by Russell Noga | Updated September 27th, 2023

Navigating the world of Medicare Supplement Insurance and the various plans can be quite the challenge, especially when it comes to understanding the factors that influence premium costs.

Navigating the world of Medicare Supplement Insurance and the various plans can be quite the challenge, especially when it comes to understanding the factors that influence premium costs.

Medicare Plan N, a popular Medigap option, offers coverage for various out-of-pocket expenses, but do Medicare Plan N premiums increase with age? Knowing the answer to this question can help you make informed decisions about your coverage and save money in the long run.

In this article, we will discuss the intricacies of Medicare Plan N and the factors that affect its premiums, including the question, “Do Medicare Plan N premiums increase with age?” and tips for managing costs.

By the end, you will have a better understanding of how to choose the right plan for your needs and budget.

Short Summary

- Medicare Plan N is a Medicare Supplement plan that covers out-of-pocket expenses and offers international travel benefits at an affordable rate.

- Factors such as age, location, health status, inflation, and rating methodology affect the premiums of Medicare Plan N.

- Shopping around for plans, considering switching plans when necessary, and consulting a licensed insurance agent can help manage costs while getting the best coverage.

Understanding Medicare Plan N

Medicare Plan N is a widely-utilized Medicare Supplement Plan that provides coverage for a range of out-of-pocket expenses. It is important to enroll in Medicare Part A & B during the Initial Enrollment Period, as private insurance companies may charge higher premiums or deny coverage if you miss this window.

Factors such as:

- inflation rates

- location

- pre-existing conditions

- the type of Medigap plan chosen

Various factors can affect Medicare Supplement Insurance Companies’ premium prices for medicare supplement policies.

Understanding the coverage provided by Plan N and how it compares to other Medigap plans in 2024 is essential in making informed decisions about your supplemental health insurance.

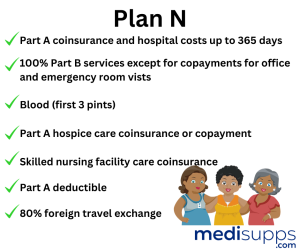

Plan N Coverage

Medicare Plan N offers coverage for hospital and medical expenses, helping to fill gaps in Original Medicare coverage. However, it does not cover the Part B deductible or excess charges, making it more affordable than some other Medigap plans.

This means that while Plan N covers most of the costs of Part B services, there will still be some copayments for certain office visits and emergency room visits.

Additionally, Plan N covers the following:

- Medicare Part A deductible

- Coinsurance for Parts A and B

- Three pints of blood

- 80% of medical costs incurred when traveling outside the United States

The monthly premium for Plan N varies depending on factors such as age, location, and health condition.

Comparing Plan N to Other Medigap Plans

To determine which supplemental health insurance plan best suits your needs and budget, it’s crucial to compare Plan N to other plans, such as Plan F and Plan G.

- Plan F covers all nine potential benefits, including the Medicare Part B deductible.

- Plan G covers all the same out-of-pocket Medicare costs as Plan F, apart from the Part B deductible.

- Plan N covers hospital and medical expenses but does not cover the Part B deductible or excess charges.

For example, Plan F is priced at an average of $161.00/month, and Plan G is priced at an average of $130.00/month for a 70-year-old female. Medicare Supplement Premiums vary depending on factors such as age, location, and health condition.

By comparing these plans and evaluating their coverage options, you can make a well-informed decision about which plan is right for you.

Compare Medigap Plans & Rates

Enter Zip Code

Factors Affecting Medicare Plan N Premiums

Several factors can affect Medicare Plan N premiums, including age, location, and health status.

Understanding how these factors influence premiums is essential in making informed decisions about your coverage and managing costs. Inflation and the rating methodology employed by the insurance company (community-rated, issue-age-rated, or attained-age-rated) may also have an effect on Medicare Plan N premiums.

In the following sections, we will delve into these factors and their impact on Plan N premiums, providing you with a comprehensive understanding of how to manage your Medicare Supplement costs.

Age

Age

Age is a significant factor in determining Medicare Plan N premiums, with older individuals generally paying higher premiums. This is because as people age, they tend to require more medical care, resulting in higher costs for insurance companies.

