by Russell Noga | October 15th, 2024

Navigating the world of healthcare coverage can often be confusing, but understanding the options available to you can make all the difference. One such option worth considering is enrolling in a Medicare Supplement, which can help pay for the gaps in Original Medicare coverage and give you financial peace of mind.

Let’s explore the ins and outs of Medicare Supplement plans, the various types available, and the factors to consider when choosing the best plan for your needs.

Short Summary

- Medicare Supplement Insurance is a private health insurance plan designed to supplement out-of-pocket costs of Medicare Part A and B (also called Gaps)

- Different pricing methods, such as community-rated and issue-age-rated, are used when selecting a Medicare Supplement Plan.

- Medicare Supplement plans are standardized, which means every company offers the same plans and benefits

Understanding Medicare Supplement Insurance

Medicare Supplement insurance, also known as Medigap, is designed to help cover some of the out-of-pocket costs that Original Medicare does not cover. These private health insurance plans offer additional benefits to fill the gaps in coverage, ultimately reducing financial strain and worry for beneficiaries.

When comparing Medicare Supplement insurance plans, it’s essential to consider the differences between companies, the quality of service, and the cost. Keep in mind that these plans are regulated by both the federal government and the relevant state insurance department.

The Role of Private Insurance Companies

Private insurance companies specialize in the sale of Medicare Supplement plans. They are responsible for providing customers with appropriate coverage options. Each insurer has exclusive financial accountability for the products they offer.

To ensure transparency and avoid confusion, disclaimers are often used, such as “Not connected with or endorsed by the U.S.

The government is responsible for the federal Medicare program. They manage it and make sure everything runs as expected.

Medicare Supplement Insurance Companies

There are several private insurance companies offering Medigap plans. Some popular companies include:

Original Medicare and Medigap

The Federal Medicare Program is a government initiative that provides healthcare coverage to those aged 65 and older, as well as certain individuals under 65 with disabilities or end-stage renal disease (ESRD).

Medicare Supplement plans, also known as Medigap, are designed to supplement the Original Medicare, filling in gaps in coverage and easing the financial burden on beneficiaries.

To be eligible for a Medicare Supplement plan, one must first enroll in Original Medicare Parts A and B. This provides a solid foundation for coverage, which can then be enhanced with a Medicare Supplement insurance plan tailored to the individual’s needs.

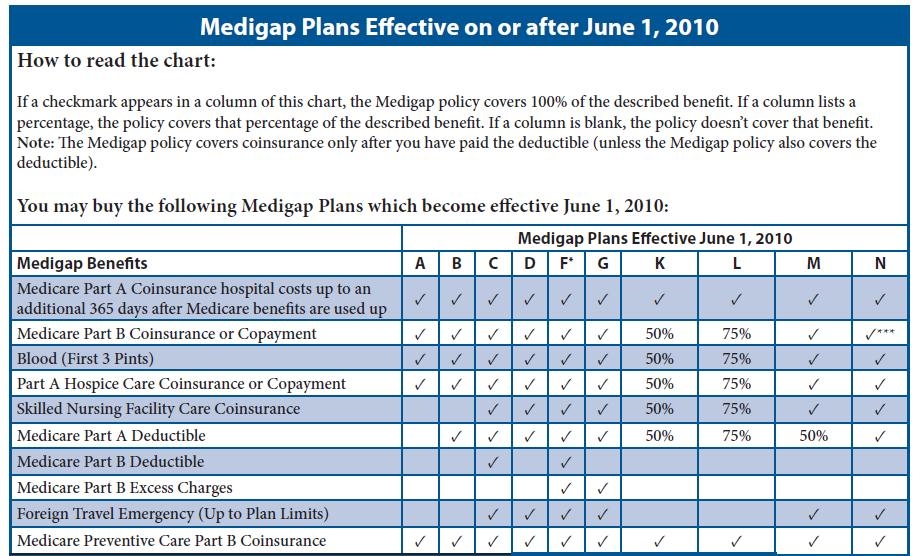

Types of Medicare Supplement Plans

Medicare Supplement plans are standardized, meaning each company offers the same plans and benefits.

These plans are labeled with letters, and the benefits offered by each plan may differ. Medicare Supplement plan F, G, and N are the most popular plans as they provide comprehensive coverage for relatively low premiums.

It’s important to note that some plans are no longer available for those first eligible for Medicare after January 1, 2020, such as Plan options C, F, and High Deductible Plan F.

Comparing Plan Benefits

When selecting a Medicare Supplement plan, it’s crucial to consider your current and future medical needs, budget, as well as your family’s medical history.

Medicare Supplement Plans are also referred to as “Medigap,” because they help pay the gaps in Original Medicare Part A and B.

Understanding the differences in coverage between the various Medicare Supplement plans is vital to making an informed decision about your healthcare coverage.

