by Russell Noga | Updated December 10th, 2023

While Original Medicare provides essential healthcare benefits for millions of elderly, disabled, and chronically ill Americans, the government-funded insurance program doesn’t cover the cost of all medical expenses.

While Original Medicare provides essential healthcare benefits for millions of elderly, disabled, and chronically ill Americans, the government-funded insurance program doesn’t cover the cost of all medical expenses.

Beneficiaries are responsible for covering the costs that Part A and Part B don’t cover out of their own pockets, and those expenses can become exorbitant and for many, can lead to financial difficulties. For these individuals, Medicare Supplement Insurance can be a real lifesaver.

This supplementary insurance helps to fill in the gaps in Original Medicare coverage and makes the cost of healthcare more affordable and easier to manage.

If you reside in Des Moines, Iowa and you’re interested in purchasing Medicare Supplement Insurance to help offset your medical expenses, read on to learn more about the options that are available in this Iowa city.

Compare 2024 Plans & Rates

Enter Zip Code

About Medicare Supplement Insurance

Medicare Supplement Insurance, as the name suggests, is designed to supplement Original Medicare. In other words, it doesn’t replace Original Medicare, but it works in conjunction with it.

Original Medicare consists of two separate parts that cover different aspects of healthcare expenses: Part A covers the cost of inpatient care and services and Part B covers the cost of outpatient care and services.

Original Medicare only covers 80 percent of outpatient and inpatient expenses; the remaining 20 percent, beneficiaries are responsible for.

Medicare Supplement Insurance – also known as Medigap – is designed to fill in the gaps in Original Medicare.

There are 10 plans and each plan covers different expenses that aren’t covered by Part A and Part B. The plans, which are named for letters (Plans A through N) are sold by private health insurance companies and are regulated by the federal government via the Centers for Medicare and Medicaid Services (CMS).

All plans of the same letter must offer the same benefits, no matter where they’re sold and which insurer provides them; for example, Plan A must offer the same benefits, whether it’s provided by Washington Mutual in New Mexico or by Mutual of Omaha in Florida.

Des Moines Medigap Insurance Plans

The capital and most populous city in the state of Iowa, Des Moines is home to millions of residents, and of those residents, thousands receive their health insurance through Original Medicare.

Many of the Medicare beneficiaries who reside in the city of Des Moines rely on Medicare Supplement Insurance to help pay for the expenses that aren’t covered by Part A and Part B.

There is a large selection of Medicare Supplement Insurance plans to choose from in Des Moines, and there are several insurers that offer these policies in Iowa’s capital.

It’s important to note that in order to purchase a Medigap insurance policy in Des Moines, you must be enrolled in both Part A and Part B of Original Medicare. Individuals who have Medicare Advantage cannot purchase a Medicare Supplement Insurance policy.

Compare Medicare Plans & Rates in Your Area

What Medigap Plans are Available in Des Moines?

As stated above, there are 10 Medicare Supplement Plans, and all 10 plans are available in Des Moines, Iowa, including Plan A through Plan N. With that said, however, some Medigap plans are more popular among Des Moines Medicare beneficiaries than others.

The following are some of the most popular options among residents of Iowa’s capital city:

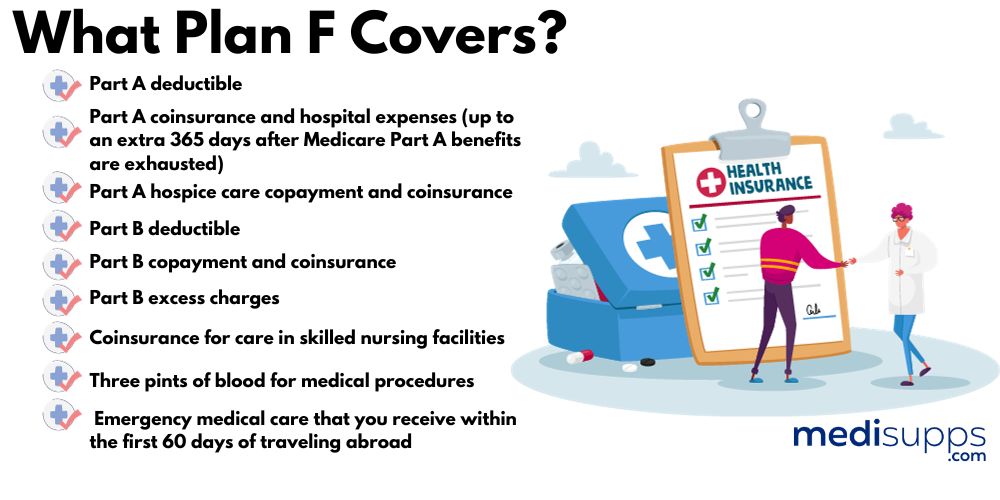

Medigap Plan F. Of all the Medicare Supplement Insurance policies, Plan F is the most popular, as it offers the most comprehensive coverage. In other words, it covers all of the expenses that are left behind by Part A and Part B, including:

- Part A coinsurance and hospital costs

- Part A deductible

- Part A coinsurance or copay for hospice care

- Part B coinsurance or copayment

- Part B deductible

- Part B excess charges

- Coinsurance for skilled nursing facility care

- The first three pints of blood required for medically necessary procedures

- Emergency health care services while traveling abroad, as long as the services are provided within the first 60 days of travel

It’s important to note that not all Des Moines residents can purchase Medigap Plan F. As of January 1, 2020, new Medicare enrollees are no longer eligible for this coverage; however, individuals who had this plan prior to this date can keep it and individuals who became eligible for Medicare before this date but never enrolled can still purchase it.

