by Russell Noga | Updated November 29th, 2023

Is Medicare Plan N Still Available in 2024?

Are you considering enrolling in Medicare Plan N but unsure if it’s the right choice for you? Fear not, as we dive into the world of Medigap plans and explore whether “is Medicare Plan N still available” in 2024.

Are you considering enrolling in Medicare Plan N but unsure if it’s the right choice for you? Fear not, as we dive into the world of Medigap plans and explore whether “is Medicare Plan N still available” in 2024.

We’ll take a closer look at the key features, compare it with other Medigap plans, and provide tips on choosing the right Medicare Supplement Plan for you. So let’s embark on this journey together and make informed decisions for a healthier future.

Short Summary

- Medicare Plan N is still available in 2024 with comprehensive coverage and lower premiums.

- It covers seven of the nine Medigap benefits, including 100% Part B coinsurance and copayments, capped doctor’s office visits & emergency room visits, as well as 80% foreign travel emergencies.

- Enrollment requires aligning with Medicare Part B within a 6 month window for pre-existing conditions before underwriting approval.

Is Medicare Plan N Still Available?

Good news for those considering Medicare Supplement Plan N – it is still available in 2024, and there are no modifications to the plans being introduced or discontinued for 2024.

This comprehensive coverage plan helps supplement Original Medicare, providing most of the same Medicare benefits, including hospital care, physician visits, and preventive care.

Medicare Plan N does come with some copayments and coinsurance. There is a copayment of up to $20 for doctor visits and up to $50 for emergency room visits.

However, it also includes coinsurance of up to 20% for certain medical expenses, providing a good balance between coverage and out-of-pocket expenses.

Enrollment in Medicare Plan N is quite straightforward. You can enroll online, by phone, or in person through private health insurance companies. You will need to provide your Medicare number and other necessary details to complete the enrollment process.

View Rates for 2024

Enter Zip Code

Understanding Medicare Supplement Plans

Medigap plans, also known as medicare supplement insurance, are policies sold by private companies to cover the costs of health care that lie outside of Medicare’s scope. These policies are commonly referred to as Medicare Supplement Plans.

Medicare Supplement Plan N is designed to assist with the payment of out-of-pocket expenses not covered by Medicare Parts A and B. It covers seven of the nine available Medigap benefits, such as the cost of the first three pints of blood, skilled nursing facility coinsurance costs, and the Medicare Part A deductible for hospitalization.

One of the main advantages of Medicare Plan N is its combination of comprehensive coverage and moderate premiums.

However, it’s essential to note that copays are applicable for physician visits and ER visits that do not result in hospitalization. As long as the healthcare provider accepts Medicare assignment, Plan N covers the Medicare Part B coinsurance, except for a small copayment.

The cost of Medicare Plan N varies, with the average cost being approximately $152 per month. The pricing method used by your carrier can affect your premium over time.

Medigap Plan N offers lower premium increases compared to Medicare Supplement Plans F and G. This makes it a desirable option for those who wish to save money.

Key Features of Medicare Plan N

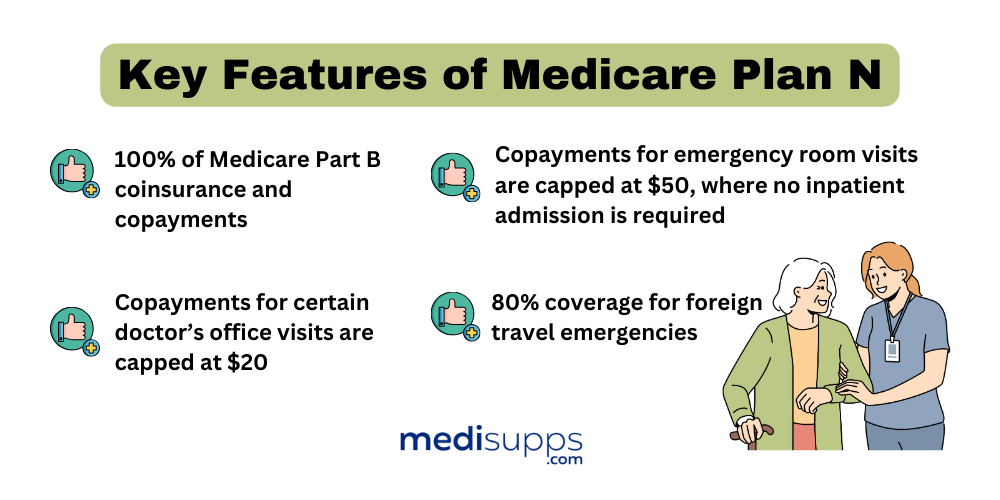

Medicare Plan. N offers coverage for most out-of-pocket expenses, with some exceptions. It covers:

- 100% of Medicare Part B coinsurance and copayments

- Copayments for certain doctor’s office visits are capped at $20

- Copayments for emergency room visits are capped at $50, where no inpatient admission is required

Additionally, Plan N provides 80% coverage for foreign travel emergencies.

