by Russell Noga | Updated February 28th, 2024

Navigating the world of Medicare can be daunting, but understanding the options available is crucial to securing the best possible coverage.

Navigating the world of Medicare can be daunting, but understanding the options available is crucial to securing the best possible coverage.

Farm Bureau Health Plans offers Medicare Plan N, a popular Medigap plan that provides coverage for out-of-pocket expenses not covered by Original Medicare.

In this article, we will guide you through the ins and outs of Farm Bureau Medicare Plan N, helping you make informed decisions about your healthcare coverage.

Short Summary

- Understanding Medicare Plan N is essential for evaluating its key features and comparing it to other Medigap plans.

- Farm Bureau Medicare Plan N provides comprehensive coverage with premiums varying according to age, location and tobacco use.

- Beneficiaries should utilize Open Enrollment Periods, compare rates across providers, evaluate customer service & financial strength of a provider as well as access resources such as Medicare.gov & SHIPs for assistance in understanding their benefits.

Understanding Medicare Plan N

Medicare Plan N is a widely-used Medigap plan offered by Farm Bureau Health Plans, designed to reduce the out-of-pocket expenses associated with Original Medicare and make it more economical.

By enhancing the Medicare benefits available to beneficiaries, this plan provides additional coverage for expenses not covered by Original Medicare.

To get more information about Farm Bureau’s Medicare Supplement plans, you can complete a form, call 800-955-3728, or contact your local representative for a quote.

It is essential to understand the various aspects of Medicare Plan N, such as its key features and how it compares to other Medicare plans.

Key Features of Plan N

Medicare Plan N provides comprehensive coverage for various health care services, including copayments, coinsurance, and deductibles, with certain exceptions. This plan is similar to Medicare Supplement Plan G, but with some differences in coverage and cost.

Understanding these features will help you determine if Plan N is the right choice for your healthcare needs.

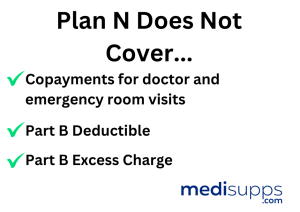

It is important to note that Plan N does not cover specific services, such as long-term care, vision, and hearing.

However, it does cover expenses related to health care providers, including doctors, hospitals, and skilled nursing facilities.

Knowing the coverage limitations of Plan N will allow you to make informed decisions about your healthcare coverage.

Comparing Plan N to Other Medigap Plans

When choosing a Medigap plan, it is essential to compare Plan N to other available options to ensure you select the best coverage for your needs. Some key distinctions between Plan N and other Medigap plans include:

- Coverage of Medicare Part B excess charges

- Premiums

- Out-of-pocket costs

- Coverage level

For example, Medigap Plan G covers Medicare Part B excess charges, while Plan N does not.

Plan N generally has lower monthly premiums compared to other plans like Plan F or Plan G, but it may have some out-of-pocket costs for medical care. However, these costs are usually minimal.

Evaluating these differences will help you make an informed decision when selecting the right Medigap plan for you.

Discover 2024 Plans & Rates

Enter Zip Code

Farm Bureau Health Plans and Medicare Plan N

Farm Bureau Health Plans is approved by the Centers of Medicare and Medicaid Services to offer Medicare Advantage HMO and Prescription Drug Plans (PDP).

It has a contract with Medicare to provide services. They also offer Medicare Supplement policies like Plan N.

In this section, we will discuss the specific coverage details and premium rates of Farm Bureau Health Plans’ Medicare Plan N.

Coverage Details

Coverage Details

Farm Bureau Medicare Plan N offers coverage for hospitalization, medical services, and skilled nursing facility care. This comprehensive coverage helps beneficiaries save on out-of-pocket expenses not covered by Original Medicare.

It is crucial to understand the coverage limitations of Plan N. This plan does not cover specific services like long-term care, vision, and hearing.

However, it does cover expenses related to health care providers, such as doctors, hospitals, and skilled nursing facilities.

Premium Rates

The premium rates for Plan N vary depending on factors such as age, location, and tobacco use. Understanding these factors and how they affect your premium rates will help you make an informed decision about your healthcare coverage.

