by Russell Noga | Updated January 9th, 2023

If you’ve recently enrolled in Medicare, you might be thinking about investing in Medigap insurance to help cover the cost of the expenses that Medicare Part A and Part B don’t cover. There are several different Medigap plans, and Plan G is one of the most popular options, as it offers the most comprehensive coverage.

If you’ve recently enrolled in Medicare, you might be thinking about investing in Medigap insurance to help cover the cost of the expenses that Medicare Part A and Part B don’t cover. There are several different Medigap plans, and Plan G is one of the most popular options, as it offers the most comprehensive coverage.

Medigap policies, including Plan G, are only available via private insurance companies. Many private insurers offer Plan G, including Humana.

To find out if Humana Medigap Plan G is the right option for you, keep on reading. Below, you’ll find pertinent details, including information about Humana and Plan G, to help you determine if purchasing this Medicare Supplement Insurance plan from this company is worth your while.

Compare 2024 Plans & Rates

Enter Zip Code

About Medicare Supplement Insurance

Medicare is a federally sponsored health insurance plan for people aged 65 and older; individuals with disabilities may also be eligible for coverage. While Original Medicare – Plan A and Plan B – does cover a lot of the expenses that are associated with medical care, it doesn’t cover everything; copays, deductibles, and coinsurance, for example. Medicare beneficiaries are responsible for paying the expenses that Plan A and Plan B don’t cover themselves.

Medicare Supplement Insurance (also known as Medigap) is designed to help pay for gaps in Medicare coverage. There are a total of 10 Medigap plans, ranging from Plan A through Plan N.

Each letter plan provides different benefits, though each letter plan, no matter where it is purchased, must provide the same benefits, as required by the federal government; for example, Plan A must offer the same benefits, whether it’s purchased in Texas or Oklahoma. Insurance companies determine the cost of the Medigap plans they sell, and the prices can vary from company to company.

About Medigap Plan G

Of the 10 Medicare Supplement Insurance plans, Plan G is one of the most popular options, as it offers the most comprehensive coverage. Like all other supplemental insurance policies for Medicare, Plan G is standardized by the federal government.

Of the 10 Medicare Supplement Insurance plans, Plan G is one of the most popular options, as it offers the most comprehensive coverage. Like all other supplemental insurance policies for Medicare, Plan G is standardized by the federal government.

It covers most of the expenses that Original Medicare doesn’t cover, including coinsurance and copays for services that are approved for Part A and Part B, as well as the deductible for Part A. Plan G covers everything that Plan F covers, a comprehensive policy that was discontinued for new Medicare enrollees in 2020; the only exception being the Part B deductible.

The cost of the Part B deductible changes each year. In 2023, it’s $226, which is a $7 less than the previous year. Despite the fact that Plan G doesn’t cover the Part B deductible, it still provides Medicare beneficiaries with the lowest out-of-pocket expenses.

About Humana

Humana is one of the many private insurance companies that sell Medicare Supplement Insurance G Plans. The company, which is based in Louisville, Kentucky, was founded in 1961. The company started out as a nursing home chain (the largest one in the United States) and shifted to hospitals. In 1984, Humana shifted into the health insurance industry, which is still operates in today.

Humana offers Medigap plans to help Medicare beneficiaries offset the cost of services and products that Original Medicare doesn’t cover; copayments, coinsurance, and deductibles, for example. At the time of writing, more than 10 million Americans received Medicare benefits through Humana, and 3.1 percent of those individuals were enrolled in one of the company’s Medigap plans.

Compare Medicare Plans & Rates in Your Area

Humana Medigap Plan G Coverage

Humana sells a variety of Medicare Supplement Insurance plans, including Plans A, B, C, F, G, K, L, and N. Of the plans the company sells, Plan G is one of the most popular. Since Medigap policies are standardized by the federal government in 47 US states, Humana’s Plan G Medigap insurance provides the same coverage as any other insurance company, no matter what part of the country you reside in.

What Does Humana Medigap Plan G Cover?

Humana’s Medigap Plan G covers many of the gaps in Original Medicare – the expenses that Plan A and Plan B don’t cover. If you purchase this plan through Humana, you will receive the following benefits:

- Part A coinsurance and hospital benefits coverage

- Part A deductible

- Part B copayments and coinsurance

- Copayments and coinsurance for hospice care

- Coinsurance for care in skilled nursing facilities

- Part B excess expenses

- The first 3 pints of blood needed for medical procedures

- Medical emergencies within the first 60 days of traveling abroad

In short, Humana’s Plan G Medigap insurance provides the same coverage as Plan F, the only exception being coverage for the Part B deductible. As of 2020, new Medicare enrollees cannot purchase any Medigap policy that covers the Part B deductible; Plan F or otherwise.

What Does Humana Medigap Plan G Cost?

The rates that Humana charges for Medigap Plan G vary. Like all other insurance companies that sell supplemental insurance for Medicare, Humana takes several factors into consideration when determining premiums for Plan G, such as age, sex, geographic location, and the time of the year.

The best way to find out how much Plan G through Humana will cost you is by consulting with a licensed insurance agency that sells Humana. At Compare Medicare Supplement Plans, we’d be happy to assist you with finding the best rates possible for Humana Plan G.

