by Russell Noga | Updated September 15th, 2023

Are you looking for a Medicare Supplement Plan for 2024 to support Original Medicare Part A & B? Plan G offers you the best level of supplemental coverage of any “Medigap” plan. The comprehensive gap cover provided by Plan G takes care of most of your medical costs after reaching your deductible.

Are you looking for a Medicare Supplement Plan for 2024 to support Original Medicare Part A & B? Plan G offers you the best level of supplemental coverage of any “Medigap” plan. The comprehensive gap cover provided by Plan G takes care of most of your medical costs after reaching your deductible.

Original Medicare Parts A and B cover different medical services, including doctor visits and hospital stays. However, there are limitations on the coverage it offers, and many Medicare members find they’re left out-of-pocket for many medical bills. Facing financial stress because you didn’t realize you had the coverage you needed can be a harrowing experience.

With Medicare Supplement Plan G, you get the widest coverage of any of the 10 Medigap plans, with only Plan F offering more. The difference between Plan F & G is that Plan F covers the Medicare Part B deductible, but Plan G doesn’t – and that’s it. Unfortunately, Plan F isn’t available for new Medicare members.

However, Plan G is fast becoming the new go-to plan for Medicare members, and it has a more affordable monthly premium than Plan F. So, how does Medicare Supplement Plan G work? This post unpacks everything you need to know about it.

View 2024 Rates Now

Enter Zip Code

How Does Medicare Supplement Plan G Work?

“Medigap” plans are supplemental additions to your Original Medicare Part A & B packages. While Medicare Part A & B offer Americans a tremendous benefit in covering many of their medical bills, they don’t cover everything.

“Medigap” plans are supplemental additions to your Original Medicare Part A & B packages. While Medicare Part A & B offer Americans a tremendous benefit in covering many of their medical bills, they don’t cover everything.

As a result, many Americans find themselves having to shell out their retirement savings to cover their medical bills when they have to go to the hospital for a serious operation or emergency care. Medicare also doesn’t cover preventative medical treatments.

This lack of total coverage is a problem for seniors, especially those who are retired and living on a fixed income. Taking a supplemental Medigap plan fills the gaps in Original Medicare. That means that after you meet your annual deductible, Plan G takes care of the bulk of medical expenses you would otherwise pay out-of-pocket.

Medigap Plan G covers expenses like extended hospital stays, specialized care, preventative treatments, and more.

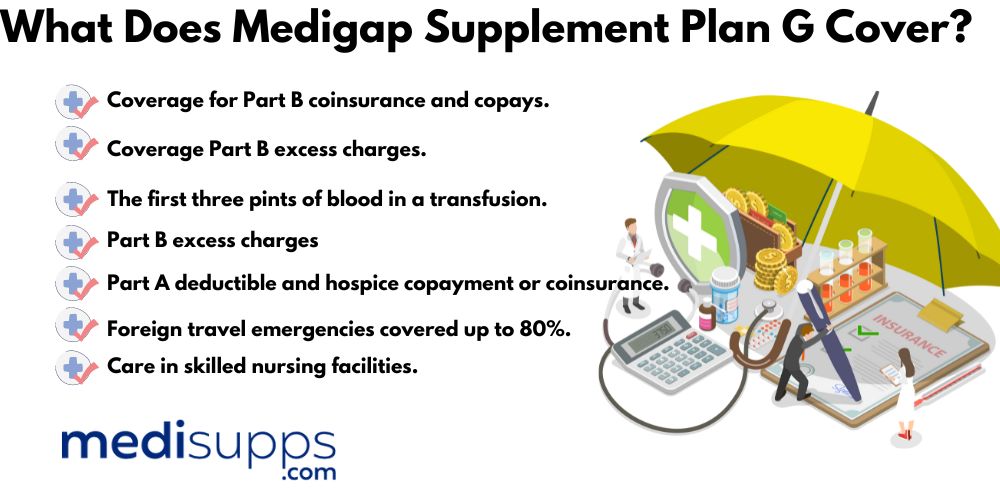

What Does Medigap Supplement Plan G Cover?

You get coverage for the following with Medicare Supplement Plan G.

- Coverage for Part B coinsurance and copays.

- Coverage Part B excess charges.

- The first three pints of blood in a transfusion.

