by Russell Noga | Updated May 4th, 2025

Looking for Medicare Supplement Plans Illinois? This article covers the available options, benefits, eligibility, and how to choose the right plan to fill the gaps in your Medicare coverage.

Key Takeaways

- Medicare Supplement Plans, or Medigap policies, help cover costs not included in Original Medicare, such as deductibles and copayments, enhancing financial security for beneficiaries in Illinois.

- There are a variety of Medicare Supplement Plans available in Illinois, each with different coverage levels, allowing individuals to select a plan that best suits their medical needs and financial situation.

- To enroll in a Medicare Supplement Plan, individuals must be at least 65 years old, enrolled in Medicare Parts A and B, and reside in Illinois, with specific open enrollment periods allowing guaranteed issue rights.

Compare 2026 Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Insurance Plans

Medicare Supplement Insurance Plans, often referred to as Medigap policies, play a crucial role in the healthcare landscape for Medicare beneficiaries in Illinois. These plans are designed to cover the costs that Original Medicare does not, such as deductibles, copayments, and coinsurance, ultimately providing additional financial security for beneficiaries. With the rising cost of healthcare, having a Medigap plan can be a game-changer for many seniors.

A significant portion of Medicare enrollees in Illinois have turned to Medicare Supplement Plans to help manage their healthcare expenses. In 2021, these plans gained popularity as many beneficiaries sought comprehensive coverage. These plans offer a safety net, ensuring that individuals are not burdened with unexpected medical bills that could strain their finances.

Purchasing a Medicare Supplement Plan from reputable providers like Blue Cross and Blue Shield of Illinois can further enhance this coverage. These plans are tailored to meet diverse needs and can include additional health and wellness benefits beyond the standard coverage, providing even more value to beneficiaries.

Whether you’re new to Medicare or looking to enhance your existing coverage, understanding the intricacies of Medigap policies is the first step towards securing your healthcare future.

Types of Medicare Supplement Plans Available in Illinois

Illinois residents have a variety of Medicare Supplement Plans to choose from, each designed to cater to different healthcare needs and preferences. These plans are standardized and labeled from Plans A to N, allowing beneficiaries to compare their benefits easily. Understanding the differences between these plans is crucial in selecting the one that best fits your medical and financial situation.

Plan A offers the most basic benefits, covering essential services but leaving out more comprehensive coverages that other plans might include. On the other hand, Plan B adds coverage for certain copayments, providing the same benefits of a bit more security for those who anticipate higher medical expenses.

For those seeking extensive benefits, Plan C and Plan F are popular choices, known for their comprehensive coverage that includes almost all out-of-pocket costs associated with Medicare. Plan G is another favored option among Illinois residents. This plan covers nearly all costs after the deductible, with the exception of the Medicare Part B deductible, making it a viable choice for many.

Plans K and L offer out-of-pocket limits for financial protection against high costs. Plans M and N are newer, offering varied coverage and copayment responsibilities, providing beneficiaries with more flexibility in managing healthcare expenses. With such a wide range of options, it’s important to thoroughly evaluate each plan to determine which one aligns best with your needs.

Eligibility Requirements for Medicare Supplement Plans

To qualify for a Medicare Supplement Insurance Plan in Illinois, individuals must meet specific eligibility requirements.

Primarily, you must:

- Be at least 65 years old

- Be enrolled in both Medicare Parts A and B

- Reside in the state where the plan is offered, ensuring that the coverage is applicable to your location

These are the fundamental criteria that set the stage for enrolling in a Medigap plan.

People under 65 might also qualify for Medicare Supplement Plans if they meet certain conditions. For example, those who have been receiving Social Security Disability Insurance for 24 months or have been diagnosed with amyotrophic lateral sclerosis (ALS) are eligible. This inclusivity ensures that a broader range of individuals can benefit from the financial security these plans offer, regardless of age.

The enrollment process ensures a fair opportunity for new beneficiaries. Upon turning 65 and enrolling in Medicare Part B, you enter a six-month open enrollment period. During this time, you can sign up for any Medicare Supplement Plan without worrying about being denied coverage due to pre-existing conditions.

This period is crucial as it provides guaranteed issue rights, allowing you to secure a plan that best fits your needs without the barriers of medical underwriting.

Comparing Medicare Supplement Plans vs. Medicare Advantage Plans

Choosing between Medicare Supplement Plans and Medicare Advantage Plans can be challenging, as both offer distinct benefits. One of the primary differences lies in the flexibility of choosing healthcare providers. Medicare Supplement Plans typically provide more freedom in selecting doctors and hospitals compared to Medicare Advantage Plans, which often have network restrictions. This flexibility can be a significant advantage for those who prefer seeing specific healthcare providers.

