by Russell Noga | Updated July 23rd, 2025

Looking for information on Medicare Supplement Plans Alabama 2026? This article covers upcoming changes, including new drug cost caps, plan adjustments, and their impact on your healthcare. Find out what you need to know to choose the right plan for you.

Key Takeaways

- Alabama offers 10 Medigap plans, providing coverage for out-of-pocket costs not covered by Original Medicare, with specific restrictions on certain plans for new enrollees.

- Significant changes in 2026 include a $2,000 cap on out-of-pocket drug costs under Medicare Part D and negotiations for prices on high-cost medications, enhancing affordability for beneficiaries.

- When selecting a Medicare Supplement Plan, beneficiaries should consider factors like monthly premiums, out-of-pocket costs, and the freedom to choose healthcare providers without network restrictions.

Compare 2026 Plans & Rates

Enter Zip Code

Overview of Medicare Supplement Plans in Alabama

Medicare Supplement Plans, commonly known as Medigap, are designed to cover healthcare costs that Original Medicare (Parts A and B) does not, such as copayments and deductibles. These plans play a crucial role in helping Medicare beneficiaries manage out-of-pocket expenses, providing a safety net that Original Medicare alone cannot.

In Alabama, there are currently 10 different Medigap plans available to choose from, each offering varying levels of coverage to suit different healthcare needs and budgets. While Plans C, E, F, H, I, and J are no longer available for new enrollees, they remain accessible for those already enrolled before 2020.

Alabama residents should also be aware that they cannot be enrolled in both a Medigap plan and a Medicare Advantage plan simultaneously.

Key Changes to Medicare Supplement Plans in 2026

Significant changes are coming to Medicare Supplement Plans in 2026, largely influenced by the Inflation Reduction Act. One of the most impactful changes is the introduction of a cap on out-of-pocket costs for drugs covered under a Medicare Part D plan. Starting in 2025, there will be a $2,000 limit on these expenses, providing much-needed financial relief for beneficiaries. Additionally, the coverage gap phase for Medicare Part D enrollees will be eliminated, ensuring continuous coverage without unexpected costs.

From 2026, beneficiaries will also benefit from negotiated prices for 10 high-cost Medicare drugs. These changes aim to make prescription drug coverage more affordable and accessible, reflecting a broader effort to reduce healthcare costs for Medicare beneficiaries.

Anyone planning their healthcare strategy should stay informed about these updates for the coming years.

Top Medicare Supplement Plan Options in Alabama

Alabama offers a range of Medicare Supplement plans designed to meet diverse healthcare needs and financial situations, providing different levels of coverage for out-of-pocket expenses.

The right plan depends on individual healthcare needs, budget, and preferences.

Plan G

Plan G is among the most comprehensive Medicare Supplement plans, covering nearly all out-of-pocket costs that Original Medicare does not. This includes Part A coinsurance, hospital costs, and foreign travel emergencies, making it attractive for many beneficiaries.

The only significant expense not covered by Plan G is the annual Part B deductible. The extensive coverage, including benefits for excess charges, makes it a popular choice for those seeking robust healthcare protection.

Plan N

Plan N is favored for its lower monthly premiums compared to other Medigap options, such as Plan G. Plan N helps cover many out-of-pocket expenses while keeping monthly premiums affordable, allowing beneficiaries to save on overall healthcare costs.

Plan N requires cost-sharing for certain services, such as copayments for doctor visits and emergency room visits. This balance of cost savings and essential coverage makes Plan N a favored choice for managing healthcare expenses effectively.

High-Deductible Plan F

The high-deductible version of Plan F suits beneficiaries preferring lower monthly premiums but willing to meet a higher deductible before coverage starts. This plan allows for affordable monthly premiums while ensuring that beneficiaries have coverage for major medical expenses once the deductible is met.

In 2026, the deductible for High-Deductible Plan F is set at $2,870, making it a viable option for those who want to reduce their monthly insurance costs while still having protection against significant out-of-pocket expenses. Starting at approximately $64 per month, it remains among the most affordable Medigap options.

Eligibility Requirements for Medicare Supplement Plans

Several factors determine eligibility for Medicare Supplement Plans in Alabama. Residents can enroll in various Medigap plans, such as:

- A

- B

- C

- D

- F

- G

- H

- K

- L

- M

- N

Individuals born in 1954 or earlier can enroll in Medigap Plan F or C despite new restrictions.

The open enrollment period for Medicare supplements lasts six months after Medicare Part B begins. Insurers must accept applicants regardless of pre-existing conditions during this period. Afterward, applicants might need to pass health underwriting to enroll in a Medigap plan.

