by Russell Noga | Updated June 5th, 2024

Navigating the world of Medicare Supplement plans can feel like traversing a maze. With so many options, how can you be sure you’re choosing the best plan for your unique needs?

Navigating the world of Medicare Supplement plans can feel like traversing a maze. With so many options, how can you be sure you’re choosing the best plan for your unique needs?

Rest assured, this article is your beacon of light, illuminating the path to finding the perfect plan. By delving into the details of “Medicare Plan N vs Plan G”, two popular Medicare Supplement plans, we’ll provide you with the essential information to make an informed decision and enjoy peace of mind.

In the following sections, we’ll explore the basics of Medicare Supplement plans, compare “Medicare Plan N vs Plan G” in-depth, and discuss factors to consider when choosing between these two options.

Let’s embark on this journey together and uncover the mysteries of Medicare Supplement plans.

Short Summary

- Medicare Supplement Plans provide additional financial protection for healthcare costs not covered by Original Medicare.

- Plan G offers comprehensive coverage with higher premiums, while Plan N provides lower monthly premiums but may require copays for certain services.

- When selecting a plan, consider personal healthcare needs, budget and provider acceptance to determine the best balance of coverage and affordability.

Understanding Medicare Supplement Plans

When it comes to Medicare, it’s essential to understand that Original Medicare doesn’t cover everything. That’s where Medicare Supplement plans, also known as Medigap plans, come into play.

These plans work alongside Original Medicare to cover additional healthcare costs and limit out-of-pocket expenses, providing beneficiaries with an extra layer of financial protection.

Among the various popular Medicare Supplement plans, Medicare Advantage Plan, and Medicare Plan, three have gained prominence: Plan F, Plan G, and Plan N. These standardized Medicare Supplement Insurance Plan options are designed to help Medicare beneficiaries cover costs not included in Original Medicare, offering a range of coverage tailored to individual needs.

Let’s delve deeper into the world of Medigap plans and learn how they can benefit you.

The Role of Medigap Plans

Like a trusty sidekick, Medigap plans supplement Original Medicare coverage, providing beneficiaries with standardized benefits and financial security. For instance, Plan F is more comprehensive in coverage than a Medigap Plan G, including the Medicare Part B deductible, while Plan G offers extensive coverage at a slightly lower premium.

The advantages of Medigap plans are numerous, offering a safety net for beneficiaries to navigate the complexities of healthcare costs without fear. Some of the advantages include:

- Coverage for out-of-pocket costs, such as deductibles and copayments

- Access to any doctor or hospital that accepts Medicare

- Guaranteed renewable policies, ensuring consistent coverage as long as you maintain your policy ownership

With these advantages, you can rest assured that your healthcare costs will be covered and your coverage will remain consistent.

Standardization of Medicare Supplement Plans

By law, all Medicare Supplement Plans are standardized, ensuring that each plan offers the same benefits regardless of the insurance company offering them.

This standardization offers consumer protection, allowing beneficiaries to compare plans with confidence, knowing that they’ll receive the same coverage for each lettered policy, such as Plan N or Plan G, regardless of the insurance provider.

One important aspect to consider when choosing a Medicare Supplement plan is the potential for excess charges, which are fees charged by healthcare providers that exceed the Medicare-approved amount.

Understanding the standardization of Medicare Supplement Plans can empower you to make the best decision for your healthcare needs and financial situation.

Discover 2025 Plans & Rates

Enter Zip Code

Key Differences Between Plan G and Plan N

Key Differences Between Plan G and Plan N

Now that we have a solid understanding of Medicare Supplement plans, let’s dive into the key differences between Plan G and Plan N. These differences can play a crucial role in determining which plan is the best fit for you, taking into account coverage, premiums, and out-of-pocket costs.

In the following subsections, we’ll explore the specific coverage and premiums for Plan G and Plan N, providing you with a clear comparison to make an informed decision. Let’s uncover the unique elements of each plan and determine which one is right for you.

Plan G Coverage and Premiums

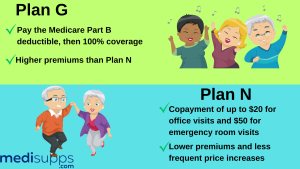

Medicare Supplement Plan G is often regarded as the “gold standard” of coverage, offering comprehensive protection at a higher premium. With Plan G, you can expect coverage for most healthcare costs, with the exception of the annual Part B deductible.

