by Russell Noga | Updated January 3rd, 2024

Medicare Plan N Arizona

Navigating the world of Medicare can be overwhelming, especially when it comes to choosing the right supplemental insurance plan.

Navigating the world of Medicare can be overwhelming, especially when it comes to choosing the right supplemental insurance plan.

With so many options available, how do you determine which plan best suits your needs?

Enter Medicare Plan N, a popular choice for Arizona residents seeking comprehensive coverage to bridge the gap left by Original Medicare.

In this post, we’ll explore the ins and outs of Medicare Plan N Arizona, its benefits, costs, and how it compares to other popular supplement plans.

Get ready to become an expert on Plan N and make an informed decision for your healthcare future!

Short Summary

- Medicare Plan N in Arizona provides standardized coverage with copayments and excludes Part B deductible/excess charges.

- Compare Medicare Plan N to other Supplement plans like G & F, as well as A-L for best coverage at lowest cost.

- Consider factors such as age, gender, location when selecting a provider offering the most suitable plan for individual needs.

Understanding Medicare Plan N in Arizona

Medicare Supplement Plan N, also known as Medigap Plan N, is designed to help protect individuals from out-of-pocket costs associated with Original Medicare coverage.

Medicare Supplement Plan N, also known as Medigap Plan N, is designed to help protect individuals from out-of-pocket costs associated with Original Medicare coverage.

It is essential to consider your most frequent healthcare expenses and out-of-pocket costs when selecting from various Medigap plans, including Medicare Supplement plan or Medicare Supplement insurance in Arizona.

Over nine out of 10 Arizonans with Medigap policies have chosen Plan F, G, or N.

Plan N covers certain standardized benefits in Arizona, excluding Part B deductible, excess charges, and requiring copayments for certain services.

Coverage Details of Plan N

Plan N provides standardized coverage in Arizona, not including Part B deductible, excess charges, and requiring copayments for specific services. It helps with coinsurance and hospital costs, making it a solid choice for those seeking additional coverage.

One of the notable features of Plan N is its 80% coverage of foreign travel exchange within the plan’s limits, as well as assistance with hospital costs.

Certain private insurance companies may offer additional benefits such as UnitedHealthcare’s NurseLine in conjunction with Plan N in Arizona.

Eligibility Requirements for Plan N

To be eligible for an Arizona Medicare Supplement Plan N, you must be enrolled in Medicare Part A and Part B, and be within the Medigap Open Enrollment Period or have guaranteed issue rights.

The Medigap Open Enrollment Period is a six-month period which commences upon enrollment in Medicare Part B at age 65. This is the best time to choose from the best Medicare Supplement plans available in Arizona.

Guaranteed issue rights enable individuals to enroll in a Medicare Supplement plan without undergoing medical underwriting. Some examples of situations that may trigger guaranteed issue rights include:

- Losing employer-sponsored health coverage

- Moving out of your plan’s service area

- Losing coverage due to a plan’s contract termination

- Losing coverage due to a plan’s bankruptcy

The Special Enrollment Period provides individuals with the opportunity to enroll in a Medicare Supplement plan outside of the Medigap Open Enrollment Period if they experience certain life events.

Compare Rates For 2024 Now

Enter Zip Code

Comparing Medicare Plan N with Other Supplement Plans

In order to make an informed decision, it’s crucial to compare Plan N with other popular Medicare Supplement plans, such as Plan G and Plan F.

Plan G is currently the gold standard for Medicare Supplement plans in Arizona, providing comprehensive coverage.

Plan F is the most comprehensive Medigap plan, but is no longer accessible to new beneficiaries.

Plans available in Arizona:

- Plan A

- Plan B

- Plan C

- Plan K

- Plan L

When selecting a plan, it’s essential to consider the monthly premiums against potential out-of-pocket costs.

Choosing plans with lower upfront fees could save you money in the short term. However, it could lead to higher expenses in the long run.

Plan N vs. Plan G

Plan N and Medicare Supplement Plan G are both popular Medicare Supplement plans in Arizona, but they differ in terms of coverage and premiums.

Plan G covers all expenses except for the Part B deductible, whereas Plan N necessitates copayments and does not cover Part B excess charges.

Plan G provides comprehensive benefits, including 100% coinsurance for Part B after the deductible is met, full rate coverage for Part A hospice coinsurance and copayment, and three pints of blood per year.

