by Russell Noga | Updated January 3rd, 2024

Medicare Part B Late Enrollment Penalty

Navigating the world of Medicare can be challenging, especially when it comes to enrolling on time and avoiding the Medicare Part B late enrollment penalty.

Navigating the world of Medicare can be challenging, especially when it comes to enrolling on time and avoiding the Medicare Part B late enrollment penalty.

Timely enrollment is crucial to ensure access to healthcare services and minimize financial burdens.

This comprehensive guide will help you understand the consequences of late enrollment, the intricacies of Medicare Parts B, C, and D, and the various financial assistance programs available to Medicare beneficiaries.

With this knowledge, you can make informed decisions and avoid the Medicare Part B late enrollment penalty while securing the healthcare coverage you need.

Key Takeaways

- Late enrollment in Medicare Part B can result in penalties such as increased premiums and reduced access to healthcare services.

- Enrolling during the Initial or Special Enrollment Period is the best way to avoid late enrollment penalty fees.

- Financial assistance programs, expert guidance, and staying informed are available resources for navigating Medicare penalties and enrolling on time.

The Consequences of Late Enrollment in Medicare Part B

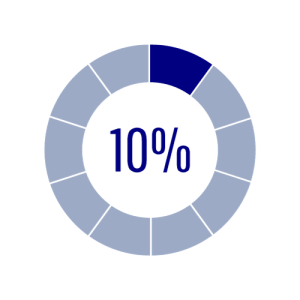

Late enrollment in Medicare Part B can have significant consequences, including Medicare late enrollment penalties, such as a 10% penalty for each year missed, resulting in increased monthly premiums and potential impact on access to healthcare services.

If you have health insurance coverage through your or your spouse’s employer, you may be able to postpone enrollment in Medicare Part B without penalties.

If you have health insurance coverage through your or your spouse’s employer, you may be able to postpone enrollment in Medicare Part B without penalties.

However, signing up for Medicare during a special enrollment period within eight months of losing job-based coverage is a way to avoid penalties.

The Duration of the Part B Penalty

The Part B monthly penalty, one of the premium penalties, is a permanent imposition that will remain in effect throughout the beneficiary’s enrollment in Medicare Part B.

The penalty is calculated based on the national base beneficiary premium and amounts to an additional 10% for each 12-month period of delayed enrollment, in addition to the standard premium.

Certain circumstances, such as having job-based insurance or creditable prescription drug coverage, can waive or reduce the Part B penalty.

View Quotes for 2024 Now

Enter Zip Code

How to Circumvent the Medicare Part B Late Enrollment Penalty

Enrolling during the Initial Enrollment Period, which lasts for seven months and begins three months before your 65th birthday, is a strategy to avoid the Medicare Part B late enrollment penalty.

Alternatively, you may qualify for a Special Enrollment Period if you meet specific conditions, such as having job-based insurance or an extraordinary situation that warrants a special enrollment period.

Retirement can also impact the Initial Enrollment Period for Medicare Part B. Even if you retire before turning 65, your Initial Enrollment Period will still begin three months before your 65th birthday month.

Failing to enroll during the appropriate enrollment periods can result in a 10% penalty for each 12-month period of delay, potentially doubling the number of years delayed if the penalty is applied.

Comparing Coverage and Costs

Medicare is composed of several parts, each offering different coverage. Here are the different parts of Medicare:

- Medicare Part A: Covers inpatient hospital stays.

- Medicare Part B: Encompasses doctor and outpatient services.

- Medicare Part C (Medicare Advantage): Combines the benefits of Parts A and B and may include additional coverage options.

- Medicare Part D: Provides prescription drug coverage, assisting beneficiaries with prescription drug costs.

The standard monthly premium for Medicare Part B in 2024 is $174.70.

Analyzing different Medicare plans and costs can aid you in making decisions that could help you avoid penalties. Understanding the coverage provided by each Medicare plan, including:

- Part A

- Part B

- Part C

- Part D

Our team will assist you in determining which plan best suits your needs and budget, taking into account twice the number of factors for a comprehensive evaluation.

Prescription Drug Coverage and Medicare Part D

Medicare Part D provides prescription drug coverage as a benefit, helping beneficiaries with the cost of prescription drugs.

Late enrollment in Medicare Part D can result in a permanent penalty based on the number of months without coverage.

