by Russell Noga | Updated April 20th, 2025

Looking for Medicare Supplement Plans Georgia 2026? Discover everything you need to know, from top providers like AARP and Aetna to understanding costs and enrollment steps. Get the insights to make an informed healthcare choice.

Key Takeaways

- AARP/UnitedHealthcare leads the market in Georgia for Medicare Supplement plans, notably offering the most affordable Plan G.

- Mutual of Omaha is recognized for exceptional customer service, maintaining a low complaint rate among Medigap providers in Georgia.

- Medicare Supplement plans do not include prescription drug coverage, making it essential for beneficiaries to enroll in a separate Medicare Part D plan.

Compare 2026 Plans & Rates

Enter Zip Code

Top Medicare Supplement Companies in Georgia

Selecting the right Medicare Supplement insurance provider ensures comprehensive healthcare coverage. In Georgia, several private insurance companies stand out for their exceptional offerings and customer satisfaction. With Plans F and G being the most popular choices, knowing which companies offer the best services and prices is essential.

Among the top providers, AARP/UnitedHealthcare, Mutual of Omaha, and Aetna are highly regarded. Each of these companies excels in different aspects, whether it’s overall coverage, customer service, or affordability.

Here’s a closer look at why these insurers dominate the market in Georgia.

Best Overall Provider: AARP/UnitedHealthcare

AARP/UnitedHealthcare is considered the best overall Medicare Supplement provider in Georgia for several compelling reasons. This provider dominates the market, accounting for 95% of all Medicare Supplement plans sold in the state. One of the standout features is the affordability of their plans, particularly Plan G, which is the cheapest in Georgia.

Purchasing an AARP/UnitedHealthcare Medigap policy requires AARP membership, a minor prerequisite for accessing their comprehensive coverage and excellent customer service. High ratings for customer support highlight AARP/UnitedHealthcare’s commitment to assisting policyholders, making it a reliable choice for those eligible for Medicare.

Best for Customer Service: Mutual of Omaha

Mutual of Omaha distinguishes itself in customer service among private insurance companies. This provider boasts the fewest customer complaints among Medigap providers in Georgia, receiving less than a quarter of the complaints expected for its size. This low complaint rate underscores their commitment to customer satisfaction and reliability.

Additionally, Mutual of Omaha’s Medicare Supplement plans are typically more affordable than the state average, except for their high-deductible Plan G. Their strong customer support and competitive pricing make them a top choice for those seeking dependable Medicare Supplement insurance.

Most affordable Plan N: Aetna

Aetna is the top choice for an affordable Medicare Supplement Plan N. Aetna’s Plan N is recognized for its cost-effectiveness, with an average monthly premium that is 11% lower than the statewide average.

This makes Aetna an attractive option for budget-conscious individuals who still wish to maintain robust healthcare coverage.

Understanding Medicare Supplement Plan Costs in Georgia

Knowing the costs of Medicare Supplement plans is crucial for making an informed decision. Medigap plans typically have higher monthly premiums compared to Medicare Advantage plans, but they offer more predictable out-of-pocket costs. The average cost for a Plan G policy from AARP/UnitedHealthcare is approximately 15% lower than the state average, showcasing the variability in pricing among providers.

Several factors influence the cost of Medigap policies, including the type of plan, timing of enrollment, and geographic location. For instance, Mutual of Omaha’s plans are generally cheaper than the state average, except for its high-deductible Plan G. These variables can help you select the most cost-effective plan that meets your healthcare needs.

High Deductible Plans

High deductible Medigap plans allow individuals to pay more out-of-pocket initially to lower their monthly premiums. These plans allow enrollees to significantly reduce their monthly costs while still maintaining essential healthcare coverage. Once the deductible is met, these plans cover the same services as regular Medigap plans, making healthcare expenses manageable.

Healthy individuals who do not anticipate frequent medical expenses may find high deductible plans to be a smart choice. These plans balance lower premiums with coverage for significant medical events, making them a viable option for managing healthcare budgets.

Factors Affecting Medigap Policy Costs

Key factors influence the cost of Medigap policies. The type of plan chosen plays a significant role, with more comprehensive plans like Plan F generally costing more. Enrollment timing is another critical factor; enrolling during the Medigap Open Enrollment Period can help you avoid higher premiums and medical underwriting.

Geographic location also impacts cost, with prices varying significantly between areas. For instance, the cost of a Medigap plan in urban areas may differ from those in rural regions due to varying healthcare costs and provider availability.

Out-of-pocket costs like deductibles, copayments, and coinsurance are covered by Medigap plans, offering financial predictability.

Compare Medicare Plans & Rates in Your Area

Eligibility and Enrollment for Medicare Supplement Plans Georgia 2026

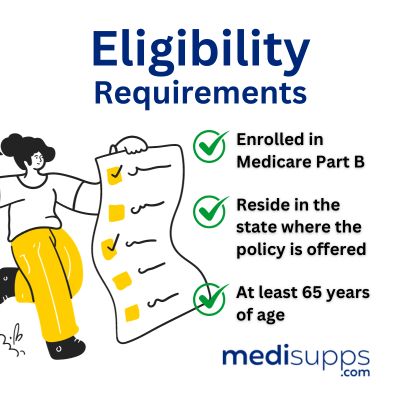

Eligibility and enrollment are crucial steps in securing Medicare Supplement coverage. Eligibility requires enrollment in Medicare Part A and Part B. The Medigap Open Enrollment Period is a critical time frame that allows individuals to enroll without the risk of higher premiums or medical underwriting. Understanding these steps helps you maximize your Medigap plan options.

