by Russell Noga | Updated October 3rd, 2024

Are you considering enrolling in a BCBSIL Medicare Plan N?

Are you considering enrolling in a BCBSIL Medicare Plan N?

This comprehensive guide will help you understand the benefits of this popular Medicare Supplement plan, compare it to other plans like Plan G and Plan F, and provide insights into cost savings, enrollment periods, eligibility, and more.

By the end of this article, you will have a clear understanding of whether Plan N is the right choice for you.

Short Summary

- BCBSIL Medicare Plan N is a cost-sharing plan that provides basic benefits and helps to reduce healthcare costs.

- Comparing BCBSIL plans such as Plan F, G, K, L & N can help select the most suitable plan for individual needs.

- Disabled individuals under 65 are eligible with no health exclusions and premium discounts may be available depending on provider.

Understanding BCBSIL Medicare Plan N

BCBSIL Medicare Plan N is a popular Medicare Supplement plan that offers basic benefits for Medicare coverage while providing cost-sharing features to help reduce healthcare costs.

Similar to Plan G, Plan N does not cover the Medicare Part B deductible. Plan N requires a possible $20 copayment for office visits and a $50 copayment for emergency room visits.

Medicare Plan N is a great option for those who want to save money on their healthcare costs yet still have comprehensive coverage.

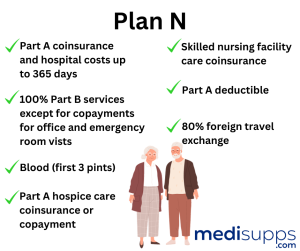

Coverage Details

Coverage Details

Medigap Plan N provides similar medical coverage as other popular Medicare Supplement plans, including the 20% coinsurance that Medicare Part B does not cover.

It also offers coverage for skilled nursing facility care up to 100 days.

In addition to these basic benefits, BCBSIL Medicare Plan N may include extra benefits such as:

Plan N allows policyholders to enjoy a wide range of healthcare services provided by their insurance company, including those offered by private insurance companies, while keeping their out-of-pocket costs manageable.

Medicare Part B Deductible

With BCBSIL Medicare Plan N, you have the freedom to choose your own doctors and specialists, as long as they accept Medicare patients.

Plan N provides coverage for medical expenses after your original Medicare benefits end, ensuring continuous health care coverage.

However, it is important to note that Plan N does not cover the annual Medicare Part B deductible, which means you will need to pay this amount out-of-pocket before your Plan N coverage kicks in. This deductible amount changes each year.

Compare 2025 Medigap Rates

Enter Zip Code

Comparing BCBSIL Medicare Supplement Plans

To help you make an informed decision, it is crucial to compare BCBSIL Medicare Plan N with other popular plans, such as Plan G and Plan F.

Blue Cross and Blue Shield of Illinois offer several Medicare Supplement Plans, including:

- Plan F

- Plan G

- Plan K

- Plan L

- Plan N

They also offer their Med-Select counterparts.

By understanding the differences and similarities between these plans, you can choose the one that best fits your needs and preferences.

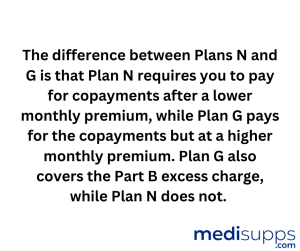

Medicare Plan N vs. Plan G

Medicare Plan N and Plan G share many similarities, with the exception of a few key differences. While Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room visits, Plan G covers the full cost of these services.

Additionally, Plan G covers the annual Medicare Part B deductible, whereas Plan N does not.

Both BCBSIL Medicare Plan G and BCBSIL Medicare-Select Plan G offer the same advantages, but the Medicare-Select version provides cost savings by requiring policyholders to use a Medicare Select participating hospital for non-emergency care.

This can be an attractive option for those looking to save on premiums without sacrificing coverage.