The penalty fee is calculated as 1% of the average monthly prescription drug premium, which was $33.06 in 2021, multiplied by the number of months you were late in enrolling in Part D.

Signing up for Part D when first enrolling in Medicare, ensuring that you never have more than 63 days without prescription drug coverage through Medicare or another credible insurer, or opting not to enroll in a Part D or Medicare Advantage plan, can help you avoid the Part D late enrollment penalty.

You may be exempt from the penalty if you had health insurance through either your job or your spouse’s job when you were initially eligible for Medicare Part B. Such health insurance must have been issued before you enroll in the Part B plan.

Navigating Medicare Advantage (Part C) and Late Enrollment

Medicare Advantage (Part C), also known as Medicare Advantage HMO, is an alternative to Original Medicare that combines the benefits of Parts A and B and may include additional coverage options.

Medicare Advantage (Part C), also known as Medicare Advantage HMO, is an alternative to Original Medicare that combines the benefits of Parts A and B and may include additional coverage options.

While there is no late enrollment penalty for Medicare Advantage if you are already enrolled in Original Medicare, enrolling during the Initial or Annual Enrollment Period can help you avoid potential complications.

The Initial Enrollment Period for Medicare Advantage is based on the month you turn 65, starting three months before your birth month and ending three months after.

If you fail to enroll in Medicare Advantage during the Initial or Annual Enrollment Period, you may have to wait until the next enrollment period to sign up and may be subject to a late enrollment penalty for Medicare Part B, which increases your monthly premium for each 12-month period you were eligible but didn’t enroll.

Medigap (Medicare Supplement) and Timely Enrollment

Medigap, or Medicare Supplement, plans can help cover costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Medigap, or Medicare Supplement, plans can help cover costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

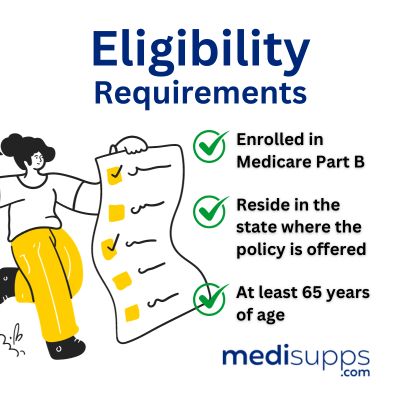

Enrolling in a Medicare Supplement plan during the first six months of Medicare Part B eligibility ensures guaranteed issue and avoids potential penalties.

The Medigap Open Enrollment Period is the initial six-month period after your Medicare Part B coverage begins, during which you are guaranteed acceptance for Medicare Supplement plans.

Applying for a Medicare Supplement plan outside of the Medigap Open Enrollment Period can result in no guaranteed issue, having to go through medical underwriting, and possibly being unable to obtain the plan you desire.

Medical underwriting involves the collection of detailed information about your health and medical history, which is used to assess the risk and establish premium rates for the plan.

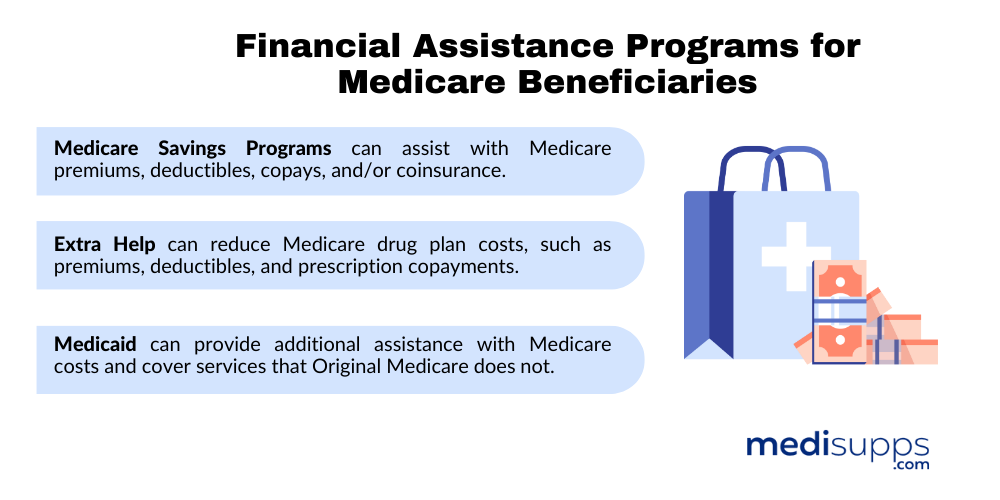

Financial Assistance Programs for Medicare Beneficiaries

Financial assistance programs that can help eligible beneficiaries with healthcare costs and avoid penalties include:

- Medicare Savings Programs: These programs can assist with Medicare premiums, deductibles, copays, and/or coinsurance.

