by Russell Noga | Updated November 29th, 2023

Does Medicare Plan N Cover Vision?

Navigating the world of Medicare can be a daunting task, especially when it comes to understanding the intricate details of vision care coverage. With an aging population and the prevalence of eye-related issues on the rise, it’s more important than ever to ensure you have the right Medicare plan to meet your vision care needs.

Navigating the world of Medicare can be a daunting task, especially when it comes to understanding the intricate details of vision care coverage. With an aging population and the prevalence of eye-related issues on the rise, it’s more important than ever to ensure you have the right Medicare plan to meet your vision care needs.

Are you aware of what “does Medicare Plan N cover vision” entails, or how it compares to other supplement plans? Let’s explore the ins and outs of Medicare Plan N and its implications on vision care coverage.

In this comprehensive guide, we will delve into the specifics of “does Medicare Plan N cover vision”, compare it to other supplement plans, discuss alternative options for vision care coverage, and provide valuable tips for saving on vision care with Medicare. By the end of this article, you’ll be well-equipped to make an informed decision about your Medicare plan and vision care needs.

Short Summary

- Medicare Plan N does not cover routine vision care such as eye exams, glasses, or contact lenses.

- When choosing a Medicare Supplement plan for vision coverage, individuals must consider their needs and budget to select the most suitable plan.

- Alternatives like standalone insurance plans and community resources can help save on costs while meeting one’s individual vision care needs.

Understanding Medicare Plan N and Vision Care

Medicare Plan N is a popular supplemental plan that fills gaps in traditional Medicare coverage.

Medicare Plan N is a popular supplemental plan that fills gaps in traditional Medicare coverage.

While it offers numerous benefits, it’s important to note that Plan N does not cover routine vision care or eyewear.

This means that eye exams, glasses, and contact lenses are not covered under this plan, leaving you responsible for these costs.

So, what exactly does Plan N offer, and what are your options for vision care coverage? Let’s take a closer look.

Medicare Plan N Overview

Medicare Supplement Plan N provides a comprehensive array of benefits, covering most out-of-pocket costs left by Original Medicare. This includes copayments, coinsurance, and deductibles for services such as hospital stays and physician visits.

However, Plan N does not cover the Medicare Part B deductible, excess charges, or routine vision care. Additionally, Plan N requires copayments of $20 for physician visits and $50 for emergency room visits that do not lead to hospitalization.

Despite these coverage gaps, Plan N remains a popular choice for Medicare Supplement Insurance due to its cost-sharing advantages and more comprehensive coverage compared to other Medigap plans. Factors such as your state of residence, gender, age, and tobacco use can influence the cost of your monthly premium for Plan N.

Medigap Rates for 2024

Enter Zip Code

Vision Care Under Plan N

When it comes to vision care, Plan N’s coverage is limited to what is offered by Original Medicare. This means that medically necessary treatments for chronic eye conditions, such as cataract surgery and annual glaucoma tests for individuals at risk, are covered.

However, routine eye exams, glasses, and contact lenses are not covered under Plan N, leaving you responsible for these costs out of pocket.

It’s important to note that Original Medicare may provide coverage for vision-related items or services in specific circumstances, such as when an illness or injury has caused eye problems or when medically necessary treatments are required to improve or cure chronic eye conditions like glaucoma or cataracts.

In these cases, does Medicare cover vision expenses? You would be responsible for 20% of the Medicare-approved amount in addition to the Part B deductible.

Comparing Medicare Supplement Plans for Vision Coverage

With the limited vision coverage offered by Plan N, you may be wondering how it compares to other Medicare supplement plans, such as Plan G or Medicare Advantage.

In this section, we’ll explore the differences in coverage and costs between these plans, helping you make an informed decision about which plan best suits your vision care needs.

Plan N offers basic coverage for vision care, including routine eye exams and eyeglasses.

Plan N vs. Plan G

Both Plan N and Plan G are Medicare Supplement plans that provide similar coverage.

However, there are some key differences between the two. Plan G offers more comprehensive coverage without copays for physician and emergency room visits, while Plan N requires copays and does not cover routine vision care. This means that if you require regular eye exams or eyewear, Plan G may be a better option for you.

When considering costs:

- Plan G typically has higher monthly premiums compared to Plan N due to its more comprehensive coverage.

- Plan G covers the Part B deductible.

- Plan G does not require copays for office visits or emergency room visits.

- Plan N has copays of $20 and $50, respectively, for office visits and emergency room visits.

The choice between these two plans ultimately depends on your individual needs, preferences, and budget.

Plan N vs. Medicare Advantage

Medicare Advantage plans, also known as Part C, offer an alternative to Medicare supplement plans like Plan N. These plans may provide additional vision coverage, such as eye exams and eyewear, which can be beneficial for individuals with ongoing vision care needs.

