by Russell Noga | Updated June 6th, 2024

Medicare Plan N Cost

As 2024 approaches, it’s essential for Medicare beneficiaries to understand the changes and costs associated with their healthcare plans.

One popular choice among seniors is Medicare Plan N – a Medigap policy designed to cover gaps in Original Medicare, providing additional benefits to help with out-of-pocket expenses.

One popular choice among seniors is Medicare Plan N – a Medigap policy designed to cover gaps in Original Medicare, providing additional benefits to help with out-of-pocket expenses.

In this blog post, we’ll dive into the Medicare Plan N cost 2024, compare it to other Medigap plans, and offer tips on maximizing savings and managing expenses.

Stay with us as we explore the ins and outs of this supplemental insurance plan so you can make an informed decision for your healthcare needs.

Short Summary

- Medicare Plan N is a Medigap plan providing comprehensive coverage for copayments, coinsurance and hospital costs.

- In 2024, the cost of Medicare Plan N is expected to range from $80-$200 per month depending on age, gender & location.

- Maximize savings on premiums by shopping around providers and taking advantage of discounts/incentives. Manage out-of-pocket expenses effectively to maximize policy value.

Understanding Medicare Plan N

Medicare Plan N is a supplemental insurance plan that provides coverage for certain expenses not covered by Original Medicare, including copayments, coinsurance, and deductibles.

It is particularly popular among seniors due to its comprehensive coverage and relatively lower premiums compared to other Medigap plans.

However, it’s worth noting that Medicare Plan N does not include Medicare prescription drug coverage, which is essential for many beneficiaries. To address this gap, beneficiaries may consider enrolling in Medicare Part D coverage for their prescription drug needs.

What is Medicare Plan N?

Medicare Plan N is a type of Medigap plan offered by private insurance companies to help beneficiaries manage out-of-pocket expenses not fully covered by Original Medicare.

Specifically, Plan N covers copayments, coinsurance, and hospital costs, but leaves out the Medicare Part B deductible or Part B excess charges, and does not provide prescription drug coverage under Part D.

The copayment amounts for office and emergency room visits under Medicare Supplement Plan N are up to $20 and $50, respectively.

This makes it a popular choice among beneficiaries who prefer lower monthly premiums, such as the average supplemental premium and the base beneficiary premium, in exchange for occasional co-pays for doctor visits.

Check Rates for 2024

Enter Zip Code

Benefits of Medicare Plan N

The main benefits of Medicare Plan N include its coverage for copayments, coinsurance, and hospital costs, making it an attractive option for comprehensive coverage.

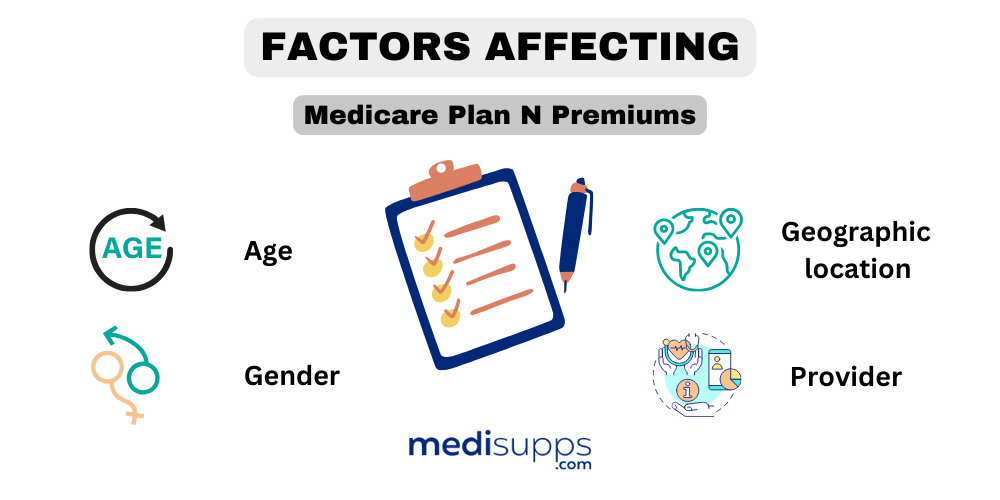

However, the exact cost of Medicare Plan N depends on various factors, including age, gender, location, and provider.

It’s essential to compare rates among different providers to find the best Medicare Plan N policy suited to your individual needs.

Analyzing the Cost of Medicare Plan N in 2024

The cost of Medicare Plan N in 2024 is expected to vary between $80 to $200 per month or more, depending on factors such as age, gender, location, and provider. This range is influenced by the national average monthly bid for this plan.