- Extra Help: This program can reduce Medicare drug plan costs, such as premiums, deductibles, and prescription copayments.

- Medicaid: Medicaid can provide additional assistance with Medicare costs and cover services that Original Medicare does not.

Eligibility requirements for these programs vary by state but generally require individuals to have Medicare Part A and meet income and asset criteria. Income thresholds usually range from 100% to 135% of the Federal Poverty Level (FPL), depending on the specific program, and asset restrictions may also apply.

Researching these programs and determining if you qualify for financial assistance can help alleviate healthcare costs and dodge penalties.

Staying Informed and Connected with Medicare

Keeping up-to-date with Medicare updates and changes is key in maximizing your healthcare coverage and sidestepping penalties. One way to stay informed is by:

- Attending meetings

- Signing up for e-newsletters

- Regularly checking official resources like Medicare.gov, CMS (Centers for Medicare & Medicaid Services), and the Social Security Administration website.

Subscribing to Medicare e-newsletters can provide valuable information on:

- Program and policy details

- News and announcements

- Press releases

- Claims updates

These resources help you stay up-to-date on Medicare policy and advocacy developments, changes in Medicare, and information on compliance and reimbursement, including details on the medicare contract.

Remaining updated and connected with Medicare leads to a more seamless healthcare experience and reduces the risk of late enrollment penalties.

Getting Help with Medicare Penalties and Enrollment

Negotiating Medicare penalties and enrollment processes can be complex, but enlisting the help of Medicare experts or sales teams can ease the transition into Medicare coverage.

Organizations that can provide assistance with Medicare penalties and enrollment processes include:

- State Health Insurance Assistance Programs

- Centers for Medicare & Medicaid Services

- Social Security Administration

- Medicare Rights Center

Medicare sales teams, such as HealthPartners, can also help address common queries and apprehensions regarding Medicare plans, coverage, costs, and enrollment.

Connecting with these organizations and professionals can provide you with valuable guidance, aiding in decision-making, penalty avoidance, and securing the healthcare coverage you need.

Summary

In conclusion, timely enrollment in Medicare is crucial to avoid late enrollment penalties and ensure access to healthcare services.

By understanding the intricacies of Medicare Parts B, C, and D, and the various financial assistance programs available, you can make informed decisions and avoid penalties while securing the healthcare coverage you need.

Staying informed about Medicare updates and changes, seeking assistance from experts, and utilizing available resources can help you navigate the world of Medicare and enjoy a smooth healthcare experience.

Get Quotes in 2 Steps!

Enter Zip Code

Frequently Asked Questions

What is the Medicare Part B late enrollment penalty?

The Medicare Part B late enrollment penalty is an extra 10% added to your monthly premium multiplied by the number of years you were eligible for Part B but not enrolled.

This penalty may also be applied based on your income and it is lifelong, unless you qualify for a Special Enrollment Period.

What happens after initial enrollment period for Medicare Part B has expired?

If you miss your Initial Enrollment Period for Medicare Part B, you’ll have to wait until the next General Enrollment Period and may have to pay a late enrollment penalty. Coverage begins the month after enrollment during the Special Enrollment Period.

Can I delay Medicare Part B if I am still working?

You can delay enrolling in Medicare Part B if you are still working and have health insurance coverage through your employer or your spouse’s employer.

You won’t be subject to the lifetime late enrollment penalty when you do enroll, so long as you sign up for Part A and Part B when you (or your spouse) stop working (or lose your health insurance).

How long does it take to get medicare part b after applying?

Medicare Parts A and B usually take four to eight weeks to be approved after applying. If you apply during your birthday month or the three months after, your Medicare Part B coverage could begin one to three months afterwards.

How long does the Medicare Part B late enrollment penalty last?

The Medicare Part B late enrollment penalty is permanent, lasting for the entire duration of enrollment in Medicare Part B.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about Medicare Part B late enrollment penalty, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.