by Russell Noga | Updated February 28th, 2024

Are you considering a Medicare Supplement plan to fill the gaps in your Original Medicare coverage? Look no further than Family Life Medigap plans.

Are you considering a Medicare Supplement plan to fill the gaps in your Original Medicare coverage? Look no further than Family Life Medigap plans.

With comprehensive coverage, lower monthly premiums, and provider flexibility, this plan offers a perfect balance of value and protection. In this article, we’ll explore the ins and outs of Family Life Medicare Plan N to help you make an informed decision about your healthcare needs.

From understanding the coverage details and costs to comparing this plan with other popular Medigap options, we’ll guide you through every aspect of this sought-after plan.

Ready to dive in? Let’s get started!

Short Summary

- Family Life Medicare Plan N offers comprehensive coverage at an affordable price with minimal out-of-pocket costs.

- Comparing Family Life Medicare Plan N to other plans is important when selecting the right plan for you and your healthcare needs.

- Family Life Insurance Company has excellent financial strength ratings and customer reviews, providing assurance of reliable coverage.

Understanding Family Life Medicare Plan N

Family Life Medicare Plan N is a Medigap plan offered by Family Life Insurance Company, designed to provide additional coverage for Medicare beneficiaries.

This plan is a popular choice among seniors seeking comprehensive coverage at an affordable price.

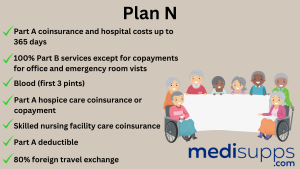

With coverage for:

- Medicare Part A and Part B coinsurance

- Copayments

- Deductibles

- Excess charges

- Coinsurance and hospital costs

Family Life Medicare Plan N makes it easier to manage healthcare expenses.

One of the key advantages of this plan is its lower monthly premiums compared to other Medicare Supplement plans.

However, it’s essential to be aware of any deductibles and copayments you may be responsible for. In the following sections, we’ll delve deeper into the coverage details, costs, and eligibility criteria of Family Life Medicare Plan N.

Coverage Details

Family Life Medicare Plan N offers robust coverage to help manage the out-of-pocket costs associated with Original Medicare. This plan covers:

- Part A and Part B coinsurance

- The first three pints of blood

- Part A hospice care coinsurance or copays

- Part B coinsurance or copays

With such comprehensive coverage, you can enjoy peace of mind knowing that your medical expenses are well taken care of.

There are some copays associated with Plan N, which include a $20 copay for physician visits and a $50 copay for emergency room visits not resulting in hospitalization. It’s important to note that Plan N does not cover the Medicare Part B deductible, which is currently $226.

However, the overall out-of-pocket costs for medical care with Plan N are generally minimal, making it an attractive alternative to Medicare Advantage plans.

Cost and Premiums

Cost and Premiums

One of the most appealing aspects of Family Life Medicare Plan N is its lower monthly premiums compared to other Medicare plans. While the specific cost of Plan N varies depending on your state of residence, the rates typically range from $80 to $100 per month.

This affordability allows you to enjoy comprehensive coverage without breaking the bank.

It’s essential to consider other expenses associated with Plan N as well. You’ll be responsible for deductibles and copayments, which can accumulate throughout the year.

Despite these additional costs, many beneficiaries find the lower monthly premiums of Plan N to be an ideal balance between affordability and comprehensive coverage.

Eligibility Criteria

To be eligible for enrollment in Medicare Supplement Plan N, you must already have Original Medicare Part A and Part B. Medicare Supplement plans like Plan N are offered through private insurance companies, making it easy to find a plan that suits your needs and preferences.

Once you’ve confirmed your eligibility, you can begin the enrollment process. This typically involves selecting the appropriate plan and consulting with licensed insurance brokers for further guidance.

With Family Life Medicare Plan N, you’ll enjoy the added benefits and protection that come with enrolling in a Medigap plan.

Compare Medigap Rates for 2024

Enter Zip Code

Comparing Family Life Medicare Plan N to Other Plans

To help you make an informed decision about your Medicare Supplement coverage, let’s compare Family Life Medicare Plan N with two other popular Medigap plans: Plan G and Plan F.

Each plan offers its own set of benefits and costs, so understanding the differences will help you determine which option is best for you, including considering Medicare supplement policies and a Medicare supplement insurance plan.