Medicare Advantage Plans, on the other hand, often include additional benefits not covered by Medicare Supplement Plans, such as dental, vision, and hearing coverage. These plans can also offer perks like gym memberships and travel insurance, making them attractive to those looking for comprehensive care beyond what Original Medicare provides. However, it’s essential to consider that these additional medicare benefits might come with network limitations and potentially higher out-of-pocket costs.

Another key difference is in the cost structure. Medicare Supplement Plans usually involve higher premiums but lower out-of-pocket expenses, whereas Medicare Advantage Plans often have lower premiums but may require copayments and coinsurance for services.

Assess your healthcare needs and financial situation to determine which plan best aligns with your lifestyle. Additionally, keep in mind that enrolling in a Medicare Advantage Plan can limit your ability to switch to a Medicare Supplement Plan later.

Prescription Drug Coverage and Medicare Supplement Plans

One critical aspect to understand about Medicare Supplement Plans is that they do not include prescription drug coverage. This means that if you require medications, you will need to enroll in a separate Medicare Part D plan to cover these costs. This separation ensures beneficiaries have access to necessary medications without compromising the structure of their Medicare Supplement Plan.

For those looking to secure comprehensive healthcare coverage, it’s essential to consider this additional step. Enrolling in a Medicare Part D plan alongside your Medigap policy will provide the prescription drug coverage necessary to manage your health effectively. Combining these plans ensures all healthcare needs are addressed, from hospital visits to medication costs.

Compare Medicare Plans & Rates in Your Area

How to Choose the Right Medicare Supplement Plan

Selecting the right Medicare Supplement Plan requires careful consideration of your personal healthcare needs and financial situation. Start by assessing how often you visit doctors, the types of medical services you frequently use, and any ongoing health conditions that require regular treatment. This self-assessment will help you identify which plan offers the coverage you need without overpaying for unnecessary services.

Consulting with a Medicare advisor or broker can provide valuable guidance during this process. These professionals can clarify your options, explain plan differences, and offer insights into the best fit for your specific circumstances. Their expertise can be instrumental in making an informed decision.

When evaluating Medigap plans, consider total coverage costs, additional benefits, and whether your preferred healthcare providers are included in the plan’s network. The standardized policies, labeled from Plans A to N, offer varying levels of coverage, so it’s important to compare these options carefully. Ultimately, choosing the right Medicare Supplement Plan is about balancing your healthcare needs with your budget to ensure you receive the best possible coverage.

Costs and Premiums of Medicare Supplement Plans

The costs associated with Medicare Supplement Plans can vary significantly between different private insurance companies. While the benefits of each lettered Medigap plan are standardized, the premium rates are not, meaning they can differ widely among insurers. This variation underscores the importance of shopping around and obtaining quotes from multiple providers to find the best deal.

Several factors influence the costs of Medigap policies, including the insurer, the specific plan, and the applicant’s location. Additionally, some insurance providers offer discounts that can affect the overall premium, such as discounts for non-smokers or for those who pay annually instead of monthly. These discounts can make a significant difference in your overall healthcare expenses.

When selecting a Medicare Supplement policy, Illinois residents should obtain official quotes to understand the exact costs involved. Comparing these quotes will help you identify the plan that offers the best value for your needs. Remember, while premiums are an important consideration, it’s equally crucial to evaluate the coverage and benefits provided by each plan to ensure it meets your healthcare requirements.

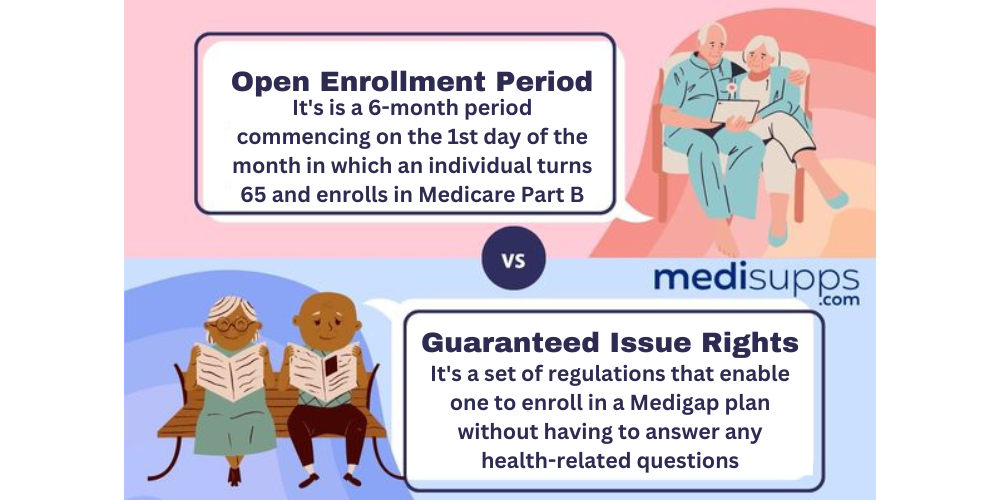

Guaranteed Issue Rights and Enrollment Periods

Understanding the guaranteed issue rights and enrollment periods for Medicare Supplement Plans is essential for securing the coverage you need. The open enrollment period for Medicare Supplement Insurance starts when you turn 65 and enroll in Medicare Part B, lasting six months. During this period, you have guaranteed issue rights, meaning you cannot be denied coverage based on pre-existing conditions. This is a critical time to secure a Medigap plan without the risk of medical underwriting.