This means that you’ll have fewer out-of-pocket expenses, allowing you to focus on your health and wellbeing without worrying about unexpected costs.

The trade-off for this extensive coverage is a higher monthly premium, which typically ranges from $150 to $220. However, if you value peace of mind and comprehensive coverage, Plan G may be well worth the investment.

Plan N Coverage and Premiums

If you’re seeking a more budget-friendly option without sacrificing essential coverage, Medicare Supplement Plan N might be the perfect fit. Plan N offers lower monthly premiums compared to Plan G, but requires copays for certain services and does not cover Part B excess charges.

With Plan N, you’ll still have solid coverage for major healthcare costs, but you’ll need to be prepared for modest copays for physician visits and hospitalizations.

For those who are comfortable with a bit more cost-sharing, Plan N offers an appealing balance between coverage and affordability.

In-Depth Comparison: Plan G vs Plan N

Armed with the key differences between Plan G and Plan N, it’s time to delve even deeper into the specifics of each plan. In this section, we’ll compare the two plans in terms of:

- Hospital benefits

- Outpatient benefits

- Excess charges

- Network restrictions (if any)

By the end of this section, you’ll have a thorough understanding of the pros and cons of each plan, empowering you to make an informed decision based on your unique healthcare needs and circumstances.

Hospital Benefits

When it comes to hospital benefits, both Plan G and Plan N shine. They offer full inpatient coverage, including hospital stays, skilled nursing facility care, and hospice care coinsurance.

This means that regardless of whether you choose Plan G or Plan N, you can rest easy knowing that your inpatient care will be covered.

Having comprehensive hospital benefits is crucial, as unexpected hospital stays can quickly become a significant financial burden. With either Plan G or Plan N, you’ll be well-prepared for any hospital-related healthcare expenses.

Outpatient Benefits

Turning our attention to outpatient benefits, Plan G and Plan N differ in key ways. Plan G covers 100% of outpatient services, meaning that all doctor visits, lab tests, and preventive care are covered without any copays.

This comprehensive coverage can provide peace of mind and help you avoid unexpected out-of-pocket expenses.

On the other hand, Plan N may require copays for some outpatient services, such as doctor visits and emergency room visits.

While these copays are generally modest, it’s essential to consider whether you’re comfortable with the potential for additional out-of-pocket costs when choosing between Plan G and Plan N.

Excess Charges and Network Restrictions

Excess charges can be a significant factor when choosing a Medicare Supplement plan. Plan G covers the areas Plan G covers. Part B excess charges, ensuring that you won’t face any surprises for services that exceed the Medicare-approved amount.

Plan N, however, does not cover these charges, which may result in additional out-of-pocket expenses.

When it comes to network restrictions, both Plan G and Plan N require beneficiaries to use providers that accept Medicare assignment.

This means that you’ll need to ensure your preferred healthcare providers accept Medicare, regardless of whether you choose Plan G or Plan N.

Choosing the Right Plan: Factors to Consider

Now that we’ve thoroughly compared Plan G and Plan N, it’s time to consider the factors that will ultimately guide your decision.

In this section, we’ll discuss personal healthcare needs, budget, and provider acceptance, helping you weigh the pros and cons of each plan and determine the best fit for your unique situation.

By taking the time to carefully assess these factors, you’ll be well-equipped to make an informed decision and find the Medicare Supplement plan that aligns with your needs and preferences.

Personal Healthcare Needs

Personal Healthcare Needs

Your individual healthcare needs should be at the forefront of your decision-making process. Consider the frequency of office visits, the types of medical services you require, and any pre-existing conditions when choosing between Plan G and Plan N.

For example, if you visit the doctor often or require specialized services, Plan G’s comprehensive coverage and lack of copays may be more appealing.

On the other hand, if you have relatively few healthcare needs and are comfortable with cost-sharing, Plan N’s lower premiums might be the better choice.

Budget and Premiums

Budget and Premiums

When choosing between Plan G and Plan N, it’s crucial to consider your budget and the monthly premiums associated with each plan. Plan G’s higher premiums may provide peace of mind, but they might not be financially feasible for everyone.

By comparing the monthly premiums and potential out-of-pocket costs for each plan, you can determine which option fits best within your budget.

It’s important to strike a balance between coverage and affordability, ensuring that you’re not stretching yourself too thin financially.

Provider Acceptance

Provider Acceptance

Lastly, you’ll want to ensure that your preferred healthcare providers accept Medicare assignment to avoid excess charges and network restrictions.

