by Russell Noga | Updated July 16th, 2025

Wondering about the Medicare Supplement Plans Pennsylvania 2026? Our article provides an overview of the anticipated changes, ensuring you understand how these updates could affect your healthcare coverage and costs.

Key Takeaways

- Medicare Supplement Plans (Medigap) in Pennsylvania will continue to cover gaps in Original Medicare, providing essential benefits to reduce out-of-pocket costs for beneficiaries in 2026.

- Key Medigap plans like Plan G and Plan N offer varying levels of coverage, with Plan G covering nearly all out-of-pocket costs and Plan N providing cost-sharing options for lower premiums.

- Beneficiaries should be aware of premium changes and enhancements in coverage set for 2026, as well as the importance of enrollment periods and financial planning when selecting a Medigap plan.

Compare 2026 Plans & Rates

Enter Zip Code

Overview of Medicare Supplement Plans in Pennsylvania for 2026

Medicare Supplement Plans, also known as Medigap, play a vital role in filling the gaps left by Original Medicare. These plans are designed to cover expenses such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Parts A and B. In 2026, these plans will continue offering crucial supplemental benefits coverage to beneficiaries in Pennsylvania, allowing access to necessary healthcare services without excessive out-of-pocket costs.

The upcoming adjustments to Medigap plans are aimed at enhancing benefits and accessibility for Medicare beneficiaries. These changes are expected to improve healthcare access and reduce financial strain for many individuals. Staying informed about these adjustments helps in navigating healthcare options and making choices that fit your needs and budget.

Standardized Medigap Plans

Medigap plans are standardized across the nation, including Pennsylvania, into options labeled A through N. Each of these plans offers different levels of coverage, designed to complement Original Medicare by covering various out-of-pocket expenses like deductibles and copayments. This standardization ensures that the benefits of a particular plan are consistent regardless of the insurer, providing transparency and ease of comparison for beneficiaries.

As we approach 2026, there are expected adjustments in the premiums of these Medigap plans. These changes will likely reflect an increase in the coverage of essential services, further enhancing the value provided to beneficiaries. Knowing these adjustments aids in making informed decisions about the Medigap plan that best suits your healthcare needs and financial situation.

Plan G

Plan G is widely recognized for its comprehensive coverage, making it a popular choice among Medicare beneficiaries. This plan covers nearly all out-of-pocket costs for Medicare Part A and Part B, with the exception of the annual Part B deductible. This broad coverage minimizes out-of-pocket expenses, offering peace of mind and financial stability.

One of the key advantages of Plan G is its accessibility. Anyone enrolled in Medicare Parts A and B can access it, regardless of income or health status. Additionally, the benefits of Plan G are standardized across different insurers in Pennsylvania, ensuring that the coverage remains consistent no matter which company provides the policy.

Plan N

Plan N offers a balanced approach to coverage and cost, making it an attractive option for many beneficiaries. It covers basic Medicare benefits, including coinsurance and hospital costs, but requires beneficiaries to pay copayments for certain doctor visits and emergency room visits. This cost-sharing aspect helps keep the monthly premiums lower than those of higher-coverage plans.

Despite the copayments, Plan N remains cost-effective for many, particularly those who infrequently visit doctors or require emergency services. The standardization of Plan N across most states ensures that the benefits remain consistent, making it easier for beneficiaries to understand and compare their options.

High Deductible Plan G

High Deductible Plan G is designed for those who prefer lower monthly premiums in exchange for higher out-of-pocket costs. This plan is available to individuals who became eligible for Medicare on or after January 1, 2020. The annual deductible for High Deductible Plan G is set at $2,870 for the year 2025, and beneficiaries must meet this deductible before the plan’s benefits kick in.

The deductible amount for High Deductible Plan G is adjusted annually based on the Consumer Price Index for all Urban Consumers, ensuring it keeps pace with inflation. This plan suits those who are healthy and do not foresee frequent medical expenses but seek coverage for significant costs if they occur.

