by Russell Noga | Updated November 27th, 2023

Are you considering Medicare Plan N as a healthcare solution in Ohio? In this comprehensive guide, we’ll explore the benefits, key features, eligibility requirements, and how it compares to other Medicare Supplement plans.

Are you considering Medicare Plan N as a healthcare solution in Ohio? In this comprehensive guide, we’ll explore the benefits, key features, eligibility requirements, and how it compares to other Medicare Supplement plans.

By the end of this article, you’ll have a clear understanding of Medicare Plan N Ohio and how it can help you manage your healthcare expenses.

Short Summary

- Medicare Plan N in Ohio is a standardized Medicare Supplement insurance plan designed to cover out-of-pocket expenses not covered by Original Medicare.

- Eligible individuals can enroll during the six-month Medigap Open Enrollment period without medical underwriting or pre-existing health conditions.

- Comparing costs, coverage and additional benefits of different plans is essential to make an informed decision that best suits individual healthcare needs.

Understanding Medicare Plan N in Ohio

Medicare Plan N is a standardized Medicare Supplement insurance plan available in different states across America. Ohio is one among them.

It is designed to help cover out-of-pocket expenses not covered by Original Medicare for Medicare-approved services, apart from the Medicare Part B deductible. Aetna, one of the many providers of Plan N in Ohio, offers additional benefits such as Foreign Travel Emergency coverage.

To enroll in a Medigap Plan in Ohio, you’ll need to:

- Contact the insurance company

- Confirm your eligibility during the open enrollment period or with guaranteed issue rights

- Complete the application

- Choose a policy start date

In Ohio, the average monthly premium for Plan N is $105.50 for 65-year-olds and $173.68 for 75-year-olds. These amounts represent the monthly premiums for this plan in the state of Ohio.

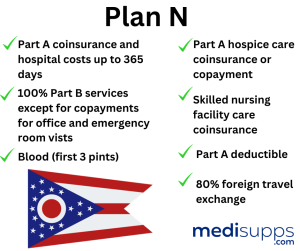

Key Features of Plan N

Medicare Plan N in Ohio covers the following:

- Part A co-insurance and hospital costs up to an additional year after Medicare benefits are used up

- Part B co-insurance or copayments

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayments

- Skilled nursing facility care co-insurance

- Part A deductible

- Foreign travel exchange (up to plan limits)

Plan N does not cover Part B deductibles. Additionally, only 80% of international travel expenses is provided, up to the plan’s maximum.

Individuals enrolled in Medicare Supplement Plan N are responsible for their Medicare Part B deductible, minor copays at the physician’s office, and any excess charges that may arise.

A copayment of $50 is required for emergency room visits, unless they end in an inpatient admission. Additionally, there will be a copayment of $20 for doctors’ appointments.

Eligibility Requirements for Plan N

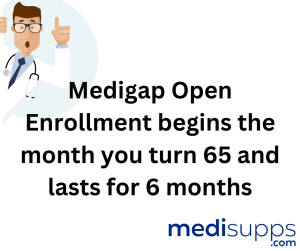

To be eligible for Medicare Plan N in Ohio, you must be at least 65 years old and enrolled in both Medicare Parts A and B. The Medigap Open Enrollment period in Ohio begins when you turn 65 and are enrolled in both Parts A and B. It carries on for six months from the very first day.

During this period, you can enroll in Medicare Plan N without being denied coverage due to medical underwriting or pre-existing health conditions.

Discover 2024 Plans & Rates

Enter Zip Code

Comparing Medicare Plan N to Other Supplement Plans

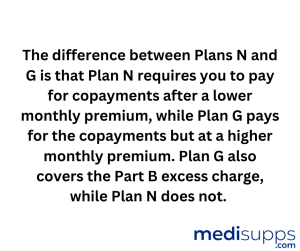

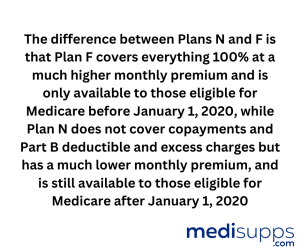

It’s essential to compare Medicare Plan N with other popular Medicare Supplement plans in Ohio, such as Plans G and F, to make an informed decision that best suits your healthcare needs. The main distinctions among these plans are their coverage and benefits.

For example, Plan N provides assistance with expenses not covered by Original Medicare, while other supplement plans may provide additional coverage for deductibles.

It’s important to consider the cost of each plan, as well as the coverage.

Coverage Differences

While Medicare Plan N covers copayments and coinsurance, it may not cover all deductibles. In contrast, other popular Medicare Supplement plans in Ohio, such as Plans G and F, may offer more comprehensive coverage, including deductibles and additional charges.

However, these plans may come with higher monthly premiums.