It is essential to understand the premium payments and their frequency for the chosen plan.

By comparing the premium rates of Farm Bureau Medicare Plan N to other Medigap plans, you can determine if this plan is the most cost-effective option for your healthcare needs.

Enrollment Process for Farm Bureau Medicare Plan N

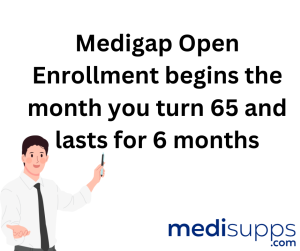

Enrolling in Farm Bureau Medicare Plan N involves understanding the Open Enrollment Period and Guaranteed Issue Rights.

In this section, we will discuss these important aspects of the enrollment process to help you make informed decisions about your healthcare coverage.

Open enrollment period is the time of year when you can enroll in a Medicare plan. During the summer during the summer.

Open Enrollment Period

Open Enrollment Period

The Open Enrollment Period is the most opportune time to enroll in a Medigap plan, as beneficiaries possess additional choices and reduced rates.

During this period, you have access to a greater variety of options at more competitive rates, making it the perfect time to enroll in a Medicare Supplement plan like Plan N.

It is crucial to take advantage of the Open Enrollment Period to secure the lowest rates and best coverage options for your healthcare needs. Missing this window may result in limited options and potentially higher premium rates.

Guaranteed Issue Rights

Guaranteed Issue Rights ensure that beneficiaries are not denied coverage or charged higher premiums on the basis of their health conditions.

These rights are applicable when enrolling in a Medicare Advantage plan or a Medicare Supplement plan during the initial enrollment period or during a special enrollment period.

Some exceptions to Guaranteed Issue Rights include pre-existing conditions, late enrollment penalties, and certain other conditions.

Being aware of these exceptions and understanding their implications can help you navigate the enrollment process and secure the best coverage possible.

Evaluating Farm Bureau Health Plans’ Customer Service and Financial Strength

When choosing a Medicare Plan N provider, it’s crucial to consider customer service and financial strength.

In this section, we will evaluate Farm Bureau Health Plans’ customer service and financial strength to help you make an informed decision about your healthcare coverage.

Customer service is an important factor to consider when selecting a Medicare Plan N provider. Farm Bureau Health.

Customer Satisfaction

Customer satisfaction ratings signify the caliber of service provided by Farm Bureau Health Plans. These ratings serve as an indicator of the quality of service provided by Farm Bureau Health Plans, thus aiding in the evaluation of a Medicare Plan N provider.

Farm Bureau Health Plans typically have a favorable customer satisfaction rating.

By considering these ratings when choosing a Medicare Plan N provider, you can ensure that you are selecting a company that values its customers and provides high-quality service.

Financial Ratings

Financial ratings are a measure of a company’s ability to fulfill its financial obligations and remit claims. Farm Bureau Health Plans boasts a strong financial rating, indicating that the company is capable of meeting its financial obligations and paying claims.

When selecting a Medicare Plan N provider, it is essential to consider the financial strength of the company.

A solid financial rating indicates that the company is dependable and able to handle its financial commitments, ensuring that your healthcare coverage is secure.

Comparing Farm Bureau Medicare Plan N to Competitors

In order to make an informed decision regarding coverage, it is beneficial to compare Farm Bureau Medicare Plan N to other Medigap plans.

In this section, we will discuss coverage and rate comparisons between Farm Bureau Medicare Plan N and its competitors.

Coverage Comparison

Coverage Comparison

Comparing coverage benefits offered by different Medigap plans is crucial in making an informed decision about your healthcare coverage. Farm Bureau Medicare Plan. N offers coverage that assists in the payment of numerous costs not covered by Medicare.

To adequately compare the coverage with that of its competitors, it is recommended to thoroughly investigate and compare the benefits, cost, and available plans of different Medicare Supplement insurance companies.

This will help you determine if Farm Bureau Medicare Plan N is the best fit for your healthcare needs and ensure you have the right Medicare Supplement coverage, including a suitable Medicare Supplement policy.