In Illinois, there’s an additional annual enrollment window for those aged 65 to 75 with an existing Medicare Supplement plan. This 45-day period begins on your birthday, allowing you to switch plans without being denied coverage due to health conditions. This flexibility ensures that beneficiaries can adjust their coverage as their healthcare needs change over time.

During these enrollment periods, it’s crucial to evaluate your options and choose a plan that best suits your needs. By understanding your guaranteed issue rights and taking advantage of these enrollment windows, you can secure the Medigap coverage necessary to protect your health and financial well-being.

Benefits of Buying from Blue Cross and Blue Shield of Illinois

Purchasing a Medicare Supplement Plan from Blue Cross and Blue Shield of Illinois offers numerous advantages. These plans are designed to meet diverse healthcare needs, providing comprehensive coverage that goes beyond the standard benefits. With Blue Cross and Blue Shield, you can access additional health and wellness benefits, enhancing the overall value of your coverage.

One of the standout features of Blue Cross and Blue Shield of Illinois is the availability of MedicareRx plans, which cover prescription drugs and are tailored to different healthcare needs and budgets. The Blue Cross MedicareRx Value plan, for instance, offers a broader range of covered drugs compared to other plans, ensuring that beneficiaries have access to necessary medications. Additionally, these plans include access to a nationwide pharmacy network, making prescription fulfillment convenient and accessible.

Blue Cross and Blue Shield of Illinois also provides strong customer support, offering resources and tools to assist members in managing their healthcare. With a wide network of healthcare providers, members can benefit from extensive medical services, ensuring they receive the care they need when they need it. These benefits make Blue Cross and Blue Shield of Illinois a trusted choice for Medicare Supplement Insurance.

Tools and Resources for Illinois Residents

Illinois residents have access to various tools and resources to help them compare and enroll in Medicare Supplement Plans. Medicare.gov, for example, offers a tool that allows users to find and compare Medigap policies by entering their ZIP code, making it easier to see available options in their area. This tool is invaluable for those looking to understand the different plans and coverage options available to them.

The Illinois Department of Insurance also provides resources and assistance for residents navigating Medicare Supplement Plan options. Additionally, CMS.gov offers comprehensive information on Medicare and Medicaid services, helping residents understand their benefits and enrollment options.

Utilizing these tools and resources helps Illinois residents make informed healthcare coverage decisions.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In summary, Medicare Supplement Plans offer essential coverage that can significantly enhance your healthcare security by filling the gaps left by Original Medicare. Understanding the different types of plans available, eligibility requirements, and the costs involved is crucial for making informed decisions about your healthcare. The advantages of purchasing from reputable providers like Blue Cross and Blue Shield of Illinois further underscore the value these plans can bring to beneficiaries.

As you navigate your healthcare options, remember to utilize available tools and resources to compare plans and find the best fit for your needs. By doing so, you can ensure that you have the comprehensive coverage necessary to manage your health effectively and protect your financial well-being.

Frequently Asked Questions

What are Medicare Supplement Insurance Plans?

Medicare Supplement Insurance Plans, or Medigap policies, help cover out-of-pocket expenses that Original Medicare does not, including deductibles and copayments. They provide added financial security for beneficiaries seeking comprehensive healthcare coverage.

How do Medicare Supplement Plans differ from Medicare Advantage Plans?

Medicare Supplement Plans provide greater flexibility in choosing healthcare providers and cover out-of-pocket costs not included in Original Medicare. In contrast, Medicare Advantage Plans often feature added benefits but may impose network restrictions and higher out-of-pocket expenses.

What should I consider when choosing a Medicare Supplement Plan?

When choosing a Medicare Supplement Plan, it’s essential to assess your healthcare needs, consult with a Medicare advisor, and evaluate total coverage costs, additional benefits, and the inclusion of your preferred healthcare providers in the plan’s network. Making an informed choice can greatly enhance your healthcare experience.

Are prescription drugs covered under Medicare Supplement Plans?

Prescription drugs are not covered under Medicare Supplement Plans; you need to enroll in a separate Medicare Part D plan for medication coverage.

What are the guaranteed issue rights for Medicare Supplement Plans in Illinois?

In Illinois, guaranteed issue rights for Medicare Supplement Plans allow residents to obtain coverage without denial due to pre-existing conditions during specific periods, including the six-month open enrollment period that begins when one turns 65 and enrolls in Medicare Part B. Taking advantage of this period ensures access to necessary coverage.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Illinois 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.