Plan F

Plan F is known for its comprehensive coverage, making it one of the most sought-after Medigap plans. It covers nearly all out-of-pocket costs not included in Original Medicare, including Medicare Part A and B deductibles, coinsurance, and copayments. However, it is important to note that Plan F is no longer available to individuals who are newly eligible for Medicare.

For those who were eligible before the cut-off date, the high-deductible version of Plan F remains an option. This version has a deductible set at $2,800, and while it offers extensive coverage, the premiums are generally higher compared to other Medigap plans due to its broad coverage.

Enrollment Periods and Eligibility

Knowing the enrollment periods and eligibility criteria for Medigap plans ensures you have the coverage you need. In Pennsylvania, residents can enroll in a Medigap plan at any time after enrolling in Medicare Part A and Part B. However, the best time to enroll is during the Medigap Open Enrollment Period, which lasts for six months starting from the month you turn 65 and are enrolled in Part B.

During this period, you have guaranteed issue rights, meaning insurance companies cannot deny you coverage or charge you higher premiums due to pre-existing conditions. Outside of this period, enrolling in a Medigap plan may require medical underwriting, which could affect your eligibility and costs.

Special enrollment

Special enrollment periods provide additional opportunities for beneficiaries to enroll in or change their Medicare plans outside of the typical enrollment periods. These opportunities arise from specific life events, such as moving out of your plan’s service area or losing other health coverage. For example, if you move to a new location where your current plan is not offered, you may qualify for a two-month Special Enrollment Period.

Additionally, individuals working past age 65 have an eight-month Special Enrollment Period starting from the month employment ends or the employer-provided health coverage ends, whichever comes first. This allows them to enroll in Medicare Parts A, B, C, and D without facing late penalties.

Medicare Supplement have Open enrollment?

Medicare Supplement Plans, or Medigap plans, operate differently from Medicare Advantage and Part D plans regarding enrollment periods. Medigap plans are not subject to the Annual Open Enrollment Period (AOEP) that applies to Medicare Advantage and Part D plans. This means that beneficiaries can change their Medigap plans at any time of the year, but it’s essential to be aware of the potential need for medical underwriting if they are outside their initial enrollment period.

If you decide to change your Medigap plan outside a guarantee issue period, you may have to undergo medical underwriting, which can affect your eligibility and premium costs. Thus, reviewing your Part D Prescription Plans during the AOEP is essential, while noting that Medigap plans follow a different schedule.

Compare Medicare Plans & Rates in Your Area

Key Changes to Medicare Supplement Plans in 2026

The landscape of Medicare Supplement Plans in Pennsylvania is set to evolve in 2026 with changes aimed at enhancing beneficiary access and affordability. These updates may include revisions to the coverage details of certain Medigap plans, reflecting the ongoing adjustments in healthcare costs and regulatory landscapes. Being aware of these changes aids in making better decisions regarding your healthcare coverage.

One of the significant aspects of these changes is the focus on improving the comprehensiveness of coverage options. Aligning with regulatory changes and addressing rising healthcare costs, these updates should offer more robust protection against out-of-pocket expenses, including expanded medicaid coverage.

Impact of the Inflation Reduction Act

The Inflation Reduction Act of 2022 has already started lowering prescription drug costs for people with Medicare, and its impact will continue into 2026. For instance, beginning in 2025, the out-of-pocket drug costs for Part D enrollees will be capped at $2,000, providing significant financial relief for many beneficiaries. Furthermore, the act eliminates the coverage gap phase, meaning beneficiaries will no longer experience a change in cost-sharing for medications as they move through different phases of coverage.

These changes aim to reduce the overall drug spending by the federal government while ensuring that Medicare beneficiaries have better access to necessary medications without the burden of high out-of-pocket costs, including those eligible for the low income subsidy, such as those in a Medicare Advantage prescription drug plan and a medicare prescription drug plan, and pharmacy benefit managers, and Medicare Medicaid services CMS, including prescription drug coverage.

The elimination of the 5% coinsurance requirement for Medicare Part D enrollees in the catastrophic phase and the adjustment of cost-sharing responsibilities between Medicare and the part d proposed rule plans are some of the key elements driving these improvements.