How to Enroll in Humana Plan G

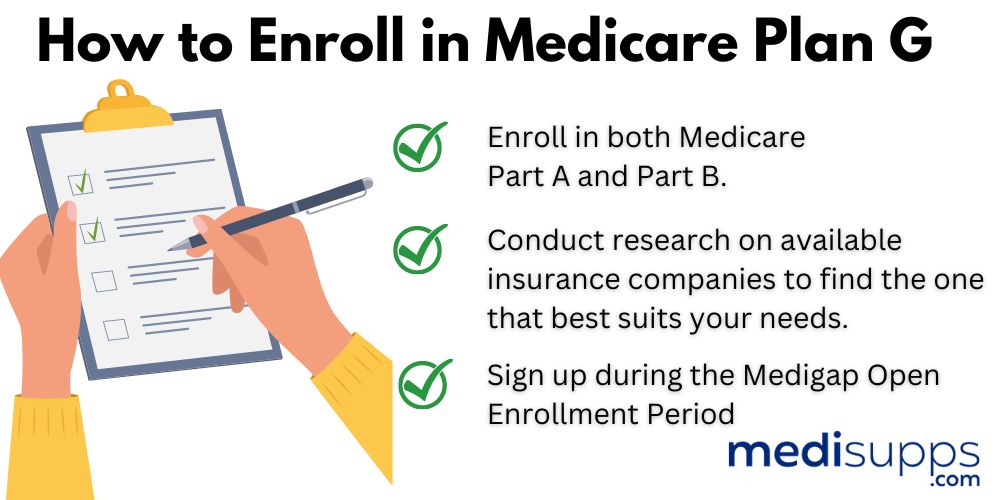

While you can apply for Medigap Plan G any time of the year, the ideal time to apply is during the Medicare Open Enrollment period. The Open Enrollment period commences the first day of the month you will be turning 65 and lasts for a total of 6 months.

During this time, you have guaranteed issue rights, meaning that Humana or any other health insurance company cannot refuse you based on your current health or health history.

It is important to note that in order to enroll in Medigap Plan G, you must first be enrolled in Original Medicare – Part A and Part B.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

Who is eligible for Humana Medigap Plan G?

To be eligible for Humana Medigap Plan G, individuals must be enrolled in both Medicare Part A and Part B. The best time to enroll is during the Medigap Open Enrollment Period, which starts when you are 65 or older and enrolled in Part B. During this period, you have guaranteed issue rights, ensuring you can access any Medigap plan without medical underwriting.

When can you enroll in Humana Medigap Plan G?

The Medigap Open Enrollment Period is the ideal time to enroll in Humana Medigap Plan G. After this period, you can still apply, but insurance companies may consider your health status, and you may have limited options.

What are the best Medicare Supplement plans offered by Humana?

Humana offers various Medicare Supplement plans, but the best ones depend on individual healthcare needs and budget. Plan G and Plan N are often considered the best due to their comprehensive coverage and affordability.

What does Humana Medigap Plan G cover?

Humana Medigap Plan G provides extensive coverage, including Part A coinsurance and hospital costs, Part B coinsurance or copayment, and the first three pints of blood. It also covers skilled nursing facility care coinsurance, Part A deductible, Part B excess charges, and 80% of foreign travel emergency costs.

What does Humana Medigap Plan N cover?

Humana Medigap Plan N offers similar coverage to Plan G but with some cost-sharing requirements. Beneficiaries must pay certain copayments for doctor’s office visits and emergency room visits. Plan N does not cover the Part B deductible or Part B excess charges.

What is the difference between Humana Medigap Plan G and Medicare Advantage?

Humana Medigap Plan G works alongside Original Medicare, while Medicare Advantage plans replace Original Medicare. With Medigap Plan G, you have the freedom to see any healthcare provider that accepts Medicare. On the other hand, Medicare Advantage plans typically require beneficiaries to use a network of providers and follow plan rules.

How does Humana Medigap Plan G help with out-of-pocket expenses?

Humana Medigap Plan G helps with out-of-pocket expenses by covering certain costs not paid by Original Medicare. Depending on the plan, beneficiaries can enjoy reduced or no copayments, coinsurance, and deductibles for Medicare-covered services.

Can you switch from a Medicare Advantage plan to Humana Medigap Plan G?

Yes, beneficiaries can switch from a Medicare Advantage plan to Humana Medigap Plan G during the Medicare Advantage Disenrollment Period, which runs from January 1st to February 14th each year. This allows individuals to return to Original Medicare and enroll in a Medigap plan.

Can you have both Humana Medigap Plan G and Medicaid?

Yes, individuals who are eligible for both Medicare and Medicaid, known as “dual-eligible” beneficiaries, can have both Humana Medigap Plan G and Medicaid coverage. Medicaid may help cover some Medicare costs, such as premiums and cost-sharing, depending on the state’s Medicaid program rules.

Is Humana Medigap Plan G the right choice for everyone?

While Humana Medigap Plan G offers comprehensive coverage, the right choice depends on individual healthcare needs and budget. Some beneficiaries may find other Medigap plans or Medicare Advantage plans more suitable. It’s essential to compare different options and consider personal preferences before making a decision.

Find the Best Humana Medigap Plan G Prices

To start exploring rates for Humana Medigap Plan G, simply submit the form on this page. If you prefer to speak to one of our licensed agents, call 1-888-891-0229.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.