In the following sections, we’ll examine the coverage, costs, and benefits of Plan G and Plan F in comparison to Family Life Medicare Plan N. This side-by-side analysis will provide you with valuable insights as you navigate the world of Medicare Supplement plans.

Medicare Plan G vs. Plan N

When comparing Family Life Medicare Plan G and Plan N, the main difference lies in the coverage and costs. Plan G offers more comprehensive coverage, including coverage for Medicare Part A and Part B deductibles.

In contrast, Plan N requires cost-sharing for specific services such as copayments for doctor visits and emergency room visits.

While Plan G provides more extensive coverage, it typically comes with higher monthly premiums. Plan N, on the other hand, offers lower monthly premiums but may have higher copays for certain services.

Ultimately, your decision between Plan G and Plan N will depend on your healthcare needs and preferences regarding coverage and costs.

Medicare Plan F vs. Plan N

Differences between Plan F and Plan N come down to coverage and costs. Plan F is the most comprehensive Medigap plan, offering one additional benefit compared to Plan N: coverage for the Medicare Part B deductible. However, Plan F typically comes with higher monthly premiums compared to Plan N.

If you prefer lower monthly premiums and don’t mind cost-sharing for specific services, Plan N may be the better choice for you. Ultimately, it’s crucial to assess your healthcare needs and budget to determine which plan is the best fit.

Additional Services and Benefits

Family Life Medicare Plan N offers more than just coverage for medical expenses. Enrollees can also take advantage of additional services and benefits designed to support overall health and wellness.

In the following sections, we’ll explore the health and wellness programs and provider flexibility that come with choosing Family Life Medicare Plan N.

These added perks make Family Life Medicare Plan N an even more attractive option for those seeking comprehensive coverage and valuable extras to support a healthy lifestyle.

Health and Wellness Programs

Family Life Medicare Plan N enrollees have access to a variety of health and wellness programs, including preventive care, health screenings, and disease management services.

These Medicare benefits, supported by the federal Medicare program and traditional Medicare, are designed to promote better health outcomes, more effective chronic condition management, and cost reductions.

To access these programs and services, Family Life Medicare Plan N enrollees can consult their primary care provider or contact Family Life directly. With these additional resources at your fingertips, you can take a proactive approach to maintaining your health and well-being.

Provider Flexibility

One of the key benefits of choosing Family Life Medicare Plan N is the freedom to choose any Medicare-approved healthcare provider. This provider flexibility allows you to:

- Select a doctor and hospital that best meets your needs and preferences

- Access a wide network of healthcare providers

- Receive care from specialists and hospitals that accept Medicare

With Family Life Medicare Plan N, you can enjoy the peace of mind that comes with knowing you have the flexibility to choose your healthcare providers without being locked into a restrictive network, unlike a medicare advantage HMO.

Prescription Drug Coverage and Family Life Medicare Plan N

Prescription Drug Coverage and Family Life Medicare Plan N

While Family Life Medicare Plan N offers comprehensive coverage for medical expenses, it’s important to note that it does not include prescription drug coverage. To obtain coverage for your prescription medications, you’ll need to enroll in a separate Medicare Part D plan.

In the next section, we’ll discuss Medicare Part D and how it can be combined with Family Life Medicare Plan N to provide complete coverage for your healthcare needs.

Medicare Part D

Medicare Part D is a voluntary outpatient prescription drug benefit for individuals with Medicare. It helps cover the cost of prescription drugs and is offered through private plans that contract with Medicare.

Part D covers most outpatient prescription drugs, including both generic and brand-name medications, as well as certain preventive services such as vaccines and screenings.

To obtain prescription drug coverage alongside Family Life Medicare Plan N, you’ll need to enroll in a Medicare Part D plan. You can do this through the Family Life Insurance Company or through a private insurer.

By combining Plan N with a Part D plan, you can ensure comprehensive coverage for your healthcare needs.

Enrolling in Family Life Medicare Plan N

Now that you have a better understanding of Family Life Medicare Plan N and its benefits, you might be wondering how to enroll. The enrollment process is simple and can be completed online at Cigna.com.

To enroll, you’ll need to reside in the service area of the plan and have your Medicare Number and Part A and/or Part B ready.

Before enrolling, it’s essential to know the best time to sign up. In the following sections, we’ll discuss the Medigap Open Enrollment Period and Special Enrollment Periods, which can greatly impact your coverage and costs.

Medigap Open Enrollment Period

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is a crucial time for Medicare beneficiaries. This six-month period begins on the first day of the month when you’re both 65 or older and enrolled in Medicare Part B.

