by Russell Noga | Updated September 20th, 2023

Does Plan G Cover 100%

There are several different Medicare plans available, and it can get quite confusing, but have you considered the benefits of Medicare Supplement Plan G?

This comprehensive plan offers a way to bridge the gaps in Original Medicare, providing financial relief and peace of mind.

In this article, we’ll delve into the details of Plan G, compare it to other popular Medigap plans, and help you determine if it’s the right choice for your healthcare needs – and answer the question, “Does Plan G cover 100%?”

Short Summary

- Medicare Supplement Plan G offers comprehensive coverage for most out-of-pocket costs associated with Original Medicare, excluding the annual Part B deductible.

- Comparing Plan G to other Medicare Supplement Plans like F and N can help determine which plan best fits individual needs and budget.

- Enrolling in Plan G requires having both Parts A & B of Original Medicare during the Medigap Open Enrollment Period.

Understanding Medicare Supplement Plan G

Medicare Plan G, also known as Medicare Supplement Plan G or Medigap Plan G, is a popular Medigap policy that helps cover out-of-pocket costs associated with Original Medicare.

Offered by private insurance agencies, Plan G provides 100% coverage after the annual deductible is fulfilled, making medical costs more predictable and budgeting more manageable with the help of Medicare supplement insurance plans.

Additionally, Plan G, a Medicare plan, is accepted anywhere Medicare is accepted across the country, giving you the freedom to choose the healthcare providers that best suit your needs.

How Plan G Works with Original Medicare

Designed to work alongside Medicare Parts A and B, Plan G fills gaps in coverage and reduces out-of-pocket expenses.

By supplementing Original Medicare it provides additional coverage to help manage healthcare costs.

This means that any provider who accepts Original Medicare must also accept your Plan G coverage, making it easier to access the medical services you need without worrying about network restrictions.

Get Quotes in 2 Easy Steps

Enter Zip Code

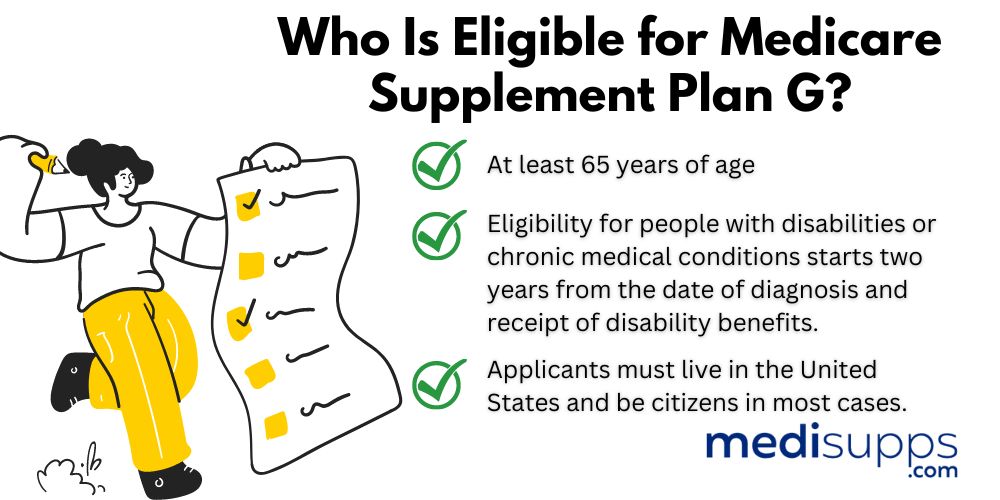

Who is Eligible for Plan G

Plan G is available to U.S. citizens and legal residents with Original Medicare who meet age and disability criteria.

Certain carriers even offer Plan G to individuals who are receiving disability benefits, making it accessible to a wider range of Medicare beneficiaries. However, it’s important to note that the premium for individuals under 65 may be significantly higher than for those over 65.

Certain carriers even offer Plan G to individuals who are receiving disability benefits, making it accessible to a wider range of Medicare beneficiaries. However, it’s important to note that the premium for individuals under 65 may be significantly higher than for those over 65.

Enrollment in Plan G is best undertaken during the Medigap Open Enrollment Period (OEP), which begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B.

Keep in mind that Plan G may not be available in all locations, so it’s essential to check the availability of plans in your area before deciding.

Coverage Details: Does Plan G Cover 100%?

While Plan G covers most out-of-pocket costs associated with Original Medicare, it does not cover all healthcare expenses. For instance, the annual Medicare Part B deductible remains uncovered by Plan G.

In the following sections, we will explore the various aspects of coverage offered by Plan G, as well as its limitations, to help you understand the full scope of its benefits.

Part A Deductible and Coinsurance

One of the key benefits of Plan G is its coverage for the Medicare Part A deductible and coinsurance costs for hospital stays and skilled nursing facility care. The Medicare Part A deductible for 2023 is $1,600 per benefit period, according to official Medicare guidelines.

In addition to covering the Part A deductible, Plan G also offers complete coverage for your Part A coinsurance costs.