However, a Medicare Advantage plan may come with certain drawbacks, such as restrictive doctor networks and less flexibility in case of medical emergencies compared to Plan N.

When comparing Plan N to Medicare Advantage, it’s essential to weigh the pros and cons of each plan in terms of vision coverage, costs, and overall benefits. While Medicare Advantage plans may offer more extensive vision coverage, they may not provide the same level of flexibility and choice in healthcare providers as Plan N.

Ultimately, the decision between these two plans depends on your individual vision care needs and preferences.

Alternatives for Vision Care Coverage

If you’re looking for additional options to cover your vision care needs, there are several alternatives to consider.

These include standalone vision insurance, discount vision programs, and community or non-profit resources.

In this section, we’ll explore these alternatives and discuss their potential benefits and drawbacks.

Standalone Vision Insurance

Standalone vision insurance is a separate insurance plan specifically designed to cover vision care services, such as eye exams, glasses, and contact lenses.

These plans are typically offered by vision insurance companies like VSP Vision Care, EyeMed, and Davis Vision. Standalone vision insurance can provide comprehensive coverage for routine eye exams, glasses, and contacts, but may come with additional premiums.

While standalone vision insurance can offer more extensive coverage for vision care compared to Plan N, it may not be the best fit for everyone. Some individuals may find the additional premiums and potential coverage limitations for pre-existing conditions or non-routine vision care services to be a drawback.

It’s essential to compare the costs and benefits of standalone vision insurance plans to determine if this option is suitable for your needs.

Discount Vision Programs

Discount vision programs provide savings on eye exams, glasses, and contacts for a low annual fee.

These programs are typically offered by vision insurance companies, private health insurance plans, and other organizations. By participating in a discount vision program, you can access a network of providers offering reduced rates on vision care services, potentially saving you money on routine exams and eyewear.

However, discount vision programs may have certain limitations, such as restricted provider networks, making it difficult to find the care you need.

Additionally, the annual fee associated with these programs may be too costly for some individuals. It’s important to weigh the potential savings against the drawbacks of discount vision programs when considering this alternative for vision care coverage.

Community and Non-Profit Resources

Community and non-profit resources, such as EyeCare America and Vision USA, offer free or low-cost vision services to eligible individuals.

Community and non-profit resources, such as EyeCare America and Vision USA, offer free or low-cost vision services to eligible individuals.

These organizations provide a valuable safety net for those without adequate insurance coverage or who cannot afford the out-of-pocket costs associated with vision care.

While community and non-profit resources can be a lifeline for many, they may not be available to everyone. Eligibility for these services is often based on factors such as income, age, and specific vision care needs. Additionally, resources may be limited, and not all services may be available in every community.

It’s crucial to explore all available options for vision care coverage, including Medicare supplement plans, standalone vision insurance, and discount programs, to find the best fit for your needs.

Tips for Saving on Vision Care with Medicare

Even with the limitations of Medicare Plan N’s vision care coverage, there are still ways to save on vision care costs. In this section, we’ll share some valuable tips, including maximizing your “Welcome to Medicare” visit, utilizing in-network providers, and taking advantage of carrier discounts.

Maximizing your “Welcome to Medicare” visit is a great way to get Medicare benefits.

Maximizing Your “Welcome to Medicare” Visit

The “Welcome to Medicare” visit includes:

- A comprehensive physical exam

- A review of your medical and social history

- Education and counseling about preventive services

- A simple vision test to identify potential vision issues early on

This visit is covered by Medicare Part B and is a one-time preventive visit.

To make the most of your “Welcome to Medicare” visit, come prepared with a list of questions and concerns about your vision care needs.

Be sure to discuss any vision-related symptoms or worries with your healthcare provider, who can provide guidance on the best course of action for your specific needs. Early detection and treatment of vision issues can potentially save you money and improve your overall quality of life.

Utilizing In-Network Providers

Using in-network providers for vision care can help reduce your out-of-pocket costs and ensure that your services are covered under your Medicare plan. In-network providers are healthcare providers that have agreed to accept a specific amount of payment from your insurance company for services rendered.

To find in-network providers, consult your Medicare plan’s website or contact their customer service number. By utilizing in-network providers, you may be able to save money on vision care services while still receiving the care you need.

Taking Advantage of Carrier Discounts

Some Medicare carriers may cover eye exams and offer discounts on vision-related products, which can help you save on vision care costs.

Some Medicare carriers may cover eye exams and offer discounts on vision-related products, which can help you save on vision care costs.

These discounts can vary between carriers, so it’s essential to research the offers available from your specific carrier and take advantage of any that apply to your vision care needs.

In addition to carrier discounts, don’t hesitate to ask your eye care provider about any promotions or discounts they may offer on exams, glasses, or contacts.

