by Russell Noga | Updated October 20th, 2023

Finding the right Medicare Supplement Plan in Colorado can be overwhelming. With various options and factors to consider, it’s essential to understand the basics and make an informed decision.

Finding the right Medicare Supplement Plan in Colorado can be overwhelming. With various options and factors to consider, it’s essential to understand the basics and make an informed decision.

In this article, we’ll explore the ins and outs of Medicare Supplement Plans Colorado, including the popular Medigap plan types, costs, and how to choose the right provider.

So, let’s dive in and get a clear understanding of what Colorado’s Medicare Supplement plans have to offer!

Key Takeaways

- Medicare Supplement Plans in Colorado are available to those enrolled in Original Medicare, providing financial assistance and supplemental benefits.

- Popular plans include Plan F, G & N with varying levels of coverage. Premiums range from $72-$403/month on average.

- Enrollment is governed by Open Enrollment Periods and rating methods vary based on age and location.

Understanding Medicare Supplement Plans in Colorado

Medicare Supplement Plans, also known as Medigap plans, are designed to help cover the gaps in Original Medicare coverage (Parts A and B). Offered by Medicare-approved private insurance companies, these plans assist with cost-sharing requirements like deductibles, copayments, and coinsurance.

To be eligible for Colorado Medicare Supplement plans, individuals must be enrolled in both Medicare Parts A and B.

The Role of Medigap Plans

Medigap plans in Colorado:

- Fill the gaps in Original Medicare coverage

- Provide supplemental benefits

- Help cover out-of-pocket costs, such as deductibles, copayments, and coinsurance

- Some Medigap plans even provide coverage for excess charges and foreign travel health emergencies.

With 10 standardized Medigap plans available and regulated by both the federal government and state governments, Colorado residents have a variety of options to choose from to suit their healthcare needs.

Eligibility Criteria

Eligibility for a Medigap policy in Colorado requires individuals to be at least 65 years old and enrolled in both Medicare Part A and Part B. Colorado also offers guaranteed issue protections, which ensure that individuals can enroll without being denied coverage or charged higher premiums based on pre-existing conditions.

This makes Medicare Supplement plans an attractive option for those seeking comprehensive coverage and peace of mind, including the benefits of Medicare Supplement Insurance. With various Medicare Supplement Insurance Plans available, individuals can choose the one that best suits their needs.

Popular Medicare Supplement Plans in Colorado

Among the 12 available Medicare plans in Colorado, the most popular ones are:

- Plan F: This is the most comprehensive option, but it is limited to those who received Medicare Part A before January 1, 2020.

- Plan G: This plan offers similar coverage to Plan F but with a slightly lower premium.

- Plan N: This plan has lower premiums than Plans F and G, but requires you to pay some out-of-pocket costs.

Each of these plans offers varying levels of coverage to cater to different healthcare needs.

As alternatives to Plan F, Plans G, and D are highly recommended due to their comprehensive coverage and lower premiums. We’ll examine each of these popular Medicare Supplement Plans in Colorado in more detail.

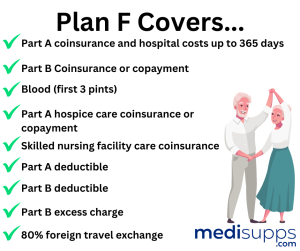

Medicare Plan F in Colorado Highlights

Medicare Plan F in Colorado Highlights

Plan F is the most comprehensive Medicare Supplement plan available in Colorado, covering 100% of the medical costs not covered by Original Medicare. However, it is only available to those who attained Medicare Part A prior to January 1, 2020.

Plan F covers a wide range of expenses, including:

- Part A co-insurance and hospital costs

- Part B co-insurance/copayments

- Blood (first 3 pints)

- Part A hospice care co-insurance/copayments

- Skilled nursing facility care coinsurance

- Part A and B deductibles

- Part B excess charge

- Foreign travel exchange (up to plan limits)

The average cost of Plan F in Colorado is $280.90.

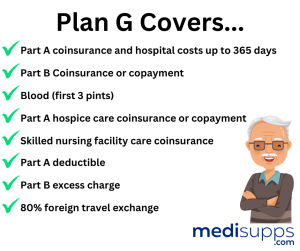

Medicare Plan G in Colorado Highlights

Plan G in Colorado offers coverage comparable to Plan F, except for the Medicare Part B annual deductible. It covers expenses such as:

- Part A co-insurance and hospital costs

- Part B co-insurance/copayments

- Blood (first 3 pints)

- Part A hospice care co-insurance/copayments

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B excess charge

- Foreign travel exchange (up to plan limits)

The average monthly cost of Medicare Plan G in Colorado is $180.80.

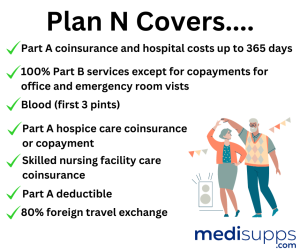

Medicare Plan N in Colorado Highlights

Medicare Plan N in Colorado Highlights

Medicare Plan N in Colorado offers the following coverage:

- Part A co-insurance and hospital costs

- Part B co-insurance/copayments

- Blood (first 3 pints)

- Part A hospice care co-insurance/copayments

- Skilled nursing facility care coinsurance

- Part A deductible

- Foreign travel exchange (up to plan limits)

However, it does not cover Medicare Part B deductible or excess charges.