- Part A deductible and hospice copayment or coinsurance.

- Foreign travel emergencies covered up to 80%.

- Care in skilled nursing facilities.

Compare Medicare Plans & Rates in Your Area

What are the Premiums for Medicare Supplement Plan G?

Private health insurers across the United States offer Medicare Supplement policies to Original Medicare members. There are several companies providing these services in all states. However, while Original Medicare premiums are standardized, supplemental plans range in premium costs.

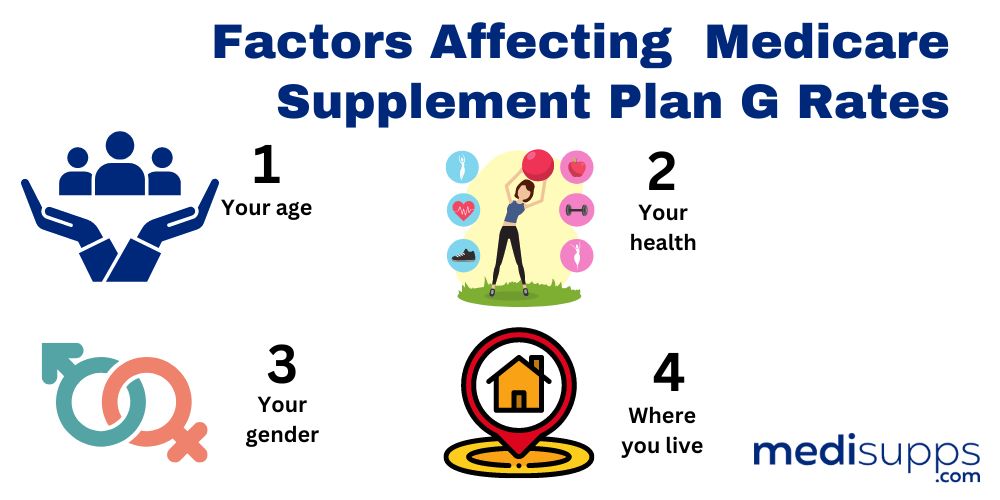

The premiums can vary depending on the insurer you choose, the state you live in, your health status, gender, and age. Not all insurers offer Medigap plans in all states, so you’ll need to find a company that operates in your area offering Plan G.

Not all insurers operating in your state may offer Plan G, and premiums vary in pricing between companies. So, it pays to shop around when looking for the right health insurance partner. As an industry average across all companies, states, and age groups, you can expect to pay somewhere in the neighborhood of $145 per month for your Plan G premium.

For instance, Plan G’s price for Atlanta residents might be lower than for Californians. Or the price of Medigap Plan G from Cigna may vary from what Humana offers in the same state. That’s why it’s a prudent move to work with an agent that understands the market.

An experienced agent can assist you with finding the best rate for Plan G in your state with the lowest premium. Plan G is available in high-deductible and standard deductible offerings from many providers. If you choose a high-deductible plan, your deductible threshold is higher, but your monthly premiums are lower.

An experienced agent can assess your situation and advise you on choosing the best Plan G option to suit your medical requirements and budget.

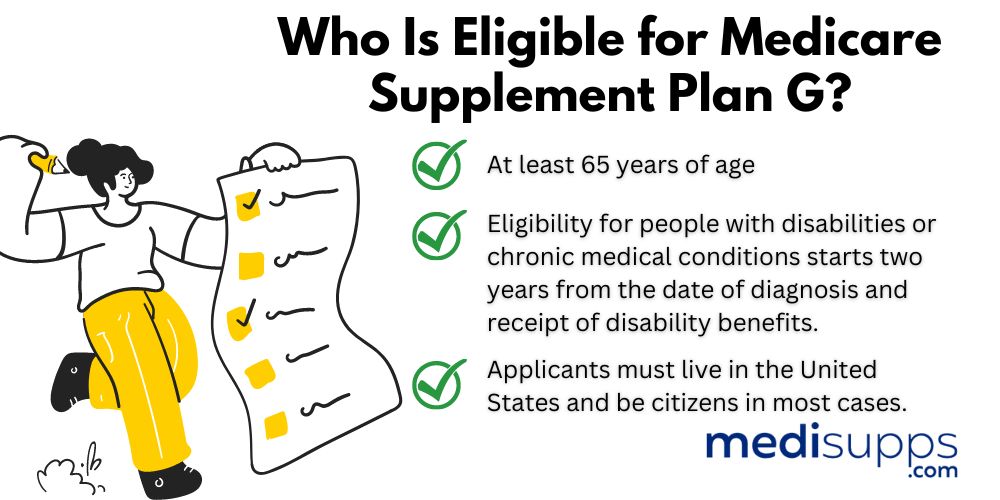

Who Is Eligible for Medicare Supplement Plan G?