Although both Plan G and Plan N require beneficiaries to use providers that accept Medicare assignment, it’s essential to verify that your preferred doctors, hospitals, and other healthcare providers will accept your chosen plan.

By taking the time to research provider acceptance, you’ll be better prepared to choose the plan that offers the most seamless access to the care you need, without any interruptions or additional costs.

Enrollment Timing and Switching Plans

With a thorough understanding of Plan G and Plan N, it’s essential to also consider the best time to enroll in a Medicare Supplement plan and the process of switching plans, if necessary.

In this section, we’ll explore the Medigap Open Enrollment Period and the potential implications of switching plans outside of this time frame.

By understanding the optimal time to enroll and the potential challenges associated with switching plans, you’ll be well-prepared to navigate the Medicare Supplement landscape with ease.

Open Enrollment Period

The Medigap Open Enrollment Period offers the best opportunity to purchase a plan without medical underwriting or coverage denials. This six-month period begins on the first day of the month in which you turn 65 or older and are enrolled in Medicare Part B.

During the Open Enrollment Period, you can choose any Medicare Supplement plan without being subject to medical underwriting or having to wait for preexisting condition coverage. This is the ideal time to enroll in the plan that best suits your needs and circumstances.

Switching Plans and Medical Underwriting

Switching plans may be possible outside of the Open Enrollment Period, but medical underwriting may apply, and coverage is not guaranteed. Medical underwriting is the process by which insurers assess factors such as age, gender, geographic location, and prior medical history to determine whether to offer a policy.

If you’re considering switching plans, it’s important to be aware of the potential implications, such as higher premiums or coverage denials.

Make sure to carefully weigh the pros and cons of switching plans outside of the Open Enrollment Period.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, choosing the right Medicare Supplement plan can be a daunting task, but armed with the knowledge and insights provided in this article, you’ll be well-equipped to make an informed decision.

By carefully considering the coverage, premiums, and out-of-pocket costs of Plan G and Plan N, along with your personal healthcare needs, budget, and provider acceptance, you can find the plan that perfectly aligns with your unique circumstances.

Remember, navigating the world of Medicare Supplement plans is a journey, and this article is your compass.

Use the information provided here as a guide, and you’ll be well on your way to finding the perfect plan that offers the coverage, peace of mind, and financial security you deserve.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Plan N, and how does it differ from Plan G?

Medicare Plan N and Plan G are both Medigap plans that help cover healthcare costs not covered by Original Medicare. The main difference is how they handle certain out-of-pocket expenses.

What does Medicare Plan N cover?

Medicare Plan N covers many of the same benefits as Plan G, including Medicare Part A and B coinsurance, hospital costs, and preventive care. However, Plan N may require copayments for some doctor visits and emergency room visits.

What does Medicare Plan G cover?

Medicare Plan G is known for its comprehensive coverage. It covers all Medicare Part A and B coinsurance, hospital costs, skilled nursing facility care, and even the Part B excess charges.

Are there any differences in premiums between Plan N and Plan G?

Plan G generally has a higher premium than Plan N due to its more extensive coverage. However, Plan N may have lower monthly premiums but includes copayments for certain services.

How do the copayments work with Medicare Plan N?

With Medicare Plan N, you may be responsible for copayments of up to $20 for some doctor visits and up to $50 for emergency room visits, even if you’re admitted as an inpatient.

Does Medicare Plan N cover the Part B deductible?

No, Plan N does not cover the Medicare Part B deductible, which is an out-of-pocket expense you’ll have to pay before your coverage kicks in for most services.

Can I see any doctor with Plan N and Plan G?

Yes, both Plan N and Plan G allow you to see any healthcare provider that accepts Medicare. They don’t restrict your choice of doctors or hospitals.

Which plan is better for those who rarely visit the doctor?

If you rarely visit the doctor and are comfortable with paying modest copayments, Medicare Plan N with its lower premiums might be a cost-effective choice.

Which plan is better for those who want comprehensive coverage without copayments?

If you prefer comprehensive coverage without worrying about copayments for doctor visits and emergency room care, Medicare Plan G is often considered the better choice.

Can I switch from Plan N to Plan G (or vice versa) after enrollment?

Yes, you can generally switch between Medigap plans, but you may need to pass medical underwriting in some cases. It’s essential to compare costs, coverage, and your healthcare needs before making any changes.

Find the Right Medicare Plan for You

Searching for the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.