by Russell Noga | Updated December 26th, 2023

Average Cost of Medicare Supplement Plan G

Navigating the world of Medicare Supplement plans can be overwhelming, but understanding the costs associated with Plan G is crucial for making informed decisions.

With various factors influencing the cost, it’s essential to compare different providers and consider factors like age, location, gender, and tobacco use.

This article provides a comprehensive guide to the average cost of Medicare Supplement Plan G and offers valuable insights on saving money and choosing the right plan for your needs.

Key Takeaways

- Cost of Medicare Supplement Plan G is impacted by age, location, gender and tobacco use.

- Compare costs among insurance providers to get the best coverage at lowest cost.

- Enroll during Medigap Open Enrollment Period for maximum benefit and savings.

Understanding Medicare Supplement Plan G

Medicare Supplement Plan G, also known as Medigap Plan G, is a popular choice among Medicare beneficiaries due to its comprehensive Medicare supplement coverage.

Medicare Supplement Plan G, also known as Medigap Plan G, is a popular choice among Medicare beneficiaries due to its comprehensive Medicare supplement coverage.

This plan helps fill the gaps left by Original Medicare (Part A and Part B), covering expenses like coinsurance, copayments, and deductibles that would otherwise be out-of-pocket costs for individuals.

Unlike a Medicare Advantage plan, which is an alternative to Original Medicare, a Medicare Supplement plan works alongside Original Medicare to help reduce out-of-pocket expenses. With a variety of Medigap plans available, it’s essential to find the right one to suit your needs.

Plan G covers a wide range of services, including hospitalization, skilled nursing facility care, and even foreign travel emergency care.

However, bear in mind that Plan G does not cover prescription drugs. Individuals who require prescription drug coverage may consider enrolling in a stand-alone Medicare Part D plan to complement their Original Medicare and Medicare Supplement Plan G coverage.

Factors Affecting the Cost of Medicare Supplement Plan G

The cost of Medicare Supplement Plan G is influenced by several factors, such as:

- Age

- Location

- Gender

- Tobacco use

Different pricing methods and state regulations also play a role in determining the premiums for this plan.

The subsequent sections will further examine these factors and their effect on the cost of Medicare Supplement Plan G.

Age and Pricing Methods

Insurance companies use one of three rating methods to calculate the cost of a Medigap policy:

- Community-rated: everyone pays the same monthly premium regardless of their age.

- Issue age-rated: premiums are based on an individual’s age at the time of purchase, generally resulting in younger individuals paying lower premiums than older individuals.

- Attained-age-rated: premiums increase as an individual ages, factoring in their current age.

Grasping these pricing methods is key when comparing Medicare Supplement Plan G costs, as they have a significant impact on the premiums you pay.

While some factors, such as inflation, may cause all premiums to increase over time, choosing a plan with a pricing method that suits your needs and budget can help manage the overall cost of your Medicare Supplement Plan G.

Location and State Regulations

Location and state regulations can have a considerable impact on the cost of Medicare Supplement Plan G.

States may have different regulations regarding pricing methods for Medicare Supplement Insurance.

This means it’s not always possible to use the same pricing method in each state. As a result, the cost of Plan G can vary significantly between states.

Moreover, Medigap premium rates depend on the geographical location, further contributing to the variations in Plan G costs across different areas.

Thus, if you’re thinking about enrolling in Medicare Supplement Plan G, it’s important to study the available plans and pricing methods in your state and compare costs to make a sensible choice.

Gender and Health Factors

Gender and health factors can also influence the cost of Medicare Supplement Plan G. Here are some key points to consider:

- Women generally pay lower premiums due to their better average health.

- Insurance companies consider the overall health status of their policyholders when determining premiums.

- Individuals with better health may qualify for lower costs.

During the enrollment period, a health assessment may affect the cost of Medicare Supplement Plan G. If an individual has a pre-existing health condition, medical underwriting may be applied, resulting in higher premiums or even denial of coverage.

Therefore, it’s important to take your health status and any pre-existing conditions into account when selecting a Medicare Supplement Plan G that suits your needs and budget.

Tobacco Use and Premiums

Tobacco use is another factor that can significantly affect the cost of Medicare Supplement Plan G. Due to the increased health risks associated with tobacco use, insurance companies typically charge higher premiums for tobacco users.

This is an essential consideration for smokers or individuals who use tobacco products when enrolling in a Medicare Supplement Plan G, as the increased premiums can impact their overall healthcare expenses.

To find the most suitable rates and coverage for your needs, it’s key to compare the costs of Medicare Supplement Plan G among different insurance providers, considering various factors such as:

- Age

- Location

- Gender

- Tobacco use

- Pricing methods

Average Cost of Medicare Supplement Plan G: National and Regional Breakdown

The average cost of Medicare Supplement Plan G varies depending on the factors previously discussed, such as:

- Age

- Location

- Gender

- Tobacco use

This means the premiums for Plan G can differ significantly across different areas, making it essential to compare costs and coverage in your specific region.

If you’re contemplating enrolling in Medicare Supplement Plan G, it’s important to:

- Study the available plans in your area

- Compare costs to guarantee you’re getting the best value for your healthcare needs

- Utilize online tools and consult with licensed Medicare agents to help you make informed decisions regarding your Medicare Supplement Plan G coverage and costs.

Comparing Plan G Costs Among Insurance Providers

Comparing Plan G costs among various insurance providers is an essential step in finding the best coverage and rates for your needs.

Some factors to consider when comparing different providers include customer satisfaction, extra benefits, and plan options.