It’s crucial to weigh the coverage differences against the costs when choosing the best Medicare Supplement plan for your needs.

Costs and Premiums

The average monthly premium for Medicare Plan N in Ohio is $105.50 for 65-year-olds and $173.68 for 75-year-olds. In comparison, the premium for Aetna Medicare Plan G in Ohio is $112.95 per month.

Additionally, the deductible for Aetna’s high-deductible plan G in Ohio is $2,490.

When comparing the costs and premiums of Medicare Plan N and other supplement plans in Ohio, keep in mind that Plan N may have lower premiums than more comprehensive plans, but it does not offer coverage for additional charges and foreign travel emergency care.

Top Providers of Medicare Plan N in Ohio

There are 48 providers offering Medicare Plan N in Ohio, including:

- Aetna

- Anthem

- CareSource

- Cigna

- Humana

To help you find the most suitable option, MoneyGeek has collected contact information and pricing strategies for all Plan N providers in Ohio.

It’s essential to research and compare the top providers to ensure you receive the best Medicare Supplement plan for your healthcare needs.

Provider Profiles

Provider Profiles

Some of the most widely recognized Medicare insurance providers in Ohio include:

- Aetna

- Anthem

- CareSource

- Cigna

- Humana

To get a better understanding of their Medicare Plan N offerings, it’s recommended to contact the providers directly.

Factors to consider when choosing a provider include their history, reputation, customer satisfaction ratings, and the specific features and benefits they offer with their Medicare Plan N plans.

How to Choose the Right Provider

When selecting the best provider for Medicare Plan N in Ohio, consider your individual needs and preferences, such as the provider’s reputation, customer satisfaction ratings, and the specific features and benefits they offer with their Medicare Plan N plans.

It’s also essential to compare the costs and premiums of different providers to ensure you receive the best value for your healthcare investment.

When comparing providers, look for those that offer the most comprehensive coverage for the lowest cost. Additionally, additional information is provided below.

Enrolling in Medicare Plan N in Ohio

To enroll in Medicare Plan N in Ohio, you’ll need to:

- Contact the insurance company

- Confirm your eligibility during the open enrollment period or with guaranteed issue rights

- Complete the application

- Choose a policy start date.

There are no specific dates and deadlines for enrolling in Medicare Plan N in Ohio; however, being subject to Medicare Supplement underwriting questions means that a carrier can reject your application for any reason.

Open Enrollment Period

Open Enrollment Period

The Open Enrollment Period for Medicare Plan N in Ohio is a six-month period starting in the month of your 65th birthday. During this period, you can enroll in Medicare Plan N without being denied coverage due to medical underwriting or pre-existing health conditions.

This is a crucial time to enroll, as it allows you to obtain coverage without the need for answering health questions or providing medical records.

Guaranteed Issue Rights

Guaranteed Issue Rights

Guaranteed issue rights for Medicare Plan N in Ohio apply during your Medigap Open Enrollment Period, as mandated by federal law.

This means that during this period, you can acquire any Medicare Supplement plan of your choice, regardless of any pre-existing chronic conditions.

These rights are essential in ensuring that you have access to the healthcare coverage you need without the worry of being denied due to health reasons.

Medicare Plan N and Prescription Drug Coverage

While Medicare Plan N in Ohio does not offer coverage for prescription drugs, you can still obtain prescription drug coverage by enrolling in a Medicare Part D plan. Combining Medicare Plans.

A prescription drug plan will help you achieve comprehensive healthcare coverage, ensuring that your medical and prescription drug needs are met.

With this combination, you can rest assured that you will have the coverage you need to stay safe.

Medicare Part D Plans

Medicare Part D Plans

Medicare Part D is a voluntary outpatient prescription drug benefit for individuals with Medicare. It helps cover the cost of prescription drugs and is administered through private plans that have contracted with Medicare.

Enrolling in a Medicare Part D plan can assist in reducing your expenditure on prescription drugs, ensuring that you have access to the medications you need at an affordable price.

Combining Plan N with a Prescription Drug Plan

To combine Medicare Plan N with a prescription drug plan, you can join a separate Medicare drug plan (Part D). This will provide you with prescription drug coverage in addition to the benefits of Medicare Plan N.

By combining both plans, you can achieve comprehensive healthcare coverage that meets your medical and prescription drug needs.

Additional Benefits and Services with Medicare Plan N

Although Medicare Plan N does not typically provide dental, vision, or hearing coverage, it’s essential to explore the additional benefits and services that may be available with this plan.

Some providers may offer extra benefits, such as Foreign Travel Emergency coverage.

It’s crucial to research and compare the top providers to ensure you receive the best Medicare Supplement plan for your healthcare needs.

