by Russell Noga | Updated June 6th, 2024

Navigating the world of Medicare can be challenging, especially when it comes to choosing the right supplement plan. Understanding Medicare Plan N coverage can help you make a well-informed decision that suits your healthcare needs and budget.

Navigating the world of Medicare can be challenging, especially when it comes to choosing the right supplement plan. Understanding Medicare Plan N coverage can help you make a well-informed decision that suits your healthcare needs and budget.

In this article, we will explore the ins and outs of Medicare Plan N, its benefits, costs, and how it compares to other popular Medigap plans. Buckle up for an enlightening journey through Medicare Supplement Insurance Plan N!

Short Summary

- Understand Medicare Plan N Coverage to make an informed decision.

- Key features include coinsurance, deductibles, hospice care, and emergency health services while traveling abroad.

- Compare cost-sharing requirements and coverage of different plans before selecting one that best suits your needs.

Understanding Medicare Plan N Coverage

Medigap Plan N, also known as Medicare Plan N, is a supplemental insurance policy that fills in the gaps left by Original Medicare, covering crucial expenses such as Part A deductible and Part B coinsurance costs.

It provides comprehensive coverage and is considered a more flexible option compared to Medicare Advantage HMO plans, which may have more restrictions on provider networks.

With a Medigap policy like Plan N, beneficiaries can enjoy the peace of mind that comes with knowing their medical expenses are well-covered.

While Plan N offers a robust set of benefits, it’s essential to understand the key features and how it compares to other Medicare supplement plans. This knowledge will enable you to make an informed decision on whether Plan N is the right choice for you.

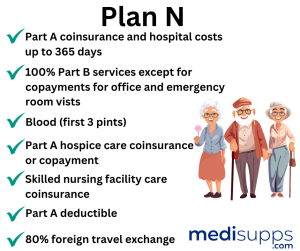

Key Features of Plan N

Medicare Plan N covers a wide array of medical expenses, providing coverage for:

- Coinsurance

- Deductibles

- Hospice care

- Emergency health care services while traveling outside the United States

One of its most significant benefits is covering the Medicare Part A deductible, an expense not fully covered by Original Medicare. Additionally, Plan N provides coverage for coinsurance costs associated with Medicare Parts A and B.

The coverage for three pints of blood and 80% of medical expenses incurred during foreign travel is another notable feature of Plan N. Thus, with Plan N, beneficiaries can rest assured that they have comprehensive coverage for a wide range of medical expenses, both at home and abroad.

Comparing Plan N to Other Medicare Supplement Plans

Comparing Plan N to Other Medicare Supplement Plans

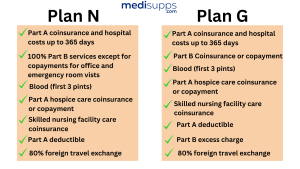

When comparing Plan N to other Medicare supplement policies, it’s crucial to consider the cost-sharing requirements, such as copayments for doctor visits and emergency room visits. Although Plan N premiums may be lower than those of other plans like Plan G or Plan F, the cost-sharing aspect is something to keep in mind when making a decision.

It’s also essential to note that Plan N does not cover Medicare Part B excess charges. Thus, if a healthcare provider charges more than the Medicare-approved amount, you may be responsible for additional charges.

The health and wellness programs included in Plan N may vary depending on the insurance carrier, so it’s important to research and compare these offerings when choosing a plan.

Discover 2024 Plans & Rates

Enter Zip Code

The Cost of Medicare Plan N

The cost of Medicare Plan N can vary based on factors such as age, location, and tobacco use. Generally, premiums for Plan N are lower than more comprehensive plans like Plan G, making it an attractive option for cost-conscious beneficiaries.

As with any Medicare supplement plan, it’s essential to consider your healthcare needs and budget when evaluating the cost of Plan N.