Like Original Medicare, you’re only eligible for a supplemental Medigap plan when you turn 65. There are exceptions to this rule for disabled individuals or people with chronic medical conditions. Your employment history, location in the United States, and citizenship status can affect your eligibility for Original Medicare, but your income doesn’t play a role in your eligibility.

Suppose you’re approaching the qualifying age of 65. In that case, your enrollment period starts three months before your birthday month, ending three months after your birthday month, giving you a six-month enrollment period.

Eligibility for people with disabilities or chronic medical conditions starts two years from the date of diagnosis and receipt of disability benefits.

Regarding the criteria involved with citizenship and residency status, Applicants must live in the United States and be citizens in most cases. Permanent US residents qualify for Medicare and supplemental plans if they’ve lived in the United States for at least five years before applying.

Government-issued Original Medicare plans are available countrywide for qualifying applicants. However, this may vary from state to state, depending on the parts private insurers offer.

In most instances, your primary residence is the basis of your evaluation for Medicare, based on the state you live in. You can get quotes for Original Medicare and supplemental plans using your zip code to check availability in your area.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

How Does Medicare Supplement Plan G Work?

Medicare Supplement Plan G is a popular choice among beneficiaries seeking comprehensive coverage for their medical expenses. Understanding how this plan works can help you make informed decisions about your healthcare coverage.

What does Plan G cover?

Plan G covers various out-of-pocket costs associated with Original Medicare. This includes Medicare Part A coinsurance and hospital costs, skilled nursing facility care coinsurance, Part A hospice care coinsurance, and more.

Does Plan G cover the Part B deductible?

No, Plan G does not cover the Medicare Part B deductible. This deductible is an annual amount you must pay before Medicare starts covering your outpatient services.

How does cost sharing work with Plan G?

With Plan G, you’ll generally only be responsible for the Medicare Part B deductible and any excess charges, which are fees that some doctors may charge above Medicare-approved amounts. Once these costs are paid, Plan G covers the rest.

Can I see any doctor with Plan G?

Yes, you can see any doctor or specialist who accepts Medicare patients. Plan G doesn’t restrict you to a network, giving you the freedom to choose your healthcare providers.

Is there a network for hospitals?

No, Plan G doesn’t have a network of hospitals. You can receive care from any hospital that accepts Medicare patients.

How does Plan G compare to other plans?

Plan G is often compared to Plan F due to its comprehensive coverage. The main difference is that Plan G doesn’t cover the Part B deductible. Despite this, Plan G can offer cost savings in terms of lower premiums.

When can I enroll in Plan G?

You can enroll in Plan G during your Medigap Open Enrollment Period, which starts when you’re both 65 or older and enrolled in Medicare Part B. You can also enroll during Special Enrollment Periods under certain circumstances.

Can I switch to Plan G if I have another plan?

Yes, you can switch to Plan G from another Medigap plan. Keep in mind that if you already have coverage, you might need to go through medical underwriting, which could affect your eligibility and rates.

How do I know if Plan G is right for me?

Deciding if Plan G is suitable for you depends on your healthcare needs, budget, and preferences. If you’re comfortable paying the Part B deductible out of pocket but want comprehensive coverage for other expenses, Plan G could be a good fit.

Ask the Experts for Advice on Medicare Supplement Plan G

Before we get into the details of Plan G, we realize people new to Medicare supplemental plans can find the specifics of how they operate confusing. If that’s the case for you, reach out to our team at 1-888-891-0229.

Our professional experts know all the ins and outs of Medigap plans, and we’ll help you choose the right option to meet your budget and requirements.

Alternatively, complete the contact form on our site, and we’ll get back to you to answer your queries. We’re here to help you make an informed decision on the right Medicare supplemental plan for your needs.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.