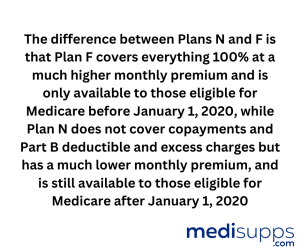

Medicare Plan N vs. Plan F

Plan F is the most popular and comprehensive Medicare Supplement plan available in Illinois, providing coverage for any Part B medical expenses not covered by other plans. It covers the full cost of services, with no copayments or deductibles required.

In contrast, Plan N requires copayments for office and emergency room visits and does not cover the Medicare Part B deductible. With a Medicare supplement insurance plan like Plan F, you can have peace of mind knowing that your healthcare costs are covered.

However, Plan F comes with a higher premium due to its comprehensive coverage. High Deductible Plan F offers the same benefits as Plan F but requires an annual deductible to be met before benefits begin.

This option can result in significantly lower premiums compared to Standard Plan F.

When comparing Plan N and Plan F, it is essential to consider your individual healthcare needs and financial situation. If you prefer comprehensive coverage without copayments and can afford a higher premium, Plan F might be the best choice.

On the other hand, if you are willing to pay copayments for certain services and want to save on premiums, Plan N could be a suitable option.

Only those enrolled prior to January 1st of 2020 may enroll in a Medicare Plan F.

Enrollment Periods and Eligibility for Plan N

Enrollment Periods and Eligibility for Plan N

To enroll in BCBSIL Medicare Plan N, you must first enroll in Medicare Part A and Part B. The Medigap policy has an open enrollment period of six months. This period starts on the first day of the month in which you turn 65 and are enrolled in Medicare Part B.

It is essential to enroll during this period, as missing it may result in limited access to Medigap policies and higher costs.

If you reside in Illinois and are between the ages of 65-75, the Illinois Senate Bill 147 provides an additional 45-day annual enrollment period commencing on your birthday.

Your application will not be rejected, limited, or discriminated against in terms of pricing of coverage during this period. This includes issues such as:

- health status

- claims experience

- receipt of health care

- a medical condition

Disabled individuals under 65 who qualify for Medicare Part A and Part B are eligible to join a BCBSIL Medicare Supplement plan with no health exclusions.

Coverage will start immediately without any waiting period. However, these individuals will be charged the 100+ age rate for their plan.

Premium Discounts and Reduced Rates

BCBSIL Medicare Plan N policyholders may be eligible for premium discounts and reduced rates, depending on the insurance provider. These discounts can include reduced rates for non-smokers, married couples, or those who enroll online.

It is important to explore your options and inquire about any available discounts when choosing a Medicare Supplement plan.

You may be eligible for a discount if you and at least one other person residing in the same household are both enrolled in a BCBSIL Medicare Supplement Insurance policy effective on or after May 1, 2019. Additionally, this discount may be applicable to you.

You may qualify for a discount when you enroll in a BCBSIL Medicare Supplement Insurance policy. This applies if you were enrolled in either employer-provided or individual health coverage with a Blue Cross and Blue Shield plan issued in Illinois, Montana, New Mexico, Oklahoma, or Texas within one year of the policy’s effective date.

Additional Benefits and Programs

Additional Benefits and Programs

BCBSIL Medicare Plan N offers more than just basic medical coverage. Additional benefits and programs may include:

- Dental coverage

- Vision coverage

- Hearing coverage

- Fitness access

These additional benefits provide a well-rounded healthcare experience.

These additional benefits and programs of BCBSIL Medicare Plan N include:

- Higher quality of life

- Overall well-being

- Reliable coverage

- Wide range of healthcare services

These benefits and programs contribute to a comprehensive and valuable choice for individuals seeking reliable coverage and a wide range of healthcare services.

Plan N Rates for Illinois Residents

The rates for BCBSIL Medicare Plan N in Illinois vary depending on whether you reside inside Cook, DuPage, Kane, Lake, McHenry, or Will counties, or outside of these specific counties. It is essential to check the rates applicable to your area when considering enrolling in Plan N.