There are also special enrollment situations that allow for changes to Medicare coverage following significant life events, such as relocation or loss of existing coverage. These circumstances offer flexibility to adjust healthcare plans outside standard enrollment periods.

Who is Eligible for Medicare Supplement Plans Georgia 2026?

Individuals must be at least 65 or have a qualifying disability to enroll in Medigap plans. In Georgia, those under 65 may also qualify if they meet specific state guidelines. After enrolling in Original Medicare, you have the option to select a Medigap plan. You can choose from any available plans in your area.

Eligibility for Medicare Supplement plans requires enrollment in both Medicare Part A and Part B. Dual enrollment ensures Medigap plans cover the gaps left by Original Medicare, offering comprehensive healthcare coverage.

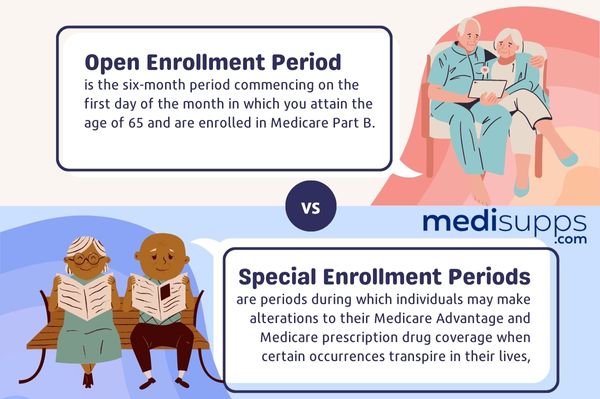

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is crucial for enrolling in Medigap plans without medical underwriting. This period starts on the first day of the month you turn 65 and are enrolled in Medicare Part B. Enrolling during this period helps avoid higher premiums and additional medical screening, ensuring you get the necessary coverage.

Utilizing the Medigap Open Enrollment Period can save money and stress, offering a straightforward path to securing Medicare Supplement insurance. It’s a one-time opportunity that can significantly impact your healthcare costs and coverage in the long run.

Special Enrollment Situations

Special enrollment periods provide flexibility for those experiencing significant life events, like moving or losing coverage. These periods allow for changes to Medicare coverage, ensuring that beneficiaries can adapt their plans to meet new circumstances.

Beginning January 1, 2024, those enrolling in Part A or B due to special circumstances will have a two-month window to join a Medicare Advantage or Part D plan. This change offers additional opportunities to secure necessary coverage without waiting for the next standard enrollment period.

Prescription Drug Coverage and Medicare Supplement Plans

Medicare Supplement plans are comprehensive in many areas but do not include prescription drug coverage. This gap requires additional steps for those needing medication coverage. Enrolling in a separate Medicare Part D plan is necessary for accessing prescription drug benefits.

Understanding the interaction between Medigap and Medicare Part D ensures complete healthcare coverage. Without this additional plan, you could face significant out-of-pocket costs for medications, making it vital to include Part D in your healthcare strategy.

No Prescription Drug Coverage in Medigap

Since Medigap plans do not cover prescription drugs, beneficiaries must take proactive steps to secure this coverage elsewhere. The best way to cover your medications is by enrolling in a standalone Medicare Part D plan. This separate plan will cover the costs of prescription medications, complementing your Medigap coverage.

Awareness of this gap in Medigap plans is essential for comprehensive healthcare planning. Understanding that Medigap does not cover prescription drugs allows you to take steps to avoid unexpected medical expenses.

Adding Medicare Part D

To add prescription drug coverage, beneficiaries must enroll in a Medicare Part D plan. This involves choosing a standalone plan that fits your medication needs and budget. Medicare Part D plans are specifically designed to cover prescription drug costs, providing a crucial complement to your Medigap policy.

Adding Medicare Part D ensures your prescription costs are covered, avoiding significant out-of-pocket expenses. It is an essential part of managing overall healthcare costs and ensuring comprehensive coverage.