Dental and Vision Coverage

Dental and Vision Coverage

Medicare Plan N does not usually provide dental and vision coverage. To obtain dental and vision coverage, you may need to look into separate dental and vision plans or Medicare Advantage plans that offer these additional benefits.

By combining Medicare Plan N with dental and vision coverage, you can ensure that your healthcare needs are met in a comprehensive manner.

Hearing Benefits

Hearing Benefits

Medicare Plan N does not offer hearing benefits. However, you can explore other options such as Medicare Advantage plans or separate hearing insurance plans to supplement your Medicare coverage.

By combining Medicare Plan N with hearing coverage, you can ensure that your healthcare needs are met in a comprehensive manner.

Medicare Plan N vs. Medicare Advantage Plans in Ohio

It’s essential to compare Medicare Plan N and Medicare Advantage plans in Ohio to make an informed decision that best suits your healthcare needs.

While both options provide healthcare coverage, there are key differences in coverage and costs that you should consider.

For example, Medicare Plan N covers most of the same services as a Medicare Advantage Plan, but it does not cover all of the same services.

Coverage Differences

Medicare Plan N is a Medigap plan that helps cover certain out-of-pocket costs, such as Medicare Part A coinsurance and hospital costs, Part B coinsurance or copayments, and blood transfusions.

On the other hand, Medicare Advantage plans are comprehensive health plans provided by private insurance companies that include Medicare Part A, Part B, and sometimes Part D prescription drug coverage.

They may also offer additional benefits such as dental, vision, and hearing coverage.

The specific coverage differences between Medicare Plan N and Medicare Advantage plans in Ohio may vary depending on the insurance company and plan selected.

Cost Comparisons

Medicare Plan N typically ranges from $120 to $180 per month in Ohio, while the costs of Medicare Advantage plans may vary based on the specific plan.

It’s important to compare the premiums, cost-sharing, and out-of-pocket limits of different Medicare Advantage plans for a comprehensive cost comparison.

Keep in mind that Medicare Advantage plans have an annual out-of-pocket limit, while Medicare Plan N creates an out-of-pocket limit for Original Medicare.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Medicare Plan N in Ohio offers a cost-effective solution to help cover out-of-pocket expenses not covered by Original Medicare.

By understanding the key features, eligibility requirements, and comparing it to other Medicare Supplement plans, you can make an informed decision that best suits your healthcare needs.

Don’t forget to explore additional benefits and services that may be available with Medicare Plan N, as well as how to combine it with a prescription drug plan for comprehensive coverage.

With the right Medicare Supplement plan, you can ensure that your healthcare needs are met in a comprehensive and affordable manner.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Plan N, and how does it work in Ohio?

Medicare Plan N in Ohio is a type of Medicare Supplement insurance designed to help residents cover out-of-pocket healthcare costs not covered by Original Medicare.

What specific healthcare services does Medicare Plan N cover in Ohio?

In Ohio, Medicare Plan N typically covers hospitalization, medical services, hospice care, skilled nursing facility care, and limited foreign travel emergencies.

Are there any out-of-pocket expenses associated with Medicare Plan N in Ohio?

Yes, beneficiaries of Medicare Plan N in Ohio are responsible for paying copayments or coinsurance for certain services, such as doctor’s office visits or emergency room visits.

How can I find Medicare Plan N providers in Ohio?

You can find Medicare Plan N providers in Ohio by contacting insurance companies that offer Medicare Supplement plans. They will provide you with a list of available providers in your area.

Does Medicare Plan N in Ohio allow me to choose any doctor or hospital?

Yes, you have the flexibility to select any healthcare provider in Ohio who accepts Medicare patients when you have Medicare Plan N.

Is prescription drug coverage included in Medicare Plan N in Ohio?

No, Medicare Plan N in Ohio does not include prescription drug coverage. To get coverage for medications, you would need to enroll in a separate Medicare Part D plan.

What is the cost of Medicare Plan N in Ohio?

The cost of Medicare Plan N in Ohio can vary based on the insurance provider, your location, and other factors. It’s important to compare different plans to find one that fits your budget.

Are there any financial assistance programs or subsidies available for Medicare Plan N in Ohio?

Some Ohio residents may qualify for assistance programs that help cover Medicare costs. Check with the Ohio Department of Aging or local SHIP offices for information on available assistance.

Can I switch from another Medicare Supplement plan to Medicare Plan N in Ohio?

Yes, you can switch from one Medicare Supplement plan to another, including Medicare Plan N, during specific enrollment periods. Be sure to compare benefits and costs before making the switch.

When can I enroll in Medicare Plan N in Ohio?

You can enroll in Medicare Plan N in Ohio during your Initial Enrollment Period when you first become eligible for Medicare. You can also consider enrolling during the Open Enrollment Period or a Special Enrollment Period if you qualify.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have inquires about Medicare Advantage or Medicare Part D, we can help.

Call today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!