by Russell Noga | Updated September 26th, 2023

Navigating the world of Medicare can be overwhelming, especially when it comes to choosing the right Medigap plan to maximize your benefits and ensure comprehensive coverage.

Navigating the world of Medicare can be overwhelming, especially when it comes to choosing the right Medigap plan to maximize your benefits and ensure comprehensive coverage.

Fear not, as American Republic Medicare Plan N is a popular option that can provide the security and peace of mind you’re seeking.

Let’s dive into the details of this plan and explore how it can help you get the most out of your Medicare benefits.

Short Summary

- American Republic Medicare Plan N is an affordable Medigap plan that offers tailored coverage based on factors such as location and age.

- Plan N requires copays for doctor’s visits, making it more budget-friendly than other alternatives while still providing comprehensive coverage.

- American Republic Insurance Company has a superior customer service reputation and an A+ Financial Strength Rating from A.M Best, enabling beneficiaries to maximize their Medicare benefits with confidence.

Understanding American Republic Medicare Plan N

Medigap plans, also known as Medicare Supplement insurance plans, are designed to fill the gaps left by Original Medicare, covering out-of-pocket expenses such as copays, coinsurance, and deductibles. With a Medicare supplement plan, you can ensure comprehensive coverage and financial security through supplemental Medicare plans.

Medigap plans, also known as Medicare Supplement insurance plans, are designed to fill the gaps left by Original Medicare, covering out-of-pocket expenses such as copays, coinsurance, and deductibles. With a Medicare supplement plan, you can ensure comprehensive coverage and financial security through supplemental Medicare plans.

American Republic Medicare Plan N is a prime example of a comprehensive American Republic Medicare Supplement that offers beneficiaries a solid combination of coverage and affordability.

The cost of American Republic Medigap plans depends on factors such as location and age, ensuring that each beneficiary receives a tailored solution.

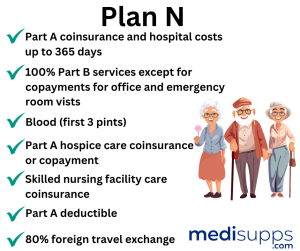

Coverage Details

American Republic Medicare Plan N covers most out-of-pocket expenses, providing financial security for beneficiaries. This comprehensive coverage includes:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- The first three pints of blood

- Part A hospice care coinsurance or copayment

However, it is important to note that Plan N does not provide coverage for Medicare Part B doctor’s visit copays and excess charges. This means that although Plan N offers extensive coverage, beneficiaries are still responsible for some costs, such as those related to outpatient services.

In exchange for some out-of-pocket expenses, there is a lower monthly premium for Medicare Plan N than Plan G.

Despite these exclusions, American Republic Medicare Plan N remains a popular choice for beneficiaries seeking to maximize their Medicare benefits without breaking the bank.

Its comprehensive coverage, coupled with its cost-sharing structure, makes it a valuable option for those looking to fill the gaps left by Original Medicare while keeping out-of-pocket costs to a minimum.

Cost-Sharing Structure

One of the primary reasons American Republic’s Plan N stands out among other Medigap plans is its cost-sharing structure. Beneficiaries are required to pay copays for doctor’s and emergency room visits, which makes the plan more affordable than other alternatives.

Specifically, Plan N requires a $20 copayment for doctor visits and a $50 copayment for emergency room visits after the Medicare Part B deductible is paid.

This cost-sharing structure not only makes Plan N more economical compared to other Medigap plans, but it also encourages beneficiaries to be mindful of their healthcare usage.

By sharing some of the costs, beneficiaries are more likely to make informed decisions about their healthcare and avoid unnecessary visits, ultimately saving money in the long run.

Eligibility Requirements

To be eligible for American Republic Medicare Plan N, beneficiaries must be enrolled in both Medicare Part A and Medicare Part B and meet the age requirements.

By ensuring that they fulfill these requirements, beneficiaries can confidently choose Plan N and enjoy its comprehensive coverage and cost-sharing benefits.

