by Russell Noga | Updated November 6th, 2023

Healthcare costs in the United States are a big concern for seniors during their retirement and golden years.

Healthcare costs in the United States are a big concern for seniors during their retirement and golden years.

Incurring a huge medical or hospital bill could disrupt your financial planning, making it harder to live on your savings.

Medicare, Medicaid, and Medigap policies make it easier for seniors to deal with healthcare costs as they age. These policies take care of your out-of-pocket healthcare expenses, leaving you with a minimal contribution for healthcare services or nothing to pay.

Do I still need a supplement plan (Medigap) if I have Medicare and Medicaid? Or do my policies cover all healthcare expenses?

What's the Difference Between Medicare, Medicaid, and Medicare Supplement Plans?

Medicare, Medicaid, and Medigap policies cover different aspects of healthcare expenses and are very different in how they operate.

Let’s examine their differences to understand which policies you need to manage your healthcare requirements as you age.

Compare 2024 Plans & Rates

Enter Zip Code

Understanding Medicare

The US Federal government regulates and offers Medicare policies for seniors over 65. Medicare has four parts, each offering coverage for different healthcare costs.

- Part A — This part of Original Medicare covers policyholders for hospital stays, hospice care, stays at skilled nursing facilities, and some aspects of home healthcare services.

- Part B — This policy covers medically necessary services and some aspects of preventive care, such as doctor visits, durable medical equipment, and lab tests.

- Part C (Medicare Advantage) — This policy replaces Medicare Parts A & B. It’s available for private healthcare insurance companies and covers most of the Part A & B benefits and drug coverage. Some Medicare Advantage plans also offer discounts on gym memberships, OTC medications, and supplements.

- Part D — This policy offers coverage for prescription medications. You can add it to a Part A, B, or C policy to receive the benefits.

Medicaid

Medicaid is a joint program between states and the federal government. It offers health insurance policies to low-income seniors and families. Disabled individuals, pregnant women, and children qualify for Medicaid in specific circumstances.

Medicaid offers coverage for a range of healthcare services, including the following.

- Hospital stays.

- Doctor and emergency room visits.

- Long-term nursing care.

- Prescription drugs.

- Immunizations (vaccines).

- Health screenings.

The states are responsible for administering Medicaid policies, not the federal government. You must meet the state’s asset and income requirements to be eligible for Medicaid. Each state has a separate list of eligibility requirements for Medicaid policies and services.

How Do Medicare and Medicaid Combine?

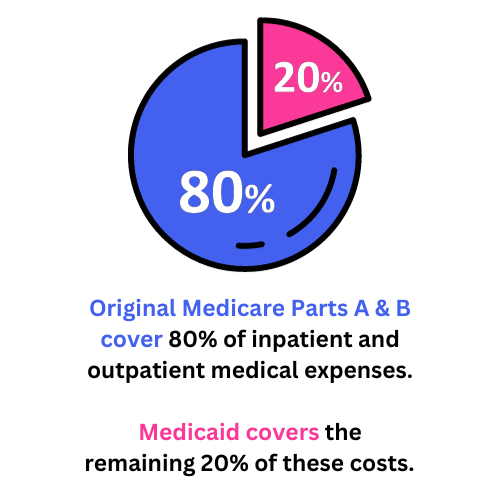

Original Medicare Parts A & B cover 80% of inpatient and outpatient medical expenses. Medicaid covers the remaining 20% of these costs. So, Medicaid covers the services unavailable through Original Medicare or the costs not fully covered by these policies.

Original Medicare Parts A & B cover 80% of inpatient and outpatient medical expenses. Medicaid covers the remaining 20% of these costs. So, Medicaid covers the services unavailable through Original Medicare or the costs not fully covered by these policies.

For instance, Medicare may cover doctor visits, hospital stays, and lab tests. Medicaid covers additional healthcare expenses, such as long-term care, hearing aids and eyewear, and prescription medications.

Both policies combine to optimize healthcare benefits and increase your coverage to a comprehensive level.

What Is the Coordination of Benefits?

If a beneficiary has Medicare and Medicaid, healthcare providers must coordinate the benefits to avoid duplicate coverage or overpaying for healthcare services.

If a beneficiary has Medicare and Medicaid, healthcare providers must coordinate the benefits to avoid duplicate coverage or overpaying for healthcare services.

