by Russell Noga | Updated October 2nd, 2024

Millions of Americans who receive health insurance through Original Medicare rely on Medicare Supplement Insurance to help offset the out-of-pocket expenses that aren’t covered by Part A and Part B; copays, coinsurance, and deductibles, for example.

Millions of Americans who receive health insurance through Original Medicare rely on Medicare Supplement Insurance to help offset the out-of-pocket expenses that aren’t covered by Part A and Part B; copays, coinsurance, and deductibles, for example.

These supplementary policies are sold by private health insurance companies, such as Colonial Penn.

If you’ve recently enrolled in Medicare or you’re about to, or if you have a Medicare Supplement Insurance plan and you’re thinking about switching plans, there are several factors that you should consider before making your final decision.

One of the most important factors to consider is your insurer. If you’re contemplating Colonial Penn Medicare Supplement Insurance, before purchasing coverage from this provider, keep on reading.

Compare 2024 Plans & Rates

Enter Zip Code

Medicare Supplement Insurance: An Overview

Original Medicare consists of two parts: Part A, which helps to pay for the cost of inpatient medical care, and Part B, which covers the cost of outpatient medical care and services.

While Original Medicare will cover a lot of your healthcare expenses, it doesn’t cover everything. You’re responsible for the costs that Part A and Part B don’t cover. As you can imagine, those expenses can be hard to keep track of and can become exorbitant.

Medicare Supplement Insurance (also known as Medigap) can help to offset those out-of-pocket expenses. This supplementary insurance is designed to cover the costs that Part A and Part B won’t pay for. There are a total of 10 Medigap plans, and each plan offers different benefits.

The plans are named for letters, are sold by private health insurance companies, and are regulated by the federal government via the Centers for Medicare and Medicaid Services (CMS). All plans of the same letter have to offer the same standard benefits, no matter where they’re purchased or which insurer provides them.

Medicare Supplement Insurance is a separate insurance policy, which means you’ll have to pay separate monthly premiums for coverage, in addition to the monthly premiums for Original Medicare.

When you receive medical care, as long as your premiums are current, your Medigap insurance will kick in and cover the costs that aren’t covered by Part A and Part B that the policy you selected provides.

About Colonial Penn

Colonial Penn Life Insurance (more commonly referred to simply as Colonial Penn) is a life insurance company and an affiliate of the Bankers Life and Casualty Company. The company, which is based in Philadelphia, was founded by Leonard Davis, the co-founder of the American Association of Retired Persons (AARP).

Initially, Colonial Penn concentrated on providing life insurance for individuals via the AARP. Though life insurance continues to be one of the company’s primary offerings, it also offers Medicare Supplement Insurance plans.

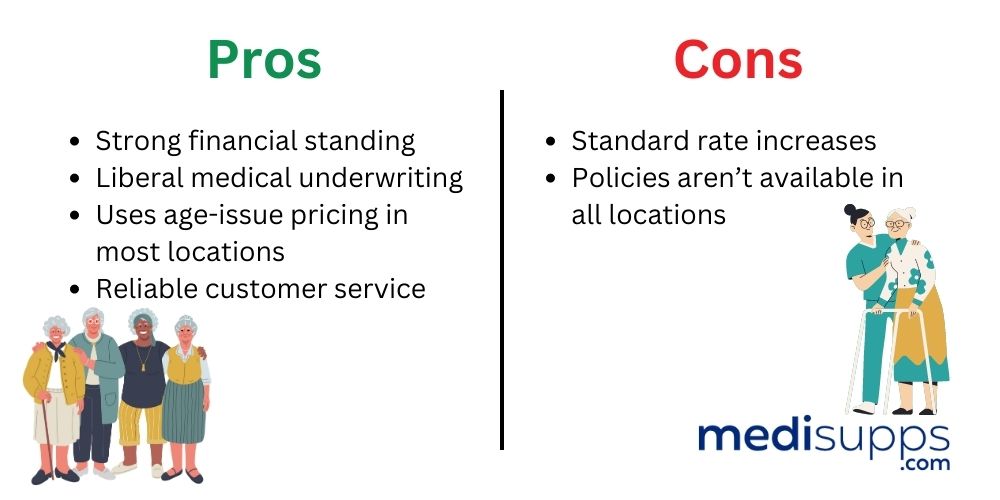

Colonial Penn focuses on four core values, including integrity, excellence, teamwork, and customer focus. The Medigap policies the company offers are available to Medicare beneficiaries who reside in most states within the United States. It’s become one of the top providers of Medicare Supplement Insurance, is regarded for offering fair prices and excellent customer care, and services millions of policyholders. With an A- (Excellent) rating from AM Best, a BBB+ rating from Standard and Poors, and an A2 from Moodys, Colonial Pen has a very strong and stable financial standing.

