by Russell Noga | Updated July 9th, 2023

Medigap plans are a vital part of healthcare for any senior or retiree. While Original Medicare provides relief for the swelling costs of healthcare in the United States, it doesn’t cover you for everything.

Taking a Medigap policy helps you cope financially with the additional out-of-pocket expenses not covered by Original Medicare.

If you want better predictability in your healthcare budget and confidence knowing you have the best overage for handling the expenses Medicare Parts A & B don’t cover.

How many Medicare supplement plans are there?

What does each offer, and how can you apply for one?

We Can Help You Choose the Right Medigap Plan

Finding the right Medigap plan to suit your healthcare needs requires research and thought. We offer you a free consultation to assist you in making an informed decision on the right plan.

Reach out to our team of professional licensed agents at 1-888-891-0229, and we’ll get you there.

Reach out to our team of professional licensed agents at 1-888-891-0229, and we’ll get you there.

Use the calculator on our site for a free automated quote on any Medigap plan in your area.

Complete the contact form on this site, and we’ll get a competent, knowledgeable broker to call you back for a free consultation.

How Many Medicare Supplement Plans Are There?

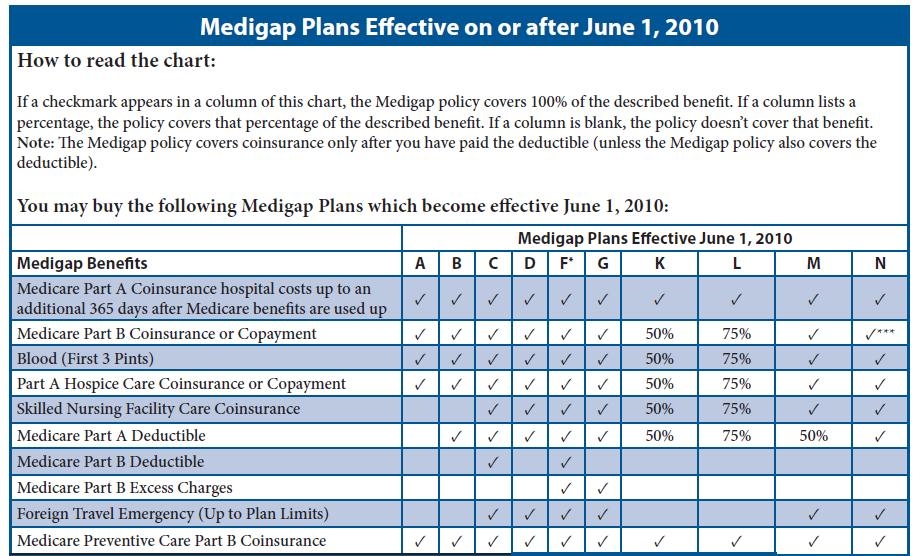

There are ten Medigap plans as shown on the 2024 comparison chart. They are Plans A, B, C, D, F, G, K, L, M, and N. Each comes with a different level of coverage available at a premium cost to suit your budget.

Plans C, F, E, H, I, and J are no longer available to new Medigap enrollees. If you were eligible for Medicare before January 1, 2020, you could still access Plans C & F.

Plan F was the most popular Medigap plan to date due to the fully-comprehensive coverage it offered beneficiaries. However, new enrollees can look at Plan G for a similar substitute.

The difference between Plan F & G is that Plan F covers the Part B deductible, whereas Plan G doesn’t.

However, you get a lower premium with Plan G, which contributes to covering the $226 for the Part B deductible in 2023.

Massachusetts, Minnesota, and Wisconsin have different rules surrounding Medigap plans from the other states.

The Federal government regulates the industry, ensuring that all providers offer the same standardized benefits in their Medigap plans.

Insurers offering Medigap plans must provide options for Medigap Plan A and Plan C or F.

However, the Federal government doesn’t require insurers to offer every plan in the Medigap range. Plans G & F come in standardized or high-deductible versions.

