Medicare Supplement plans provide coverage for medical expenses you may already be paying for out of your own pockets.

Even if you have Medicare coverage, you might not be able to easily afford your remaining medical expenses. After all, Medicare does not cover everything.

With CignaPlan F you can get full coverage for supplementary medical expenses, which includes a lot of stuff that Medicare subscribers have to end up paying for.

With CignaPlan F you can get full coverage for supplementary medical expenses, which includes a lot of stuff that Medicare subscribers have to end up paying for.

What you pay for yourself depends on your medical conditions and on what coverage you already have.

Keep in mind only those who were enrolled in Medicare prior to January 1st of 2020 may enroll in Plan F!

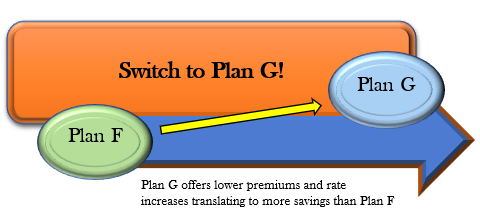

At this point, we highly suggest that anyone who kept their Plan F supplement consider moving to Medicare Plan G as soon as possible. Keep in mind you can change Medigap plans anytime during the year.

But in this article, I’d like to show you what this plan offers and who it would be suitable for, then show you how to sign up for it and how to compare it to other plans to make the best coverage decision.

Click below to learn more!

Cigna Medicare Plan F

If you were to sign up for this plan and start being covered by it, then you would not have to pay for it anymore.

Medicare Part A deductibles or Part B deductibles. Those costs would all be covered, as would the cost of the Medicare Part A and Part B co-payments.

Medicare Part A deductibles or Part B deductibles. Those costs would all be covered, as would the cost of the Medicare Part A and Part B co-payments.

They are common expenses anyone with a Medicare plan has to pay since Medicare leaves these medical expenses uncovered.

Plan F is also going to take care of coverage for emergency medical transport that is outside the United States. It covers you for as much as $50,000 on this single expense over the course of your lifetime.

On top of that, it covers the cost of three pints of blood, and unlike the last time we mentioned, this one gets renewed each year.

Plan F is also going to take care of your hospice care coinsurance payments from Medicare Part A and the skilled nursing care coinsurance. It covers the cost of Medicare Part B excess charges too.

When you put all that coverage together, you get something that is comprehensive and that leaves you with few things to pay on your own, out of your own pockets.

You may still have to pay for dental, medication, vision, and hearing expenses, but your hospital costs should be about as covered as they can be.

If you do need more coverage than what Plan F offers, you should look at Medicare Part C plans, as they can cover quite a bit as well, but none of the other Supplement plans can match what Plan F is offering.

A few of them come very close, though, and we want to talk to you for a moment about some of them.

Cigna Plan F

You should take time to compare Plan F to some of the other Medicare Supplement plans. You know now what Plan F covers, and we want to show you two other plans that are worth looking at.

These are plans that are similar to Plan F, so if you are interested in that plan, then you should know about these other two.

Plan G will cover you for all the same things we listed above for Plan F, except for one item. That would be the Medicare Part B deductible, which only costs you $203 in 2022.

Plan G will cover you for all the same things we listed above for Plan F, except for one item. That would be the Medicare Part B deductible, which only costs you $203 in 2022.

You may be able to save some money by paying that expense yourself and going with the lower coverage and lower cost Plan G instead of Plan F.

We also recommend you compare Plan F to Plan N. This is another high-coverage plan, but it will not cover some small co-payments, nor will it cover the Part B deductible or the Part B excess charges.

If you are thinking about Cigna Medicare Supplement Plan F, then you need to look at these other two plans and see how they compare.

What you may find is that one of these two is a better choice for you. They are plans that cover a lot but don’t cost as much as Plan F does. You may not need quite all the coverage that Plan F comes with, which is why we recommend these slightly lower coverage plans for you.

Cigna Plan F Cost

Plan F is incredibly popular, and a lot of seniors do save money with it. However, that doesn’t make it an ideal coverage plan for you.

Plan F is incredibly popular, and a lot of seniors do save money with it. However, that doesn’t make it an ideal coverage plan for you.

You need to compare this plan to what your actual needs are. Examine how much you are paying for medical care and how much Plan F costs.

See which one would be cheaper. Why you are at it, you should also be comparing your needs to some other plans, as we mentioned above.

Plan F is not for every senior. For some of them, it works very well, and Cigna can offer competitive pricing sometimes which makes it a slightly better deal.

Their member services can be beneficial as well, but you need to compare those to other insurance companies to get an idea of who has the best benefits to offer.

Plan F isn’t changing in any way by purchasing it at Cigna, but the price and member perks can change. You need to look at that core coverage, and we talked about what this plan can take care of for you earlier in this article.

You need to determine if that makes it a good fit for you or not. It could be that this plan simply costs too much or covers more than you need to have covered.

We recommend that every senior carefully look over their own expenses before they sign up for any Medicare Supplement plan, and to definitely consider Plan G if you currently have or want Plan F!

You want a plan that will save you as much money as possible and that may not be the most expensive plan out there.

While Plan F’s awesome coverage can be convenient and leave you with few things to pay out of pocket, it simply has begun too expensive with too much premium, for too little benefit.

Call us today to get started and switch to Cigna Plan G, or another company if they have the lowest premiums!

Call 1-888-891-0229 now!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.