by Russell Noga | Updated July 18th, 2025

Want to know what’s changing with Medicare Supplement Plans Rhode Island 2026? This article covers all the updates, from premiums and coverage options to policy changes. Find out what you need to know to make the best choices for your healthcare coverage.

Key Takeaways

- Medicare Supplement Plans (Medigap) in Rhode Island provide essential coverage for out-of-pocket costs not covered by Original Medicare, with standardized benefits across the state.

- Significant changes in 2026 include an expected 4.33% increase in payments to Medicare Advantage plans and elimination of certain coinsurance requirements, improving financial relief for beneficiaries.

- When selecting a Medigap plan, compare options based on premiums, benefits, and the financial strength of insurers, while being mindful of the Open Enrollment Period for guaranteed acceptance.

Compare 2026 Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Plans

Medicare Supplement Plans, commonly known as Medigap, are designed to help cover out-of-pocket costs that Original Medicare does not pay for, such as copayments and deductibles. These plans act as a safety net, ensuring that beneficiaries do not face unexpected and potentially overwhelming medical expenses.

One of the key features of Medigap plans is that they offer the same benefits nationwide. This means that coverage does not vary by state, providing a consistent level of protection regardless of where you live. This is particularly beneficial for those who may travel or move frequently, as their coverage remains intact across state lines.

In Rhode Island, over 50,000 residents have opted for Medigap coverage, with a significant percentage using it alongside fee-for-service Medicare. The most common Medigap options in the state include Plans C, F, and N, with Plan C being the most popular among beneficiaries. These plans offer a variety of benefits, catering to different healthcare needs and preferences.

Premiums for Medicare Supplement plans in Rhode Island range from $80 to $160, influenced by factors such as age and the chosen plan. This variation in cost allows individuals to select a plan that fits their budget while still providing the necessary coverage. Understanding these aspects of Medigap plans is the first step in making informed healthcare decisions.

Changes in 2026

Looking ahead to 2026, several significant changes are expected to impact Medicare policies and reimbursement rates. One of the notable updates is the anticipated adjustment in Medicare reimbursement rates for physicians, which will follow the updated rates discussed at the December meeting of the Medicare Payment Advisory Commission. This change aims to ensure that reimbursement rates are fair and reflective of current medical costs.

The final rate announcement for Medicare Advantage plans in 2026 will be published on or before April 7, providing clarity on reimbursement levels. This announcement is crucial for beneficiaries as it will determine the overall payment structures for Medicare Advantage plans. An expected net increase of 4.33% in payments to Medicare Advantage plans is projected, amounting to over $21 billion. This increase highlights the growing investment in these plans and their importance in the healthcare system.

In 2026, add-on payments will be implemented without increasing beneficiary cost-sharing, thus helping to manage out-of-pocket expenses. This is a significant development as it ensures that additional payments are covered without placing a financial burden on beneficiaries. Furthermore, the elimination of the 5% coinsurance requirement in the catastrophic phase of Medicare Part D will lead to lower costs for enrollees.

These changes for 2026 reflect ongoing efforts to improve the Medicare system, making it more efficient and cost-effective for both providers and beneficiaries. Staying informed about these updates will help you better navigate your health care costs and take advantage of the benefits available.

Comparing Top Plans

When it comes to selecting a Medicare Supplement Plan in Rhode Island 2026, it’s essential to compare the various options available to ensure you choose the best plan for your needs. In 2026, the premiums for these plans may vary significantly, with some plans offering lower costs but potentially less comprehensive coverage. Understanding this trade-off is crucial for making an informed decision.

One important factor to consider is the customer service ratings and financial strength of the carriers offering these plans. A provider with high ratings and robust financial health is likely to offer better service and stability, which is an essential consideration for long-term health care quality planning.

Medicare Supplement plans in Rhode Island are standardized, meaning the coverage levels remain consistent across different carriers. This standardization simplifies the comparison process, as you can focus on other factors such as premiums and additional benefits. High-deductible options, like Plans F and G, offer lower premiums but require beneficiaries to pay more upfront. For those who prefer predictable costs, Plans K and L feature out-of-pocket limits, providing a cap on healthcare spending for covered services.

Popular choices among Rhode Island seniors include Medicare Supplement Plan F, G, and N, each offering different balances of benefits and costs. For example, Plan G is increasingly favored due to its similar coverage to Plan F, especially for those not eligible for Plan F after 2020. Plan N, on the other hand, fully covers Part B services but may require copayments for specific office and emergency room visits.

Rhode Island residents have 12 Medigap options available, though the availability varies by ZIP Code. This highlights the importance of local research in plan selection. Comparing these top plans and understanding their specific features will help you select the best option tailored to your healthcare needs.

Compare Medicare Plans & Rates in Your Area

Benefits of Medigap Plans

Medigap plans play a crucial role in managing healthcare costs by covering out-of-pocket expenses not paid by Original Medicare, such as copayments and deductibles. This financial protection provides peace of mind to beneficiaries, ensuring that unexpected medical bills do not become a burden.

Some Medigap plans offer additional out-of-pocket cost protections, which can substantially lower overall healthcare expenses for enrollees. These plans can cover a range of costs, including Part A coinsurance and hospital stay costs beyond Medicare coverage. Certain plans even cover the first three pints of blood needed for medical procedures. Additionally, some Medigap plans provide coverage for services that Original Medicare does not, such as skilled nursing facility care and foreign travel emergency care.

In Rhode Island, the Medicare Premium Payment Program assists residents in paying for Medicare premiums, co-payments, and deductibles. This program includes three key components: Qualified Medicare Beneficiary (QMB), Specified Low-Income Medicare Beneficiary Program (SLMB), and Qualified Individual (QI).

