by Russell Noga | Updated January 14th, 2024

Are you a Medicare beneficiary residing in Illinois and considering a Medicare Supplement plan to bridge the gaps in your Original Medicare coverage?

Are you a Medicare beneficiary residing in Illinois and considering a Medicare Supplement plan to bridge the gaps in your Original Medicare coverage?

Look no further!

In this guide, we will walk you through the ins and outs of Medicare Plan G Illinois, one of the most popular Medicare plans available in the state.

Get ready to explore the coverage details, compare Plan G with other Medigap plans, understand costs and pricing, and learn how to choose the best provider and plan for your unique needs.

Short Summary

- Medicare Plan G in Illinois is a popular Medigap plan providing extensive coverage for most gaps in Original Medicare.

- Factors such as age, location and provider can affect the premiums of this plan. Comparing providers is essential to find the best option.

- A personalized needs assessment should be conducted to ensure an informed decision about healthcare coverage with access to resources like SHIP available for Illinois residents.

Understanding Medicare Plan G in Illinois

Medicare supplement Plan G in Illinois is a Medigap plan that provides coverage for the majority of gaps in Original Medicare, with the exception of the Part B deductible.

It is one of the popular Medicare supplement insurance plans available in the state, offering extensive coverage and peace of mind for beneficiaries.

So, why is Plan G so popular among Illinois Medicare beneficiaries? Let’s dive deeper into the coverage details and compare it to other Medigap plans.

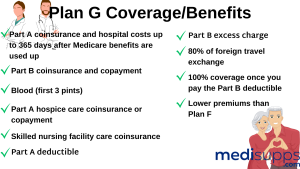

Coverage Details

Plan G in Illinois covers most gaps in Original Medicare, including:

- Medicare Part A coinsurance and hospital costs

- Part B coinsurance or copayments

- Blood (first three pints)

- Part A hospice care coinsurance or copayments

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charges

However, Plan G, a high deductible plan, does not cover the Part B deductible, which is an important consideration when choosing a plan.

In addition to these standard benefits, insurers offer supplementary benefits with their Plan G coverage, such as foreign travel emergency coverage.

Knowing these coverage details will help you make an informed decision when selecting a Medicare Supplement plan.

Comparing Plan G to Other Medigap Plans

Though Plan G is a popular choice among Illinois Medicare beneficiaries, it’s essential to compare it with other Medigap plans to ensure it’s the best fit for your healthcare needs.

Two other popular Medigap plans are Plan F and Plan N. Plan F is the most comprehensive plan, covering everything that Plan G covers, including the Part B deductible.

Medicare Plan F is not available for people who became Original Medicare beneficiaries after January 1st, 2020. This is a change from the previous policy.

Plan N is another option that may suit your needs, but it does not provide coverage for excess charges. Comparing these Medicare supplement plans is crucial when selecting the best Medicare Supplement plan or Medicare Advantage Plan for you.

Keep in mind that all Medigap plans, including Plan G, are standardized, meaning they offer the same benefits regardless of the insurance company.

The main differences between providers will be in the pricing and additional benefits they may offer.

View Plan G Rates

Enter Zip Code

Costs and Pricing for Medicare Plan G in Illinois

Now that we’ve explored the coverage details of Plan G, it’s time to discuss the costs and pricing for this plan in Illinois.

The average cost of Medicare Plan G in Illinois is $176.10 per month, but premiums can vary depending on several factors.

It’s essential to understand these factors to ensure you’re getting the best value for your healthcare coverage.

Factors Affecting Premiums

The cost of Medicare Plan G premiums in Illinois may be affected by age, location, and provider. Medigap plans in Illinois are generally priced utilizing three pricing styles: Attained-Age, Issue-Age, and Community-Rated.

Attained-Age pricing is based on your current age, while Issue-Age pricing is based on the age you were when you first purchased the policy. Community-rated pricing applies the same monthly premium to all individuals, regardless of age.

Understanding these factors and how they influence premiums is crucial when comparing different Plan G options.

For example, a younger individual may find lower premiums with Issue-Age pricing, while someone older may benefit from Community-Rated pricing.

Keep these factors in mind when selecting the best Medicare Plan G in Illinois for your needs.

Popular Providers of Medicare Plan G in Illinois

With an understanding of coverage details and costs, it’s time to compare the top providers of Medicare Plan G in Illinois.

Some well-known insurance companies offering Plan G in the state include:

- Mutual of Omaha

- Humana

- Aetna

- Allstate

- Cigna

- Philadelphia American

And many more.

Each provider may have different pricing, coverage, and customer service, so it’s important to compare them side-by-side to find the best option for your needs.

Provider Comparison

UnitedHealthcare offers the most economical Plan G coverage in Illinois. However, it’s essential to consider additional benefits and customer service when comparing providers, such as Blue Shield of Illinois.

For instance, Cigna offers a health rewards program and a health information line as supplementary features of their Medigap Plan G.

When choosing a provider, it’s important to not only look at the cost but also consider the company’s reputation, customer service, and any additional benefits they may offer.

Comparing these factors will help you find the best Medicare Plan G in Illinois that meets your healthcare needs and budget.

Enrollment Process for Medicare Plan G in Illinois

Once you have chosen the best Medicare Plan G in Illinois for your needs, the next step is to enroll. The enrollment process can be done through the insurance provider or via the Medicare website.

