by Russell Noga | Updated September 25th, 2023

Navigating the complex world of Medicare supplement plans can be overwhelming, especially when trying to find the best plan to suit your individual needs. Medicare Plan N in Texas has emerged as a popular choice for those seeking comprehensive coverage at an affordable price.

Navigating the complex world of Medicare supplement plans can be overwhelming, especially when trying to find the best plan to suit your individual needs. Medicare Plan N in Texas has emerged as a popular choice for those seeking comprehensive coverage at an affordable price.

But is Plan N the right fit for you?

This article will guide you through the essential information about Medicare Plan N in Texas, including its coverage details, eligibility requirements, comparisons with other Medigap plans, costs, and the enrollment process.

By the end of this article, you will be equipped with the knowledge to make an informed decision about whether Medicare Plan N is the best choice for your healthcare needs in Texas.

Short Summary

- Medicare Plan N in Texas is a Medigap option offering coverage for coinsurance and deductibles, skilled nursing facility care, and foreign travel emergencies.

- Eligible individuals can compare Medicare Plan N with other popular plans to find the best coverage at competitive rates.

- Alternatives such as Medicare Supplement Plan G may offer more coverage but with a higher premium

Understanding Medicare Plan N in Texas

Medicare Plan N in Texas is a widely-used Medigap option offered by private insurance companies that covers most out-of-pocket expenses, with the exception of Part B deductible, certain copays, and possible excess charges though these are rare.

Medigap Plan N is designed to help Medicare beneficiaries by offering additional features, such as Foreign Travel Emergency coverage.

This plan is suitable for individuals seeking lower premiums and willing to pay copays for certain services. It is essential to note that Medicare Plan N in Texas is one of the popular supplement plans in Texas that does not cover all medical costs.

Medigap plans, also called Texas Medicare supplement plans, are outlined and standardized by Medicare.

Medicare Plan N Coverage Details

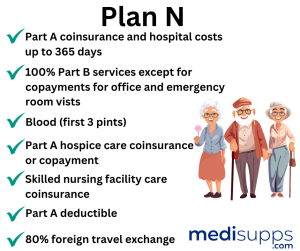

Plan N is considered one of the best Medicare supplement plans, providing coverage for Medicare Part A and B coinsurance, Part A deductible, skilled nursing facility care, and foreign travel emergency; however, it does not cover Part B deductible or excess charges.

Plan N is considered one of the best Medicare supplement plans, providing coverage for Medicare Part A and B coinsurance, Part A deductible, skilled nursing facility care, and foreign travel emergency; however, it does not cover Part B deductible or excess charges.

This means that while Plan N offers significant coverage, individuals enrolled in this plan will still be responsible for paying the Part B deductible and any excess charges out-of-pocket.

Additionally, some providers offer extra features in their Plan N coverage. Medigap Plan N provides Foreign Travel Emergency coverage for any medical needs while traveling.

Who is Eligible for Medigap Plan N?

To be eligible for Medicare Plan N in Texas, individuals must be enrolled in Medicare Parts A and B and not enrolled in a Medicare Advantage plan.

Medicare Plan N in Texas is offered by private insurance companies and is available to individuals aged 65 and above, as well as those who are younger but have a qualifying disability or medical condition, such as end-stage renal disease (ESRD) or Lou Gehrig’s disease.

It’s crucial to understand the distinction between Medicare Plan N and Medicare Advantage plans. Medicare Plan N is a Medigap plan that assists in covering some of the expenses not covered by Original Medicare, such as coinsurance and the Medicare Part A deductible.

Compare Plans & Rates in 2 Easy Steps

Enter Zip Code

Comparing Medicare Plan N with Other Medigap Plans

When choosing a Medicare supplement plan, it’s important to compare Plan N with other popular Medigap plans in Texas, such as Plan G and High-Deductible Plan G. This comparison will help you decide which plan offers the best coverage and cost savings for your specific needs.

Standard Plan G, High-Deductible Plan G, and Plan N are the most popular Medicare supplement insurance plans in Texas.

Understanding the differences in coverage and costs between these plans can help you make an informed decision about the best plan for your healthcare needs.

Plan N vs. Plan G

Plan N vs. Plan G

The primary difference between Plan N and Plan G is the level of coverage and the associated premiums. Plan N has more affordable premiums than Plan G, though it necessitates copays for doctor and emergency room visits, whereas Plan G covers all costs apart from the Part B deductible.