This means that after day 60 of your hospital stay in 2023, the coinsurance charge of $400 per day will be covered by Plan G, escalating to $800 per day on day 91 of your stay.

Part B Coinsurance and Copayments

When it comes to Medicare Part B coinsurance and copayments, Plan G has you covered. After meeting the Part B deductible, which is set at $233 for 2022, Plan G will cover copayments and coinsurance for the remainder of the year.

This means that once you’ve fulfilled your Part B deductible, you can expect Plan G to provide coverage for the majority of Original Medicare services, helping you manage your healthcare costs more effectively.

Additional Benefits Covered by Plan G

Beyond the coverage of deductibles and coinsurance, Plan G offers additional benefits, such as:

- coverage for excess charges

- blood transfusions

- and foreign travel emergency care

Excess charges refer to when doctors charge a rate of up to 15% more than the Medicare-approved amount for services or procedures. Plan G provides coverage for these excess charges, ensuring that you don’t face unexpected costs when seeking medical care.

This coverage can be especially helpful for those who are on a fixed income or who have limited resources.

Limitations of Medicare Supplement Plan G

Though Plan G offers comprehensive coverage, it’s important to be aware of its limitations. Plan G does not cover:

- The annual Medicare Part B deductible, which is set at $233 for 2022

- Services or items outside the U.S. and U.S. territories

- An annual out-of-pocket limit

In the next sections, we’ll discuss these limitations in more detail.

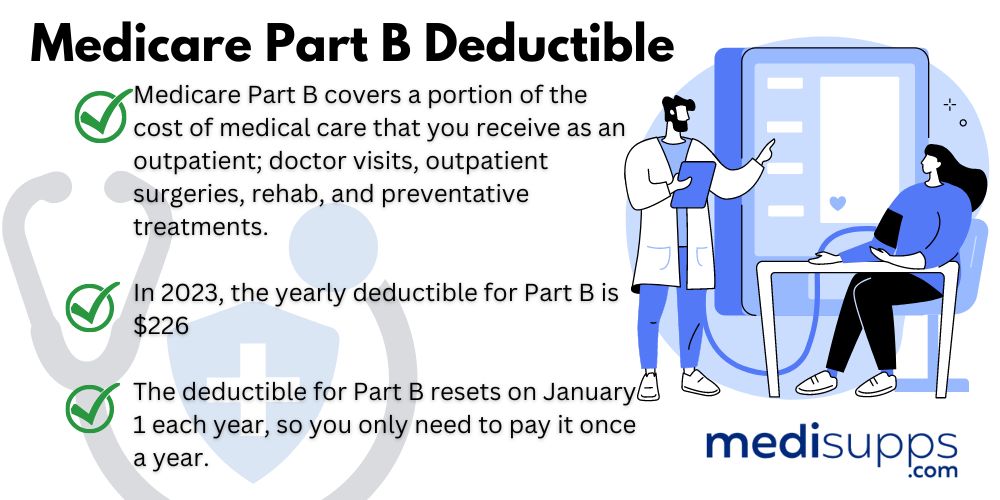

Medicare Part B Deductible

The annual Medicare Part B deductible is a fee that must be paid out-of-pocket before your Medicare Part B coverage begins. For 2023, the deductible is set at $226 and will likely be slightly higher in 2024.

Plan G does not cover this deductible, so it’s essential to budget accordingly and be prepared to cover this cost on your own.

Dental, Vision, and Hearing Services

Plan G does not offer coverage for routine dental, vision, or hearing services.

Plan G does not offer coverage for routine dental, vision, or hearing services.

If you require coverage for these services, you may need to consider enrolling in a separate dental, vision, and hearing plan to ensure that your needs are met.

These health insurance plans are available through private insurers and may provide more comprehensive coverage than Plan G.

Prescription Drug Coverage

Prescription drug coverage is not included in Plan G. To obtain coverage for prescription medications, you will need to enroll in a separate Medicare Part D plan.

This is an important consideration when choosing a Medicare supplement plan, as prescription drug costs can significantly impact your overall healthcare expenses.

Comparing Plan G to Other Medicare Supplement Plans

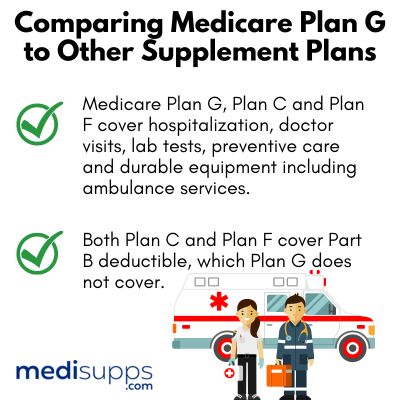

When considering Plan G, it’s helpful to compare it to other popular Medigap plans, such as Plan F and Plan N.

By understanding the differences in coverage and costs, you can make a more informed decision about which plan is best suited to your individual needs.

Plan F is the most comprehensive plan, covering all the gaps in Medicare Part B.