Copayments and Coinsurance

In Medicare Plan N, copayments and coinsurance are out-of-pocket costs for which beneficiaries are accountable. Plan N covers 100% of the Medicare Part B coinsurance, with a copayment of up to $20 for some office visits and up to $50 for emergency room visits.

Despite these copayments, Plan N still covers the majority of out-of-pocket expenses, making it an attractive option for many beneficiaries.

Foreign Travel Emergency Coverage

For those who love to travel, Medicare Plan N offers 80% coverage for emergency medical care costs incurred while traveling abroad.

This valuable benefit provides peace of mind for globetrotters looking to explore the world while ensuring they have access to emergency healthcare services when needed.

No matter where you go, you can rest assured that you will have access to quality medical care.

Comparing Medicare Plan N with Other Medigap Plans

When selecting the right Medigap plan, it’s crucial to compare Medicare Plan N with other popular plans to make the best decision based on your healthcare needs and budget. For example:

- Plan N has a lower monthly premium than Plan G

- Plan N imposes copays for physician office visits or trips to the emergency room that do not result in hospitalization, whereas Plan G does not

- Opting for Plan N over Plan G can result in an average savings of $31 per month

Plan N and Medigap Plan D are quite similar. The most prominent difference is the Medicare Part B coinsurance coverage provided by each plan. Compared to Plan A, Plan N offers a more extensive range of benefits. However, it’s important to note that Plan N offers fewer benefits than Plan F.

Approximately 10% of all Medigap enrollees have chosen Plan N, ranking it as the third most popular among all plans. It is also the second most popular plan for new enrollees.

This popularity is likely due to its comprehensive coverage and lower premiums compared to other Medigap plans.

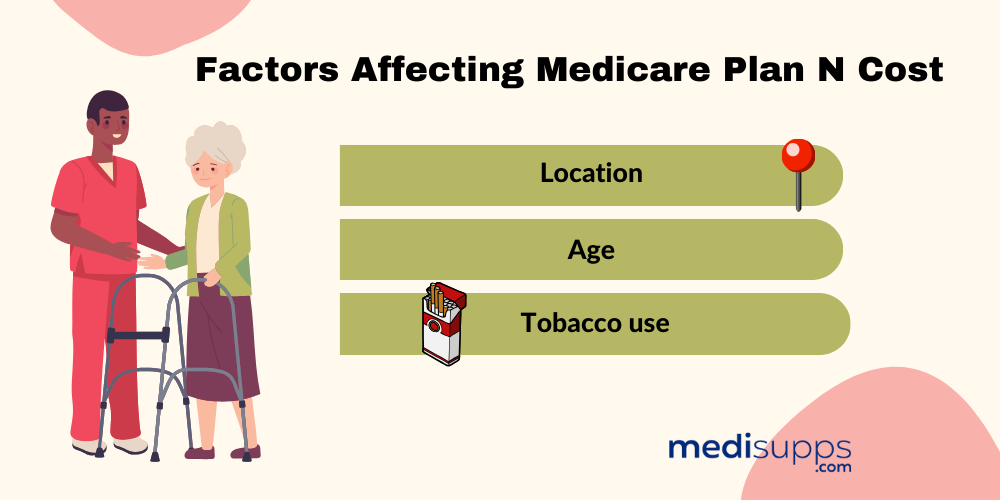

Cost of Medicare Plan N in 2024

The cost of Medicare Plan N in 2024 can vary depending on factors such as location, age, and tobacco use, with average monthly premiums ranging from $70 to $400. Factors that affect the cost include location, insurer, reductions, and medical assessment.

For example, a 65-year-old non-smoking female residing in the 32162 ZIP code of Florida may expect a cost between $124 and $182 for Medicare Plan N in 2024.

It’s essential to compare the cost of coverage for both males and females aged 65 and 75 years old who don’t use tobacco to get a better understanding of the cost variations. Comparing like with like can help ensure you find the best plan that suits your needs and budget.

Enrollment Process for Medicare Plan N

The enrollment process for Medicare Plan N involves aligning enrollment with Medicare Part B and considering the 6-month window for pre-existing conditions. You are eligible for Medicare Supplement Open Enrollment when initially signing up for Medicare Part B.

During this time, you can enroll in a plan without the need to answer any health-related underwriting questions. Your Medicare Part B benefits may be effective up to six months after your 65th birthday. This time frame is available for that period of time.