The RI Office of Healthy Aging also provides additional community support and resources for individuals seeking help with Medicare Supplement Plans. These benefits and support programs highlight the comprehensive nature of Medigap plans and their role in improving healthcare quality and affordability.

How to Choose the Right Plan

Choosing the right Medicare Supplement Plan requires careful consideration of various factors, and enrolling during the Open Enrollment Period is crucial. This period begins on the first day of the month you turn 65 and lasts for six months. Enrolling during this time ensures that insurance companies cannot impose medical underwriting, guaranteeing acceptance regardless of health status. This is the best time to minimize costs and secure a plan that fits your needs.

The cost of premiums for Medicare Supplement plans is influenced by factors such as age, gender, and tobacco use. Understanding these factors can help you anticipate and manage your expenses. Additionally, certain life events, like moving out of a coverage area or losing existing coverage, can grant guaranteed issue rights for purchasing a Medigap policy. Being aware of these rights can provide additional opportunities to secure coverage when needed.

Potential pitfalls in the enrollment process include missing the Open Enrollment window and not understanding guaranteed issue rights, which could affect your coverage options. It’s important to stay informed and notice questions to ensure you understand all the details and make the best decision for your healthcare needs.

Enrollment Process

Enrolling in a Medigap plan in Rhode Island is most beneficial during the Open Enrollment Period, which starts at age 65. To begin the process, individuals must contact the insurance provider to confirm they are within their Open Enrollment period and complete the application process. This initial step is crucial for securing the best rates and coverage.

Switching between Medigap plans can occur at any time, but it may require medical underwriting, which could affect acceptance. This means that changing plans outside of the Open Enrollment Period might involve additional scrutiny of your health status, potentially impacting your ability to switch plans easily.

For support in navigating the Medicare application process and accessing resources, Rhode Island residents can contact the Point at 401-462-4444. This local resource provides assistance and guidance, helping individuals understand their options and make informed decisions about their healthcare coverage.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In summary, understanding and selecting the right Medicare Supplement Plan is essential for managing healthcare costs and ensuring access to quality care. The changes expected in 2026 highlight the importance of staying informed about policy updates and their impact on your healthcare options. Comparing top plans, understanding the benefits of Medigap, and knowing how to choose the right plan are all crucial steps in making informed decisions.

By taking advantage of the enrollment period and utilizing available resources, you can secure a plan that meets your healthcare needs and provides financial protection. Stay proactive, ask questions, and make informed decisions to navigate your Medicare options effectively.

Frequently Asked Questions

What are Medicare Supplement Plans, and how do they work?

Medicare Supplement Plans, or Medigap, are designed to cover out-of-pocket costs not included in Original Medicare, like copayments and deductibles. They provide standardized benefits across the country, offering essential financial protection against unforeseen medical expenses.

What changes are expected in Medicare policies for 2026?

Expect significant changes in Medicare policies for 2026, including updated reimbursement rates, increased payments to Medicare Advantage plans, and the elimination of the 5% coinsurance requirement in the catastrophic phase of Medicare Part D, all aimed at improving beneficiary costs and care.

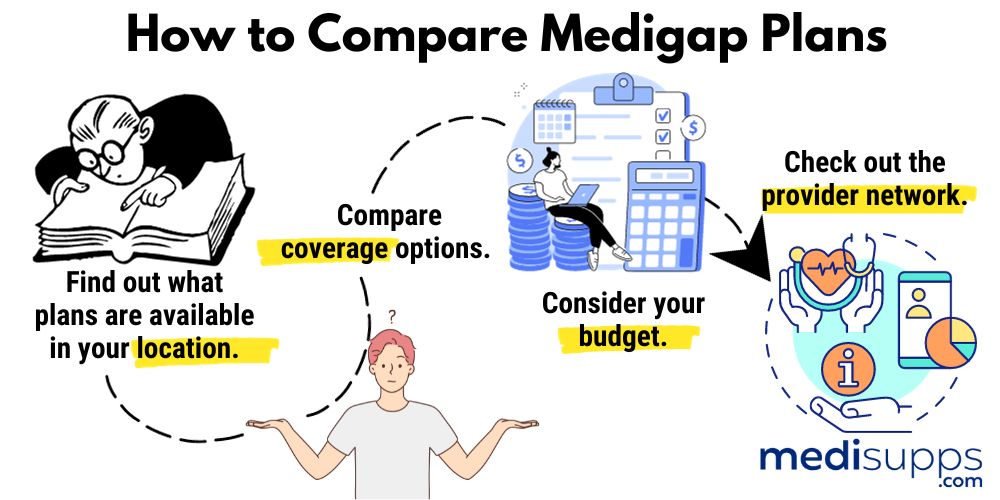

How do I compare different Medicare Supplement Plans?

To effectively compare Medicare Supplement Plans, evaluate premiums, coverage levels, customer service ratings, and the financial strength of the insurers, as all plans offer standardized benefits. This will help you identify the best fit for your specific needs.

What are the benefits of enrolling in a Medigap plan?

Enrolling in a Medigap plan offers financial protection by covering out-of-pocket expenses not included in Original Medicare, as well as potential coverage for additional services like foreign travel emergencies. This can lead to reduced healthcare costs and greater peace of mind.

What is the best time to enroll in a Medicare Supplement Plan?

The optimal time to enroll in a Medicare Supplement Plan is during the Open Enrollment Period, starting on your 65th birthday and lasting for six months. Enrolling during this time guarantees coverage without medical underwriting, ensuring acceptance regardless of your health status.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Rhode Island 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.