by Russell Noga | Updated September 23rd, 2023

Is Medicare Plan G Accepted Everywhere?

One of the most popular Medigap Plans for people new to Medicare is Medicare Supplement Plan G.

One of the most popular Medigap Plans for people new to Medicare is Medicare Supplement Plan G.

It’s a popular choice that offers comprehensive coverage at a lower cost than Plan F.

Let’s dive deep into Plan G, exploring its benefits, costs, and where Medigap Plan G is accepted and by which healthcare providers.

By the end, you’ll be better equipped to make an informed decision on whether Medicare Plan G is the right fit for you.

Short Summary

- Medicare Plan G is a cost-effective Medigap policy that offers extensive coverage for Part A and B of Original Medicare, except for the Part B deductible.

- It is widely accepted by healthcare providers who accept Medicare, providing flexibility in choosing the best provider.

- Assessing individual healthcare needs and comparing costs & coverage is essential to selecting a plan that fits your needs best

Understanding Medicare Plan G

Medicare Plan G is a standardized Medigap policy designed to help reduce out-of-pocket expenses under Original Medicare by covering everything that Medicare Part A and B cover except for the annual Medicare Part B deductible.

Plan F is often regarded as the most comprehensive Medigap policy, but Plan G offers almost the same coverage at a lower premium since it doesn’t cover the Part B deductible, which is $226 in 2023. This will likely go up a bit in 2024.

Plan G is a great option for those who want to save money on their premiums while still keeping the premiums low.

Coverage of Medicare Plan G

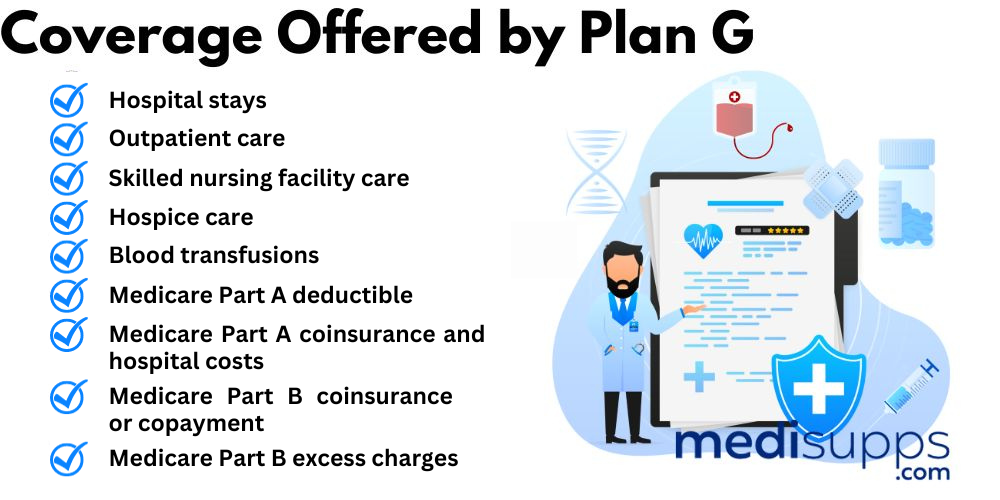

Plan G offers comprehensive Medicare coverage, including a wide range of Medicare benefits such as:

- Hospital stays

- Outpatient care

- Skilled nursing facility care

- Hospice care

- Blood transfusions

- Medicare Part A deductible

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Medicare Part B excess charges

The only notable exception is the Medicare Part B deductible, which you’ll need to pay out of pocket before Plan G kicks in to cover the remaining costs.

When it comes to choosing a Medigap plan, understanding the coverage offered is crucial to avoid unexpected expenses.

With Plan G, you can rest assured that most of your healthcare costs will be covered, allowing you to focus on maintaining your health and well-being without worrying about mounting medical bills.

View Medicare Plan G Rates

Enter Zip Code

Comparing Plan G to Other Medigap Plans

There are 10 different Medigap plans, each offering a standardized set of benefits. Plan G is often compared to Plan F, which is considered the most comprehensive but also the most expensive Medigap policy.

The main difference between these two plans is that Plan G does not cover the Part B deductible, making it a more cost-effective option for many enrollees.