It is crucial to consider these factors when choosing a Medicare Plan N policy to ensure you get the most value for your money.

Age, gender, location, and provider all play a role in determining the cost of Medicare.

Factors Affecting Premiums

Several factors can influence Medicare Plan N premiums, with age being one of the most significant determinants. Generally, rates tend to increase with age, as older individuals are more likely to require medical attention. Gender also plays a role in determining premiums, with women usually paying slightly higher rates than men.

Geographic location and the provider are two other critical factors that can impact Medicare Plan N premiums.

Rates may vary significantly depending on the region, and it is advisable to compare rates among different providers to secure the most advantageous rate.

Inflation and Medicare Plan N Cost

Inflation may impact Medicare Plan N costs; however, the exact effect on premiums for 2024 is yet to be determined.

Inflation can lead to an increase in the overall cost of healthcare services, such as doctor’s fees, hospital services, and health insurance premiums, which may result in higher out-of-pocket expenses for Medicare Plan N beneficiaries.

Additionally, the Inflation Reduction will be achieved. Act can affect prescription drug costs, further contributing to the overall cost of Medicare Plan N by potentially leading to lower prescription drug costs.

Comparing Medicare Plan N with Other Medigap Plans

To make an informed decision, it’s essential to compare Medicare Plan N with other popular Medigap plans, such as Plan G and Plan F. Understanding the differences in coverage and costs can help you select the best plan for your needs.

Comparing the plans can be a daunting task, but it’s important to understand the plans.

Medicare Plan N vs. Plan G

Medicare Plan G provides more comprehensive coverage at a higher premium compared to Plan N. The primary distinction between the two plans is that Plan G covers two areas that Plan N does not, including Medicare Part B excess charges and Part B copayments.

This makes Plan G a more expensive option, but it offers more extensive coverage for beneficiaries who require it.

In contrast, Medicare Plan N offers lower monthly premiums with the requirement of occasional co-pays for doctor visits. This might be a suitable choice for those who prefer a more cost-effective plan and are willing to pay occasional out-of-pocket expenses.

Medicare Plan N vs. Plan F

The main difference between Medicare Plan N and Plan F is that Plan F covers the Medicare Part B deductible, while Plan N does not.

However, it’s important to note that Plan F is no longer available to new enrollees since 2020. As such, Medicare Plan N remains a popular choice for beneficiaries seeking a cost-effective Medigap plan with comprehensive coverage.

Plan N offers coverage for Medicare Part A coinsurance, Part B coinsurance, Part A hospice care coinsurance, and services provided by part d plan sponsors, including the part d premium.

How to Find the Best Rates for Medicare Plan N in 2024

Finding the best rates for Medicare Plan N in 2024 requires thorough research and comparison of various providers.

The following tips can help you find the most affordable Medicare Plan N policy for your needs:

The following tips can help you find the most affordable Medicare Plan N policy for your needs:

- compare the premiums,

- deductibles,

- and copayments of different plans.

Shopping Around for Providers

Exploring different providers and comparing their rates is essential for locating the most cost-effective Medicare Plan N policy. Some providers may offer better coverage and lower premiums than others, so it’s important to shop around and compare quotes from different insurance carriers.

One effective method for comparing rates is to use websites like medisupps.com, which offers free online quotes from top carriers for Medicare Supplement Plans.

Additionally, the Medicare website or DFS Portal can provide a comprehensive list of Medicare supplement insurance carriers and their current monthly rates based on your zip code.

Compare 2024 Medicare Supplement Plans & Rates

Enter Zip Code

Online Rate Comparison Tools

Online rate comparison tools can simplify the process of comparing Medicare Plan N premiums, including the average basic premium, from various providers.

Websites like Medicare.gov and AARP Medicare Plans allow users to easily compare rates for Medicare Plan N by entering their zip code and other relevant information.

Utilizing these tools can help you find the best rates for your individual needs, ensuring that you get the most value for your money and enjoy reduced costs.

Enrollment Process for Medicare Plan N

Understanding the enrollment process for Medicare Plan N is crucial for ensuring you get the coverage you need. The process includes determining your eligibility, enrolling during the appropriate enrollment period, and selecting a provider.

Eligibility is based on age, disability, or end-stage renal disease. You are the one.

Eligibility Requirements

To be eligible for Medicare Plan N, you must be enrolled in Medicare Parts A and B.

To be eligible for Medicare Plan N, you must be enrolled in Medicare Parts A and B.

There are no pre-existing condition restrictions during the initial enrollment period, making it easier for Medicare beneficiaries to obtain coverage.

