by Russell Noga | Updated March 17th, 2024

Searching for Medicare supplement plans in South Dakota for 2025? You need a plan that fits your budget and healthcare needs without unnecessary hassle. With various options standardized by benefits but varied in cost, this guide helps you compare the top Medicare Supplement Plans in South Dakota 2025, understand premiums, and prepare for changes to coverage in the year ahead.

Key Takeaways

- Medigap plans in South Dakota are standardized across carriers, but prices can differ, with Plan G being notably popular for comprehensive coverage after 2020 eligibility changes.

- Medigap premiums in South Dakota may vary by age, sex, tobacco use, and geographic location, with Plan F observed as the most popular, though changes in Medicare costs can impact future Medigap pricing.

- Beneficiaries have a six-month open enrollment window starting upon Medicare Part B signup, during which they can join a Medigap plan without medical underwriting, while switching plans later may lead to health status-based pricing or coverage denial.

Compare 2025 Plans & Rates

Enter Zip Code

Understanding Medicare Supplement Insurance in South Dakota

Medigap, or Medicare Supplement Insurance, is a lifeline for many Medicare beneficiaries in South Dakota. This type of supplemental coverage, offered by Medicare-approved private insurance companies, steps in to help manage out-of-pocket expenses that Original Medicare Parts A and B do not cover, such as copayments, coinsurance, and deductibles. In essence, Medigap fills the ‘gaps’ between what Medicare pays for covered services and what the beneficiary is charged, offering a safety net for those unexpected costs that could otherwise leave you scrambling.

One of the key features of Medigap plans in South Dakota is their standardization. Regardless of the insurance carrier, the benefits provided by each plan are the same, allowing for easy comparison and peace of mind that you’re getting the coverage you expect. The only variation you may encounter is in the prices, which can differ between insurers.

Adding to the appeal of these plans is the fact that you can maintain continuity in your healthcare by keeping your chosen primary care doctors, ensuring your healthcare journey remains as smooth as possible.

Navigating Medigap Plans in South Dakota for 2025

In South Dakota, you’ll find an array of Medigap plans to select from, each one meticulously designed to cater to a wide spectrum of healthcare needs. The options include:

- Plans A

- Plans B

- Plans C

- Plans D

- Plans F

- Plans G

- Plans K

- Plans L

- Plans M

- Plans N

Each plan is standardized to provide the same set of benefits across different insurers.

Among these, Plan G stands out as the most comprehensive, particularly for beneficiaries who became eligible after January 1, 2020. This plan covers all the major expenses, from daily hospital charges to Part B coinsurance, and provides a safety net for many South Dakota residents.

Breaking Down the Costs: What to Expect in 2025

When considering a Medigap plan, it’s crucial to understand that premiums in South Dakota can vary based on a range of factors. These include:

- Age

- Gender

- Tobacco usage

- Household discounts

- Payment method

- History of rate increases

For instance, older individuals and males generally pay higher monthly premiums. To give you a clear picture, a 70-year-old male could be looking at spending anywhere between $172 to $437 per month, depending on the plan letter.

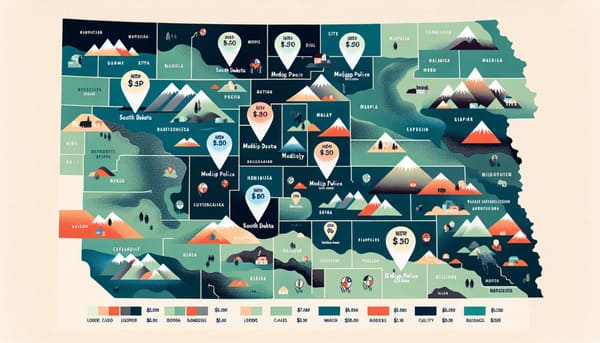

Another interesting aspect to consider is the variation in costs across different cities in South Dakota. Premiums for Medigap policies can differ based on the beneficiary’s zip code, leading to different pricing for the same plan across various locations.

Additionally, future adjustments to Medigap premiums may be influenced by changes in Medicare costs. For example, a change in the standard monthly Part B premium or Part A deductible, like the one seen in 2024, could potentially affect Medigap pricing in subsequent years.

Plan Popularity: South Dakota’s Preferred Choices

When it comes to Medigap plans in South Dakota, certain plans stand out for their popularity. As of 2023, Plan F is the most popular among South Dakota beneficiaries, followed closely by Plan G. Plan G’s popularity can be attributed to its similar offerings to Plan F, except for the coverage of the Part B deductible. The slightly lower premiums further add to its allure.

Plan N also enjoys a fair share of popularity, offering substantial benefits with cost-sharing measures such as copayments for office visits and emergency room visits. Interestingly, South Dakota provides both ‘Standard’ and ‘Select’ Medicare Supplement plans. While ‘Select’ plans come with network restrictions, ‘Standard’ plans offer the flexibility to access any Medicare-approved location, catering to different beneficiary preferences.