Medigap Plan G. Plan G is the second-most popular Medicare Supplement Insurance plan, and it’s considered a replacement for Plan F. It offers the same benefits as Plan G, except the Part B deductible. The cost of the Part B deductible was $226 in 2023. Anyone can purchase this coverage, regardless of when they became eligible for Medicare.

Medigap Plan N. For Des Moines residents who are looking for more affordable Medigap coverage, Plan N is a popular choice. The monthly premiums for this policy are lower; however, in exchange for lower monthly premiums, policyholders are responsible for copays, which can cost up to $20 per office visit and up to $50 per emergency room visit. For individuals who are in good health and don’t require a lot of medical care, Plan N is a good choice.

What Insurance Carriers Offer Medigap in Des Moines

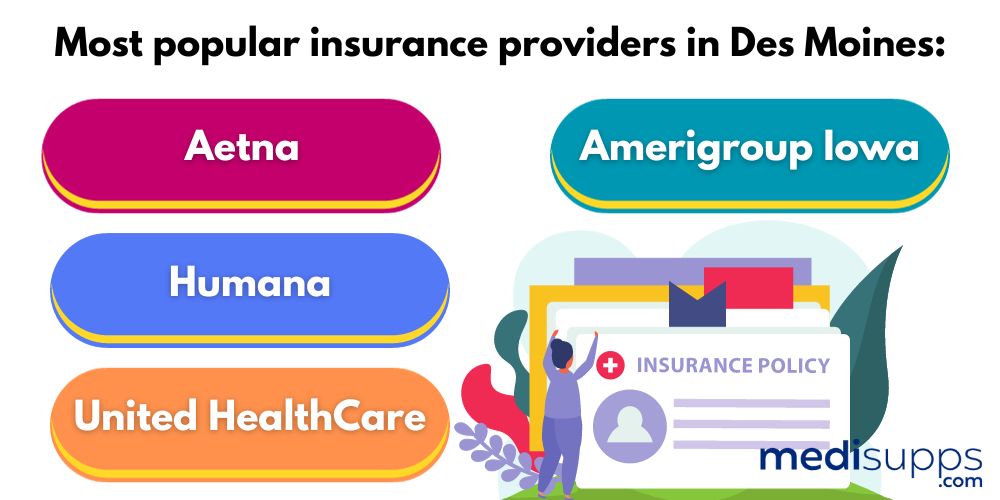

Several insurance companies offer Medigap plans in Des Moines. Some of the most popular insurance providers include:

- Aetna

- Humana

- United HealthCare

- Amerigroup Iowa

It’s important to note that when you’re trying to decide which provider to choose, thoroughly researching each company and comparing quotes from each provider is essential. Rates vary from company to company, as do the plans that each carrier offers.

Compare 2024 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is Des Moines Medigap Insurance?

Des Moines Medigap Insurance refers to Medicare Supplement insurance plans available to beneficiaries in Des Moines, Iowa. These plans help cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Who is eligible for Des Moines Medigap Insurance?

Individuals who are 65 years old or older and enrolled in Medicare Part B are eligible for Des Moines Medigap Insurance. Some individuals under 65 with disabilities may also be eligible in certain circumstances.

When can you enroll in Des Moines Medigap Insurance?

The best time to enroll in a Des Moines Medigap plan is during the Medigap Open Enrollment Period, which lasts for six months and begins when you are 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, which means insurance companies cannot deny you coverage or charge you more based on pre-existing conditions.

What are the best Medicare Supplement Plans for Des Moines residents?

The best Medicare Supplement plans for Des Moines residents will depend on their specific healthcare needs and preferences. Plan G and Plan N are popular options due to their comprehensive coverage and competitive pricing.

What does Medicare Supplement Plan G cover?

Medicare Supplement Plan G covers most of the gaps in Original Medicare, including Part A and Part B coinsurance, hospice care coinsurance, and the first three pints of blood. It also covers skilled nursing facility care coinsurance, Part A deductible, and 80% of foreign travel emergency costs.

What does Medicare Supplement Plan N cover?

Medicare Supplement Plan N provides similar coverage to Plan G but requires beneficiaries to pay certain cost-sharing amounts, such as a copayment for doctor’s visits and emergency room visits. It does not cover the Part B excess charges.

What is the difference between Medicare Supplement Plans and Medicare Advantage?

Medicare Supplement plans work alongside Original Medicare and help pay for out-of-pocket expenses not covered by Medicare. Beneficiaries can see any healthcare provider that accepts Medicare.

Medicare Advantage plans, also known as Medicare Part C, are private health insurance plans that replace Original Medicare. They often include prescription drug coverage and may offer additional benefits like dental and vision. However, beneficiaries may need to use a network of providers and follow plan rules.

Can you have both Des Moines Medigap Insurance and Medicare Advantage?

No, it is illegal to have both Des Moines Medigap Insurance and a Medicare Advantage plan at the same time. You must choose one or the other, as they provide different types of coverage.

How can you find Des Moines Medigap Insurance plans?

To find Des Moines Medigap Insurance plans, contact licensed insurance agents or brokers in the area who specialize in Medicare. They can assist you in comparing plans, rates, and coverage options to find the best fit for your healthcare needs and budget. Additionally, you can research online and review plan details on the official Medicare website.

Are Des Moines Medigap Insurance plans available to residents outside of Des Moines?

Yes, Medigap plans are available to residents across the state of Iowa, not just in Des Moines. These plans are standardized and must follow federal and state regulations, ensuring consistent coverage options for all eligible beneficiaries in Iowa.

Contact Us for a Free Consultation on Medigap Plans

If you have questions about Medicare supplement plans, call our team at 1-888-891-0229. We offer professional advice on Medigap policies. Our fully licensed agents offer free consultations to give you all the information you need about Medigap. If you want someone to call you back, leave your details on our contact form, and we’ll get a Medigap expert to reach out to you.

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.