by Russell Noga | Updated June 27th, 2025

If you’re a New Jersey resident navigating Medicare, understanding your Medicare Supplement Plans New Jersey 2026 options is crucial. These plans, also known as Medigap, fill the gaps in Original Medicare coverage, helping to cover out-of-pocket costs like copayments and deductibles. In this guide, we’ll explore the various Medigap plans available in New Jersey, their costs, and how to choose the best one for your needs.

Key Takeaways

- Medicare Supplement Plans (Medigap) in New Jersey enhance coverage beyond Original Medicare, with about 37% of the population enrolled in these plans due to their financial benefits.

- Plan G is a popular alternative to the now-unavailable Plan F, providing substantial coverage while excluding the Part B deductible, making it a suitable choice for new enrollees.

- Understanding the enrollment process, including the Medigap Open Enrollment Period, is critical for accessing the best plans without penalties for pre-existing conditions.

Compare 2026 Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Plans in New Jersey

Medicare Supplement Plans, often referred to as Medigap, play a pivotal role in enhancing the healthcare coverage for residents in New Jersey. These plans provide additional medicare supplement coverage beyond what Original Medicare offers, helping to offset healthcare costs that might otherwise become burdensome. With approximately 78% of Medicare beneficiaries in New Jersey enrolled under Original Medicare, the need for supplementary coverage is significant.

New Jersey stands out with a higher enrollment rate in Medigap plans compared to neighboring states like New York and Connecticut. Approximately 37% of the state’s population is covered by Medicare Supplement Plans, reflecting the value residents place on this additional coverage. Understanding these plans can greatly impact your financial security and access to healthcare services.

What is Medigap Coverage?

Medigap coverage, provided through Medicare Supplement Plans, is designed to fill the gaps left by Original Medicare. These plans help pay for some of the healthcare costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles. Medigap plans help reduce out-of-pocket costs for beneficiaries, enhancing the affordability and predictability of healthcare.

New Jersey offers several types of Medigap plans, each with varying levels of coverage and benefits. While not all plans cover the same services, the federal government standardizes the benefits included in each type of Medigap plan, ensuring consistency across different insurance companies. This standardization allows you to compare plans easily and choose one that best fits your healthcare needs and budget.

Eligibility for Medigap Plans in New Jersey

Enrollment in a Medigap plan requires eligibility for Original Medicare, typically for individuals aged 65 and older, though those under 65 with specific disabilities may also qualify. Approximately 90% of Medicare beneficiaries in New Jersey are eligible due to age, while about 10% qualify due to disability.

New Jersey residents who qualify for Medicare due to disability, particularly those under 50, have specific provisions that allow them to access Medigap coverage from at least one carrier. Special enrollment periods (SEPs) allow individuals to change their Medicare coverage without penalties under circumstances like losing employer health coverage or relocating.

Popular Medicare Supplement Plans in New Jersey

When it comes to Medicare Supplement Plans, New Jersey residents have a variety of options to choose from. However, the majority of beneficiaries gravitate towards a few popular plans due to their comprehensive coverage and value. Approximately 83% of Medigap members in New Jersey are enrolled in one of the three leading plans: F, G, or N.

These plans are favored because they offer substantial benefits that help cover the out-of-pocket costs not paid by Original Medicare. While Plan F has been particularly popular for its extensive coverage, it is no longer available to new enrollees as of 2020 due to federal regulations.

Nonetheless, understanding these popular options can help you make an informed decision about your healthcare coverage.

Plan F: The Most Comprehensive Coverage

Plan F stands out as the most comprehensive Medigap plan available, covering nearly all out-of-pocket costs not covered by Original Medicare. This includes deductibles, copayments, and coinsurance, making it an attractive option for those seeking extensive coverage. Plan F’s popularity in New Jersey is a testament to its broad benefits and the peace of mind it provides to beneficiaries.

However, it’s important to note that Plan F is no longer available to individuals who became eligible for Medicare after January 1, 2020. For those who were already enrolled, Plan F continues to offer robust coverage. New enrollees should consider alternative options like Plan G for comprehensive benefits.

Other Significant Medigap Plans

With Plan F no longer available to new Medicare members, Plan G has emerged as the best alternative. Plan G offers similar coverage to Plan F, excluding the Part B deductible, making it a highly popular choice among new enrollees. This plan covers most out-of-pocket costs not paid by Original Medicare, providing substantial financial protection.

Another notable option is Plan N, which offers lower premiums in exchange for higher copayments and potential excess charges. This plan is ideal for those who seek a balance between cost and coverage, making it one of the more economical choices.