Additionally, there may be state residency requirements for Medicare Supplement plans, so it’s essential to check your state’s rules before enrolling.

Enrollment Periods

Enrollment periods for Medicare Plan N include the initial enrollment period, which begins three months before obtaining Medicare and ends three months after obtaining Medicare. The Medigap open enrollment period lasts for six months, beginning on the first day of the month when you’re eligible for Medicare.

Special enrollment periods may also be available based on specific circumstances, such as leaving a Medicare Advantage plan or losing employer-sponsored coverage, which may be related to the Medicare Advantage program.

Maximizing Savings on Medicare Plan N

By following the tips and strategies provided in this blog post, you can maximize savings on Medicare Plan N premiums and manage out-of-pocket expenses effectively.

For example, you can compare different plans to find the one that best fits your needs and budget.

Discounts and Incentives

There are various discounts and incentives available for Medicare Plan N, such as household discounts or non-smoker discounts, which can help reduce premiums.

Additionally, some insurance companies offer a 6% discount on the monthly premium when purchasing Medicare Plan N online.

Additionally, some insurance companies offer a 6% discount on the monthly premium when purchasing Medicare Plan N online.

Utilizing these discounts and incentives can help you save money on your Medicare Plan N policy, making it more affordable in the long run.

The rewards program offered by Medicare Plan N provides discounts on health and wellness programs. These rewards can further enhance the value of your Medicare Plan N policy by promoting a healthier lifestyle and potentially reducing healthcare costs.

Managing Out-of-Pocket Expenses

Managing out-of-pocket expenses effectively is crucial for minimizing costs associated with Medicare Plan N coverage and understanding the differences between Medicare and Medicaid services.

One strategy is to select providers that accept Medicare assignment, which means they agree to accept the Medicare-approved amount as payment in full for the services they provide.

This can help to minimize out-of-pocket expenses and ensure you get the most value from your Medicare Plan N policy.

Summary

In conclusion, Medicare Plan N is an attractive option for beneficiaries seeking comprehensive coverage at a more affordable cost compared to other Medigap plans.

By understanding the factors that affect premiums, such as age, gender, location, and provider, and comparing rates among different providers, you can find a Medicare Plan N policy that suits your needs and budget.

Furthermore, it’s essential to be aware of the enrollment process, eligibility requirements, and enrollment periods to ensure you get the coverage you need.

By maximizing savings through discounts and incentives, and effectively managing out-of-pocket expenses, you can make the most of your Medicare Plan N coverage in 2024.

Get Quotes Now

Enter Zip Code

Frequently Asked Questions

What will the Medicare donut hole be in 2023?

In 2023, you will enter the Medicare donut hole when your total drug costs reach $4,660. While in the gap, you are responsible for a percentage of the cost of your drugs.

This means that you will have to pay more out of pocket for your medications. However, there are ways to save money while in the donut hole. For example, you can use generic drugs.

Is Donut Hole going away in 2024?

The Donut Hole will be eliminated in 2024, one year before the $2,000 cap goes into effect. This cap on total spending will protect retirees who require costly medications.

What are the CMS star measures for 2024?

The CMS Star Measures for 2024 include Controlling Blood Pressure (CBP) with increased weight from 1x to 3x, Transitions of Care (TRC), Follow-up after Emergency Department Visit for Patients with Multiple Chronic Conditions (FMC), Annual Flu Vaccine, Breast Cancer Screening, Colorectal Cancer Screening, Diabetes Care – Blood Sugar Controlled, Diabetes Care – Eye Exam, Improving Bladder Control, Medication Reconciliation Post-Discharge and MTM Program Completion Rate.

These measures are designed to improve the quality of care for Medicare beneficiaries. CBP, TRC, FMC, and Annual Flu Vaccine are all focused on preventive care, while Breast Cancer Screening, Colorectal Cancer Screening, Diabetes Care – Blood Sugar Controlled, Diabetes Care – Eye Exam, Improving Bladder Control, Medication Reconciliation Post-Discharge and MTM Program completion rates are all focused on chronic care management.

By increasing the weight of these measures, CMS is incentivizing providers to focus on preventive and chronic care management, which will ultimately lead to improved care.

How much will Medicare cost retirees in 2023?

In 2023, most Medicare Part B enrollees will pay the standard monthly premium of $164.90, down from $170.10 in 2022, while the annual deductible for all beneficiaries is $226.

What is the primary difference between Medicare Plan N and Plan G?

The main difference between Medicare Plan N and Plan G is that Plan G covers Part B excess charges and copayments, while Plan N does not.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about Medicare Plan N cost, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.