by Russell Noga | Updated September 15th, 2023

Are you reviewing Medicare Supplement plans? Plan G & F are two of the most popular options due to the comprehensive level of care they offer beneficiaries.

Are you reviewing Medicare Supplement plans? Plan G & F are two of the most popular options due to the comprehensive level of care they offer beneficiaries.

There is only one slight difference between the two plans, and Medicare Plan G can typically save you quite a bit of money over Plan F.

So if you still have Plan F, keeping reading to see if It’s worth the switch!

Understanding Medicare Medigap Plans

Anyone enrolled in both Original Medicare Part A & B has the option of applying for “Medigap” insurance to cover the shortfalls in their medical expenses.

Medigap plans are lettered with different benefits within each plan. Of the ten Medigap plans available, Medicare Plan G & F are the most popular because they offer superior comprehensive coverage.

Medicare Supplement plans help you pay for out-of-pocket medical expenses, and there are no limits to the coverage they provide in dollar terms. For instance, we’ve all heard the nightmare stories of someone admitted to a hospital and, despite having Medicare, they end up stuck with a huge medical bill they can’t afford.

Don’t let this happen to you. Hospitals and medical providers are relentless at chasing down outstanding accounts. You could end up with your credit record affected by outstanding medical bills you can’t afford, or you might even receive a judgment against your name.

And for Seniors on a fixed income, unexpected medical costs to eat into your retirement savings. Supplemental Medicare insurance plans provide the gap cover you need to meet these financial obligations for medical expenses.

Compare 2024 Plans & Rates

Enter Zip Code

The Primary Difference Between Medigap Plan G & F

So, what’s the difference between Plan G & F, and which offers you the best value for your money?