Enrollment Insights: Joining a Medigap Plan in South Dakota

Eligibility for Medigap in South Dakota primarily requires individuals to have both Medicare Part A and Part B. This makes residents with Medicare, including those under 65 with Medicare due to a disability, eligible for Medigap plans.

There’s a one-time six-month Medigap open enrollment period that starts from the individual’s enrollment date in Medicare Part B. This open enrollment period is a golden opportunity for beneficiaries, as medical underwriting is not required for enrollment in Medigap during this time.

The Best Time to Enroll: Understanding Your Window of Opportunity

The South Dakota Medicare Open Enrollment period is of paramount importance. It provides the best opportunity for Medicare beneficiaries to sign up without being affected by medical underwriting. In South Dakota, any person reaching the age of 65 and enrolling in Medicare Part B is granted a six-month period to obtain a Medigap policy without health condition discrimination. This privilege also extends to those under 65 who qualify for Medicare because of a disability.

Enrolling in a Medigap plan during these open enrollment windows offers several benefits:

- Secures the beneficiary’s policy acceptance

- Minimizes premiums regardless of health status

- Provides comprehensive coverage

- Emphasizes the importance of timing in securing the most favorable terms for your Medigap policy.

Switching Plans: What You Need to Know

Switching Medigap plans after the open enrollment period comes with its own set of considerations. In South Dakota, insurers may use medical underwriting to decide on plan acceptance and pricing after this period. This could result in higher premiums or even denial of coverage. However, guaranteed issue rights are accessible under specific circumstances, such as moving out of a Medicare Advantage Plan service area, or if you’re involuntarily losing coverage. This allows for switching to a Medigap policy without underwriting.

Interestingly, switching from Medigap to Medicare Advantage might be less complicated than the other way around, especially since post-open enrollment can often lead to less favorable Medigap plan terms. In South Dakota, apart from the six-month initial enrollment and under-65 disability period, special Medigap enrollment periods are not defined. Plus, changes in Medicare deductibles do not require a plan switch as existing Medigap policies adjust accordingly.

Compare Medicare Plans & Rates in Your Area

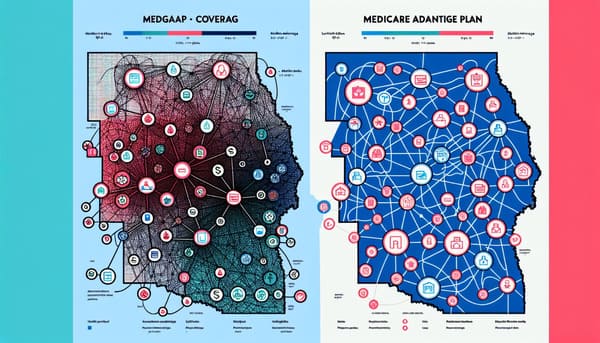

Comparing Medigap and Medicare Advantage in South Dakota

Medigap and Medicare Advantage plans are both valuable options for beneficiaries in South Dakota, but they come with distinct differences. Medigap plans allow beneficiaries to see any provider that accepts Medicare without network restrictions, offering a wide choice of healthcare providers. On the other hand, Medicare Advantage plans require beneficiaries to use network providers for the lowest costs.

When it comes to Medicare benefits, Medicare Advantage plans must cover all medically necessary services that Original Medicare covers, often including Part D prescription drug coverage, along with additional benefits such as vision, dental, and hearing coverage. This comprehensive Medicare coverage sets them apart from Medigap policies, which generally do not cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing and often require buying Medicare Select to allow the use of network hospitals.

Despite these differences, both types of plans have their merits and should be considered based on individual healthcare needs and preferences.

Getting the Most Out of Your Medigap Coverage

A well-selected Medigap plan can be a game-changer when it comes to managing your healthcare costs. Plans like Plan G offer comprehensive coverage that extends beyond Original Medicare Parts A and B, covering costs for:

- Hospitalization

- Skilled nursing care

- Blood transfusions

- Hospice care

- Outpatient medical services

- Part B excess charges

- Emergency healthcare during foreign travel

Under Original Medicare, beneficiaries typically pay 20% of the Medicare-approved amount after meeting the deductible. However, Medigap plans can assist with out-of-pocket costs like copayments, coinsurance, and deductibles, potentially reducing or even setting a limit on annual out-of-pocket expenses.

Making the most of your Medigap coverage requires careful selection of a plan that aligns with your individual healthcare needs. By assessing the specified out-of-pocket maximums, comparing different Medigap plans, and factoring in typical annual healthcare expenses, you can make an informed decision that could minimize your overall healthcare spending. This strategic approach to selecting your Medigap plan ensures you get the most out of your coverage, giving you peace of mind and financial security in your healthcare journey.

The Impact of Location on Medigap Policies

Your geographical location plays a significant role in determining your Medigap plan availability and costs. In South Dakota, not all insurance carriers offer every type of Medigap plan in every area. This affects both the accessibility and cost of plans for residents in different parts of the state. For instance, residents of all South Dakota counties, with the exception of Bennett County, have access to Select plans that require the use of a network hospital. However, Standard plans, which offer unrestricted access to any Medicare-approved location, are accessible to residents in all counties.