Compare Plans & Rates for 2024

Enter Zip Code

Comparing American Republic Medicare Plan N to Other Medigap Plans

When it comes to choosing the right Medigap plan, it’s essential to compare your options and determine the best coverage for your needs.

In the following sections, we’ll compare American Republic’s Plan N to other popular Medigap plans, such as Plan F and Plan G, to help you make an informed decision.

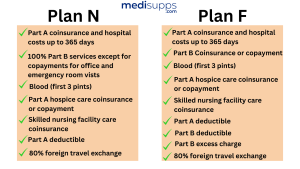

Plan N vs. Plan F

Plan F is known for being a comprehensive Medicare plan that covers all the gaps in Original Medicare. However, with its higher premiums and no cost-sharing requirements, Plan F may not be the most cost-effective option for some beneficiaries.

In contrast, Plan N offers similar coverage to Plan F, but with lower premiums and cost-sharing requirements.

The main difference between Plan N and Plan F lies in their coverage of the Medicare Part B deductible and excess charges. While Plan F covers the Part B deductible, Plan N does not. Additionally, healthcare providers may charge an extra 15% on top of what Medicare allows under Plan N.

Despite these differences, many beneficiaries find that the lower premiums and cost-sharing provisions of Plan N make it a more financially viable option than Plan F.

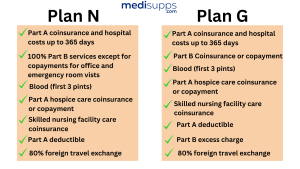

Plan N vs. Plan G

Much like Plan F, Plan G is a comprehensive Medicare plan that covers all the gaps in Original Medicare, with the exception of the Part B deductible. Plan N, on the other hand, also provides comprehensive coverage but requires cost-sharing for Part B copays, making it a more budget-friendly choice for many beneficiaries.

Both Plan N and Plan G offer extensive coverage, but their cost-sharing requirements set them apart.

By opting for Plan N, you can enjoy the security and peace of mind that comes with comprehensive coverage while keeping your premiums and out-of-pocket costs in check. This makes Plan N an attractive option for those looking to strike a balance between affordability and comprehensive coverage.

American Republic’s Financial Strength and Customer Service

Choosing a financially stable and reliable insurance provider is essential when it comes to securing your Medicare benefits. Founded by Watson Powell in 1929, American Republic Insurance Company has a long-standing reputation for offering excellent customer service to Medicare beneficiaries.

With an A- (Excellent) Financial Strength Rating from A.M. Best, you can trust that American Republic has the financial stability to pay claims and provide affordable rates.

Financial Ratings

A company’s financial ratings play a crucial role in determining its ability to fulfill its obligations to policyholders. American Republic boasts an A- (Excellent) Financial Strength Rating from A.M. Best, a testament to its financial stability and reliability.

This strong rating ensures that American Republic has the financial capacity to pay claims and provide affordable coverage to its beneficiaries, giving you peace of mind when selecting a Medigap plan.

American Republic’s A- (Excellent) Financial Strength Rating from A.M. Best.

Customer Service Reputation

Customer Service Reputation

American Republic is renowned for its exceptional customer service, providing assistance to beneficiaries in exploring their Medicare coverage options.

With an A+ rating from the Better Business Bureau and a 4.5-star rating from Trustpilot, American Republic’s commitment to providing excellent customer service is clear.

Beneficiaries can rest assured that they will receive the support and guidance they need to navigate their Medicare coverage and make informed decisions.

Enrollment Process for American Republic Medicare Plan N

Enrolling in American Republic Medicare Plan N is a straightforward process, made easier with the help of a licensed insurance agent and knowledge of enrollment periods.

In the following sections, we’ll discuss the benefits of working with a licensed insurance agent and the importance of understanding enrollment periods to ensure a smooth and stress-free enrollment experience.

Working with a licensed insurance agent can be beneficial in many ways. They can help you understand.

Working with a Licensed Insurance Agent

Engaging a licensed insurance agent for American Republic Medicare Plan N offers several advantages, such as:

- Expert Guidance

- Personalized advice

- Assistance with enrollment

- Ongoing support

By working with a licensed insurance agent, you can compare all available insurance options and choose the best plan for your needs. This ensures that you make an informed decision and maximize your Medicare benefits.