Beyond the 6-month window, it is possible to enroll in a Medicare Supplement plan at any time of the year by passing underwriting. If you submit your application after the 6-month window, you will be required to answer a series of health-related questions, provide a list of all medications you are taking, and likely complete a telephone interview.

The insurance company will then have the authority to decide whether to approve or deny your coverage.

To enroll in Medicare Plan N, it is recommended that you contact a licensed insurance agent to discuss the plans available in your area and determine which one best suits your requirements.

To enroll in Medicare Plan N, it is recommended that you contact a licensed insurance agent to discuss the plans available in your area and determine which one best suits your requirements.

The agent can help you navigate the enrollment process and ensure you get the most comprehensive coverage possible, including finding providers who accept Medicare assignment.

Top Insurance Carriers Offering Medicare Plan N

Prominent private insurance companies providing Medicare Plan N include:

Each carrier has its unique advantages and disadvantages. Enrollees can enjoy plenty of perks. For instance, they can get discounts on vision, dental, and hearing programs.

In addition, they have access to a 24/7 nurse line and free gym memberships if offered. However, coverage for Plan N is consistent, meaning enrollees will receive the same medical benefits regardless of provider.

It’s essential to research each carrier’s pros and cons to make an informed decision. Most grievances concerning UnitedHealthcare stem from their processing of claims, excessive junk mail, overly vigorous marketing, and inadequate customer service.

Aetna’s Medicare Supplement product has a below-average complaint performance index of 1.57 compared to the national average of 1.00. AARP/UHC Medigap customers must have an AARP membership. The fee for an annual membership is $16.

Medicare Plan N vs. Medicare Advantage

When comparing Medicare Plan N and Medicare Advantage plans, it’s crucial to understand their key differences. Medigap plans, like Plan N, supplement Original Medicare, whereas Medicare Advantage plans replace it. This distinction is vital in determining the best coverage based on your healthcare needs and financial goals.

It’s important to note that Medicare Advantage beneficiaries cannot enroll in Medigap Plan N. Furthermore, you cannot possess both a Medigap plan and a Medicare Advantage plan simultaneously. Therefore, it’s essential to weigh the pros and cons of each type of plan before making a decision.

By comparing Medicare Plan N with Medicare Advantage plans, you can make an informed decision on the best coverage for your healthcare needs and financial goals. Consider factors such as out-of-pocket expenses, network restrictions, and additional benefits when making your choice.

Tips for Choosing the Right Medicare Supplement Plan

To choose the right Medicare Supplement Plan, first, consider your future healthcare needs. Think about any potential medical conditions or treatments you may require and compare plans that provide the best coverage for those needs. Remember that switching plans later might be challenging, so try to anticipate your future needs as accurately as possible.

Next, compare similar plans to ensure you’re making an apples-to-apples comparison. Look at the coverage, premiums, and out-of-pocket expenses associated with each plan. This comparison will help you make an informed decision based on your healthcare needs and financial goals.

Lastly, speak with a licensed insurance agent to discuss the plans available in your area and determine which one best suits your requirements.

An agent can help you navigate the complexities of the Medicare system and ensure you get the most comprehensive coverage possible.

Summary

In conclusion, Medicare Supplement Plan N is a comprehensive coverage plan that remains available in 2024, offering an appealing balance between coverage and out-of-pocket expenses.

By comparing Plan N with other Medigap plans and Medicare Advantage options, you can make an informed decision on the best coverage for your healthcare needs and financial goals.

Choosing the right Medicare Supplement Plan is a crucial step in ensuring a healthy future. By considering your future healthcare needs, comparing similar plans, and consulting a licensed insurance agent, you can confidently select the plan that best suits your unique requirements and enjoy peace of mind knowing you are well-covered.

Get Quotes Now

Enter Zip Code

Frequently Asked Questions

What are the disadvantages of Plan N?

Plan N does not provide coverage for certain types of expenses such as Part B excess charges, emergency medical care abroad, and coinsurance for Part D drug plans.

This can lead to unexpected costs that the insured must cover themselves.

Is there a Part N in Medicare?

Yes, there is a Part N in Medicare which provides coverage to help pay for the out-of-pocket expenses not covered by Parts A and B. It has similar benefits to Medigap Plans C and F and lower premiums.

Will Medicare Plan N be available in 2024?

Yes, Medicare Supplement Plan N will remain available in 2024.

What are the copayments for office visits and ER visits in Medicare Plan N?

Medicare Plan. N has a copayment of up to $20 for doctor visits and up to $50 for emergency room visits.

What is the average cost of Medicare Plan N?

On average, Medicare Plan N costs approximately $152 per month. This may vary depending on factors such as location, age, and tobacco use.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know if Medicare Plan N is still available in 2024, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.