There are also variations in Medigap policy costs across different counties in South Dakota. Premiums for the same plan can differ based on the beneficiary’s zip code, leading to different pricing across various locations. For instance, premiums for Medigap plans that are age-rated are the same for beneficiaries under 65 as for those who are 75, as insurers are not allowed to charge higher rates to those under 65 due to state regulations. It’s essential to keep these geographical considerations in mind when comparing and choosing your Medigap plan.

Prescription Drug Coverage with Medigap in South Dakota

It’s important to note that Medigap plans do not include prescription drug coverage. Therefore, beneficiaries are advised to purchase a separate Part D plan for medication costs. In South Dakota, there are 24 Medicare Part D prescription drug plans available to beneficiaries, with the lowest monthly premium in 2023 being $4.70. These plans require enrollment in Medicare Part A and/or Part B. Some of these Part D plans even participate in the Part D Senior Savings Model, which provides lower out-of-pocket costs for insulin, capped at $35 for a month’s supply.

Looking ahead, the Inflation Reduction Act set to come into effect in 2025 introduces a cap on annual out-of-pocket costs at $2,000 for Medicare Part D. This development could have significant implications on Medigap plans and is something to keep an eye on as you plan your healthcare coverage for 2025 and beyond.

Medigap Providers: Choosing the Right Insurer

Choosing the right Medigap insurer is a critical step in securing your healthcare coverage. When choosing a Medigap insurer, it’s essential to consider factors such as:

- The enrollment period

- How premiums are influenced by factors such as health status, gender, smoking status, or marital status

- Whether the policy premiums are no-age-rated, issue-age-rated, or attained-age-rated

- If the insurer sells Medigap policies to people under 65, as availability and costs may differ

In addition, use tools like Medicare.gov’s Medigap Policy Finder to compare different Medigap policy options available to you. Consider the National Association of Insurance Commissioners (NAIC) complaint rate when evaluating Medigap insurers; lower complaint rates can be indicative of higher customer satisfaction. Also, look for insurers that offer a wide range of plan types to ensure you can find a plan that fits your specific needs. For instance, AARP/UnitedHealthcare offers eight out of the 10 standardized Medigap plan types.

Remember that while Medigap plans are standardized in benefits, prices can vary between companies for the same plan, so it’s essential to shop around for the most competitive rates.

Future-Proofing Your Coverage: Medigap for 2025 and Beyond

Ensuring your healthcare coverage is future-proof is crucial in the ever-changing landscape of healthcare policies and regulations. In South Dakota, Medigap policies automatically adjust to cover changes in Medicare deductibles, ensuring current policyholders remain covered without the need to switch plans. However, upcoming CMS strategies, including improved risk adjustment models and Medicare Advantage payment system changes, could potentially influence the cost and benefits of future Medigap plans.

Further, CMS’s goal of having all Medicare beneficiaries enrolled in organizations that enhance the quality and cost management of care by 2030 could have implications for Medigap coverage. Additionally, starting in 2024, Medicare will begin compensating healthcare providers for patient navigation and family caregiver training, which could lead to adjustments in the benefits of the Medigap plan. Hence, selecting Medigap plans that can adapt to future healthcare changes and policy updates is critical for beneficiaries to ensure sustained and robust coverage beyond 2025.

Summary

Navigating the realm of Medicare Supplement Insurance in South Dakota requires careful consideration of several factors. From understanding what Medigap is and how it fills the ‘gaps’ in Original Medicare to choosing the right insurer and future-proofing your coverage, it’s paramount to make informed decisions every step of the way. With the onset of 2025 and beyond, there’s no better time to delve into the world of Medigap and ensure your healthcare coverage is as comprehensive and tailored to your needs as possible. Take charge of your health today, and secure a future where healthcare worries are a thing of the past.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Is Plan G better than Plan F?

Yes, Plan G is generally better than Plan F, as they have the same benefits, except that Plan G does not cover the Medicare Part B deductible, which could result in higher out-of-pocket costs for you.

What is the downside to Medigap plans?

The downside to Medigap plans is that they do not typically offer additional benefits such as dental, vision, and hearing coverage, unlike Medicare Advantage plans. If you’re in need of extra healthcare-related benefits, you may need to consider other healthcare options.

What is the most popular supplement insurance with Medicare?

The most popular supplement insurance with Medicare is Plan G, which covers nearly all costs except for the Medicare Part B deductible. Plan F is also widely popular for its comprehensive coverage of Medicare expenses.

Are Medicare Supplement plans being phased out?

Yes, Medicare Supplement Plan F is being phased out starting January 1, 2020. However, if you currently have this plan, you can keep it as long as you want.

What is a Medigap plan?

A Medigap plan, also known as Medicare Supplement Insurance, helps manage out-of-pocket expenses not covered by Original Medicare Parts A and B, offered by Medicare-approved private insurance companies.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about Medicare Supplement Plans South Dakota in 2025, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, cost and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.