In other words, if you choose Plan N, you will pay lower premiums, but you will also be responsible for copays when you visit a doctor or an emergency room. On the other hand, Plan G offers more comprehensive coverage, with the only out-of-pocket expense being the Part B deductible.

Your choice between these two plans will depend on your healthcare needs and budget.

Plan N vs. High-Deductible Plan G

Another popular Medigap plan to compare with Plan N is the High-Deductible Plan G. This plan has a lower monthly premium compared to Plan N but requires you to meet a set deductible amount before your benefits become effective.

Plan N provides more coverage than High-Deductible Plan G; however, it comes with higher premiums. If you anticipate infrequent medical visits and prefer lower monthly premiums, High-Deductible Plan G might be a suitable option.

However, if you require more comprehensive coverage and are willing to pay higher premiums for fewer out-of-pocket expenses, Plan N could be a better choice.

Costs of Medicare Plan N in Texas

The cost of Medicare Plan N in Texas varies by provider, age, and other factors, with premiums ranging from $94.20 to $117.60 per month. Aetna offers some of the lowest Plan N premiums for a 65-year-old in Texas, with an average rate of $94.20 per month, while Cigna has some of the highest Plan N premiums in Texas, with an average rate of $117.60 per month.

It’s important to research and compare various insurance providers to find the most advantageous discounts and savings for Medicare Plan N in Texas.

Understanding the factors that affect Plan N premiums will help you make an informed decision when selecting a provider.

Factors Affecting Plan N Premiums

Factors Affecting Plan N Premiums

Several factors influence the cost of Medicare Plan N in Texas, including:

- Age

- Geographic location

- Tobacco use

- Provider pricing practices

Typically, premiums increase with age, and tobacco users generally face higher premiums. Geographic location also plays a role, with premiums varying depending on the state and region.

Understanding these factors will help you anticipate the potential costs associated with Plan N and make an informed decision when choosing a provider.

Keep in mind that provider pricing methods also play a role in determining premiums, so it’s crucial to compare different providers to find the most competitive rates.

Potential Discounts and Savings

Discounts and savings on Plan N premiums may be accessible through household discounts, early enrollment, or selecting an insurance company with competitive rates. Some companies, such as Aetna and Cigna Healthcare, offer discounted rates for Medicare Plan N.

Additionally, certain discounts may be available for enrolling online or for specific demographics, such as non-smokers or married individuals.

To find the best discounts and savings for Medicare Plan N in Texas, it’s crucial to research and compare various insurance providers.

Top Medicare Plan N Providers in Texas

Selecting the right Medicare Plan N provider is essential for ensuring you receive the best coverage, cost, and customer satisfaction. Some of the top Plan N Medicare providers in Texas include Allstate, Mutual of Omaha, Aetna, and Philadelphia American among others.

These providers have robust financial ratings and are well-established organizations, offering exemplary customer service, knowledgeable representatives, and a range of plan options.

Comparing these top providers based on their coverage, cost, and customer satisfaction will help you make an informed decision when selecting a Medicare Plan N provider in Texas.

Provider Comparison

Provider Comparison

When comparing Medicare Plan N providers, it’s important to consider factors such as financial strength, customer service, and plan offerings. The top Medicare Plan N providers in Texas have strong financial ratings and are well-established, ensuring that they can provide the coverage and support you need.

Additionally, these providers offer a range of plan options, including Medicare coverage for preventive care, hospitalization, and prescription drugs.

By researching and comparing various providers, you can find the best Medicare Plan N provider that meets your specific healthcare needs and budget, while also considering the medicare benefits offered.

Enrollment Process for Medicare Plan N in Texas

Enrolling in Medicare Plan N in Texas is a crucial step in securing the right coverage for your healthcare needs. There are specific enrollment periods during which you can sign up for Plan N, including the Medigap Open Enrollment Period and Special Enrollment Periods.

Enrolling during these periods ensures guaranteed issue rights and avoids medical underwriting, making it easier to obtain coverage.

Understanding the enrollment process and the different enrollment periods will help you make an informed decision about when to enroll in Medicare Plan N in Texas. Be sure to enroll during the appropriate period to secure the best coverage and avoid potential issues with eligibility.

Medigap Open Enrollment Period

The Medigap 6-Month Open Enrollment Period is a one-time, six-month period that begins when you enroll in Medicare Part B at the age of 65 or above. This period offers the ideal opportunity to enroll in Plan N, as it ensures guaranteed issue rights and precludes medical underwriting.