Turning 65 and enrolling in Medicare Part B will trigger the enrollment period for a Medicare Supplement plan. Beginning on the first day of the month, you can sign up for coverage.

If you choose to switch plans in the future, you may be subject to medical underwriting and potentially higher premiums or denied coverage.

Location

Location

Location can also impact Plan N premiums, as costs may vary depending on the state or region you live in. For instance, premiums may be higher in certain counties or geographic areas than in others.

This is due to variations in the cost of living, healthcare expenses, and insurance regulations across different regions.

Therefore, it’s essential to research and compare Plan N premiums in your specific location to ensure you’re getting the best possible rate. You can use our FREE online quote engine to check rates in your area.

Health Status

Health Status

Your health status can influence Plan N premiums, with healthier individuals potentially paying lower premiums depending on the insurance company. Factors such as pre-existing conditions or chronic illnesses may contribute to increased premiums, though not in your 6-month Medigap Open Enrollment Period which begins on the first day your Medicare Part B starts, and lasts for 6 months.

However, the precise effect on premiums may differ depending on the insurance provider and the individual’s overall health status.

Maintaining good health through preventive care and a healthy lifestyle can help reduce your Plan N premiums and overall healthcare costs.

Pricing Models for Medicare Supplement Insurance

There are three pricing models for Medicare Supplement Insurance: community-rated, issue-age-rated, and attained-age-rated. These models determine how premiums are set and if they increase with age.

Understanding the differences between these pricing models can help you make informed decisions about your Medicare Supplement plan and manage costs more effectively.

In the following sections, we will explore each pricing model in detail, highlighting its advantages and disadvantages to help you determine which is best suited for your needs and budget.

Community-Rated

Community-Rated

Community-rated pricing offers the same premium regardless of your age. This means that regardless of your age, you will pay the same premium as everyone else in your community who has the same Medigap plan.

A limited number of states provide community-rated Medigap plans, including Maine, Vermont, Massachusetts, Connecticut, New York, Arkansas, Minnesota, and Washington.

While this pricing model may seem appealing at first, it’s essential to consider future premium changes and compare them with other pricing models to determine the best fit for your needs.

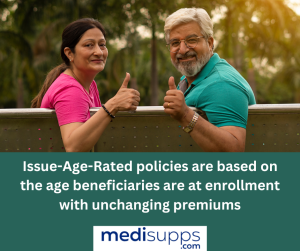

Issue-Age-Rated

Issue-age-rated policies base premiums on your current age and do not increase as you age. This means that if you enroll in a Medigap plan at a younger age, you will lock in a lower premium rate.

Issue-age-rated plans usually have higher initial premiums than attained-age-rated plans. This means that premiums may not get lower as the policyholder ages.

It’s crucial to weigh the long-term costs and benefits of issue-age-rated plans and compare them to other pricing models to determine the best option for your Medicare Supplement coverage.

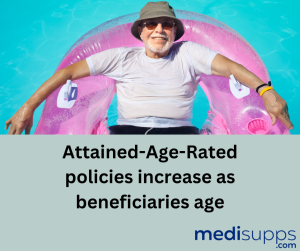

Attained-Age-Rated

Attained-Age-Rated

Attained-age-rated policies start with low premiums that increase as you age, making them more common for Medicare Supplements. Premiums for attained-age rating models are calculated based on one’s age at the time of enrollment and are known to increase with age.

While attained-age plans may seem attractive when you are younger due to their reduced premiums, they may become costly over your lifetime.

Comparing the long-term costs of attained-age-rated plans with other pricing models can help you make the right choice for your Medicare Supplement coverage, including various Medicare Supplement Plans.

Tips for Managing Medicare Plan N Costs

To manage Medicare Plan N costs effectively, it’s essential to shop around, consider switching plans, and consult a licensed insurance agent for guidance. By taking these steps, you can ensure that you’re getting the best possible coverage at the most affordable price.

Remember that understanding the factors that influence Plan N premiums and the different pricing models can help you make informed decisions and save money on your Medicare Supplement coverage.

