by Russell Noga | Updated September 27th, 2023

Navigating the world of Medicare can be overwhelming, especially when it comes to understanding the various supplement plans and their coverage.

Navigating the world of Medicare can be overwhelming, especially when it comes to understanding the various supplement plans and their coverage.

One such plan, Medicare Plan N, offers a balance of comprehensive coverage and lower premiums compared to other popular plans like Plan G.

But does Medicare Plan N cover prescriptions?

In this article, we’ll explore the ins and outs of Medicare Plan N, compare it to other Medigap plans, and help you decide if it’s the right choice for your healthcare needs.

Short Summary

- Medicare Plan N is a cost-effective Medigap plan that provides comprehensive coverage for out-of-pocket expenses associated with Original Medicare.

- It does not cover the Medicare Part B deductible or excess charges, nor prescription drugs. Beneficiaries should consider alternative options such as enrolling in a standalone Part D plan for prescription drug coverage.

- Evaluating healthcare needs and weighing the pros & cons of Medicare Plan N is essential to determine if it’s right for you.

Understanding Medicare Plan N

Understanding Medicare Plan N

Medicare Plan N is a popular choice among beneficiaries seeking additional coverage beyond Original Medicare.

This comprehensive Medicare supplement insurance plan, also known as a Medigap plan, helps cover many out-of-pocket expenses while offering lower premiums compared to other Medicare supplement plans. By choosing a Medicare supplement plan like Plan N, beneficiaries can enjoy more financial security and peace of mind.

However, it’s essential to understand the specifics of Plan N to determine if it’s the best fit for your healthcare needs.

What is Medicare Plan N?

Medicare Plan N is a standardized Medicare plan offered by private insurance companies. It aims to cover the majority of financial responsibilities associated with Original Medicare, providing cost-sharing benefits that help reduce out-of-pocket expenses for beneficiaries.

Plan N covers the following:

- Medicare Part A deductible

- Medicare Part A coinsurance

- Medicare Part B coinsurance or copayment

- Three pints of blood

- 80% of medical costs during foreign travel

However, it’s important to note that Plan N does not cover the Medicare Part B deductible or excess charges. Additionally, individuals with a Medicare Advantage plan are not eligible to sign up for Medigap Plan N.

Understanding these restrictions can help you determine if Plan N is the right choice for your healthcare needs.

Key Benefits of Medicare Plan N

One of the main advantages of Medicare Plan N is its coverage of various healthcare costs. Plan N covers the Medicare Part A deductible, coinsurance for Parts A and B, and even foreign travel emergency medical costs.

This means that beneficiaries who travel outside the United States can enjoy up to 80% coverage for emergency medical services.

However, there are some limitations to Plan N’s coverage. It does not cover the Medicare Part B deductible or excess charges, which are the charges above the Medicare-approved amount.

This is important to consider when weighing the pros and cons of choosing Plan N for your supplemental coverage.

Compare Medicare Plan N Rates

Enter Zip Code

Prescription Drug Coverage in Medicare Plan N

Medicare Plan N, or any Medigap plan, does not include prescription drug coverage. Beneficiaries who require medication coverage will need to explore other options to ensure their prescriptions are covered.

The Limitations of Plan N’s Prescription Coverage

The Limitations of Plan N’s Prescription Coverage

While Medicare Plan N offers many benefits, it does not provide coverage for prescription drugs. This limitation may necessitate beneficiaries to look for other options to cover their medication expenses.

It’s essential to understand this aspect of Medicare Plan N when deciding if it’s the right choice for you.

Some individuals may find that the lower premiums and comprehensive coverage provided by Plan N outweigh the lack of prescription drug coverage.

However, for those who require regular medications, you will need to enroll in a separate Medicare Part D prescription drug plan.

Alternative Options for Prescription Drug Coverage

If you find that Medicare Plan N is the right choice for your healthcare needs but still require prescription drug coverage, there are alternative options available.

One such option is enrolling in a standalone Medicare Part D prescription drug plan. These plans are offered by private insurers and approved by Medicare. These plans can help cover the costs of your medications.

It’s essential to weigh the pros and cons of each option to determine the best solution for your prescription drug needs.

Comparing Medicare Plan N to Other Medigap Plans

When selecting a Medigap plan for 2024, it’s crucial to compare your options to find the coverage that best suits your needs.