BCBSIL Medicare Supplement plans in Illinois calculate their rates using a non-tobacco rate, ensuring that all residents have access to fair and affordable coverage.

By understanding the rates for your specific location, you can make an informed decision when selecting a Medicare Supplement plan.

Use our FREE online quote engine to check rates from top insurance companies for Medicare Plan N.

Compare Medicare Plans & Rates in Your Area

How to Choose the Right BCBSIL Medicare Supplement Plan

To choose the right BCBSIL Medicare Supplement plan, it is essential to consider several factors, such as:

- Coverage

- Cost

- Network

- Flexibility

- Prescription drug coverage

- Enrollment period

By comparing the different plans and weighing their pros and cons, you can make an informed decision that best suits your individual needs and preferences.

When considering which plan to choose, think about your healthcare needs, financial situation, and lifestyle. For example, if you prefer more comprehensive coverage without copayments and can afford a higher premium, Plan G or even Plan F might be the best choice.

On the other hand, if you are willing to pay copayments for certain services and want to save on premiums, Medicare Plan N could be a suitable option.

Once you have determined which plan is the best fit for you, we can help you enroll in the plan.

Remember, your healthcare needs may change over time, so it is essential to reevaluate your coverage periodically to ensure you are always protected with the right plan.

Summary

In conclusion, BCBSIL Medicare Plan N offers a balanced combination of coverage and cost savings, making it an attractive option for many individuals seeking reliable Medicare Supplement insurance.

By comparing Plan N with other popular plans like Plan G and Plan F, considering your individual healthcare needs, and exploring available discounts and reduced rates, you can make an informed decision and choose the plan that best meets your needs.

Don’t leave your healthcare coverage to chance; invest in a Medicare Supplement plan that will provide you with the peace of mind you deserve.

Compare 2025 Plans & Rates

Enter Zip Code

Frequently Asked Questions

What is BCBSIL Medicare Plan N?

BCBSIL Medicare Plan N is a Medicare Supplement plan offered by Blue Cross Blue Shield of Illinois. It provides comprehensive coverage for Medicare beneficiaries, helping to pay many of the gaps in Medicare Part A and Medicare Part B.

How does BCBSIL Medicare Plan N differ from Original Medicare?

BCBSIL Medicare Plan N is a Medicare Supplement plan, that works with Original Medicare consists of Part A and Medicare Part B. Medigap Plan N helps supplement both parts, and you may not enroll in Medigap Plan N without having Original Medicare in place.

What are the key benefits of BCBSIL Medicare Plan N?

BCBSIL Medicare Plan N covers hospitalization, doctor visits, and preventive care helping to fill many of the gaps in Original Medicare.

How does the cost-sharing work with BCBSIL Medicare Plan N?

Plan N typically has cost-sharing in the form of copayments or coinsurance for certain services. You may have copays for doctor visits and emergency room visits.

Can I use my own doctors with BCBSIL Medicare Plan N?

BCBSIL Medicare Plan N is accepted by doctors who accept Medicare Part B.

Does BCBSIL Medicare Plan N cover prescription drugs?

No, BCBSIL Medicare Plan N does not include prescription drug coverage.

What is the monthly premium for BCBSIL Medicare Plan N?

Premiums for BCBSIL Medicare Plan N can vary depending on your location and the specific plan. Call us for help.

Can I switch to BCBSIL Medicare Plan N during the Annual Enrollment Period?

Yes, you can generally switch to BCBSIL Medicare Plan N during the Annual Enrollment Period (AEP), however, if you are enrolled in a Medigap plan now you may apply to switch at any time during the year.

How do I enroll in BCBSIL Medicare Plan N?

Call us today for help.

Find the Right Medicare Plan for You

Finding the right Medicare plan doesn’t have to be confusing. Whether it’s a Medigap plan or you have inquires about Medicare Advantage or Medicare Part D, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!