During the Medigap Open Enrollment Period, you can enroll in any Medicare supplement plan, including Plan N, without having to answer any health questions or undergo medical underwriting.

This period is an excellent opportunity to secure the best coverage at the most competitive rates, so it’s crucial to enroll in Plan N during this time to take advantage of these benefits.

Special Enrollment Periods

Special enrollment periods provide individuals with the opportunity to enroll in Plan N outside of the open enrollment period due to certain circumstances, such as:

- the loss of employer-sponsored coverage

- moving to a new area that is not in your current plan’s service area

- qualifying for both Medicare and Medicaid

- losing your current Medicare Advantage plan or Medicare supplement plan through no fault of your own

These periods offer guaranteed issue rights, allowing you to enroll in a Medicare supplement plan without having to answer health questions or undergo medical underwriting.

In order to take advantage of a Special Enrollment Period, you must provide proof that you have lost coverage or that your coverage will end. By enrolling during a Special Enrollment Period, you can secure Medicare Plan N coverage even if you missed the Medigap Open Enrollment Period.

Alternatives to Medicare Plan N in Texas

While Medicare Plan N in Texas is a popular choice, it’s essential to consider alternative options to ensure that you have the best coverage for your healthcare needs. A common alternative to Medicare Plan N includes Medicare Supplement Plan G.

Plan G offers additional benefits to Medicare Plan N in Texas, though it does have higher premiums.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Medicare Plan N in Texas is a popular and affordable Medigap option for those seeking comprehensive coverage and lower premiums.

By understanding the coverage details, eligibility requirements, and costs associated with Plan N, you can make an informed decision about whether this plan is the best fit for your healthcare needs.

However, it’s essential to compare Plan N with other Medigap plans in 2024 and alternatives, such as Medicare Advantage plans and employer-sponsored plans, to ensure that you are receiving the best coverage and value for your individual situation.

By carefully researching and comparing your options, you can secure the healthcare coverage that best meets your needs and budget.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Plan N in Texas?

Medicare Plan N in Texas is a Medigap plan that provides comprehensive healthcare coverage for eligible individuals, including hospital, medical, and prescription drug benefits.

How does Medicare Plan N in Texas differ from Original Medicare?

Medicare Plan N in Texas supplements Medicare Part A and Medicare Part B. It doesn’t replace Original Medicare. Plan N helps pay gaps which are expenses in Medicare Part A and Part B that you are responsible for.

What are the key benefits of Medicare Plan N in Texas?

The key benefits of Medicare Plan N in Texas include coverage for hospital stays, doctor visits, preventive care, and emergency care.

Are there monthly premiums associated with Medicare Plan N in Texas?

Yes, there are monthly premiums for Medicare Plan N in all states. The costs can vary depending on the plan and your location. You can use our website to check the rates in your area for Plan N.

What are the cost-sharing features of Medicare Plan N in Texas?

Medicare Plan N in Texas requires copayments for some services, such as doctor visits and emergency room visits after the Medicare Part B deductible is paid.

Can I enroll in Medicare Plan N in Texas at any time of the year?

If you are currently enrolled in a Medicare Advantage plan, then uyou can generally enroll in or make changes to your Medicare Plan N in Texas during the Fall Medicare Annual Enrollment Period, which typically runs from October 15 to December 7 each year.

If you already are enrolled in a Medigap plan you may apply to switch to a different Medigap plan at any time during the year. You will likely have to go through medical underwriting.

Can I switch from Medicare Plan G to Medicare Plan N?

Yes, you may apply to switch from Plan G to Medicare Plan N at any time during the year.

How do I choose the right Medicare Plan N in Texas for my needs?

To choose the right Medicare Plan N in Texas, call us today for help. We’ll shop the top companies in your area to see which one offers competitive premiums for Plan N.

What prescription drug coverage does Medicare Plan N in Texas offer?

Medicare Plan N (or any Medicare Supplement Plan) does not include prescription drug coverage. You will need to enroll in a separate Medicare Part D prescription drug plan which can help cover the cost of prescription medications.

Are there any specific Medicare Plan N providers that serve Texas residents?

Many insurance companies that offer Medicare Plan N in Texas also offer plans in multiple states. There is no benefit to just using a company that only serves Texas.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.