The average cost of Plan N in Colorado is $149.60.

Costs of Medicare Supplement Plans in Colorado

The cost of Medigap plans in Colorado varies depending on factors such as:

- specific plan type

- provider

- age

- tobacco use

Premiums for Medicare Supplement plans in Colorado range from $72 to $403 per month, with the average monthly premium for Medicare Supplement Plan N being $149.60.

Invest time in researching and comparing the costs of different plans to identify the one that aligns best with your budget and healthcare needs.

Average Premiums

The average premiums for Medicare Supplement Plans in Colorado depend on the plan type and provider. The cost of Medicare Supplement Plan F in Colorado is on average $280.90.

Similarly, Medicare Plan G has an average cost of $180.80. Since costs can fluctuate considerably, you should compare the prices of various plans and providers before deciding.

Factors Affecting Costs

Several factors can affect the cost of Medigap policies in Colorado, such as age, gender, and location. The attained-age rating method bases premiums on the individual’s current age, resulting in an increase in premiums as the individual ages.

Gender does not affect the cost of Medicare Supplement Plans in Colorado, as the cost is determined by factors like age, location, tobacco use, and health issues.

Location can also impact plan costs, as variables like the cost of living, healthcare provider rates, and competition among insurance companies can differ across Colorado regions.

Comparing Colorado Medicare Supplement Providers

When choosing a Medicare Supplement provider in Colorado, it’s essential to research and compare the top carriers and coverage options. Factors to consider include costs, reputation, and the range of coverage offered.

The subsequent sections will cover top carriers in Colorado and offer advice on choosing the appropriate provider for your needs.

Top Carriers in Colorado

Leading providers of Medicare Supplement Plans in Colorado include Cigna, Physicians Life Insurance Company, and Anthem Blue Cross Blue Shield. These providers offer a range of Medicare Supplement Plans, including Plan F, Plan G, Plan N, and others.

Notable providers in Colorado include:

- Physicians Life Insurance Company

- Cigna National Health Insurance Company

- Anthem Blue Cross Blue Shield of Colorado

- Aetna

- UnitedHealthcare

Compare these carriers to identify the provider that meets your healthcare needs and budget most effectively.

Tips for Choosing a Provider

Tips for Choosing a Provider

When choosing a Medicare Supplement provider in Colorado, factors like costs, reputation, and coverage options should be taken into account.

To determine the financial stability of a provider, consult independent companies like Standard and Poor or Weiss Research Inc for financial ratings, or contact your local library or the Colorado Division of Insurance for more information.

To ascertain the customer service reputation of a provider, you can:

- Utilize the Medicare-compliant form

- Follow the plan’s instructions to file complaints or grievances

- Contact the State Health Insurance Assistance Program (SHIP) for free, unbiased assistance.

Lastly, compare the coverage options offered by Medicare Supplement plan providers in Colorado by referring to resources like:

- the Colorado Division of Insurance

- MedicareGuide.com

- HealthInsurance.org

- Medicare.gov

Stand-Alone Coverage Options

Stand-alone dental, vision, and hearing plans are available for those who do not want a Medicare Supplement plan. These plans offer supplementary coverage not included in Original Medicare or a Medigap plan, allowing individuals to tailor their healthcare coverage to their specific needs.

Some of the most recommended stand-alone dental insurance plans in Colorado for seniors include CIGNAPlus Savings Dental Network Access Plan, Spirit Dental Network, SureBridge, Ameritas Life Insurance Corp, Humana, Standard Life and Accident Insurance Company, Golden, Humana Bright Plus Veterans, Preventive Value, and Loyalty.

Vision insurance plans available in Colorado for the elderly include Humana, VSP EyeMed, Anthem BlueCross BlueShield, and UnitedHealthcare.

Highly rated stand-alone hearing plans for Medicare beneficiaries in Colorado include Humana, UnitedHealthcare, Aetna, and Kaiser Permanente.

Enrollment Process for Medicare Supplement Plans in Colorado

Enrolling in a Medicare Supplement Plan in Colorado involves several steps, including understanding the Open Enrollment Period and the 6-month Medigap Open Enrollment Period. During the Open Enrollment Period, applicants cannot be denied coverage or charged higher premiums due to health issues.

The 6-month Medigap Open Enrollment Period commences when an individual celebrates their 65th birthday and enrolls in Medicare Part B. We’ll examine how these enrollment periods influence your eligibility for a Medicare Supplement Plan in Colorado.

Open Enrollment Period

Open Enrollment Period

The Open Enrollment Period for Medicare Supplement Plans in Colorado is a six-month window that commences on the initial day of the month in which you attain the age of 65 and are enrolled in both Parts A and B. During this period, applicants are guaranteed the rights of guaranteed issue, no denial of coverage, and the freedom to choose from any plan and carrier available to them.

This period provides an opportunity for individuals to secure comprehensive coverage without the worry of being denied or charged higher premiums due to pre-existing health conditions.