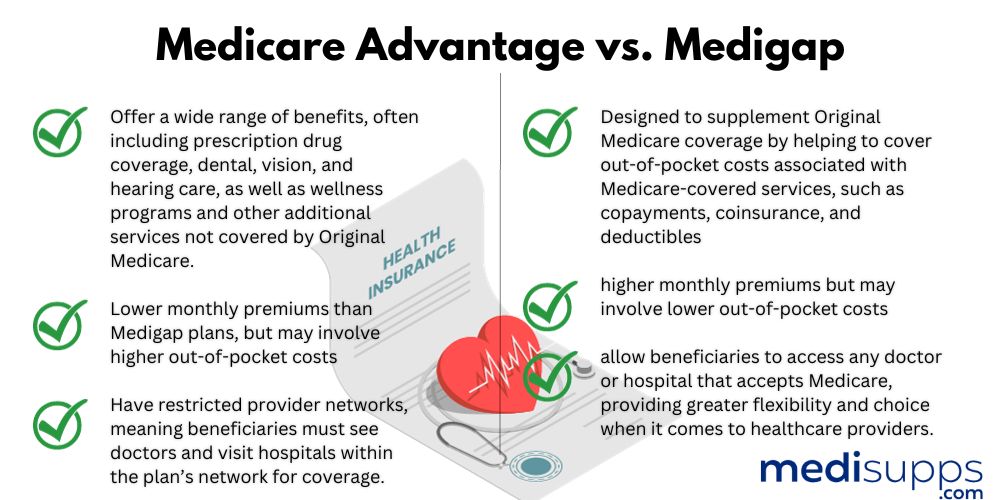

Comparing Medigap and Medicare Advantage Plans in Georgia

Choosing between Medigap and Medicare Advantage plans involves weighing the flexibility and coverage each option provides. Medigap plans supplement Original Medicare, covering gaps such as deductibles and copayments, while Medicare Advantage plans replace Original Medicare with their own coverage. Understanding these differences is crucial for making an informed decision.

Medicare Advantage plans may include additional benefits like vision and dental care, which Medigap plans do not cover. However, they often require staying within a network of providers, which can limit your healthcare choices.

Benefits of Medigap Plans

Medigap plans are designed to cover out-of-pocket costs not covered by Original Medicare, such as deductibles and copayments. This supplemental coverage provides beneficiaries with predictable healthcare costs, reducing the financial burden of medical expenses.

The predictability and comprehensive nature of Medigap plans make them a popular choice for those seeking stability in their healthcare coverage.

Advantages of Medicare Advantage Plans

Medicare Advantage plans offer several benefits that are not available with Medigap plans. Many Medicare Advantage plans include services such as vision, dental, and hearing care, providing significant advantages for comprehensive healthcare coverage. These bundled services often include preventive care and wellness programs, providing added value to beneficiaries.

Additionally, Medicare Advantage plans typically offer lower monthly premiums compared to Medigap plans, making them an attractive option for minimizing insurance costs. However, these plans often require staying within a network of providers, which can limit healthcare service choices.

Key Differences and Decision Factors

Choosing between Medigap and Medicare Advantage often involves deciding between flexibility and additional benefits. Medigap plans offer the flexibility of seeing any doctor that accepts Medicare, without the need for referrals or network restrictions. This is particularly beneficial for those who value a wide range of healthcare provider options.

On the other hand, Medicare Advantage plans provide additional benefits like vision and dental care but may require staying within a network of providers. Understanding these key differences and your healthcare needs and preferences will help you make an informed decision.

You cannot have both a Medigap plan and a Medicare Advantage plan simultaneously, so it’s crucial to evaluate which option aligns better with your healthcare priorities.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

Navigating the world of Medicare Supplement plans in Georgia can be complex, but understanding the key aspects can make it much easier. AARP/UnitedHealthcare stands out as the best overall provider due to its market dominance and affordability, while Mutual of Omaha excels in customer service, and Aetna offers the most affordable Plan N. Knowing the costs associated with Medigap plans and the factors that influence these costs can help you choose the most suitable plan for your needs.

Eligibility and enrollment are crucial to securing the right coverage, with the Medigap Open Enrollment Period being a particularly important window for avoiding higher premiums and medical underwriting. Additionally, integrating prescription drug coverage through Medicare Part D is essential for comprehensive healthcare planning. By comparing Medigap and Medicare Advantage plans, you can determine which option best meets your healthcare needs and preferences. Ultimately, making an informed decision will ensure you have the coverage necessary to enjoy peace of mind and financial stability in your healthcare journey.

Frequently Asked Questions

What are the top Medicare Supplement companies in Georgia?

The top Medicare Supplement companies in Georgia are AARP/UnitedHealthcare for overall coverage, Mutual of Omaha for excellent customer service, and Aetna for the most affordable Plan N.

What factors affect the cost of Medigap policies?

The cost of Medigap policies is influenced by the type of plan selected, the timing of enrollment, geographic location, and whether enrollment occurs during the Medigap Open Enrollment Period. Understanding these factors can help you make a more informed decision.

What is the Medigap Open Enrollment Period?

The Medigap Open Enrollment Period is a crucial six-month timeframe that begins on the first day of the month you turn 65 and enroll in Medicare Part B, enabling you to sign up for Medigap insurance without the need for medical underwriting. This period is vital for securing coverage without potential premium increases due to health conditions.

Do Medigap plans cover prescription drugs?

Medigap plans do not cover prescription drugs; you must enroll in a separate Medicare Part D plan for that coverage.

What are the main differences between Medigap and Medicare Advantage plans?

The main difference is that Medigap plans supplement Original Medicare, allowing flexibility in provider choice, while Medicare Advantage plans replace Original Medicare and typically include extra benefits but often require network restrictions.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Georgia in 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.