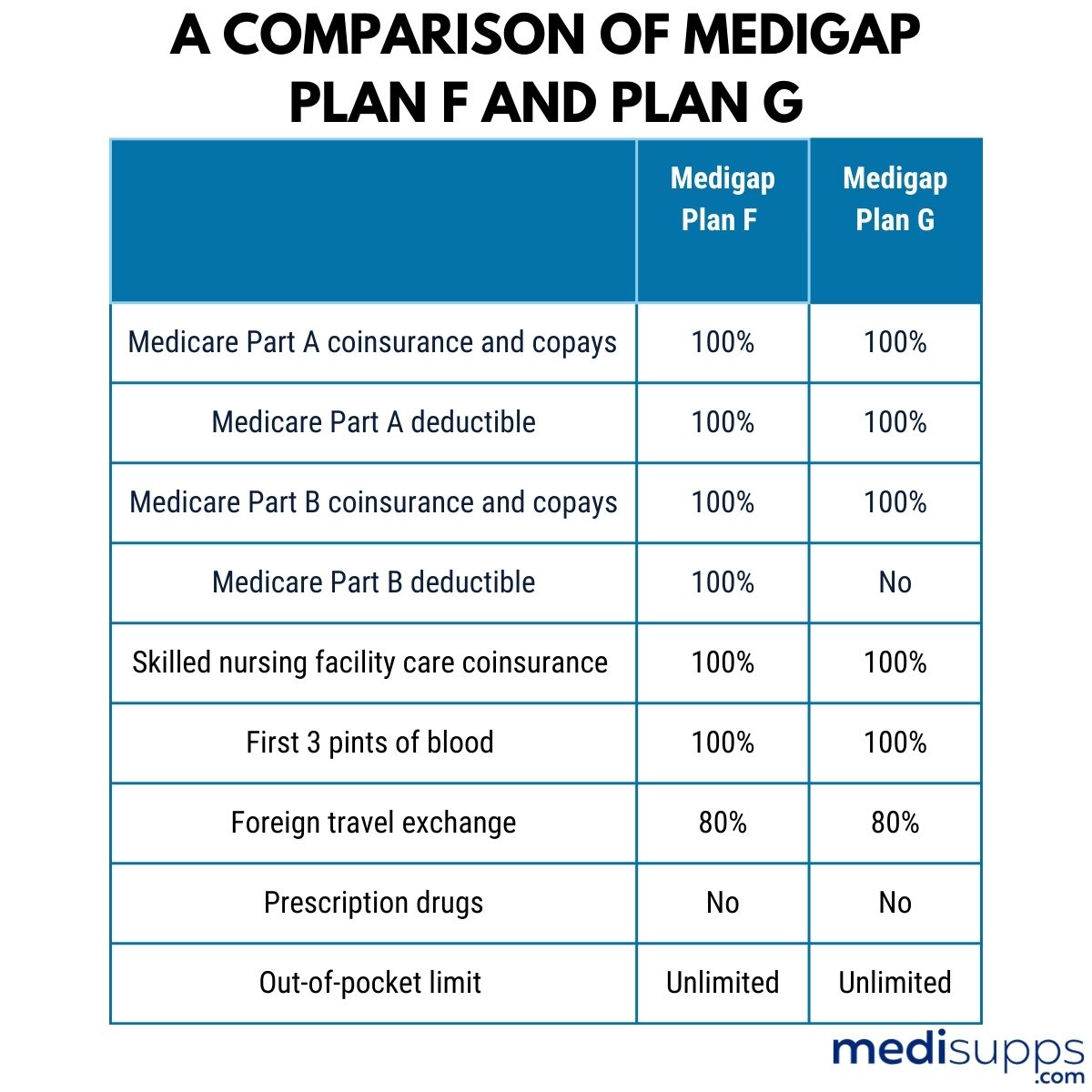

The primary difference is that Plan F covers the Part B deductible, and Medicare Plan G does not.

However, Medigap Plan G has a lower monthly premium cost than Plan F. Both Plan F and Plan G also come with high-deductible and standardized policy options.

So, if you’re in good health and don’t mind a much higher deductible to meet before receiving benefits, a high-deductible plan may be a good fit for you.

Plan G is available from several insurers across the United States. Each insurer standardizes the benefits in accordance with Federal regulations, which means they all offer identical coverage. That being said, they also all charge entirely different rates for the same thing.

Some insurers offer discounts and additional benefits with their plans. That’s why you need an experienced agent to assist you with choosing the right provider in your area, giving you the best deal.

Click below to book an appointment with us, or call today at 1-888-891-0229.

Compare Medicare Plans & Rates in Your Area

Understanding Medigap Plan G

Medigap Plan G provides members with coverage for medical expenses and out-of-pocket costs that Original Medicare doesn’t cover. After meeting your deductible, Plan G kicks in and covers the other outstanding charges associated with your medical care.

The standard deductible for Original Medicare in 2023 is $1,600, and $2,700 for the high-deductible Plan G. Plan F doesn’t come in standard and high-deductible options. In fact, Plan F is no longer available to members enrolling in Original Medicare after January 1, 2020.

If you were eligible for Medicare before this date, you could still apply for Plan F, and all Plan F members are grandfathered into the Plan, meaning they don’t have to change from Plan F to another version. However, it might be worth it to consider switching to Plan F if you consider the coverage offered by Plan G and the lower premiums associated with it.

A Comparison of Medigap Plan F and Plan G

Let’s examine the differences between Plan F & Plan G. The following table outlines the benefits offered by each plan to give you a clear overview of each.

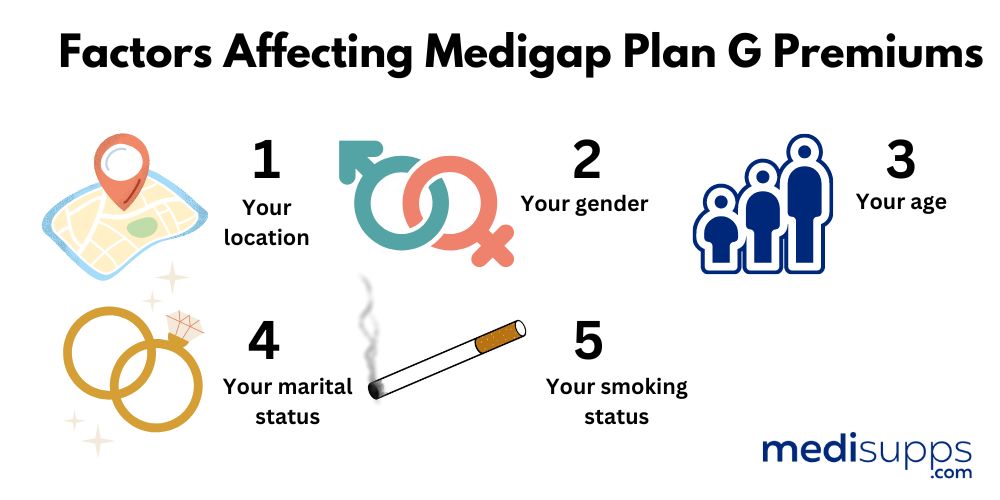

Factors for Plan G & Plan F Premium Variations

Not all states and insurers offer high-deductible versions of Plan G. You also need to be aware that insurers set their own policy premiums for Plan G & F. So, it pays to shop around for the best rate in your state. Our team can assist you with locating the right insurer and the best premium for your Plan G policy.