6-month Medigap Open Enrollment Period

The 6-month Medigap Open Enrollment Period in Colorado provides a crucial window for individuals to enroll in a Medicare Supplement Plan without facing the challenges of medical underwriting or higher premiums. This period begins when an individual attains the age of 65 and enrolls in Medicare Part B.

If you do not enroll in a Medicare Supplement plan during this period, you may still apply for coverage at any time; however, you may be subject to increased premiums or even denied coverage altogether.

Colorado Medicare Supplement Plan Rating Methods

Colorado Medicare Supplement Plan Rating Methods

Understanding the three premium determination methods – attained-age, issue-age, and community-rated – is important when considering Medicare Supplement Plans in Colorado.

Attained-age-rated policies base premiums on the individual’s current age, meaning that premiums increase as the individual ages. Issue-age-rated policies base premiums on the age of the individual at the time of enrollment, while community-rated policies charge the same premium for all individuals enrolled in the same plan within a specific geographic location, regardless of their age.

By understanding these rating methods, you can make an informed decision about which Medicare Supplement Plan is right for you.

How to Enroll

Begin your enrollment in a Medicare Supplement Plan in Colorado by following these steps:

- Explore coverage options and compare different plans and providers.

- Once you’ve found a provider that aligns with your healthcare needs and budget, complete the application process.

- Provide all necessary documentation, such as your Medicare card, proof of age, and proof of Colorado residency.

You can enroll in a Medicare Supplement Plan in Colorado online by visiting the websites of insurance providers like Anthem or Medicare.gov. By following these steps, you’ll be well on your way to securing comprehensive healthcare coverage tailored to your needs.

Compare Medicare Plans & Rates in Your Area

Summary

In conclusion, Medicare Supplement Plans in Colorado offer a wide range of coverage options to help bridge the gaps in Original Medicare.

With popular plans like F, G, and N, as well as various factors affecting costs and premiums, it’s essential to research and compare plans to find the one that best suits your healthcare needs and budget.

Don’t forget to consider alternatives such as Medicare Advantage Plans and stand-alone coverage options, and be mindful of the enrollment process to ensure you secure the most comprehensive coverage possible.

Armed with this information, you’re now ready to make an informed decision and find the perfect Medicare Supplement Plan in Colorado to support your healthcare journey.

Compare Medigap Plans & Rates

Enter Zip Code

Frequently Asked Questions

What are Medicare Supplement Plans in Colorado for 2024?

Medicare Supplement Plans in Colorado for 2024, also known as Medigap plans, are private insurance policies designed to complement Original Medicare. They help cover the gaps in healthcare costs that Medicare doesn’t pay for.

How many types of Medicare Supplement Plans are available in Colorado for 2024?

In Colorado for 2024, there are ten standardized Medicare Supplement Plans labeled with letters (A, B, C, D, F, G, K, L, M, and N). These plans offer different coverage levels to meet individual needs.

Are the benefits of each Medicare Supplement Plan the same across different insurance companies in Colorado?

Yes, the benefits for each standardized Medigap plan are the same, regardless of the insurance company. However, the prices and availability of these plans can vary.

Can I purchase a Medicare Supplement Plan in Colorado if I have a Medicare Advantage plan?

You cannot have both a Medicare Supplement Plan and a Medicare Advantage plan at the same time. You must choose one or the other.

Is there an open enrollment period for Medicare Supplement Plans in Colorado in 2024?

Yes, there is a six-month open enrollment period when you first enroll in Medicare Part B. During this period, insurance companies are generally required to sell you any Medicare Supplement Plan without underwriting.

What are the costs associated with Medicare Supplement Plans in Colorado?

The cost of Medigap plans can vary, depending on the insurance company, your age, and your location in Colorado. Premiums are paid in addition to your Original Medicare premiums.

Do Medicare Supplement Plans in Colorado cover prescription drugs?

No, Medigap plans do not cover prescription drugs. To get prescription drug coverage, you’ll need to enroll in a Medicare Part D plan.

Can I use my Medicare Supplement Plan anywhere in the U.S.?

Yes, Medicare Supplement Plans provide nationwide coverage, so you can use them anywhere in the United States where Medicare is accepted.

Do Medigap plans in Colorado offer coverage for preventive services like dental and vision?

Generally, Medicare Supplement Plans do not cover routine dental and vision care. You may need to purchase separate dental or vision insurance for these services.

Can I switch between different Medicare Supplement Plans in Colorado in 2024?

You can change your Medigap plan at any time, but you may need to go through medical underwriting if it’s outside the open enrollment period. It’s important to consider this before making changes to your coverage.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan, or you have questions about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be pleased to help you!

Medicare Supplement Plans By City

Russell Noga is the CEO and Medicare editor of Medisupps.com. His 15 years of experience in the Medicare insurance market includes being a licensed Medicare insurance broker in all 50 states. He is frequently featured as a featured as a keynote Medicare event speaker, has authored hundreds of Medicare content pages, and hosts the very popular Medisupps.com Medicare Youtube channel. His expertise includes Medicare, Medigap insurance, Medicare Advantage plans, and Medicare Part D.