Rate Comparison

Comparing premium rates for Plan N across different insurance providers is an essential step in making an informed decision about your healthcare coverage. Unfortunately, the rate comparison between Farm Bureau Medicare Plan N and its competitors is not available in the search results.

However, it is still crucial to investigate and compare premium rates for Plan N across various insurance providers to ensure that you are selecting the most cost-effective option for your healthcare needs.

Additional Resources for Medicare Beneficiaries

There are additional resources available for Medicare beneficiaries, such as Medicare.gov and State Health Insurance Assistance Programs (SHIPs).

These resources can provide valuable information and assistance in understanding and navigating the world of Medicare coverage, including medicare supplements.

Medicare.gov is a great resource for finding out more about Medicare coverage options.

Medicare.gov

Medicare.gov

Medicare.gov provides comprehensive information regarding Medicare, including:

- Eligibility and enrollment

- Coverage

- Rights and protections

- Health plan options

- Prescription drugs

- Programs

On the website, you can find detailed information on these topics to help you navigate Medicare.

Additionally, Medicare.gov allows you to:

- Locate Medicare-approved providers in your vicinity

- Compare care quality for nursing homes, doctors, hospitals, and hospice centers

- Find health and drug plans

- Check medicare approved expenses

By accessing this resource, you can make well-informed decisions about your healthcare coverage and avoid false or misleading information.

State Health Insurance Assistance Programs (SHIPs)

State Health Insurance Assistance Programs (SHIPs) provide free and impartial counseling and aid to Medicare beneficiaries. They offer individualized assistance, information, and resources to help explore Medicare coverage options and comprehend benefits.

SHIPs also provide free local health coverage counseling and can aid in understanding Medicaid benefits.

By taking advantage of these resources, you can gain a better understanding of the Medicare landscape and make informed decisions about your healthcare coverage.

Compare Medicare Plans & Rates in Your Area

Summary

We have explored various aspects of Farm Bureau Medicare Plan N, including its key features, coverage, enrollment process, and comparisons to other Medigap plans.

By understanding these factors, you can make an informed decision about your healthcare coverage.

With the help of additional resources like Medicare.gov and State Health Insurance Assistance Programs (SHIPs), you can navigate the world of Medicare with confidence and secure the best possible coverage for your healthcare needs.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Farm Bureau Medicare Plan N, and how does it compare to other Medicare plans?

Farm Bureau Medicare Plan N is a Medicare Advantage plan known for its comprehensive coverage and cost-sharing structure. Let’s explore its key features in detail.

What are the primary benefits of Farm Bureau Medicare Plan N?

Plan N typically covers hospitalization, doctor’s office visits, prescription drugs, and skilled nursing facility care. It offers a wide range of benefits.

How does cost-sharing work with Farm Bureau Medicare Plan N?

Plan N often has lower monthly premiums compared to some other Medicare plans but may require copayments or coinsurance for services like doctor’s visits and ER visits.

Are there any limitations on healthcare providers with Farm Bureau Medicare Plan N?

Generally, Plan N involves using a network of healthcare providers, with higher costs for out-of-network care.

Does Farm Bureau Medicare Plan N include prescription drug coverage?

Yes, it typically offers prescription drug coverage. However, it’s important to check the formulary for covered drugs and associated costs.

Can you enroll in Farm Bureau Medicare Plan N with pre-existing conditions?

Yes, you can typically enroll during the annual Medicare Open Enrollment period, regardless of pre-existing conditions.

Are there any wellness benefits included in Farm Bureau Medicare Plan N?

Some Plan N options may provide wellness benefits such as fitness programs and preventive care services. Review the plan details for specifics.

How can you enroll in Farm Bureau Medicare Plan N?

You can typically enroll during the annual Medicare Open Enrollment period, either directly through Farm Bureau or via the Medicare website.

Are there additional costs associated with Farm Bureau Medicare Plan N?

In addition to premiums, you may have copayments or coinsurance for certain services. It’s important to understand all costs associated with the plan.

Can you switch to Farm Bureau Medicare Plan N from another Medicare plan?

Yes, you can switch during the annual Medicare Open Enrollment period or a Special Enrollment Period if you meet the eligibility criteria.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call now at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be pleased to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.