In this section, we’ll compare Medicare Plan N to other popular Medicare plans, such as Plan G and Plan F, to help you make an informed decision.

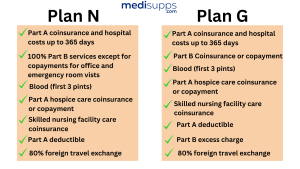

Medicare Plan N vs. Plan G

When comparing Medicare Plan N to Plan G, there are some key differences to consider.

- Plan N offers lower premiums than Plan G, making it a more cost-effective option for many beneficiaries.

- Plan N may require copayments for doctor and emergency room visits, while Medicare Plan G covers these costs in full.

- Plan N does not cover Part B excess charges, which are the charges above the Medicare-approved amount. These are rare.

In contrast, Medicare Plan G has slightly higher premiums but provides more comprehensive coverage, including the Part B excess charges.

Depending on your healthcare needs and budget, either Plan N or Plan G could be the right choice for you.

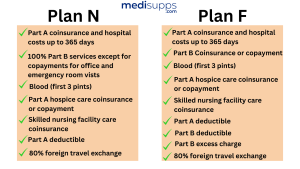

Medicare Plan N vs. Plan F

Medicare Plan F is another popular Medicare plan that offers comprehensive coverage. However, there are some differences between Plan F and Plan N.

- Plan F is more expensive than Plan N due to its extensive coverage.

- Plan F covers the Medicare Part B deductible, while Plan N does not.

- Plan F does not require copayments for certain services, unlike Plan N.

- You may only apply for Medicare Plan F if you were enrolled in Medicare prior to January 1st of 2020.

When choosing between Medicare Plan N and Plan F, it’s essential to consider your healthcare needs and budget.

If you require more comprehensive coverage and can afford the higher premiums, Plan F may be the better choice for you.

However, if you prefer lower premiums and are comfortable with copayments and the lack of Medicare Part B deductible coverage, Plan N could be the right fit.

Costs and Pricing of Medicare Plan N

The cost of Medicare Plan N can vary based on factors such as age, location, and the insurance company providing the coverage.

Understanding these factors can help you find the most affordable and suitable Plan N coverage for your needs.

Factors Influencing Plan N Premiums

Various factors influence the monthly premiums for Medicare Plan N, including your ZIP code, age, gender, and tobacco use. For example, smokers may be charged a higher premium rate than non-smokers.

Additionally, insurance companies use different pricing methods to set premiums for Medicare Supplement plans, such as community-rated, issue-age-rated, and attained-age-rated pricing systems.

Understanding these factors and pricing methods can help you find the most affordable Medicare Plan N coverage for your needs. It’s essential to compare plans and premiums from various insurance companies to ensure you’re getting the best value for your healthcare coverage.

Comparing Plan N Premiums to Other Medigap Plans

When comparing Medicare Plan N premiums to other Medigap plans, it’s essential to consider the coverage provided and the associated costs.

Plan N generally offers lower premiums compared to other Medigap plans, such as Plan G and Plan F. However, Plan N involves more cost-sharing, meaning you may have to pay out-of-pocket costs for certain services.

Taking the time to compare Plan N premiums to other Medigap plans can help you find the most cost-effective option for your healthcare needs. Remember to consider factors such as coverage, out-of-pocket costs, and the insurance company when making your decision.

Enrolling in Medicare Plan N

To enroll in Medicare Plan N, it’s essential to understand the open enrollment period and the process of switching from another Medigap plan to Plan N.

This section will provide guidance on these important aspects of enrolling in Plan N.

Open Enrollment Period for Medicare Plan N

The enrollment period for Medicare Plan N starts on the first day of the month in which an individual is 65 or above and enrolled in Medicare Part B. This period lasts six months.

During this period, you can enroll in Medicare Plan N without undergoing medical underwriting, which can be advantageous for those with pre-existing health conditions.

If you miss the open enrollment period, you may still be able to enroll in Plan N; however, you may be subject to medical underwriting, which could result in higher premiums or even denial of coverage based on your health status.

It’s essential to be aware of the open enrollment period to ensure you have the best opportunity to obtain the coverage you need.

Switching from Another Medigap Plan to Plan N

If you currently have another Medigap plan and wish to switch to Plan N, you will need to follow a specific process. Here are the steps to switch to Plan N:

- Research and compare different insurance providers that offer Plan N.

- Once you have selected a provider, contact them and request an application for Plan N.