Exploring these options can help you find a plan that aligns with your healthcare needs and budget.

Compare Medicare Plans & Rates in Your Area

Costs Associated with Medicare Supplement Plans in New Jersey

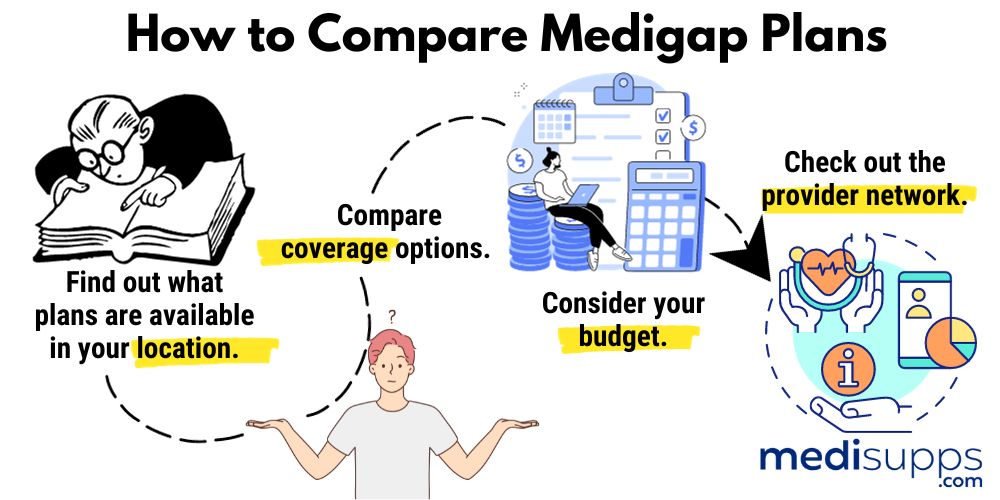

Understanding the costs associated with Medicare Supplement Plans is crucial for making an informed decision. Premium rates for these plans can vary significantly based on the insurance provider and the specific plan selected. Comparing costs and benefits across different providers helps ensure you receive the best value for your money.

In New Jersey, the variability in costs is influenced by several factors, including age, gender, and location. Some insurance companies may offer policies that allow locking in monthly premiums at the time of enrollment, providing protection against future price increases. Awareness of these cost factors aids in effective budgeting and choosing a plan that meets financial needs.

Factors Influencing Premium Costs

Several primary factors influence the cost of Medicare Supplement Plan premiums in New Jersey. Age is a significant determinant, with premiums generally increasing as beneficiaries get older. Gender and location also play crucial roles, as different demographics and regions may have varying healthcare costs and risk assessments.

Additionally, the insurance company’s pricing strategy and market conditions can affect premium rates. Knowing these factors helps anticipate potential cost changes and choose a plan aligned with your budget and healthcare needs.

Finding Affordable Medigap Plans

Finding an affordable Medigap plan requires diligent comparison shopping. By obtaining quotes from multiple providers, you can identify the best rates and benefits. Online tools and resources, such as those offered by NerdWallet and Medicare.gov, can assist in comparing plans and finding the most cost-effective options.

For those seeking lower premiums, Medigap Plan N is a strong contender. This plan offers competitive pricing with reduced monthly costs but comes with higher copays and potential out-of-pocket expenses. Balancing these factors can help you find a Medigap plan that provides the necessary coverage while staying within your budget.

Top Providers of Medicare Supplement Insurance in New Jersey

Selecting the right provider for your Medicare Supplement Insurance is just as important as choosing the right plan. In New Jersey, several top-rated providers offer a range of Medigap plans, ensuring you have access to quality coverage and customer service. Some of the leading providers include AARP/UnitedHealthcare, Cigna, Lumico, and Mutual of Omaha.

These providers are known for their competitive premium costs, comprehensive coverage options, and high customer satisfaction ratings. Selecting a reputable provider significantly enhances your overall healthcare experience, offering peace of mind and reliable support.

Comparing Providers

When comparing Medicare Supplement providers, it’s essential to consider several factors. Pricing, complaint rates, and plan availability are key criteria that can impact your decision. NerdWallet offers ratings for Medigap insurance companies based on these factors, helping you make an informed choice.

The top-rated providers, such as AARP/UnitedHealthcare, Cigna, Lumico, and Mutual of Omaha, have consistently received high marks for customer satisfaction and pricing. Comparing these providers ensures you receive the best value and coverage for your healthcare needs.