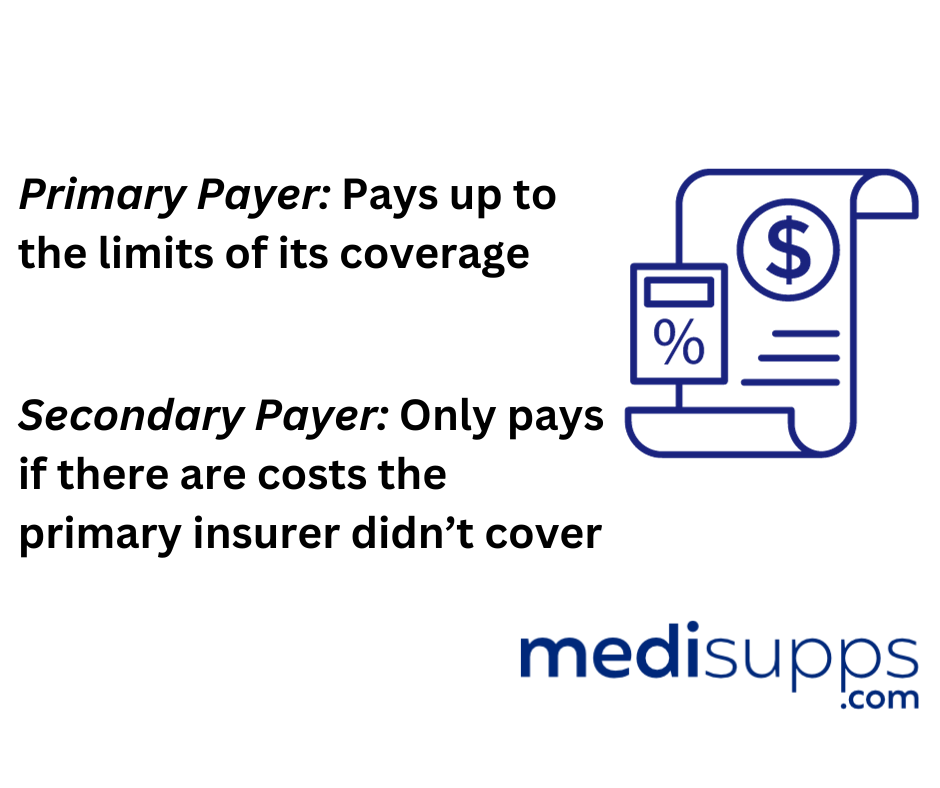

The coordination of benefits refers to which healthcare insurance policy pays for claims on medical services.

- “Primary” payer — The policy pays healthcare expenses first.

- “Secondary” payer — The policy pays healthcare expenses second.

Medicare is typically the primary healthcare payer, and Medicaid is the secondary payer.

As a result, Medicare pays for the medical expense first, and Medicaid pays for the remaining out-of-pocket costs not provided for by Original Medicare. For example, Medicaid will cover the copayments, coinsurance responsibilities, and deductibles.

When Do You Qualify for Medicare and Medicaid Together?

Individuals can benefit from Medicare and Medicaid if they’re dually eligible for both policies. However, the beneficiary must meet the eligibility criteria for both policies to qualify.

The beneficiary must meet the following criteria to be dually eligible for both Medicare and Medicaid.

- Be 65 years or older or have a disability.

- Have a low income.

Medicare Supplement Plans (Medigap)

Medicare supplement plans (Medigap plans) are supplemental insurance for Original Medicare beneficiaries with both Part A & B policies. Medigap, similar to Medicaid, covers the out-of-pocket expenses not covered by Original Medicare Parts A & B.

Medigap plans are available from private healthcare insurance companies for a monthly premium. Medigap plans come in ten options, each offering different supplemental benefits to Original Medicare Parts A & B.

The Federal government regulates the industry, ensuring all providers offer the same benefits in each plan.

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is the only policy offering coverage for the Part B deductible. However, you must be eligible for Medicare before January 1, 2020, to qualify for Plan F.

Do I Need a Supplement Plan If I Have Medicare & Medicaid?

You don’t need to enroll in a Medigap plan if you have Original Medicare and Medicaid. In fact, insurers can’t sell you a Medigap plan if you have both policies. The combination of Medicare and Medicaid is similar to the combination of Medicare and Medigap policies.

Can I Still Get a Medigap Plan if I Don't Qualify for Medicaid?