The difference with the HD version is that the Part A deductible increases from $1,600 (in 2023) to $2,700. However, you get a lower premium cost.

So, while the deductible is higher, you benefit from a lower monthly expense and still retain all the benefits of the plans after reaching this deductible limit.

The Four Most Popular Medigap Plans

While there are ten Medigap plans available, four of them are the most popular options for new enrollees, Plans F, G, N, and K. Let’s look at each in detail.

Medicare Plan F

Medicare Plan F

As mentioned, Plan F was the most popular option for Medigap. However, it’s no longer available to new enrollees in Medicare.

If you were eligible for Medicare before January 1, 2020, you could still apply for plan F. However, since it’s out of the open enrollment window, you’ll have to undergo medical underwriting for acceptance by an insurer.

Existing Plan F members get to maintain their policy. Plan F was so popular because it covered all of the additional healthcare costs left by Original Medicare Parts A & B, including the Part B deductible.

As a result, you get coverage for almost everything, giving you nothing to pay out of pocket.

Medicare Plan G

Medicare Plan G is the closest alternative to Plan F.

The only thing it doesn’t cover that Plan F does is the Part B Deductible.

Both Plan F & G come in high-deductible versions, but the HD version isn’t available from all insurers.

Plan G is the best choice for new enrollees wanting the best coverage from their Medigap plan.

Medicare Plan N

Medicare Plan N

Medicare Supplement Plan N is a good choice for healthy seniors. If you don’t make many trips to the doctor or the emergency room during the year but still want the best level of coverage in the event of a healthcare emergency, Medicare Plan N could be an excellent choice.

The difference between Plan N & G is that you’ll have to make a $20 copayment on visits to the doctor or a $50 copayment on trips to the emergency room that don’t result in you being hospitalized. Plan N also doesn’t cover the Part B excess charge where the healthcare professional doesn’t offer services at Medicare-approved rates.

Medicare Plan K

Medicare Plan K

Plan K is the most affordable plan offering you decent coverage.

It only contributes 50% of the costs to some services, such as the Part A deductible, Part B coinsurance, and others.

However, it’s an affordable policy and a good choice for low-income seniors and retirees.

Comparing Coverage from the Four Top-Rated Medigap Plans

Here’s a rundown of the coverage offered by the four most popular Medigap plans. These premiums are based on a 65-year-old female nonsmoker. They’re nationwide averages, so the premiums could be higher or lower in your state or from insurer to insurer.

Consult our team for the best rates on Medigap premiums in your area, or use our web calculator for a free automated quote.

Plan F Plan G Plan K Plan N

Average Monthly cost $179 $145 $77 $111

Part A coinsurance Yes Yes Yes Yes

Part B coinsurance Yes Yes 50% Yes

Blood (3 pints) Yes Yes 50% Yes

Part A hospice care Yes Yes 50% Yes

Skilled nursing facility Yes Yes 50% Yes

Part A deductible Yes Yes 50% Yes

Part B deductible Yes No No No

Part B excess charges Yes Yes No No

Compare Medicare Plans & Rates in Your Area

What are the Advantages of a Medigap Plan?

- Medigap plans to provide additional coverage to Medicare and healthcare costs, such as deductibles, copayments, and coinsurance.

- The more comprehensive plans, like Plan F & G, eliminate almost all your inpatient and outpatient healthcare costs, providing stability and predictability to your annual medical expenses.

- Enrolling during the six-month “Open Enrollment” period after you turn 65 guarantees acceptance to the Medigap plan of your choosing, with any insurer, even with a pre-existing health condition.

- Medigap plans will cover 80% of emergency healthcare services when traveling outside the United States, provided you meet the $250 deductible. There’s also a $ 50,000 lifetime maximum on this benefit.

- Medigap plans let you see any medical professional in the Medicare Network anywhere in the United States.

Find the Right Medicare Plan for You

Discovering the right Medicare plan doesn’t have to be overwhelming. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.