Medigap Plan G premiums vary depending on the following factors.

- Where you live in the United States.

- Your gender.

- Your age.

- Your marital status.

- Your smoking status.

Some insurers offer different variations of Plan G, such as Blue Cross Blue Shield. BCBS has a “Plan G Plus” option extending more benefits to members, such as dental, hearing, and vision.

However, you’ll pay a bit more in your monthly premium to access this facility and it’s not available everywhere.

Who Is Eligible for Medigap Plan G & F?

All Original Medicare members are eligible to apply for Medicare Plan G. However, only those members eligible for Original Medicare before January 1, 2020, are eligible for Plan F. If you enroll in Medicare after this date, Medicare Plan F is not an option.

Medicare Plan G and Medigap Plan N have the next highest coverage to Plan F.

You can enroll in Medigap Plan G for up to six months after your Medicare Part B begins and not have to go through an underwriting process.

If you enroll after the six-month open window, many providers require you to answer medical questions and go through the underwriting process, where they check your health status and have the right to deny you coverage.

View Rates in 2 Easy Steps!

Enter Zip Code

Frequently Asked Questions

Is Medicare Plan G Better Than Plan F?

There is no “better” or “best” Medicare supplement plan for everyone, as we all have different needs and budget. Medicare Plan G can usually save you money over Plan F by you simply paying the annual Medicare Part B deducible yourself each year. Some people want 100% regardless of the cost and remain with Plan F if they’re eligible.

Others like to save as much money as possible and opt for Plan G to save.

What is Medicare Plan G?

Medicare Plan G is a type of Medigap plan that covers most of the out-of-pocket costs that Original Medicare doesn’t cover. It helps pay for deductibles, copayments, and coinsurance, providing you with comprehensive coverage.

The only out-of-pocket expense with Medicare Plan G is the annual Medicare Part B deductible.

What is Medicare Plan F?

Medicare Plan F is another Medigap plan that offers extensive coverage, in fact, it’s the most comprehensive Medigap plan available to those who qualify. It covers all the gaps in Original Medicare, leaving you with no out-of-pocket expenses for Medicare-approved expenses.

This plan is only available to those who were enrolled in Medicare Part A prior to January 1st of 2020.

What does Medicare Plan G cover?

Medicare Plan G covers Part A deductibles, copayments, and coinsurance. It also provides coverage for excess charges and emergency medical services during foreign travel. However, it does not cover the Medicare Part B deductible.

What does Medicare Plan F cover?

Medicare Plan F covers 100% of the gaps in Original Medicare, including both the Part A and Part B deductibles, copayments, coinsurance, and excess charges. It offers more upfront coverage, which means you may have fewer out-of-pocket expenses.

Is Medicare Plan F still available for new enrollees?

No, Medicare Plan F is not available for new enrollees who become eligible for Medicare after January 1, 2020. However, if you were eligible for Medicare before that date, you still have the option to apply for Medigap Plan F.

How do I choose between Plan G and Plan F?

When choosing between Medicare Plan G and Plan F, consider factors such as your budget, expected medical expenses, and whether you’re comfortable paying the Part B deductible out of pocket. Plan G often offers a more cost-effective option for many beneficiaries.

We can help you decide. The easiest way to get started is by calling us today at 1-888-891-0229.

What’s the cost difference between Plan G and Plan F?

Plan F typically has a higher premium due to its comprehensive coverage, but it covers more out-of-pocket costs. Plan G generally has a lower premium and requires you to pay the Part B deductible, which can change annually.

Can I switch from Plan G to Plan F or vice versa?

Yes, you can switch between Medigap plans in 2024, including switching from Plan G to Plan F or vice versa. However, you may need to go through medical underwriting in some cases, and it’s important to consider any waiting periods for pre-existing conditions.

Is Medicare Plan G Better Than Plan F? – Talk to the Professionals

If you’re on the fence about choosing between Medigap Plan G & F, get advice from the professionals. We offer you a free consultation to help you figure out which option is the best choice for your unique situation.

Reach out to our team of Medigap experts at 1-888-891-0229 or complete to contact form on this site. We’ll have someone call you back at a convenient time to discuss your Medigap requirements.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.