Enrollment Periods

Being aware of enrollment periods is crucial to avoid penalties and ensure timely coverage.

The Initial Enrollment Period is a seven-month window that begins three months before the month of your 65th birthday and ends three months after the month of your 65th birthday. During this period, you can enroll in Medicare Part B without facing a late enrollment penalty.

Another important enrollment period is the Open Enrollment Period, which begins on the first day of the month in which an individual turns 65 and is enrolled in Medicare Part B. During this period, you can enroll in American Republic Medicare Plan N without incurring a late enrollment penalty.

Additionally, special enrollment periods may be available for certain life events, such as relocation or loss of employer-sponsored health insurance.

Maximizing Your Medicare Benefits with American Republic

By choosing American Republic Medicare Plan N, beneficiaries can maximize their Medicare benefits and enjoy comprehensive coverage at an affordable price.

With its cost-sharing structure and extensive coverage, Plan N provides the perfect balance between affordability and peace of mind, helping you make the most of your Medicare benefits while keeping out-of-pocket costs in check.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, selecting the right Medigap plan for 2024 is crucial for maximizing your Medicare benefits and ensuring comprehensive coverage. American Republic Medicare Plan N offers an attractive balance of affordability and extensive coverage, making it an ideal choice for many beneficiaries.

By comparing Plan N to other popular Medigap plans and considering factors such as financial strength, customer service, and enrollment processes, you can make an informed decision and secure the peace of mind that comes with knowing you’re protected.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is American Republic Medicare Plan N?

American Republic Medicare Plan N is a Medicare Supplement insurance plan designed to fill in the coverage gaps left by Original Medicare (Part A and Part B). It helps pay for out-of-pocket expenses such as deductibles, copayments, and coinsurance.

How does Medicare Plan N differ from other Medicare Supplement plans?

Medicare Plan N provides comprehensive coverage but may require you to pay certain out-of-pocket costs, such as copayments for doctor’s visits and emergency room visits. Other plans may cover these expenses fully.

What does Medicare Plan N cover?

Plan N covers Medicare Part A coinsurance and hospital costs, Medicare Part B coinsurance or copayments, blood transfusion costs, hospice care coinsurance, and the cost of skilled nursing facility care coinsurance. It also offers limited coverage for foreign travel emergencies.

Are there any deductibles with Medicare Plan N?

Yes, Medicare Plan N does not cover the Medicare Part B deductible. You will need to pay this deductible out of pocket before Plan N starts covering your Medicare Part B costs.

Is there a premium for Medicare Plan N?

Yes, there is a monthly premium for Medicare Plan N, in addition to the standard Medicare Part B premium. The premium amount may vary depending on your location and the insurance provider.

Here on this website, you can use our FREE quote generator to see rates in your area.

Can I see any doctor or specialist with Medicare Plan N?

Yes, you can see any doctor or specialist who accepts Medicare patients. Medicare Plan N does not restrict your choice of healthcare providers.

Is prescription drug coverage included in Medicare Plan N?

No, Medicare Plan N does not include prescription drug coverage. To get prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

Is Plan N a good option for people who travel internationally?

While Medicare Plan N does offer limited coverage for foreign travel emergencies, it may not be sufficient for extensive international travel. Travelers should consider purchasing additional travel insurance for comprehensive coverage.

How do I enroll in American Republic Medicare Plan N?

To enroll in Medicare Plan N, you must first be enrolled in Original Medicare (Part A and Part B). We can then shop for the top insurance companies that offer Plan N in your area to help you save money.

Can I switch from another Medicare Supplement plan to Plan N?

Yes, you can apply to switch from one Medicare Supplement plan to another, including Medicare Plan N, if you are currently enrolled in a Medigap plan. However, you may be subject to medical underwriting or eligibility requirements, so it’s essential to compare plans and evaluate your options carefully.

We can help, call us today at 1-888-891-0229.

Find the Right Medicare Plan for You

Searching for the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.