During this period, insurance companies are prohibited from denying coverage or charging higher premiums based on your health.

Enrolling in Family Life Medicare Plan N during the Medigap Open Enrollment Period is the best way to ensure you get the coverage you need at the most favorable rates. Don’t miss this opportunity to secure your healthcare future.

Special Enrollment Periods

Special Enrollment Periods

Special Enrollment Periods are specific times when you can enroll in a Medicare Supplement plan outside of the Medigap Open Enrollment Period. These periods are triggered by certain events, such as moving to a different state or losing other health coverage.

To learn more about the Special Enrollment Periods for Family Life Medicare Plan N, you can visit the Medicare website or Healthcare.gov.

These resources will provide you with the necessary information to ensure you don’t miss out on enrolling in the coverage you need.

Family Life Insurance Company’s Reputation and Ratings

When choosing a Medicare Supplement plan, it’s essential to consider the reputation and financial strength of the insurance company providing the coverage.

Family Life Insurance Company has been serving seniors since 1949 and was acquired by Manhattan Life in 2006.

In the following sections, we’ll explore Family Life Insurance Company’s financial strength ratings and customer reviews, providing you with valuable insights into the company’s ability to meet its financial obligations and provide reliable coverage.

Financial Strength Ratings

Financial Strength Ratings

Financial strength ratings are crucial when assessing an insurance company’s ability to fulfill its obligations and provide dependable coverage. Family Life Insurance Company boasts an A (Excellent) financial strength rating with a stable outlook.

By choosing a company with a strong financial rating, you can have confidence in the stability and reliability of your Medicare Supplement coverage.

With Family Life Insurance Company, you can trust that you’re in good hands when it comes to medicare supplement insurance.

Customer Reviews and Satisfaction

Family Life Insurance Company is generally well-regarded for its customer satisfaction and quality service, with competitive and reasonable rates.

Although specific customer reviews for Family Life Insurance Company are not readily available, their overall reputation and commitment to serving seniors speak volumes about the company’s dedication to providing excellent coverage.

By choosing Family Life Medicare Plan N, you can count on a company with a solid reputation and a long history of providing quality insurance products to seniors.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Family Life Medicare Plan N offers a comprehensive and affordable option for those seeking a Medicare Supplement plan.

With essential coverage for medical expenses, provider flexibility, and additional health and wellness programs, this plan strikes the perfect balance between value and protection.

We hope this guide has provided you with the necessary information to make an informed decision about your healthcare needs.

Family Life Medicare Plan N may just be the ideal solution for your Medicare Supplement coverage, offering peace of mind and financial security in your golden years.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Family Life Medicare Plan N, and how does it compare to other Medicare plans?

Family Life Medicare Plan N is known for its comprehensive coverage and cost-sharing structure, but also has lower premiums than Medicare Plan G.

What are the primary benefits of Family Life Medicare Plan N?

Plan N typically covers hospitalization, doctor’s office visits, prescription drugs, and skilled nursing facility care. It offers a broad range of benefits, with low premiums and copay amounts.

How does cost-sharing work with Family Life Medicare Plan N?

Medicare Plan N has lower monthly premiums than some other Medicare plans but requires copayments or coinsurance for services like doctor’s visits and ER visits.

Are there any limitations on healthcare providers with Family Life Medicare Plan N?

The only limitation with Medicare Plan N is you must see doctors who accept Medicare Part B.

Does Family Life Medicare Plan N include prescription drug coverage?

No, Medigap plans do not inclue prescription drug coverage. Be sure to check the formulary for covered drugs and associated costs.

Can you enroll in Family Life Medicare Plan N with pre-existing conditions?

Yes, you can typically enroll during the annual Medicare Open Enrollment period, though you may have to go through medical underwriting to get approval first.

Are there any wellness benefits included in Plan N?

Some Plan N options may provide wellness benefits like fitness programs and preventive care services. Review the plan details for specifics.

How can you enroll in Family Life Medicare Plan N?

Call us today for help. 1-888-891-0229

Are there additional costs associated with Family Life Medicare Plan N?

In addition to premiums, you may have copayments or coinsurance for certain services.

Can you switch to Family Life Medicare Plan N from another Medicare plan?

Yes, you can switch during the annual Medicare Open Enrollment period if you are currently enrolled in a Medicare Advantage plan. If you are switching from another Medigap plan, you may apply to switch at any time during the year.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be pleased to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.