The Best Medicare Supplement Plans

While there isn’t one “best” Medicare Supplement plan for everyone, there are three plans that stand out due to their outstanding coverage. These are the most popular Medigap plans, and the are:

- Medicare Plan G

- Medicare Plan N

- Medicare Plan F

Medicare Supplement Plan G

Medicare Plan G is a popular option among Medicare Supplement plans. It covers all expenses permitted by Medicare Part A and B at 100%, with the exception of the Part B deductible.

This plan offers comprehensive coverage at a lower premium compared to some other plans, making it an attractive choice for many beneficiaries.

What is Medicare Plan G?

Medicare Plan G is a Medicare Supplement plan that helps cover certain expenses not covered by Original Medicare. It covers a percentage of any medical benefit that Original Medicare covers, except for the Medicare Part B deductible.

In addition, it covers coinsurance, copayments, and deductibles that are not included in Medicare Part A and Part B.

Medigap Plan G is a great option for those seeking nearly comprehensive coverage without the higher premiums of some other plans.

View Plans & Rates

Enter Zip Code

Medicare Supplement Plan F

Medicare Plan F is another comprehensive Medicare Supplement plan that covers all gaps in Medicare, including 100% of Medicare Part B excess charges. However, only people enrolled in Medicare prior to January 1st of 2020 may enroll in Plan F.

Medigap Plan F covers all out-of-pocket expenses associated with Original Medicare, such as deductibles, coinsurance, and copayments.

What is Medicare Plan F?

Medicare Plan F is a Medicare Supplement Insurance plan that helps cover areas of coverage not provided by Original Medicare. It offers coverage for all the benefits of Medicare Supplement Plans A, B, and C, skilled nursing facility care, Medicare Part A and B deductibles, and international travel medical emergency assistance. This plan provides comprehensive coverage to help reduce out-of-pocket expenses for beneficiaries.

To be eligible for Medicare Plan F, one must be enrolled in both Medicare Part A and Part B prior to January 1st of 2020.

Medicare Supplement Plan N

Medicare Plan N offers comprehensive coverage with lower premiums compared to Plans F and G, making it a more budget-friendly option for some beneficiaries. However, policyholders are required to pay copayments for office visits and emergency room visits.

This plan provides coverage for the Medicare Part A deductible, coinsurance for Parts A and B, three pints of blood, and 80% of medical costs incurred, in addition to 100% of Part B coinsurance costs, excluding certain copayments.

What is Medicare Plan N?

Medicare Plan N is a Medicare Supplement plan that assists in covering certain expenses not included in Original Medicare, such as copayments, coinsurance, and deductibles. It covers the Medicare Part A deductible, coinsurance for Parts A and B, three pints of blood, and 100% of the costs of Part B services, excluding copayments for certain office visits and emergency room visits.

Plan N does not cover the Medicare Part B deductible or any Medicare Part B excess charges, though these are rare and typically not costly. A major benefit of Medigap Plan N is that the premiums can be up to $35 less per month compared to Medicare Plan G.

Eligibility and Enrollment for Medicare Supplement Insurance

Eligibility for Medicare Supplement plans is extended to those aged 65 and above who are enrolled in Medicare Part B, as well as those under 65 with qualifying disabilities.

The Initial open enrollment period for Medicare Supplement plans begins the first day you are enrolled in Medicare Part B and lasts for 6 months. This is called the 6-month Medigap open enrollment period.

Age and Disability Requirements

To be eligible for Medicare Supplement Insurance, one must be enrolled in both Parts A and B at the time of application and be aged 65 or older.

In certain states, individuals with disabilities or end-stage renal disease may be eligible for Medicare plans even before the age of 65. These plans are exclusive to those with special circumstances.

Enrollment Periods and Guaranteed Issue Rights

The period of Medicare Supplement open enrollment begins when an individual is insured under Medicare Part B and is at least 65 years of age, or in certain cases, individuals of a younger age may be eligible if they have particular disabilities. This enrollment period will last for six months.

It’s best to apply for coverage during this time as you are guaranteed to be accepted and will not have to answer medical questions.

You may still apply for a Medigap plan outside of these six months, however, in most cases, you will have to go through medical underwriting and be approved for coverage.

Medicare Supplement Plans Cost

The cost of a Medicare Supplement plan varies based on several factors, including:

- Age

- Gender

- Zip code

- Tobacco use

- Household discounts if applicable

Understanding Community-Rated, Issue-Age-Rated, and Attained-Age-Rated Pricing

Community-rated pricing for Medicare Supplement Plans denotes that all individuals located in a specific geographic area pay the same premium for the same Medigap plan, regardless of their individual age.

Issue-age-rated pricing refers to the fact that the premium for a Medigap plan is based on the age of the individual when they initially purchase the plan, and the premium will not increase based on your new age each year, though will go up due to inflationary factors.

Attained-age-rated pricing indicates that the premium for a Medigap plan is dependent upon the age of the individual when they acquire the plan, and the premium will increase as the individual ages. These typically have the best rates.