It’s essential to understand the best time to sign up for a Medigap plan and the importance of the Open Enrollment Period.

Open Enrollment Period

The Medigap Open Enrollment Period is a crucial time when beneficiaries can enroll in a Medigap plan without facing medical underwriting or higher premiums due to pre-existing conditions.

This six-month window begins on the first day of the month when you turn 65 and are enrolled in both Parts A and B of Medicare.

During the Open Enrollment Period, insurance companies cannot use medical underwriting to determine whether to accept your application or alter the price.

Taking advantage of this period ensures that you can obtain the best possible coverage and pricing for your Medicare Plan G in Illinois, including the lifetime maximum benefit.

Additionally, you may consider exploring Medicare Advantage options to find the most suitable plan for your needs.

Don’t miss out on this essential opportunity to secure your healthcare coverage!

Choosing the Right Medicare Plan G in Illinois

Now that you have a comprehensive understanding of Medicare Plan G in Illinois, it’s time to choose the best plan for your unique needs and preferences.

Keep in mind that your healthcare needs, budget, and lifestyle should all be considered when selecting a plan.

Remember, all Medigap plans are standardized, so the main differences between providers will be in pricing and additional benefits.

Personalized Needs Assessment

When assessing your personal healthcare needs, consider factors such as the type of coverage you require, the expense of the plan, and the reputation of the insurance provider.

Comparing various Medicare Plan G options in Illinois will help you find the most suitable option for you.

In addition to these factors, consider any additional benefits offered by the insurance provider, such as a health rewards program or foreign travel emergency coverage.

By taking the time to evaluate your personal healthcare needs, budget, and lifestyle, you can confidently choose the best Medicare Plan G in Illinois to support your well-being and peace of mind, while also maximizing your Medicare benefits.

Additional Resources for Illinois Medicare Beneficiaries

Navigating the federal Medicare program in Illinois can be complex, but there are helpful organizations and programs available to support seniors and their caregivers.

These resources can provide guidance and assistance, making it easier for you to make informed decisions about your healthcare coverage.

From the Illinois Department of Aging to the Senior Health Insurance Program, there are a variety of resources.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Medicare Plan G in Illinois offers extensive coverage and peace of mind for Medicare beneficiaries.

By understanding the coverage details, comparing Plan G with other Medigap plans, and evaluating costs and pricing, you can confidently choose the best provider and plan for your unique needs.

Don’t forget to take advantage of the Open Enrollment Period and utilize the valuable resources available to Illinois Medicare beneficiaries. With the right Plan G coverage in place, you can focus on enjoying your retirement years with the knowledge that your healthcare needs are well taken care of.

See Plan G Rates in your area

Enter Zip Code

Frequently Asked Questions

What is Medicare Plan G in Illinois, and how does it work?

Medicare Plan G in Illinois is a supplemental insurance plan that helps cover healthcare costs not covered by Original Medicare. It pays for many out-of-pocket expenses like deductibles, copayments, and coinsurance after Medicare pays its share.

How does Medicare Plan G differ from other Medicare supplement plans in Illinois?

Medicare Plan G offers comprehensive coverage and pays 100% of the gaps in Original Medicare, except for the Medicare Part B deductible. It’s often chosen for its robust coverage and minimal out-of-pocket costs.

Can I enroll in Medicare Plan G in Illinois if I have pre-existing conditions?

Yes, you can typically enroll in Medicare Plan G in Illinois regardless of pre-existing conditions during your initial open enrollment period. However, you may face medical underwriting and potential higher premiums if you enroll outside this period.

What are the benefits of Medicare Plan G for Illinois residents?

The benefits of Medicare Plan G include coverage for hospital stays, skilled nursing care, doctor visits, and more. It also covers the Medicare Part B excess charges.

How do I find the best Medicare Plan G provider in Illinois?

To find the best Medicare Plan G provider in Illinois, compare rates, coverage, and customer reviews from various insurance companies. You can also consult a licensed insurance agent for guidance.

What is the cost of Medicare Plan G in Illinois?

The cost of Medicare Plan G in Illinois varies depending on factors like your age, location, and the insurance company you choose. On average, monthly premiums can range from $100 to $200 or more.

Does Medicare Plan G in Illinois cover prescription drugs (Part D)?

No, Medicare Plan G does not cover prescription drugs. You’ll need to enroll in a separate Medicare Part D plan for prescription drug coverage.

When can I enroll in Medicare Plan G in Illinois?

You can enroll in Medicare Plan G in Illinois during your initial enrollment period when you first become eligible for Medicare. After that, you can apply to switch to Plan G from a different Medigap plan at any time during the year, however, you will likely need to go through medical underwriting to get approved.

Are there any network restrictions with Medicare Plan G in Illinois?

No, Medicare Plan G does not have network restrictions. You can see any doctor or specialist that accepts Medicare patients, anywhere in the United States.

Can I change from another Medicare supplement plan to Medicare Plan G in Illinois?

Yes, you can switch from another Medicare supplement plan to Medicare Plan G in Illinois, but you may need to go through medical underwriting. It’s essential to compare plans and costs before making the switch. Call us today to see if you qualify!

Find the Right Medicare Plan for You

Finding the perfect Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have questions about Medicare Advantage or Medicare Part D, we can help.

Reach out today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.