Another plan worth comparing is Medicare Supplement Plan N, which offers lower premiums but may result in higher out-of-pocket expenses.

Ultimately, the choice between Plan G, Plan F, and Plan N will depend on your individual healthcare needs and financial situation, as they all provide the same basic benefits.

If you’re looking for comprehensive coverage without the high price tag of Plan F, Plan G may be the perfect fit.

Acceptance of Medicare Plan G by Healthcare Providers

One of the key factors to consider when choosing a Medicare supplement plan is whether it’s accepted by your preferred healthcare providers.

The good news is that Medicare Plan G is accepted by healthcare providers who accept Medicare Part B.

This means you’ll be able to use your Plan G coverage at any provider that accepts Medicare, giving you the flexibility to choose the best healthcare providers for your needs.

Medicare Plan G Rates by State

The rates for Medicare Plan G vary due to a number of different factors. One main factor is which state and zip code you reside in.

Medigap plans are standardized, which means regardless of which state you live in or which company offers the plans, they all must contain the same coverage. Their premiums, however, are all entirely different.

Medigap plans are standardized, which means regardless of which state you live in or which company offers the plans, they all must contain the same coverage. Their premiums, however, are all entirely different.

A Medicare supplement plan in New York is far more expensive than the same plan in North Carolina.

If you’re considering Medicare Plan G, it’s essential to compare rates from multiple companies to make sure you don’t overpay. Unfortunately, this can be challenging as you would have to contact each individual company yourself as they each try to sell you their plan.

We do the hard part for you, and our service is entirely FREE.

Moving Out of State with Medicare Plan G

If you’re planning to move out of state, you may be wondering how your Medicare Plan G coverage will be affected.

The good news is that your Plan G coverage will generally remain valid when you relocate, but you should be aware of potential differences in rules and regulations between states.

When moving to a new state, it’s important to inform Medicare of your change of address. You should also contact your insurance company to update your address and discuss any potential changes to your Plan G coverage. We help all of our clients with this process to make it as easy as possible for them.

By staying informed and proactive, you can ensure a smooth transition and maintain your Medicare Plan G benefits.

Costs Associated with Medicare Plan G

In addition to understanding the benefits and acceptance of Medicare Plan G, it’s crucial to consider the associated costs, including premiums and out-of-pocket expenses.

In addition to understanding the benefits and acceptance of Medicare Plan G, it’s crucial to consider the associated costs, including premiums and out-of-pocket expenses.

These costs can vary depending on factors such as your location and individual circumstances, so it’s important to research and compare your options to find the best fit for your budget.

It’s important to understand the costs associated with Medicare Plan G before deciding.

Premiums for Medicare Plan G

The premiums for Medicare Plan G can range from $99 to $476 per month in 2021, depending on factors such as your location, age, and tobacco use.

It’s important to consider these factors when comparing Plan G premiums, as they can significantly impact your overall healthcare costs.

On average, the monthly premium for Medicare Plan G in 2023 is estimated to be approximately $145.

However, the actual cost may vary depending on your individual circumstances, so it’s essential to research and compare premiums from different insurance companies to find the most affordable option for your needs.

Out-of-Pocket Costs and Limitations

While Plan G covers most healthcare costs, there are some out-of-pocket expenses and limitations to be aware of. The primary out-of-pocket cost associated with Plan G is the Medicare Part B deductible, which is $226 for 2023.

Once you’ve paid this deductible, Plan G will cover the remaining Medicare-approved expenses not covered by Medicare Part A and Medicare Part B.

Another limitation to keep in mind is that Medicare Plan G also offers foreign emergency travel coverage.

Enrollment Periods and Switching to Medicare Plan G

Enrollment periods play a significant role in determining the ease of enrolling in or switching to Medicare Plan G.

There are two main enrollment periods to consider: the Open Enrollment Period and special enrollment periods.

Understanding these periods and their implications can help you make the most of your Medicare Plan G coverage.

The 6-month Medigap Open Enrollment Period

The 6-month Medigap Open Enrollment Period is a six-month window specifically designed for Medicare beneficiaries. It starts on the first day of the month you enroll in Medicare Part B.

This period is the best time to enroll in Medicare Plan G, as you can purchase a policy without health screening or medical underwriting.