Colonial Penn Medicare Supplement Insurance Pros and Cons

What Medicare Supplement Plans Does Colonial Penn Offer?

Colonial Penn offers several Medicare Supplement Insurance plans, including:

- Medigap Plan A. This is the most basic of all Medicare Supplement plans, offering only the required benefits and nothing more.

- Medigap Plan B. Plan B offers all of the same benefits as Plan A, as well as the Part A deductible.

- Medigap Plan C. This plan covers all the same costs that Plan B covers, as well as coinsurance for skilled nursing facility care, the Part B deductible, and 80 percent of emergency care while traveling abroad.

- Medigap Plan D. This plan is considered a replacement for Plan C, as it offers all the same benefits, except the Part B deductible.

- Medigap Plan F.Considered the most inclusive Medicare Supplement Insurance policy, Plan F covers the majority of the out-of-pocket expenses that are associated with Original Medicare. It includes all the benefits that Plan D offers, as well as the Part B deductible and Part B excess charges.

- Medigap Plan G. Plan G is considered a replacement, as it offers all the same benefits, excluding the Part B deductible.

- Medigap Plan K. Plan K covers 50 percent of the Part A and Part B expenses that aren’t covered by Original Medicare.

- Medigap Plan L. Plan L covers 75 percent of the Part A and Part B expenses that aren’t covered by Original Medicare.

- Medigap Plan M. Plan M is almost identical to Plan D, except it covers 50 percent of the Part A deductible rather than 100 percent.

- Plan N. The monthly premiums for Colonial Penn Medicare Plan N are lower; however, it doesn’t cover Part B copayments. You’ll need to pay $20 per office visit and $50 per emergency room visit. In exchange for paying the copayments, the monthly premiums are lower.

Compare 2024 Plans & Rates

Enter Zip Code

How Much Do Colonial Penn Medicare Supplement Plans Cost?

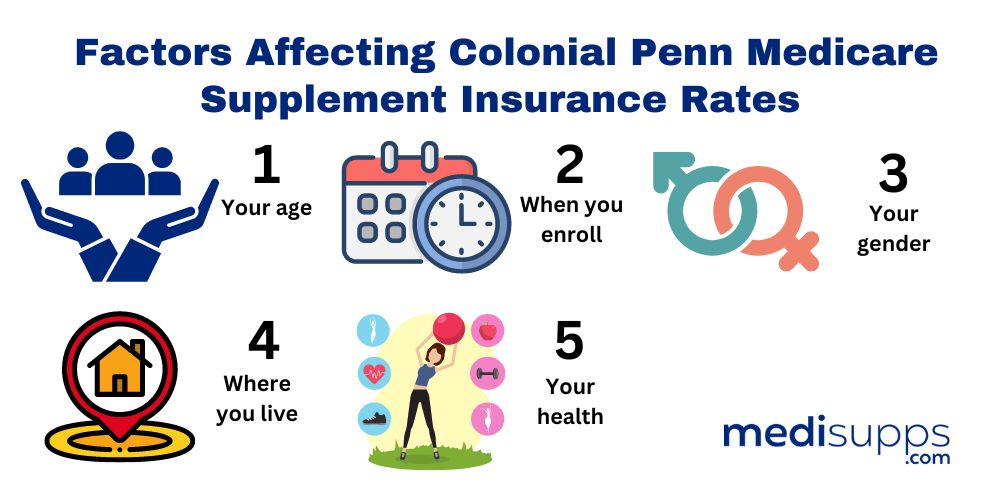

Costs for Colonial Penn Medigap policies vary and are determined by a number of factors, including:

To find out how much a Colonial Penn Medicare Supplement plan will cost, it’s important to receive quotes for multiple policies and to choose a plan that not only offers the benefits you require but that also works with your budget.

Compare Medicare Plans & Rates in Your Area

Frequently Asked Questions

What is Colonial Penn Medicare Supplement?

Contact Us for a Free Consultation on Medigap Plans

If you have questions about Medicare Supplement plans, call our team at 1-888-821-0229. We offer professional advice on Medigap policies. Our fully licensed agents offer free consultations to give you all the information you need about Medigap. If you want someone to call you back, leave your details on the contact form and we’ll get a Medigap expert to reach out to you.