Best Providers for Different Needs

Different Medicare Supplement providers cater to specific needs, making it important to choose one that aligns with your personal requirements. AARP/UnitedHealthcare and Cigna are noted for their competitive premium costs, making them excellent choices for those looking to save on monthly expenses.

For individuals with specific coverage needs or income levels, other providers, including private insurance companies, may offer tailored plans that better suit their circumstances. Exploring the offerings from various companies can help you find a plan that meets your healthcare and financial needs, ensuring comprehensive and affordable coverage.

Enrollment Process for Medicare Supplement Plans in New Jersey

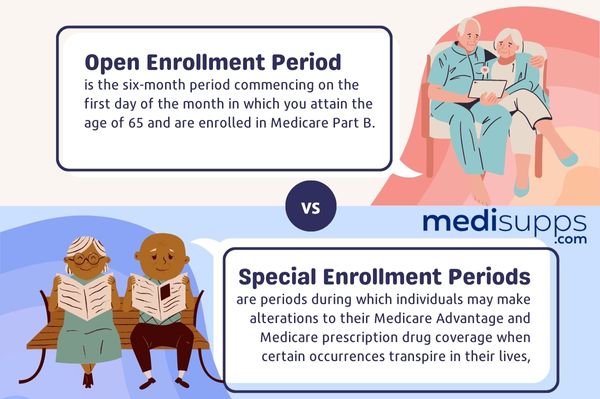

The enrollment process for Medicare Supplement Plans in New Jersey involves understanding the specific periods during which you can sign up. The Medigap Open Enrollment Period begins when an individual turns 65 and enrolls in Medicare Part B. This six-month period is the best time to purchase a Medigap plan, as it offers the most options and protections against denial for pre-existing conditions.

Beyond this initial period, there are other opportunities to enroll in Medigap plans, particularly during special enrollment periods triggered by specific circumstances. Understanding these enrollment windows is crucial for ensuring continuous and comprehensive healthcare coverage.

Initial Enrollment Period

The initial enrollment period for Medigap plans lasts for six months, starting in the first month that you are both 65 or older and enrolled in Medicare Part B. This period is crucial as it provides guaranteed issue rights, preventing insurance companies from denying coverage or charging higher premiums due to pre-existing conditions.

Taking advantage of this initial enrollment period ensures you have access to the widest range of plans and the most favorable terms. Planning your enrollment during this time can save you from potential complications and higher costs later on.

Special Enrollment Periods

Special enrollment periods (SEPs) allow individuals to enroll in Medigap plans outside the normal enrollment windows due to specific circumstances. These circumstances may include losing other health coverage, relocating, or experiencing certain health conditions.

State laws in New Jersey can also influence the availability of Medigap policies for those under 65, particularly for individuals with disabilities or End-Stage Renal Disease (ESRD). Knowing these special enrollment opportunities helps maintain continuous coverage and avoid penalties.

Assistance with Enrollment

New Jersey residents have access to various resources and services to assist them in enrolling in Medicare Supplement plans. Licensed insurance agents offer free services to help navigate different providers and packages, ensuring you find the best plan for your needs.

Additionally, online resources and counseling services provide valuable support and information, helping you understand your Medigap options and make informed decisions. Utilizing these resources can simplify the enrollment process and ensure you select the right plan.

Additional Considerations for New Jersey Residents

When choosing Medicare Supplement Plans in New Jersey, it’s important to consider additional factors specific to the state. New Jersey laws ensure that individuals under 50 who are eligible for Medicare due to disability can access Medigap coverage from at least one carrier. This inclusivity is crucial for younger beneficiaries who require comprehensive coverage.

Moreover, the state’s unique demographic and healthcare needs may influence plan availability and costs. Being aware of these state-specific considerations can help you make more informed decisions about your healthcare coverage.

Impact of Health Status on Plan Choice

Your health status significantly influences the choice of Medicare Supplement Plans in New Jersey. Premiums can vary based on gender and health conditions, with those in poorer health potentially facing higher costs. Careful consideration of your health status is essential, as it can affect both your eligibility and the overall cost of your chosen plan.

Choosing the right plan requires balancing coverage needs with potential costs. For example, individuals with chronic illnesses may benefit from plans with more comprehensive benefits, despite higher premiums. Assessing your health status and future healthcare needs can guide you to the most suitable Medigap plan.