In the following sections, we will provide practical tips and strategies for managing Medicare Plan N costs so you can focus on enjoying your retirement without worrying about healthcare expenses.

Shop Around

Shop Around

Shopping around and comparing quotes from different insurance companies can help you find the best Plan N rates. Premiums can vary widely between insurance companies, even for the same plan.

By researching and comparing rates online or contacting a licensed insurance agent, you can ensure that you’re getting the best possible coverage at the most affordable price.

Don’t be afraid to ask questions and gather as much information as possible before making a decision.

Consider Switching Plans

Consider Switching Plans

If your Plan N premiums become too expensive or your needs change, consider switching to a different Medigap plan that offers similar coverage at a lower cost.

However, keep in mind that you may be subject to medical underwriting and potentially higher premiums or denied coverage if you switch plans after the initial enrollment period.

It’s essential to weigh the pros and cons of changing plans and consult a licensed insurance agent to help you make the best decision for your situation.

Consult a Licensed Insurance Agent

Consult a Licensed Insurance Agent

Consulting a licensed insurance agent can provide personalized advice and help you navigate the complexities of Medicare Supplement Insurance. They can offer professional expertise, access to the appropriate resources, and impartial and unbiased counsel.

A licensed insurance agent can assist in determining the appropriate supplement insurance for your specific situation and guide you through the process of selecting a plan, enrolling, and managing costs.

Don’t hesitate to reach out to a licensed insurance agent for guidance in managing your Medicare Plan N costs.

Compare Medicare Plans & Rates in Your Area

Common Myths About Medicare Plan N Premiums

Common myths about Medicare Plan N premiums can lead to confusion and misinformation, so it’s crucial to understand the facts and make informed decisions about your coverage.

For instance, some people may believe that all Medicare Supplement premiums increase with age or that prescription drugs are covered by Medigap plans. However, this is not the case, as Plan N premiums are influenced by various factors such as age, location, and health status, and prescription drugs are not covered by Medigap plans.

By debunking these myths and understanding the true factors that influence Plan N premiums, you can make well-informed decisions about your Medicare Supplement coverage and avoid falling prey to misconceptions.

Summary

In conclusion, understanding Medicare Plan N premiums and the factors that influence them is essential for making informed decisions about your supplemental health insurance.

By comparing Plan N to other Medigap plans, considering the different pricing models, and following practical tips for managing costs, you can ensure that you’re getting the best possible coverage at the most affordable price.

Remember, knowledge is power, so stay informed and make the most of your Medicare Supplement Insurance.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Do Medicare Plan N premiums increase as you get older?

Generally, yes. Medicare Plan N premiums tend to rise with age, but there are other factors at play.

What is the average age-related increase in Medicare Plan N premiums?

The increase can vary, but it’s typically around 3-5% per year as you age.

Are there any age-based discounts for Medicare Plan N?

No, Medicare Plan N doesn’t offer age-based discounts. Premiums are based on various factors.

What factors besides age affect Medicare Plan N premiums?

Factors like location, gender, and health can also impact your Medicare Plan N premium.

Can you lock in a lower premium when you first enroll in Medicare Plan N?

While premiums are always lower if you enroll at a lower age, every Medigap policy will increase their rates each year. So technically there is no lock-in period for rates.

Is there a specific age when Medicare Plan N premiums increase significantly?

Premiums usually start to increase noticeably around age 70, but this is highly dependent on company. Call us for help.

Can you lower your Medicare Plan N premium as you get older?

You can’t directly lower your premium due to age, but comparing plans annually can help you find cost-effective options. We do this for you and shop the rates from the top companies to see if there are savings each year.

How does inflation impact Medicare Plan N premiums over time?

Inflation can contribute to premium increases, making it important to budget for rising healthcare costs.

Are there any strategies to manage rising Medicare Plan N premiums as you age?

Reviewing your coverage annually and considering alternative plans can help you manage costs.

Can you switch to a different Medicare plan to avoid age-related premium hikes?

Yes, you can switch plans during certain enrollment periods to potentially find more affordable options.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call now at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.