By taking advantage of these savings opportunities, you can help reduce your overall vision care expenses even if you’re enrolled in a Medicare plan with limited vision coverage.

How to Choose the Right Medicare Plan for Your Vision Needs

Choosing the right Medicare plan for your vision needs can feel overwhelming, but it doesn’t have to be.

In this section, we’ll guide you through the process of assessing your vision care needs. Comparing the costs and benefits of different plans can help you make an informed decision. Consulting with professionals can also provide valuable insight into the best plan for your needs.

Assessing Your Vision Care Needs

Before selecting a Medicare plan, it’s essential to consider your current and future vision care needs. This includes the frequency of eye exams, glasses, or contact lens prescriptions, as well as any potential vision-related treatments or procedures you may require.

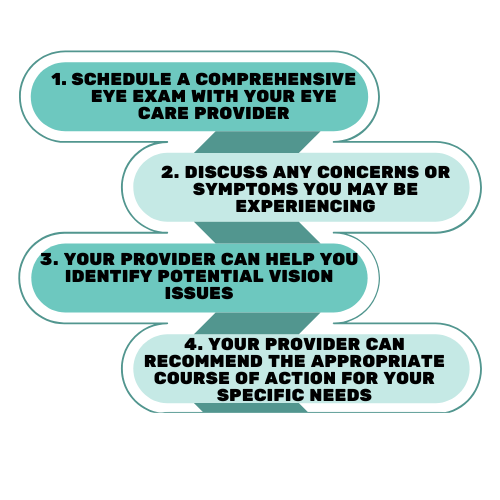

To accurately assess your vision care needs, follow these steps:

- Schedule a comprehensive eye exam with your eye care provider.

- Discuss any concerns or symptoms you may be experiencing.

- Your provider can help you identify potential vision issues.

- Your provider can recommend the appropriate course of action for your specific needs.

Comparing Costs and Benefits

Once you have a clear understanding of your vision care needs, it’s time to compare the costs and benefits of different Medicare plans. This includes evaluating:

- premiums

- copays

- coverage limits for each plan

- any additional benefits they may offer, such as discounts or promotions

Consider not only the immediate costs of each plan, but also the potential long-term savings that may result from more comprehensive coverage. By comparing the costs and benefits of multiple plans, you can make an informed decision about which plan best meets your vision care needs and budget.

Consulting with Professionals

Finally, don’t hesitate to consult with professionals, such as insurance agents or healthcare providers, when choosing the right Medicare plan for your vision care needs. These experts can help you navigate the complexities of Medicare and provide personalized recommendations based on your specific needs and preferences.

By taking the time to assess your vision care needs, compare costs and benefits, and consult with professionals, you can make an informed decision about the right Medicare plan for your unique situation. With the right plan in place, you can focus on maintaining your vision health and enjoying life to the fullest.

Summary

In conclusion, understanding the nuances of Medicare Plan N and its relation to vision care is crucial for making informed decisions about your healthcare coverage. While Plan N offers many benefits, its limited vision care coverage may not be suitable for everyone.

By comparing Plan N with other Medicare Supplement plans and exploring alternative options for vision care coverage, you can find the best fit for your needs and budget.

Your vision is an invaluable asset, and ensuring you have the right Medicare plan in place to protect it is essential. By assessing your vision care needs, comparing costs and benefits, and consulting with professionals, you’ll be well-equipped to make the best decision for your unique situation. Here’s to a clear and bright future for your vision health!

View Rates for 2024

Enter Zip Code

Frequently Asked Questions

What does Plan N pay for?

Plan N covers the Medicare Part A deductible, coinsurance for Parts A and B, three pints of blood, 80% of medical costs incurred during foreign travel, and copayments for office visits and emergency room visits that don’t result in an inpatient admission.

Copayments for office visits and emergency room visits that don’t result in an inpatient admission are covered under Plan N.

What are the disadvantages of Plan N?

Plan N has the disadvantage of not providing coverage for certain Part B services, like the Part B deductible and coinsurance, as well as some preventative services. As a result, enrollees could face unexpected expenses and have limited access to preventive care.

Does Plan N include prescription coverage?

Medicare Plan N does not include prescription coverage and a separate Medicare Part D plan must be obtained to cover prescriptions. It also does not cover vision, dental or hearing services.

Does Medicare Plan N cover routine eye exams?

Unfortunately, Medicare Plan N does not cover routine eye exams, glasses, or contact lenses.

Are there any alternatives to Medicare supplement plans for vision care coverage?

Yes, there are alternatives to Medicare supplement plans for vision care coverage, such as standalone vision insurance, discount vision programs, and community or non-profit resources.

These alternatives can provide coverage for routine eye exams, eyeglasses, and contact lenses. They may also cover additional services such as laser vision correction, vision therapy, and more.

It’s important to compare the different options available to you.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know if Medicare Plan N covers vision, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.