Plan G vs. Plan F

Plan F is a more comprehensive Medicare supplement plan than Plan G, as it covers the Part B deductible, which Plan G does not. Plan F is only available to those who already had eligibility for Medicare before January 1, 2020.

However, this plan is not open to those who become eligible after that date.

The benefits of both plans are otherwise equivalent, making cost the primary factor to consider when deciding between Plan G and Plan F.

Each insurance agency has its own pricing structure, so it’s advisable to compare the monthly premiums and calculate total yearly expenses to determine which plan is the better option for you.

Plan G vs. Plan N

Plan N is another Medicare Supplement plan that provides comprehensive coverage for Medicare gaps. While Plan G offers more coverage than Plan N, it also comes with a higher monthly premium.

Notably, Plan N may require copayments for certain services and does not cover excess charges, unlike Plan G.

When comparing Plan G and Plan N, it’s important to weigh the differences in coverage and costs to determine which plan best suits your needs.

Both plans offer valuable benefits, but the right choice will depend on your individual healthcare requirements and budget.

Costs Associated with Medicare Supplement Plan G

Understanding the costs associated with Medicare Supplement Plan G is crucial when deciding if this plan is the right fit for your healthcare needs.

In the following sections, we’ll explore the various costs related to Plan G, including monthly premiums and high-deductible options.

In the following sections, we’ll explore the various costs related to Plan G, including monthly premiums and high-deductible options.

Monthly premiums for Plan G vary depending on the state you live in and the insurance company.

Monthly Premiums

The monthly premium for Medicare Supplement Plan G varies based on factors such as location, gender, and smoking habits, with an average range of $100-$300 per month.

This premium is paid in addition to the Part B monthly premium and must be paid monthly in order to maintain both plans.

High-Deductible Plan G Option

For those interested in a lower monthly premium, a high-deductible version of Plan G is available. In 2023, the high-deductible Plan G requires its beneficiaries to pay a deductible of $2,700.

This amount must be paid before any benefits associated with the plan can become applicable.

Though the monthly premium for this option is lower, it’s important to consider whether the higher deductible aligns with your healthcare needs and budget.

Plan G vs. Medicare Advantage

When comparing Plan G to Medicare Advantage plans, it’s essential to consider the differences in coverage, networks, and additional benefits.

Both options can provide valuable healthcare coverage, but the right choice will depend on your individual needs and preferences.

Plan G helps cover expenses incurred when utilizing covered Medicare services. Medicare Advantage plans substitute Original Medicare coverage and offer additional Medicare benefits such as:

- Dental coverage

- Vision coverage

- Hearing coverage

- Prescription medication coverage

Plan G is accepted by any provider that accepts Original Medicare, giving you a broader choice of healthcare providers.

On the other hand, Medicare Advantage plans often have more limited networks and may require you to see specific in-network providers for your Medicare Advantage plan.

How to Enroll in Medicare Supplement Plan G

To apply for Medicare Supplement Plan G, you must first have Medicare Part A and Part B coverage.

Once you are enrolled in both, you can begin the process of signing up for the plan. The best time to enroll in Plan G is during the Medigap Open Enrollment Period, which begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B.

During this period, you can enroll in a Medigap plan without having to answer underwriting health questions.

It’s essential to research the available plans in your area, as Plan G may not be available in all locations.

Summary

In conclusion, Medicare Supplement Plan G offers comprehensive coverage to help bridge the gaps in Original Medicare, providing financial relief and peace of mind.

By understanding the benefits, limitations, and costs associated with Plan G, you can make a more informed decision about whether this plan is the right choice for your healthcare needs.

Remember, the key to finding the perfect Medicare supplement plan is to carefully assess your individual requirements, compare available options, and ultimately choose the plan that best suits your personal healthcare journey.

View Rates for 2024

Enter Zip Code

Frequently Asked Questions

What does Plan G not cover?

Plan G does not cover the Part B deductible, dental care, vision care, hearing aid services, skilled nursing facility care, private-duty nursing, or prescription drug costs.

Therefore, a separate policy will need to be purchased to cover these expenses.

Does Medicare Plan G have a maximum out of pocket?

No, Medicare Plan G does not have a maximum out of pocket; the only expense is the annual Part B deductible ($226 for 2023).

Consider Plan K or Plan L if you are looking for an out-of-pocket limit.

What does Plan G pay for?

Plan G covers Medicare Part A and Part B co-pays and coinsurance, Skilled Nursing and rehab facility stays, Hospice care, and excess charges, protecting you from the costs that Medicare doesn’t cover.

It is a great way to supplement your Medicare coverage and ensure that you are not left with unexpected medical bills.

What is the difference between Plan G and Plan F?

Plan F offers coverage of the Part B deductible but is no longer available to those eligible after January 1, 2020; Plan G does not cover the Part B deductible, but is an option for those that became eligible for Medicare after January 1, 2020.

Does Plan G cover prescription drug coverage?

Plan G does not cover prescription drug coverage; you will need to enroll in a Medicare Part D plan for that.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan for 2024 or you want to know if Plan G covers 100%, we can help.

Call us today at 1-888-891-0229, and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.