Cost Adjustments and Premium Changes

Knowing the premium variations for different Medigap plans is essential for effective financial planning. In 2026, there will be changes to the costs associated with these plans, including potential increases in premiums and out-of-pocket expenses. Beneficiaries need to stay informed about these adjustments to manage their healthcare budgets effectively.

Developing a budget that accounts for Medigap premiums and out-of-pocket expenses can help ensure financial stability while receiving necessary medical care. Lower premium Medigap plans often come with higher out-of-pocket costs, making it essential to balance premium payments with potential medical expenses. Planning ahead allows beneficiaries to better manage the financial aspects of their healthcare coverage.

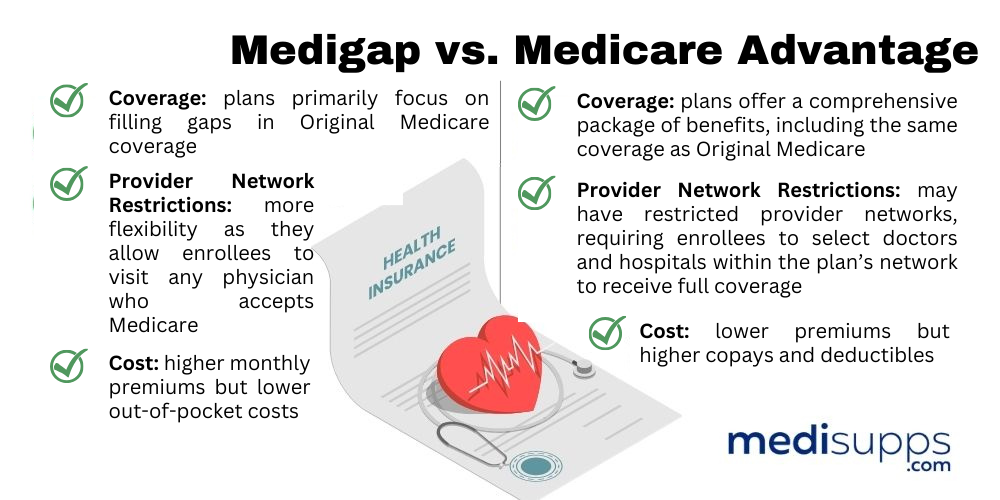

Comparing Medicare Supplement Plans with Medicare Advantage Plans

When choosing between Medicare Supplement Plans and Medicare Advantage Plans, it’s important to understand their fundamental differences. Medigap plans allow beneficiaries to maintain their Original Medicare coverage, while Medicare Advantage plans replace Original Medicare with private insurance. This distinction affects not only the coverage but also the cost structure and flexibility of the plans.

Medicare Advantage plans often have lower premiums but might involve additional out-of-pocket costs such as copayments or deductibles. In contrast, Medigap plans tend to offer more predictable out-of-pocket expenses, as they cover most of the gaps left by Original Medicare, enhancing financial stability for beneficiaries.

Knowing these differences aids in making an informed decision about which plan best suits your healthcare needs and financial situation.

Coverage Differences

One of the main differences between Medicare Supplement Plans and Medicare Advantage Plans lies in their coverage and cost-sharing structures. Medigap plans require beneficiaries to pay a monthly premium in addition to their Part B premium, but they cover a wide range of out-of-pocket costs like deductibles and coinsurance. This can make them more predictable and easier to budget for, especially for those who anticipate high healthcare needs.

On the other hand, Medicare Advantage plans may feature low or zero monthly premiums, but enrollees can incur substantial costs through copayments and deductibles based on the services used. Additionally, these plans can change their benefits and out-of-pocket costs annually, which can affect the overall financial burden on enrollees.

Knowing these differences is key to making an informed choice about your healthcare coverage.

Cost Considerations

Cost is a significant factor when comparing Medicare Supplement Plans and Medicare Advantage Plans. In 2026, there will be changes to the costs associated with Medigap plans, including potential increases in premiums and out-of-pocket expenses. The Medicare Prescription Payment Plan will introduce an automatic renewal system for subscribers, helping to maintain coverage without interruptions.