Tips for Saving Money on Medicare Supplement Insurance

To save money on Medicare Supplement insurance, it’s extremely important to let us help.

To save money on Medicare Supplement insurance, it’s extremely important to let us help.

For no cost, we’ll shop the rates from top companies in your area that you qualify for, as well as help you obtain any household and other discounts that could be available to you.

Medicare Supplement vs. Medicare Advantage

Choosing between Medicare Supplement and Medicare Advantage plans depends on your individual healthcare needs, budget, and preferred healthcare providers. Medicare does not provide coverage for certain out-of-pocket expenses, such as copayments, coinsurance, and deductibles. Fortunately, Medicare Supplement plans are available to help fill these gaps.

On the other hand, Medicare Advantage plans provide additional Medicare benefits, such as prescription drugs, vision, and dental, and offer the same coverage as Original Medicare.

Coverage Differences

Medicare Supplement plans provide supplemental coverage to Original Medicare, allowing visits to any doctor accepting Medicare, whereas Medicare Advantage plans necessitate the utilization of a network of doctors and hospitals.

Understanding the coverage differences between Medicare Supplement and Medicare Advantage plans is crucial when deciding which plan best suits your needs.

Medicare Free Look Period

Each Medigap policy comes with a 30-day free Look policy. This means you can cancel the policy within the first 30 days if you are not happy for any reason, and receive a full refund of your premiums.

Choosing the Right Option for You

To choose the right option for your healthcare needs, consider the type of coverage you require, the amount you are able to pay in premiums, and the types of providers you prefer to utilize.

By comparing the advantages of each type of plan and taking into account your personal healthcare requirements, you can make an informed decision that will benefit your health and financial well-being.

Frequently Asked Questions

What is the purpose of a Medicare Supplement Plan?

A Medicare Supplement Plan, also known as Medigap, is designed to fill in the “gaps” in Original Medicare coverage. It helps pay for out-of-pocket costs like deductibles, coinsurance, and copayments, providing added financial protection.

How many Medicare Supplement Plans are there?

There are 10 standardized Medicare Supplement Plans in most states, identified by letters A through D, F, G, K through N. Each plan offers a different level of coverage, and not all plans may be available in your state. There are also is a high-deductible version of Medicare Plan G and Plan F.

Are all Medicare Supplement Plans the same?

While each Medicare Supplement Plan letter offers the same standardized benefits across different insurance companies, the premiums may vary. For example, a Blue Cross Medicare Supplement Plan G is the same as an Allstate Medigap Plan G. However, the coverage details for each plan letter differ. For example, Plan G covers more out-of-pocket costs than Plan A.

Can a Medicare Supplement Plan deny coverage?

During your Medigap Open Enrollment Period, insurers cannot deny you coverage or charge more due to pre-existing conditions. However, if you apply for a Medicare Supplement Plan outside of this period, insurers may use medical underwriting, potentially denying coverage or charging more based on health.

How does a Medicare Supplement Plan work with Original Medicare?

A Medicare Supplement Plan works in conjunction with Original Medicare. Original Medicare pays for your healthcare costs first, and then your Medicare Supplement Plan pays for some or all of the remaining costs, such as deductibles, coinsurance, and copayments.

Is a Medicare Supplement Plan worth it?

Whether a Medicare Supplement Plan is worth it depends on your healthcare needs and financial situation. If you anticipate frequent doctor visits or need regular medical care, a Medigap plan could save you from high out-of-pocket costs. It’s important to evaluate your needs before deciding.

What is the most popular Medicare Supplement Plan?

Medicare Supplement Plan G was often considered the most popular due to its comprehensive coverage, including all gaps in Medicare Part A and B except for the Part B deductible.

What is the difference between Medicare Advantage and Medicare Supplement Plans?

Medicare Advantage, or Part C, is an alternative to Original Medicare that often includes additional benefits like vision, dental, and prescription drug coverage. A Medicare Supplement Plan, on the other hand, is additional insurance you buy to cover costs not paid by Original Medicare. You can’t have both simultaneously, but you can switch from a Medicare Advantage plan to a Medigap plan during the fall Medicare Annual Enrollment Period.

Can I use my Medicare Supplement Plan anywhere in the U.S.?

Yes, you can use your Medicare Supplement Plan with any healthcare provider in the U.S. who accepts Medicare. This nationwide coverage is one advantage Medigap plans have over many Medicare Advantage plans, which often have network restrictions.

Do Medicare Supplement Plans cover overseas travel?

Some Medicare Supplement Plans, such as C, D, F, G, M, and N, provide coverage for emergency healthcare services when you’re traveling abroad. This coverage is typically limited to 80% of billed charges for certain medically necessary emergency care outside the U.S.

Get Started Now

Call us today for help with your Medicare Supplement insurance.

Our team of experts will answer all your questions related to health insurance plans. We’ll make sure you get on the right plan, with the right company.