by Russell Noga | Updated August 24th, 2023

Nothing is more important than your health, and with the high cost of health care in the United States, making sure that you have health insurance is crucial.

Nothing is more important than your health, and with the high cost of health care in the United States, making sure that you have health insurance is crucial.

If you’re aged 65 or older or you have been diagnosed with a qualifying illness or disability, Medicare can provide the health insurance you require.

A government-funded health insurance program, Original Medicare (Part A and Part B) provides much-needed medical benefits for millions of Americans. While Original Medicare covers a lot of medical-related expenses, it doesn’t cover everything and beneficiaries are responsible for the expenses that it doesn’t cover.

As you can imagine, those out-of-pocket expenses can become quite exorbitant, but that’s where Medicare Supplement Insurance can help.

What is Medigap?

Also known as Medigap, Medicare Supplement insurance helps to offset the out-of-pocket expenses that are associated with Original Medicare and makes healthcare more predictable, easier to manage, and more affordable.

If you recently enrolled in Original Medicare or you will be soon and you’re planning on purchasing Medicare Supplement Insurance, there are a lot of factors to consider. Like many beneficiaries, the cost of coverage is probably high on your list of priorities.

To help you choose a policy that will work with your budget, in this guide, we provide an overview of cheap Medicare Supplement plans.

Compare 2024 Plans & Rates

Enter Zip Code

About Medicare Supplement Insurance

Before diving in and discussing cheap Medicare Supplement plans, you should first have a basic understanding of this type of insurance. Also known as Medigap, this supplementary insurance is designed to offset the out-of-pocket expenses that are associated with Original Medicare.

Before diving in and discussing cheap Medicare Supplement plans, you should first have a basic understanding of this type of insurance. Also known as Medigap, this supplementary insurance is designed to offset the out-of-pocket expenses that are associated with Original Medicare.

It does this by covering some of the costs that aren’t covered by Medicare Part A and Part B; copays, coinsurance, and deductibles, for instance. Medigap doesn’t replace Original Medicare but rather (and as the name suggests) supplements it and helps to make government-sponsored health insurance more affordable.

There are 10 different Medigap policies. The plans, which are named for letters, offer different benefits, and the benefits provided vary from plan to plan; however, all plans of the same letter must offer the same standard benefits.

Medicare Supplement Insurance is sold by private health insurance companies. Many insurers offer these plans, including well-known companies, such as Aetna, Allstate, Blue Cross Blue Shield, and Mutual of Omaha as well as smaller, lesser-known companies.

Insurers vary from state to state, as does policy availability.

How Much Does Medicare Supplement Insurance Cost?

While Medicare Supplement Insurance plans are regulated by the federal government and all plans that fall under the same letter must offer the same benefits, prices vary, even for the same policies.

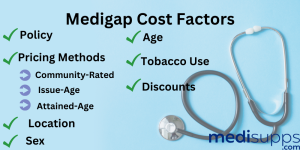

The private health insurance companies that sell Medigap insurance can set their own rates for the policies they offer and there are several factors that are taken into consideration when they set their rates, such as:

- The policy. The policy you choose will have the biggest impact on the cost of your Medicare Supplement Insurance. As mentioned, there are 10 different Medigap policies, letters A through N, and plans that offer more benefits tend to cost more, while those that offer fewer benefits tend to cost less. For example, Plan G provides comprehensive coverage, meaning it covers most of the expenses that Original Medicare doesn’t and as such, it will cost more than Plan A, which offers the most basic coverage and only includes the benefits that are required by law.

- Pricing methods. Another factor that impacts rates is the pricing method that an insurance company uses. There are three main methods that most insurers use to set Medigap rates, which include:

Attained-age. With this method, rates are based on your age and while they might be less expensive initially, over the course of time, they can end up being the most expensive.

Issue-age. Rates are based on your age when you purchase your coverage. As such, the younger you are when you purchase your plan, the lower the rates will be.

Community-rated. All members who reside in the same community are charged the same rates for a policy are charged the same rate, regardless of age.

- Location. Another major factor that will determine the cost of your Medicare Supplement Insurance is your location. In areas where the cost of living is higher, rates will be higher than in areas where the cost of living is lower. For example, for individuals who reside in New York, rates will be higher than for individuals who reside in Texas.