The average monthly premium for UnitedHealthcare’s Plan G SELECT in Arizona is $119.41, while the average monthly premium for Plan N is $110.41.

Plan N vs. Plan F

Plan N and Plan F are both Medicare supplement plans in Arizona, but they cater to different needs.

Plan N has lower premiums and requires copayments, whereas Plan F offers comprehensive coverage and is only available to those eligible for Medicare prior to 2020.

Plan F covers all standardized Medigap benefits, excluding foreign travel coverage which is limited to 80%.

In summary, Plan N is a cost-effective option with lower premiums but requires copayments, while Plan F offers comprehensive coverage but is limited in availability for new beneficiaries.

Costs Associated with Medicare Plan N in Arizona

Understanding the costs associated with Medicare Plan N in Arizona is vital for making an informed decision.

The average monthly premiums for Medicare Plan N in Arizona range from $103.50 to $180.80. Factors affecting Plan N premiums include:

- Age

- Gender

- Location

- Pricing method used by the insurance company.

Average Monthly Premiums

Premiums for Medicare Plan N in Arizona are influenced by various factors, including the specific provider and available discounts. UnitedHealthcare offers the most cost-effective monthly premium for Plan N in Arizona for 65-year-olds at $103.50.

It is essential to compare monthly premiums to find the best option for your individual needs.

Factors Affecting Plan N Premiums

Several factors influence the premiums for Plan N in Arizona, such as:

- Age: premiums are typically higher for older individuals

- Gender: premiums for males are usually higher than those for females

- Geographic location: premiums may vary based on the area you live in

- Pricing methodology employed by the insurer

These factors can affect the cost of your Plan N premium.

Location is a key factor as premiums can vary by state or region; and the pricing method used by the insurance company is significant as premiums can vary depending on the method utilized.

Top Providers Offering Medicare Plan N in Arizona

In Arizona, top providers offering Medicare Plan N include UnitedHealthcare and Humana, each with distinct pricing and coverage options.

UnitedHealthcare is the most economical choice for most letter plans in Arizona, while Humana provides Plan N coverage, with premiums varying based on factors such as age, location, and tobacco use.

Both companies offer a variety of plans, so it’s important to compare the coverage and costs.

UnitedHealthcare

UnitedHealthcare offers Medicare Supplement Plan N with an average premium of $110.41 per month.

UnitedHealthcare offers Medicare Supplement Plan N with an average premium of $110.41 per month.

They also provide a SELECT option for Plan N, which allows for lower rates but a more restrictive network. With the SELECT option, the average monthly premium is $96.53.

UnitedHealthcare is a popular choice for Arizona residents seeking a cost-effective Medicare Supplement plan with a variety of coverage options.

Humana

Humana is another provider offering Medicare Plan N coverage in Arizona. Premiums for Humana’s Plan N vary based on factors such as age, location, and tobacco use.

While Humana’s Plan N may have higher premiums than UnitedHealthcare’s Plan N, it’s essential to weigh the coverage options, customer service, and additional benefits offered by each provider to determine the best fit for your individual needs.

Comparing the different plans available can help you make an informed decision about which plan is right for you.

Enrollment Process for Medicare Plan N in Arizona

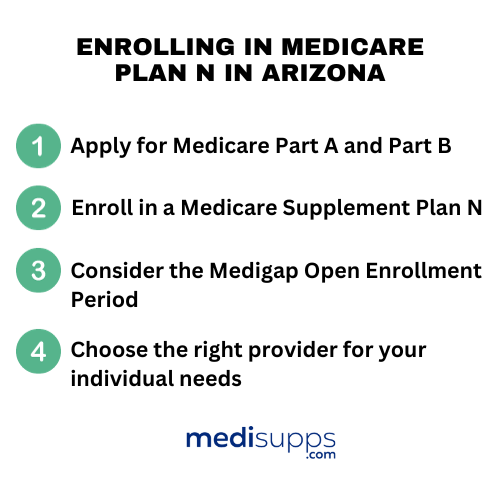

Enrolling in Medicare Plan N in Arizona involves the following steps:

- Apply for Medicare Part A and Part B.

- Enroll in a Medicare Supplement Plan N.