You qualify for a Medigap plan if you aren’t eligible for Medicaid. There are ten plans, each requiring you to pay a monthly premium for your coverage. Some plans are more comprehensive than others, like Plan G.

As a result, the more coverage you have, the more expensive your monthly premium.

Get Quotes Now

Enter Zip Code

Frequently Asked Questions

What is Medicare and Medicaid?

Medicare is a federal health insurance program that primarily covers people aged 65 and older, as well as certain younger individuals with disabilities. Medicaid, on the other hand, is a joint federal and state program that provides health coverage to low-income individuals and families.

Do I need a Medicare Supplement Plan if I have both Medicare and Medicaid?

If you have both Medicare and Medicaid, you may not necessarily need a Medicare Supplement Plan (Medigap) because Medicaid can provide additional coverage to fill the gaps in Original Medicare.

What does Medicaid cover that Medicare doesn’t?

Medicaid can cover various services that Medicare may not, such as long-term care, dental care, vision care, and some home and community-based services. Medicaid can also help with Medicare premiums, deductibles, and copayments, making it more cost-effective for those with limited financial resources.

What are the differences between Medicare Supplement Plan G and Plan N in this situation?

If you have both Medicare and Medicaid, the differences between Plan G and Plan N may still be relevant. Plan G offers more comprehensive coverage compared to Plan N. Plan G covers all Medicare Part A and Part B deductibles, as well as Part B excess charges, which are amounts that providers can charge above the Medicare-approved amount. Plan N, on the other hand, requires beneficiaries to pay certain copayments and the Part B deductible. However, for those with Medicaid, these out-of-pocket costs may be covered or reduced.

Should I consider a Medicare Supplement Plan if I have both Medicare and Medicaid?

If you have both Medicare and Medicaid, it’s essential to carefully evaluate your healthcare needs and the coverage provided by Medicaid. In many cases, Medicaid offers robust coverage that may eliminate the need for a Medicare Supplement Plan. However, if you find that certain services are not covered adequately, or if you want additional benefits that Medicaid doesn’t provide, you may consider enrolling in a Medigap plan.

Can I have both Medicaid and a Medicare Supplement Plan?

In most cases, you cannot have both Medicaid and a Medicare Supplement Plan simultaneously. Medigap plans are not allowed to coordinate benefits with Medicaid, meaning that if you have Medicaid, the Medigap plan cannot pay for any out-of-pocket costs that Medicaid covers.

Where can I get assistance in understanding my coverage options?

To better understand your coverage options and find out if you need a Medicare Supplement Plan, you can contact your local Medicaid office or speak with a licensed insurance agent specializing in Medicare. They can help you assess your current coverage, identify any potential gaps, and provide guidance on whether a Medigap plan is suitable for your situation.

Is Medicare Supplement Insurance the same as Medicare Advantage?

No, Medicare Supplement Insurance (Medigap) and Medicare Advantage (Part C) are two different types of coverage. Medigap plans work with Original Medicare (Part A and Part B) to help cover out-of-pocket costs, such as copayments, deductibles, and coinsurance. On the other hand, Medicare Advantage plans are private health insurance plans that replace Original Medicare and offer additional benefits, such as prescription drug coverage, vision, dental, and hearing services.

What is the “Guaranteed Issue” right for Medicare Supplement plans?

The “Guaranteed Issue” right is a special enrollment period during which insurance companies must sell you a Medicare Supplement Plan without considering pre-existing conditions. This right is granted in specific situations, such as when you lose other health coverage, your current plan is ending its service, or you’re leaving a Medicare Advantage plan. During the Guaranteed Issue period, insurance companies cannot deny you coverage or charge you higher premiums due to your health status.

Can I switch from one Medicare Supplement Plan to another?

Yes, you can switch Medicare Supplement Plans at any time, not just during the Open Enrollment Period.

However, if you have had your current plan for less than six months, you may be subject to underwriting, and insurance companies can consider your health status before accepting your application. If you’ve had your plan for more than six months, you can switch to a new plan with the same or lesser coverage without going through medical underwriting.

Call Us to Discuss Medicaid, Medicare, & Medigap

Contact our team at 1-888-891-0229 to discuss Medicare, Medicaid, and Medigap policies.

We offer free consultations and quotes and professional advice you can trust.

If you can’t speak to us right now, leave your details on our contact form, and we’ll get an expert to call you back.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.