individuals may have increased access to the coverage they need, without the risk of being denied or facing exorbitant costs.

This could ultimately lead to a more equitable and accessible Medicare system for all beneficiaries, regardless of their health status or medical history.

Summary

In conclusion, the California Medicare Supplement Birthday Rule offers a valuable opportunity for Medicare beneficiaries in the state to reassess their Medigap coverage and make necessary changes without the burden of medical underwriting and the potential for increased premiums.

By understanding the rule and its benefits, limitations, and comparisons to other states’ regulations, beneficiaries can make informed decisions about their coverage and take full advantage of the rule’s provisions.

As the future of the Medicare Supplement Birthday Rule continues to evolve, it is essential for beneficiaries to stay informed and proactive about their Medigap coverage in order to ensure they always have access to the best possible care and support.

By taking the time to assess your current plan, research alternative options, and make the switch when necessary, you can confidently navigate the complex world of Medicare Supplement insurance and secure the coverage you need for a healthy and secure future.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is the California Birthday Rule for Medicare Supplement Plans?

The California Birthday Rule allows Medicare beneficiaries in California to switch or upgrade their Medicare Supplement plans within 60 days of their birthday each year, without undergoing medical underwriting.

Who is eligible to take advantage of the California Birthday Rule?

Medicare beneficiaries residing in California who currently have a Medicare Supplement plan are eligible to utilize the California Birthday Rule.

When can I use the California Birthday Rule to change my Medicare Supplement plan?

You can use the California Birthday Rule to change your Medicare Supplement plan within 60 days of your birthday each year.

What is the difference between Medicare Plan G and Plan N?

Medicare Plan G and Plan N both offer comprehensive coverage but differ in terms of cost-sharing. Plan G provides coverage for Medicare Part A and Part B deductibles, while Plan N requires cost-sharing for certain services such as copayments for doctor visits and emergency room visits.

Can I switch from Plan G to Plan N using the California Birthday Rule?

Yes, you can switch from Plan G to Plan N using the California Birthday Rule as long as you meet the eligibility requirements and make the change within 60 days of your birthday.

What types of coverage are included in Medicare Supplement plans offered under the California Birthday Rule?

Medicare Supplement plans available under the California Birthday Rule offer coverage for costs such as Medicare Part A and Part B coinsurance, copayments, and deductibles.

Are prescription drugs covered under Medicare Supplement plans offered under the California Birthday Rule?

No, prescription drug coverage is not included in Medicare Supplement plans. You would need to enroll in a standalone Medicare Part D prescription drug plan for prescription drug coverage.

What are the benefits of utilizing the California Birthday Rule for Medicare Supplement plans?

The California Birthday Rule provides an opportunity for Medicare beneficiaries in California to review and potentially switch to a Medicare Supplement plan that better suits their changing healthcare needs, without undergoing medical underwriting.

Where can I find more information about the California Birthday Rule and Medicare Supplement plans?

For more information about the California Birthday Rule and Medicare Supplement plans, you can visit the official California Department of Insurance website, consult with licensed insurance agents specializing in Medicare coverage, or contact Medicare Supplement plan providers directly.

Call Our Team for Information on the California Birthday Rule

If you have any questions about the birthday rule in your state, call our Medigap experts at 1-888-891-0229. Our team of fully licensed agents will walk you through everything you need to know about joining a Medigap plan or switching plans or providers.

We offer you a free consultation and quote on any plan, and you can use the tool on our site to get a free automated quote yourself. Or leave your details on our contact form, and we’ll have an agent call you back.