- Consider the Medigap Open Enrollment Period.

- Choose the right provider for your individual needs.

You can contact a licensed insurance agent or complete an online rate comparison form to compare Medicare Supplement plans in Arizona.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period is a crucial time for securing affordable coverage and guaranteed acceptance. This six-month period commences upon enrollment in Medicare Part B at age 65.

Enrolling in a Medicare Supplement plan during the Medigap Open Enrollment Period guarantees acceptance regardless of any pre-existing medical conditions and provides cost-effective coverage.

How to Choose the Right Plan N Provider

Choosing the right Plan N provider involves comparing coverage options, premiums, and customer service to find the best fit for your individual needs.

Reviewing plan options online or consulting with a local licensed agent can provide valuable guidance in selecting a plan that meets your healthcare and budget requirements.

Alternatives to Medicare Plan N in Arizona

While Medicare Plan N is a popular choice for supplemental coverage in Arizona, there are alternatives available, such as Medicare Advantage plans.

Medicare Advantage plans offer additional coverage options and may have lower premiums than Medigap policies, but with limited provider networks.

Medicare Advantage Plans

Medicare Advantage plans, also known as Medicare Advantage Plans, provide an alternative to Medigap policies, offering additional Medicare benefits and potentially lower out-of-pocket costs, but with limited provider networks.

These plans often include additional benefits beyond those covered by Original Medicare, such as:

These plans often include additional benefits beyond those covered by Original Medicare, such as:

- Dental coverage

- Vision coverage

- Hearing coverage

- Transportation services

- Gym memberships

Additionally, there are $0 premium Medicare Advantage plans available in Arizona.

It’s essential to weigh the pros and cons of Medicare Advantage plans when considering alternatives to Plan N in Arizona.

Prescription Drug Coverage with Medicare Plan N

Medicare Plan N does not include prescription drug coverage. To receive prescription drug coverage, beneficiaries must enroll in an additional Medicare Part D plan.

It is imperative to have creditable prescription drug coverage in Arizona to avoid expensive penalties.

Arizona Medicare Resources

Arizona Medicare resources, such as the Arizona Department of Economic Security and the Arizona Department of Insurance and Financial Institutions, provide assistance and information for Medicare beneficiaries seeking guidance on Medicare Supplement plans.

You can also contact the State Health Insurance Assistance Program (SHIP) at 1-800-432-4040 for free, one-on-one insurance counseling and assistance.

Summary

In conclusion, Medicare Plan N is a popular choice for Arizona residents seeking comprehensive coverage to bridge the gap left by Original Medicare.

By understanding the benefits, costs, and comparisons to other supplement plans, you can make an informed decision on whether Plan N is the right choice for you.

Remember to consider the Medigap Open Enrollment Period and choose the right provider to ensure you receive the best healthcare coverage for your individual needs.

Get Medicare Quotes in 2 Steps!

Enter Zip Code

Frequently Asked Questions

What is Medicare Plan N coverage?

Medicare Plan. N is a type of coverage that helps pay for out-of-pocket expenses not covered by Medicare Parts A and B.

It has near-comprehensive benefits, including the Part A deductible, coinsurance for Parts A and B, three pints of blood, and 80% of medical costs incurred during foreign travel. However, it does not cover the Part B deductible.

What are the disadvantages of Plan N?

Plan N has several disadvantages, as it does not provide coverage for some services such as Part B excess charges and foreign travel emergency care.

Additionally, enrollees must pay a separate annual deductible before the plan begins to cover any costs.

What is the difference between Medicare plan G & N?

Medicare Plan G covers excess charges that Plan N does not, and Plan N has copays for certain medical office and emergency department visits while Plan G does not.

Therefore, if you don’t need to pay copays often, Plan N could be cheaper overall.

What is the difference between Medicare plans F and N?

Medigap Plan F covers the Medicare Part B deductible and excess charges, while Plan N does not, making them the two key differences between the two plans.

This is an important factor to consider when choosing between the two plans.

What is Medicare Plan N in Arizona?

Medicare Plan N in Arizona is a Medicare Supplement plan that provides additional coverage beyond basic Medicare benefits.

It is designed to help cover some of the out-of-pocket costs that Medicare does not cover, such as copayments, coinsurance, and deductibles.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about Medicare Plan N in Arizona, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.