by Russell Noga | Updated April 21st, 2024

Are you a newly eligible beneficiary of Original Medicare Parts A & B? If so, you qualify for a Medigap policy. Medigap plans pay for the out-of-pocket costs associated with Part A & B costs not fully covered by Original Medicare.

Are you a newly eligible beneficiary of Original Medicare Parts A & B? If so, you qualify for a Medigap policy. Medigap plans pay for the out-of-pocket costs associated with Part A & B costs not fully covered by Original Medicare.

Medigap policies are available from leading healthcare insurers in the United States. You can contact them directly to sign up for a plan. But that might not be the best strategy. Policy premiums can vary widely between insurers, and the benefits offered by each plan might leave you over or under-insured if you don’t know the scale of benefits they offer.

Using a licensed Medigap agent is a better move when signing up for Medicare. How can a Medicare supplement agent help me? What are the benefits of using these services? Will you have to pay extra for their advice? This post answers your questions.

Compare 2025 Plans & Rates

Enter Zip Code

A Medicare Supplement Insurance Agency Recommends the Right Plan

When you use a Medigap agent to select your plan, you get a complete understanding of how each plan works. They’ll explain what the deductibles and coinsurance responsibilities are for your plan. You’ll get advice on the copayments required in each plan and what you can expect to pay when visiting the doctor or emergency room.

Medigap plans vary in monthly premiums and in the coverage they provide. Some are more expensive than others. The Medigap agent helps you select the right Medigap policy to suit your healthcare needs and budget.

A Medicare Supplement Insurance Agency Helps You Understand Coverage

The ten Medigap plans offer differing levels of coverage and benefits for policyholders. Understanding the scope of benefits and how they apply to your unique situation is crucial to receiving the right coverage. You don’t want to end up over or under-insured.

If you’re over-insured, you’re wasting money on your premiums because you don’t need the coverage it provides. If you’re underinsured, you could face large medical bills you can’t afford to pay.

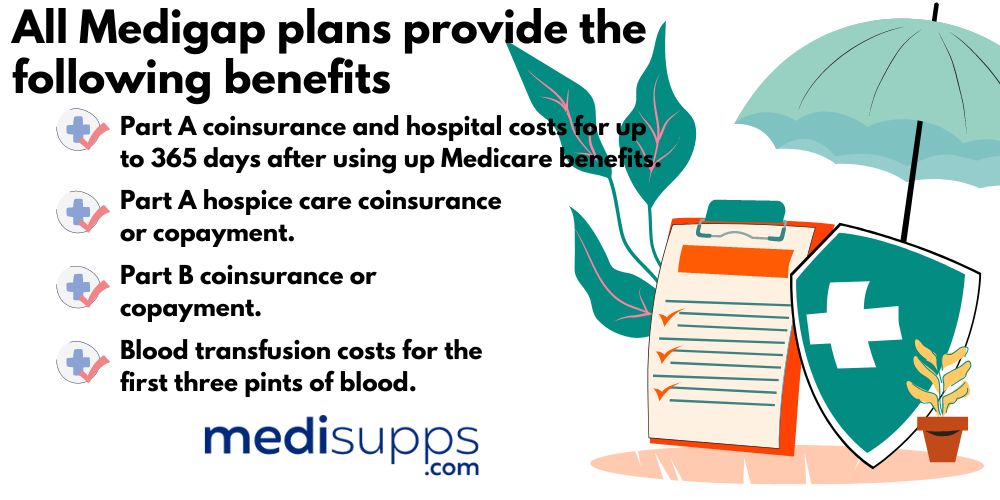

All Medigap plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plans F*, G, and N offer additional Medicare Parts A & B benefits.

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

*Plan F is only available to you if you were eligible for Original Medicare before January 1, 2020.

A Medicare Supplement Insurance Agency Gets You the Best Rates

A Medigap agent can save you money when signing up for a Medigap plan. Insurers charge different rates for their plans; some are more expensive than others. For instance, Aetna is one of the lowest-cost options for Medigap plans in many states. However, in some states, UnitedHealthcare might have a better deal on the Medigap policy you want to buy.

An insurer like UHC might be the lowest cost option for Plan G in your state, but you might get Plan N cheaper from Physicians Mutual. A Medigap agent works with all the leading insurers in your state. They’ll source you the best rates on any policy you want and present you with multiple quotes allowing you to choose the best option.

Using a Medigap agent for your quotes, you could save hundreds of dollars on your monthly premiums. The savings on premiums alone are a great reason for using a Medigap agent. However, the agent also provides information on the additional benefits and perks available from insurers in your state.

Using a Medigap agent for your quotes, you could save hundreds of dollars on your monthly premiums. The savings on premiums alone are a great reason for using a Medigap agent. However, the agent also provides information on the additional benefits and perks available from insurers in your state.

The agent can also recommend insurers offering perks and discounts for signing up for their Medigap scheme. For instance, if you sign up with Aetna, you get an affordable rate but next to no perks. If you sign up with Humana, Cigna, or UnitedHealthcare, you get a slightly higher rate but discounts on gym memberships, OTC supplements and medications, and vision, hearing, and dental services.

Compare Medicare Plans & Rates in Your Area

A Medicare Supplement Insurance Agency Guides You Through Enrollment

The Medigap agent advises you on the best way to sign up for Medigap to avoid medical underwriting. When you turn 65, you have six months to sign up for a Medigap plan with any provider. This “Open Enrollment” period gives you a guaranteed issue right to your plan.

The Medigap agent advises you on the best way to sign up for Medigap to avoid medical underwriting. When you turn 65, you have six months to sign up for a Medigap plan with any provider. This “Open Enrollment” period gives you a guaranteed issue right to your plan.

That means the provider can’t ask you to undergo medical underwriting when joining their scheme. They must accept your application, even if you have pre-existing health conditions. If you do have chronic conditions, they can’t charge you higher-than-average premiums or deny your application. The only thing they can do is institute a three to six-month waiting period before activating your benefits.

There are other special issues right available to Medigap applicants. Your Medigap agent can walk you through your rights and give you the information you need to join the Medigap plan without undergoing medical underwriting.

A Medicare Supplement Insurance Agency Works on Your Behalf

When you use a Medigap agent to advise you on your Medigap plan, they’ll work with the insurer on your behalf. You don’t have to spend hours on hold with the insurer or deal with them in any way. You deal with the agent, and they handle everything for you on your behalf.

You’ll have to sign documents and do some light paperwork, but it’s much easier than working with the insurer. The Medigap agent doesn’t charge you anything for this service. So, it makes sense to use a licensed agent when signing up for your policy. If you want to change plans or cancel, the Medigap agent can help you with the process.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is a Medicare Supplement Insurance Agency?

Get a Free Consultation from a Top-Rated Medicare Supplement Insurance Agency

Our fully licensed Medigap agents can advise you on choosing the right Medigap policy to suit your healthcare needs. We offer a free consultation to help you find the best plan. We’ll get you the lowest rates on your chosen policy and give you a free quote.

Contact us at 1-888-891-0229 or leave your details on our contact form, and we’ll connect with you to discuss your healthcare requirements.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.