Average Premiums for Plan N

The average premiums for Plan N typically range from $100 to $200 per month, depending on factors such as age, location, and the insurance company. It’s essential to keep these factors in mind when comparing Plan N premiums to other Medicare supplement plans, as they can significantly impact the overall cost of your coverage.

While the average premiums for Plan N offer a general idea of the cost, it’s crucial to obtain personalized quotes from different insurance companies to ensure you’re getting the best coverage at the most competitive price.

By comparing quotes, you can potentially save hundreds of dollars on your Medicare supplement insurance.

Ways to Save on Plan N Premiums

One of the most effective ways to save on Plan N premiums is by enrolling during the open enrollment period, which coincides with the open enrollment period for Medicare Part B, running from October 15 to December 7 annually. During this time, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions.

Another strategy to save on Plan N premiums is to:

- Compare prices from different insurance companies

- Research online, speak with insurance agents and utilize comparison tools to find the best coverage at the most competitive price

- Consider high-deductible alternatives to Medicare Plan N, such as Plan G and Plan F, for potential cost savings.

What’s Included in Medicare Plan N Coverage

While Medicare Plan N covers a variety of medical expenses, there are some limitations and exclusions to be aware of, such as copayments for office visits and emergency room visits, as well as certain excluded services.

Understanding these limitations and exclusions can help you make an informed decision about whether Plan N is the right coverage for your healthcare needs.

Copayments for Office Visits and Emergency Room Visits

Copayments for Office Visits and Emergency Room Visits

Medicare Plan N covers 100% of the Part B coinsurance costs, including coinsurance and hospital costs.

However, there is a $20 copayment for office visits and a $50 copayment for emergency room visits. These copayments are applicable regardless of whether the visit results in hospitalization or not.

While the copayments for office visits and emergency room visits may seem like a drawback, they can actually help keep the monthly premiums for Plan N lower than other Medicare supplement plans.

This cost-sharing aspect of Plan N makes it an attractive option for beneficiaries who are comfortable with making regular copayments for doctor or emergency room visits.

Limitations and Exclusions

Plan N does not cover Medicare Part B excess charges or the Part B deductible, which means you may be responsible for additional charges if a healthcare provider charges more than the Medicare-approved amount. Furthermore, Plan N does not include coverage for long-term care or private-duty nursing.

It’s essential to be aware of these limitations and exclusions when considering Medicare Plan N coverage. While Plan N provides a robust set of benefits, it may not be the best option for individuals who require coverage for services like long-term care or private-duty nursing.

Evaluating Plan N vs. Plan G

When comparing Medicare Plan N and Plan G, it’s important to consider the differences in premiums, coverage, and out-of-pocket costs to determine the best option for your needs. Both plans offer comprehensive coverage, but with some variations that can impact your overall healthcare costs and satisfaction.

Plan N has a lower premium than Plan G, but it also has higher out-of-pocket costs.

Pros and Cons of Plan N and Plan G

One of the key advantages of Plan N is its lower monthly premiums compared to Plan G. However, Plan N requires copayments for office visits and emergency room visits, which can add up over time.

On the other hand, Plan G has higher premiums but offers more comprehensive coverage without copayments.

Ultimately, the decision between Plan N and Plan G will depend on your personal healthcare needs, budget, and preferences.

By carefully weighing the pros and cons of each plan, you can make an informed decision about which plan is the best fit for you.

High-Deductible Plan G as an Alternative

For those looking for a more cost-effective alternative, high-deductible Plan G may be a suitable option. With a $2,700 deductible and low monthly premiums of around $30, high-deductible Plan G is an attractive choice for healthy beneficiaries who do not anticipate frequent medical expenses.

This Medigap plan offers a balance between affordability and coverage for those in need.

However, it’s essential to keep in mind that if you experience a major medical event or illness, you’ll need to meet the $2,700 deductible before the plan begins covering 100% of covered services for the calendar year.

As with any insurance decision, it’s crucial to weigh the potential costs and benefits of high-deductible Plan G against your healthcare needs and financial situation.