Insurance providers that offer Medicare Supplement plans, also known as Medicare supplemental insurance, include private insurance companies such as:

- Mutual of Omaha

- Anthem

- UnitedHealthcare

- State Farm

These providers may offer different rates and benefits for Plan G, so it’s important to comprehensively compare their offerings to guarantee you’re getting the best value for your healthcare needs.

Consulting with a licensed insurance agent or Medicare representative can also provide personalized guidance and help you make informed decisions regarding your Medicare Supplement Plan G coverage.

Saving Money on Medicare Supplement Plan G

There are several strategies for reducing the cost of Medicare Supplement Plan G. One of the most effective ways to save money on Plan G is to enroll during the Medigap Open Enrollment Period.

This six-month period starts the month you turn 65 and are enrolled in Medicare Part B. During this time, insurance companies cannot deny coverage or charge higher premiums based on your health status, which can result in significant savings.

Other ways to save money on Medicare Supplement Plan G include exploring household discounts offered by certain carriers and evaluating different payment methods, such as electronic payments, which may provide additional savings.

By considering these tips and comparing costs among different insurance providers, you can find the best rates for your Medicare Supplement Plan G coverage.

Plan G vs. Other Medicare Supplement Plans

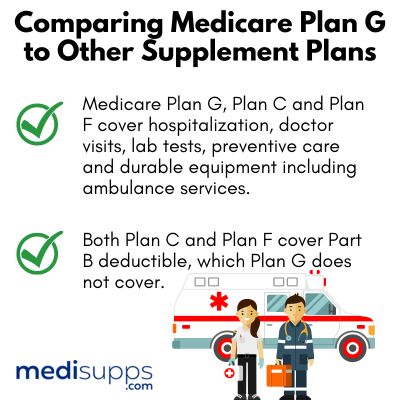

When opting for a Medicare Supplement plan, it’s necessary to compare Plan G with other options like Plan F and Plan N, to identify the best coverage for your individual needs.

Plan F, for example, covers the Part B deductible and Part B excess charges, making it a more comprehensive option than Plan G.

However, Plan F is no longer available to new Medicare beneficiaries as of January 1, 2020.

Plan N, on the other hand, provides similar coverage to Plan G but requires copayments and does not cover Medicare Part B excess charges.

By comparing the coverage and medicare supplement plans cost of Plan G with other Medicare Supplement plans, you can make an informed decision regarding the most suitable option for your healthcare needs and budget.

How to Choose the Right Medicare Supplement Plan for You

The right Medicare Supplement plan for you depends on factors like:

- coverage,

- budget,

- and personal health needs.

To make a sensible choice, it’s important to study the available plans in your area, use online tools to compare costs and benefits and consider your specific needs and budget.

Speaking with a licensed insurance agent or Medicare representative can also provide personalized guidance and help you find the best plan for your needs.

Keep in mind that your health status and any pre-existing conditions may affect your eligibility for certain plans or result in higher premiums.

Therefore, it’s important to take these factors into account when choosing a Medicare Supplement plan that provides the coverage you need at a price that suits your budget.

Enrolling in Medicare Supplement Plan G

Once you’ve decided that Medicare Supplement Plan G is the right choice for your healthcare needs, you can proceed to enroll.

Once you’ve decided that Medicare Supplement Plan G is the right choice for your healthcare needs, you can proceed to enroll.

As previously mentioned, the optimal time to sign up for Plan G is during the Medigap Open Enrollment Period.

During this period, insurance companies cannot deny coverage or charge higher premiums based on your health status, ensuring you get the best rates possible.

Securing the best rates for Medicare Supplement Plan G involves:

- Comparing costs across different insurance providers

- Considering the factors that influence premiums, such as age, location, gender, and tobacco use

- Researching available plans

- Utilizing online tools

- Consulting with licensed Medicare agents

By following these steps, you can secure the best rates and coverage for your Medicare Supplement Plan G.

Summary

Understanding the average cost of Medicare Supplement Plan G and the factors affecting its premiums is essential for making informed decisions about your healthcare coverage.

By comparing different providers and considering factors like age, location, gender, tobacco use, and pricing methods, you can find the best rates and coverage for your needs.

With the right information and guidance, you can confidently choose a Medicare Supplement Plan G that offers comprehensive coverage and fits your budget, ensuring peace of mind for your healthcare future.

Frequently Asked Questions

What is the average price of a Medicare Supplement Plan G?

On average, Medicare Supplement Plan G can cost up to $150 per month in 2023, with rates varying by age and state. 32% of Medigap beneficiaries have Plan G.

How much is Medicare Plan G for 2023?

Medicare Plan G costs on average between $100 and $300 monthly in 2023, with the cost varying depending on factors like location, gender, and age.

Is Medicare Plan G any good?

Medicare Plan G provides comprehensive coverage, pays for copays, coinsurance and out-of-pocket expenses after the Part B deductible is met, and offers good benefits, earning it an “A+” rating. Thus, Medicare Plan G is an excellent choice for those looking for quality health coverage.

Do Plan G premiums increase with age?

No, Plan G premiums do not increase with age; rather, everyone pays the same monthly premium, regardless of their age.

What coverage does Medicare Supplement Plan G provide?

Plan G provides coverage for coinsurance, copayments, deductibles, hospitalization, skilled nursing facility care, and foreign travel emergency care – all costs which would typically be out-of-pocket.

Find the Right Medicare Plan for You

Finding the right Medicare Plan 2024 doesn’t have to be confusing. Whether it’s a Medigap plan, or you want to know more about the average cost of Medicare Supplement Plan G, we can help.

Call us today at 1-888-891-0229 and one of our knowledgeable, licensed insurance agents will be happy to assist you!