During the Open Enrollment Period, both healthy individuals and those with health conditions will be charged the same amount for Plan G from the same provider.

If you miss the Open Enrollment Period, you can still apply for a Medigap plan though you will likely be asked medical questions and have to go through an underwriting process to get approved.

Special Enrollment Periods

Special enrollment periods offer the opportunity to enroll in a Medigap plan with no medical underwriting.

These typically happen due to someone leaving credible employer coverage, or if they reside in a state that has a birthday rule where to may change plans with no underwriting during a specific time revolving around their birthday.

We can help determine if you qualify for one of these enrollment periods.

Tips for Choosing the Right Medicare Supplement Plan

Choosing the right Medicare Supplement plan, also known as Medicare supplement medigap, can be a daunting task.

By assessing your healthcare needs and comparing costs and coverage of Medicare Supplement plans and Medicare Advantage plans, you can make an informed decision that best suits your individual circumstances.

We can help, call us today at 1-888-891-0229.

Let’s explore some tips to help you find the perfect fit for your healthcare needs.

Assessing Healthcare Needs

Before selecting a Medicare Supplement plan, it’s essential to evaluate your individual healthcare needs, including the frequency of doctor visits and the medical services you require.

By taking stock of your health and the type of care you need, you can narrow down your options and choose a plan that offers the right level of coverage for you.

Factors to consider when assessing your healthcare needs include:

- Access to healthcare services

- Health insurance coverage

- Affordability

- Specific healthcare needs

- Quality of care

- Health and safety

- Cultural and language considerations

- Accessibility

- Mental health support

By understanding your unique needs, you can make a more informed decision when selecting a Medigap plan.

Comparing Costs and Coverage

Once you’ve assessed your healthcare needs, it’s time to compare the costs and coverage of different Medigap plans.

This includes not only the premiums but also the deductibles and other out-of-pocket expenses associated with each plan. By comparing these costs, you can determine which plan offers the best value for your specific needs and budget.

When comparing Plan G to other Medigap plans, be sure to consider factors such as coverage, premiums, and out-of-pocket costs.

By weighing the pros and cons of each plan and considering your individual healthcare needs, you can make an informed decision that will provide you with the coverage you need at a price you can afford.

You can check rates in your area for Plan G by entering your zip code above.

Summary

In conclusion, Medicare Plan G is a popular and cost-effective Medigap policy that provides comprehensive coverage for most out-of-pocket expenses under Original Medicare.

By understanding the benefits, costs, and acceptance of Plan G, as well as navigating enrollment periods and state regulations, you can make an informed decision about whether this plan is the right fit for you.

Remember to assess your healthcare needs, compare costs and coverage, and consider enrolling during the Open Enrollment Period to ensure you make the most of your Medicare Plan G benefits.

With the right plan in place, you can focus on maintaining your health and well-being without the stress of unexpected medical expenses.

View Rates for 2024

Enter Zip Code

Frequently Asked Questions

What does Medicare Plan G not cover?

Plan G does not cover the Part B deductible, dental, vision, hearing, skilled nursing facility care, private-duty nursing, or prescription costs.

These will need to be purchased separately through a separate policy.

Is Medicare Plan G being discontinued?

Medicare Plan G is not being discontinued and is still available to those who are Medicare Supplement eligible.

Medicare Plan F, however, is no longer available to new enrollees since January 1st, 2020.

Does Medicare Part G cover doctor visits?

Yes, Medicare Part G covers doctor visits along with other outpatient medical services such as lab work, diabetes supplies, cancer treatment, durable medical equipment, x-rays, ambulance, and surgeries.

What is the main difference between Medicare Plan G and Plan F?

The main difference between Medicare Plan G and Plan F is that Plan G does not cover the Part B deductible, while Plan F does.

Are there any limitations to Medicare Plan G coverage?

Medicare Plan G does not cover the Part B deductible and does not extend coverage to healthcare services received outside of the United States, thus creating limitations to its coverage.

However, Plan G does offer a wide range of coverage for medical services and supplies received within the United States. It covers all the Medicare Part A coinsurance and hospital costs, as well as the Part B coinsurance or copayment.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know if Medicare Plan G is accepted everywhere, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.