Medigap plans allow for predictable out-of-pocket expenses, as they cover most of the gaps left by Original Medicare. This predictability can enhance financial stability for beneficiaries, making it easier to manage healthcare costs. Comparing the cost implications of each plan type helps in making a decision that aligns with your financial situation and healthcare needs.

How to Choose the Right Medigap Plan in Pennsylvania

Choosing the right Medigap plan involves careful consideration of your personal healthcare needs, financial resources, and preferences. It’s essential to evaluate your average healthcare costs, including any chronic conditions and anticipated future medical services. Understanding your health needs and financial capabilities enables you to select a plan offering the best coverage and affordability.

Managing potential out-of-pocket healthcare costs is crucial for ensuring that you have the necessary coverage without financial strain. Comparing various Medigap options and considering your unique circumstances allows you to make an informed decision that ensures peace of mind and comprehensive protection.

Assessing Your Health Needs

Evaluating both current and anticipated health conditions is essential for choosing a suitable Medigap plan. It’s important to analyze your current health issues and potential future health risks to ensure the plan you choose provides adequate coverage. Knowing your healthcare needs helps in selecting the Medigap plan that aligns with your medical conditions and expected treatments, including an integrated health risk assessment.

Consulting with your healthcare provider can also provide valuable insights into your medical needs and help identify the best Medigap plan for you. Considering both current and anticipated healthcare requirements helps you choose a plan that offers the right balance of coverage and cost.

Financial Planning for Medigap Costs

In 2026, Medigap plans in Pennsylvania are expected to have varied premium changes that can impact overall costs. Knowing these changes helps beneficiaries prepare for potential out-of-pocket expenses that may arise due to higher premiums. By staying informed about premium adjustments, you can better manage your healthcare budget and avoid unexpected financial burdens.

Developing a budget that accounts for both Medigap premiums and out-of-pocket expenses is crucial for effective financial planning. By balancing premium payments with potential medical expenses, you can ensure financial stability while receiving the necessary medical care.

State Health Insurance Assistance Program (SHIP)

The Pennsylvania Medicare Education and Decision Insight program, or PA MEDI, serves as the state’s SHIP, offering free Medicare guidance. SHIP provides tailored counseling services to help individuals make informed Medicare decisions, ensuring that they understand their options and the associated costs.

One-on-one counseling provided by SHIP helps beneficiaries navigate their Medicare choices effectively. By offering personalized information and resources tailored for specific demographic needs, SHIP ensures better access to Medicare information and support.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

Understanding the nuances of Medicare Supplement Plans in Pennsylvania for 2026 is crucial for making informed healthcare decisions. From grasping the differences between Medigap and Medicare Advantage plans to navigating enrollment periods and anticipating premium changes, this guide has equipped you with the knowledge needed to choose the best plan for your needs.

As you move forward, remember that thorough evaluation of your health needs and financial situation is key to selecting the right Medigap plan. Utilize resources like SHIP for personalized guidance, and stay informed about upcoming changes to ensure you have the best coverage possible. Your health and financial stability are worth the effort.

Frequently Asked Questions

What are the key changes to Medicare Supplement Plans in Pennsylvania for 2026?

The changes for the 2026 year have not been announced yet. Please refer back to this website for updated information.

How does Plan G differ from Plan F?

Plan G covers all out-of-pocket costs for Medicare Part A and B except for the annual Part B deductible, while Plan F includes coverage for that deductible but is not available to new Medicare enrollees. Thus, if you are newly eligible for Medicare, Plan G may be the more suitable option.

When is the best time to enroll in a Medigap plan?

The best time to enroll in a Medigap plan is during the Medigap Open Enrollment Period, which begins when you turn 65 and are enrolled in Medicare Part B. Enrolling during this time ensures you have guaranteed issue rights.

What impact does the Inflation Reduction Act have on Medicare Part D?

The Inflation Reduction Act significantly impacts Medicare Part D by capping out-of-pocket drug costs at $2,000 starting in 2025 and eliminating the coverage gap phase, ultimately reducing expenses for beneficiaries.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Pennsylvania 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.