Choosing the Right Insurance Company for Medicare Plan N

Choosing the Right Insurance Company for Medicare Plan N

Selecting the right insurance company for your Medicare Plan N coverage is just as important as choosing the plan itself. You’ll want to compare the coverage, premiums, customer service, and additional benefits offered by top providers such as Aetna, Cigna, and AARP/UnitedHealthcare to ensure you’re getting the best possible coverage and service.

It’s important to research each provider to make sure you’re getting the best value for your money.

Top Providers of Medicare Plan N

Aetna, Cigna, and AARP/UnitedHealthcare are among the leading providers of Medicare Plan N. These companies offer varying levels of coverage, premiums, and customer service, making it essential for beneficiaries to compare their options before making a decision.

When researching and comparing top providers, consider factors such as:

- Coverage limitations

- Customer service reviews

- Any additional benefits offered, such as health and wellness programs or discounts on vision, dental, and hearing services

By thoroughly evaluating your options, you can find the insurance company that best suits your needs and provides the most value for your Medicare Plan N coverage.

Health and Wellness Programs Associated with Plan N

In addition to the core Medicare benefits provided by Plan N, some insurance companies offer health and wellness programs associated with the plan.

These programs, which may include discounts on vision, dental, and hearing services, gym memberships, and rewards programs, can add value to your Medicare Plan N coverage by promoting a healthier lifestyle and potentially reducing out-of-pocket medical expenses.

These programs can help you stay healthy and active, while also providing financial savings. With the right tools.

Summary

In conclusion, understanding Medicare Plan N coverage is essential for making an informed decision about your healthcare needs.

By considering the benefits, costs, limitations, and insurance providers associated with Plan N, you can choose the plan that best aligns with your needs and budget.

Ultimately, investing in a Medicare supplement plan like Plan N can provide peace of mind and financial security, allowing you to focus on living a healthy and fulfilling life.

Compare Medicare Plans & Rates in Your Area

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Medicare Plan N coverage?

Medicare Plan N is a type of Medicare Advantage plan that provides comprehensive healthcare coverage, including hospital, medical, and prescription drug coverage, with some cost-sharing requirements.

How does Medicare Plan N differ from Original Medicare?

Medicare Plan N offers additional benefits beyond Original Medicare, including coverage for prescription drugs and preventive services. It also has cost-sharing in the form of copayments and deductibles.

What are the key benefits of Medicare Plan N?

Medicare Plan N covers hospital stays, doctor visits, preventive care, and prescription drugs. It also offers emergency care and urgently needed care coverage when traveling.

Are there any monthly premiums with Medicare Plan N?

Yes, there may be a monthly premium for Medicare Plan N, in addition to the standard Part B premium. Premiums can vary by plan and location.

What are the cost-sharing features of Medicare Plan N?

Medicare Plan N typically requires copayments for doctor visits and emergency room visits. It also has a modest deductible for some services.

Is there a network of healthcare providers with Medicare Plan N?

Yes, Medicare Plan N often has a network of preferred providers. Using in-network providers may result in lower out-of-pocket costs.

Can I enroll in Medicare Plan N at any time of the year?

You can generally enroll in Medicare Plan N during the Medicare Annual Enrollment Period, which typically runs from October 15 to December 7 each year.

Can I switch from Original Medicare to Medicare Plan N or vice versa?

You can switch from Original Medicare to Medicare Plan N during the Annual Enrollment Period or during a Special Enrollment Period if you qualify. The reverse switch is also possible.

What prescription drug coverage does Medicare Plan N offer?

Medicare Plan N often includes prescription drug coverage through Medicare Part D. It helps cover the cost of prescription medications.

How do I choose the right Medicare Plan N for my needs?

To choose the right Medicare Plan N, consider factors like your healthcare needs, budget, and preferred network of providers. Compare available plans in your area to make an informed decision.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.