- Sex. Whether you’re male or female will also influence the cost of your Medigap insurance. Statistically speaking, women tend to live healthier, longer lives than men, so their premiums tend to be lower.

- Age. The younger you are when you purchase and enroll in Medicare Supplement Insurance, the lower your rates will be. For example, someone who enrolls at the age of 65 will expect to pay lower premiums than someone who enrolls at the age of 75.

- Tobacco Use. Like all types of insurance, there are certain lifestyle habits that can affect your premiums. For Medigap insurance, tobacco use can result in higher premiums, as smoking, chewing tobacco, and vaping are linked to cancer and other illnesses.

- Discounts. Insurance companies can offer discounted rates for the Medigap policies they offer. If your company offers household discounts, for example, you can expect a discounted rate on your policy if you reside with someone who is covered by the same insurer.

Cheap Medicare Supplement Plans

If you’re looking for cheap Medicare Supplement plans for 2024, it’s important to do your due diligence and research before you jump in and invest in coverage.

Carefully compare the benefits that different plans offer, request quotes from different insurers, and carefully weigh your options. By doing your research, you’ll be able to make an informed decision that’s good for you – and your wallet.

Compare Medicare Plans & Rates in Your Area

Contact Us for a Free Consultation on Medigap Plans

If you have questions about Medicare supplement plans, call our team at 1-888-891-0229. We offer professional advice on Medigap policies.

Our fully licensed agents offer free consultations to give you all the information you need about Medigap.

If you want someone to call you back, leave your details on our contact form and we’ll get a Medigap expert to reach out to you.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Supplement Plans?

Medicare Supplement Plans, also known as Medigap plans, are private health insurance policies designed to complement Original Medicare (Part A and Part B). They help cover the “gaps” in Medicare, such as deductibles, co-payments, and coinsurance, to reduce out-of-pocket expenses.

Why are Medicare Supplement Plans essential for beneficiaries?

Medicare Supplement Plans are crucial because they provide additional coverage beyond what Original Medicare offers. They can significantly reduce the financial burden of healthcare expenses, giving beneficiaries peace of mind and access to a broader range of healthcare services.

How do I find the best affordable Medicare Supplement Plan for me?

To find the best affordable Medicare Supplement Plan, you should compare plans from different insurance providers. Focus on your specific healthcare needs, compare premiums, and check if the plan covers the services you require. Online comparison tools and working with an insurance agent can be helpful in making an informed decision.

What are some factors to consider when choosing a cheap Medicare Supplement Plan?

When selecting an affordable Medicare Supplement Plan, consider factors such as the plan’s coverage level, premium cost, provider network, financial stability of the insurance company, and customer reviews. Also, take into account your health status and anticipated medical needs in the future.

Can I change my Medicare Supplement Plan in the future?

Yes, you have the option to change your Medicare Supplement Plan in the future. However, it’s essential to understand that there are specific enrollment periods and restrictions for switching plans, so it’s best to consult with an insurance expert to navigate the process.

Are all Medicare Supplement Plans standardized?

Yes, Medicare Supplement Plans are standardized into different lettered plans (Plan A, B, C, D, F, G, K, L, M, and N). Each plan offers the same coverage regardless of the insurance company selling it. However, the premiums may vary from one company to another.

Is there a waiting period for coverage with Medicare Supplement Plans?

In most cases, Medicare Supplement Plans do not have waiting periods for coverage. However, if you have a pre-existing condition and don’t enroll during your Medigap Open Enrollment Period, a waiting period for coverage related to that condition may apply.

Are prescription drugs covered under Medicare Supplement Plans?

No, prescription drugs are not covered under Medicare Supplement Plans. For prescription drug coverage, you need to enroll in a separate Medicare Part D prescription drug plan.

Can I use my Medicare Supplement Plan outside of the United States?

Some Medicare Supplement Plans offer limited coverage for emergency medical care while traveling abroad. However, this coverage is usually limited, and beneficiaries may want to consider additional travel insurance for more comprehensive protection.

How can I apply for a Medicare Supplement Plan?

To apply for a Medicare Supplement Plan, you need to be enrolled in both Medicare Part A and Part B. Then, you can contact private insurance companies offering Medigap plans in your state and apply for the plan that best suits your needs.

Find the Right Medicare Plan for You

Searching for the right Medicare plan with the best benefits for you doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.