- Indicate on the application that you want to cancel your current Medigap plan.

- Submit the completed application.

Upon approval, you will receive confirmation of your new coverage under Plan N. However, if you switch outside the open enrollment period, you may need to pass a medical underwriting test, which could impact your premium rates or coverage eligibility.

Evaluating if Medicare Plan N is Right for You

Determining if Medicare Plan N is the right choice for your healthcare needs involves assessing your current and future healthcare needs and weighing the pros and cons of the plan.

In this section, we’ll guide you through this process to help you make the best decision for your unique situation.

To start, it’s important to understand the basics of Medicare Plan N.

Assessing Your Healthcare Needs

When deciding if Medicare Plan N is the best option for you, it’s crucial to consider your current and future healthcare needs.

Think about the medical services you regularly utilize, such as doctor appointments, hospital outpatient services, and prescription medications.

Additionally, consider any anticipated changes in your healthcare needs due to aging or the progression of pre-existing conditions.

By thoroughly evaluating your healthcare needs, you can better determine if Plan N’s coverage and cost-sharing structure align with your requirements. This assessment will help you make an informed decision about whether Plan N is the right choice for your healthcare coverage.

Weighing the Pros and Cons of Plan N

When considering Medicare Plan N, it’s essential to weigh the benefits and drawbacks of the plan.

On the one hand, Plan N offers lower premiums and comprehensive coverage, which can be attractive for those looking to save on healthcare costs. On the other hand, Plan N requires copayments for certain services, such as doctor and emergency room visits, and does not cover prescription drug expenses.

By carefully weighing the pros and cons of Plan N, you can make a well-informed decision about which Medigap plan is the best fit for your healthcare needs and budget.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Medicare Plan N is a comprehensive Medicare plan that offers lower premiums and extensive coverage compared to other popular plans. However, it does not cover prescription drugs and requires copayments for certain services.

By comparing Plan N to other Medigap plans, assessing your healthcare needs, and weighing the pros and cons, you can make an informed decision about whether Medicare Plan N is the right choice for your unique situation.

Remember to consider all factors, including coverage, out-of-pocket costs, and the insurance company, when selecting the best plan for your healthcare needs.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Does Medicare Plan N include prescription drug coverage?

No, Medicare Plan N does not include prescription drug coverage. It primarily covers hospital and medical expenses but does not cover medications.

What does Medicare Plan N cover when it comes to healthcare expenses?

Medicare Plan N covers hospitalization costs, medical services, skilled nursing care, and some out-of-pocket expenses like copayments and coinsurance.

How can I get prescription drug coverage with Medicare Plan N?

To get prescription drug coverage with Medicare Plan N, you need to enroll in a separate Medicare Part D prescription drug plan. These plans are designed to cover the cost of your medications.

Are there any exceptions to Medicare Plan N not covering prescriptions?

In some cases, Medicare Plan N may cover medications administered in a medical facility, such as injections received during a doctor’s visit. However, for most prescription drugs, you’ll need a separate Part D plan.

What should I consider when choosing a Medicare Part D prescription drug plan to complement Medicare Plan N?

When choosing a Medicare Part D plan, consider the formulary, monthly premiums, deductible, copayments, and coinsurance to ensure it covers the medications you need at a reasonable cost.

How do I enroll in a Medicare Part D prescription drug plan?

You can enroll in a Medicare Part D prescription drug plan during your Initial Enrollment Period (IEP) when you first become eligible for Medicare, or during the Annual Enrollment Period (AEP) from October 15th to December 7th each year.

Can I change my Medicare Part D plan if my prescription needs to change?

Yes, you can change your Medicare Part D plan during the Annual Enrollment Period (AEP) or during a Special Enrollment Period (SEP) if your prescription needs change, ensuring you have the most suitable coverage.

Does Medicare Plan N affect my ability to join a Medicare Part D plan?

No, having Medicare Plan N does not affect your ability to join a Medicare Part D plan. You can enroll in a Part D plan regardless of your Medicare supplement plan choice.

Is it possible to have both Medicare Plan N and a Medicare Advantage plan with prescription drug coverage?

No, you cannot have both Medicare Plan N and a Medicare Advantage plan with prescription drug coverage simultaneously. You must choose either a Medicare Advantage plan or a Medicare Supplement plan to work with Medicare Part D.

Find the Right Medicare Plan for You

Finding the perfect Medicare plan for you doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!