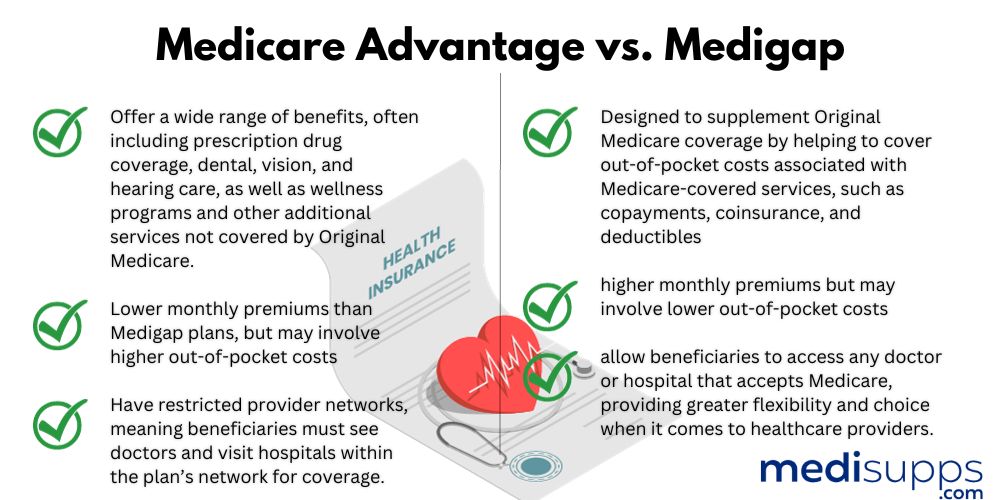

Medigap vs. Medicare Advantage Plans

When considering your Medicare options, it’s important to understand the differences between Medigap and Medicare Advantage Plans. Medigap plans supplement Original Medicare (Parts A and B) by covering additional out-of-pocket costs such as copayments and deductibles. However, you cannot use a Medigap plan with a Medicare Advantage Plan, which often includes additional benefits like vision and dental care.

Medicare Advantage Plans, on the other hand, are an alternative to Original Medicare and typically offer comprehensive coverage, including outpatient prescription drugs and medicare benefits. Choosing between Medigap and Medicare Advantage hinges on your specific healthcare needs and preferences, and the types of coverage most important to you.

Prescription Drug Coverage

One critical consideration for New Jersey residents is the coverage of prescription drugs. Medigap plans do not include prescription drug coverage, a change that has been in effect since 2006. To cover prescription medications, you must enroll in a separate Medicare Part D plan.

Medicare Part D plans are available as stand-alone policies and can be added to Original Medicare to cover outpatient prescription drugs. Enrollment in Part D can occur when you first become eligible for Medicare and during the annual open enrollment period from October 15 to December 7. Ensuring you have this coverage is essential for managing medication costs effectively.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

Navigating the complexities of Medicare Supplement Plans in New Jersey requires a thorough understanding of your options. From eligibility and enrollment to comparing popular plans like Plan F and Plan G, this guide has provided a comprehensive overview to help you make informed decisions. By understanding the costs, benefits, and specific considerations for New Jersey residents, you can choose a plan that meets your healthcare needs and financial situation.

In conclusion, whether you’re new to Medicare or looking to switch plans, staying informed and utilizing available resources can ensure you select the best Medicare Supplement Plan for your needs. Remember to compare providers, consider your health status, and ensure you have prescription drug coverage through Medicare Part D. With the right plan, you can enjoy peace of mind and comprehensive healthcare coverage.

Frequently Asked Questions

What are Medicare Supplement Plans, and why are they important?

Medicare Supplement Plans, or Medigap, offer essential coverage that fills the gaps in Original Medicare, covering out-of-pocket costs such as copayments and deductibles. These plans are crucial for minimizing unexpected medical expenses and ensuring comprehensive healthcare.

Who is eligible for Medigap plans in New Jersey?

To qualify for Medigap plans in New Jersey, you must be eligible for Original Medicare, which typically includes individuals aged 65 and older, as well as those under 65 with specific disabilities.

What are the most popular Medicare Supplement Plans in New Jersey?

The most popular Medicare Supplement Plans in New Jersey are Plan G and Plan N, with Plan F previously being favored for its comprehensive coverage but now unavailable to new enrollees since 2020.

How can I find affordable Medicare Supplement Plans?

To find affordable Medicare Supplement Plans, compare rates and benefits from various providers and consider options like Plan N, which typically offers lower premiums with higher copays. Utilizing online resources for quotes and comparisons can help you make an informed choice.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans New Jersey 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.