To avoid coverage delays, ensure enrollment in Medicare Parts A and B before turning 65. Enrollment can begin up to three months before your 65th birthday.

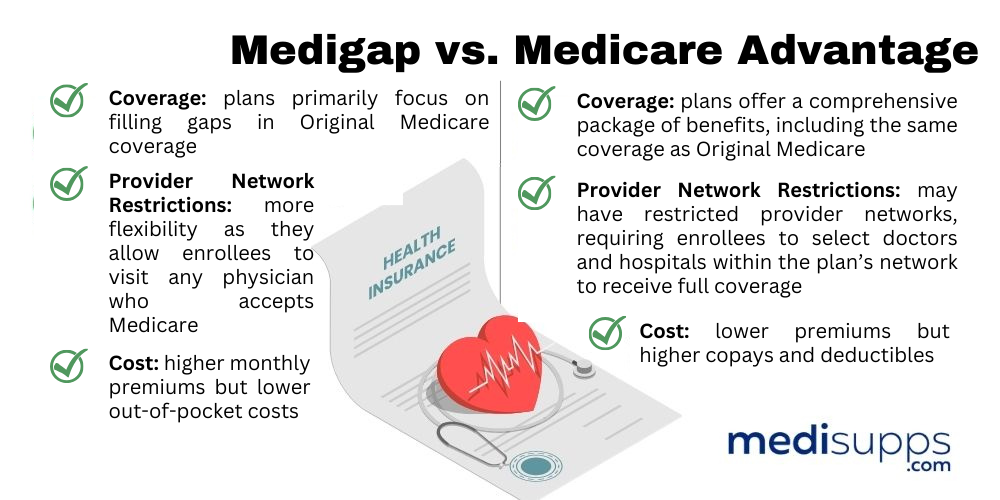

Comparing Medicare Supplement Plans vs. Medicare Advantage Plans

Understanding the key differences is crucial when deciding between Medicare Supplement Plans and Medicare Advantage Plans. Medigap plans do not include prescription drug coverage, so beneficiaries need a separate Medicare Part D plans. In contrast, many Medicare Advantage Plans bundle prescription drug coverage within the plan.

Medicare Advantage Plans may have lower monthly premiums but often come with higher out-of-pocket costs at the time of service. Medicare Supplement Plans allow patients to see any doctor who accepts Medicare, providing greater flexibility compared to the network restrictions in Medicare Advantage Plans.

It’s also crucial to consider how existing medical coverage interacts with the Medicare Supplement plan you’re evaluating.

How to Enroll in a Medicare Supplement Plan in Alabama

Enrolling in a Medicare Supplement Plan in Alabama starts on the first day of the month when you turn 65, with an initial six-month enrollment period. Begin by requesting an enrollment kit that provides the necessary tools and information to guide you through the application.

Following the enrollment kit guidelines ensures a smooth application process. Accurately and timely completing the application ensures you can take full advantage of the benefits offered by your chosen Medigap plan without delays.

Compare Medicare Plans & Rates in Your Area

Costs Associated with Medicare Supplement Plans

Medicare Supplement Plans, or Medigap, cover essential out-of-pocket medical services expenses not included in Original Medicare, significantly reducing healthcare costs and offering financial peace of mind.

Evaluating overall costs, including premiums, deductibles, and additional service fees, is vital when selecting a Medicare Supplement plan.

Monthly Premiums

Monthly premiums for Medigap plans can vary significantly based on the selected plan and the insurance provider. For instance, Plan N has lower monthly premiums compared to Plan G but requires cost-sharing for certain services like doctor visits.

Beneficiaries choosing Plan N should be prepared for potential out-of-pocket costs on specific services despite the lower monthly premiums. Weigh the benefits and drawbacks of each plan to determine which offers the best value for your healthcare needs.

Out-of-Pocket Costs

Out-of-pocket costs significantly impact Medicare beneficiaries’ decisions. Medicare Part B charges a 20% coinsurance after the deductible is met, directly affecting overall out-of-pocket expenses for beneficiaries. A $2,000 annual cap on out-of-pocket spending for prescription drugs provides some financial protection against high expenses.

Plan N is favored for its lower monthly premiums and fixed copayments, making it popular for those seeking affordable coverage. Beneficiaries pay a $20 copay for doctor’s office visits and $50 for emergency room visits after meeting their deductible, helping manage out-of-pocket costs.

Factors Influencing Costs

Age, location, and health status influence the costs of Medicare Supplement Plans. Monthly premiums for Medigap plans can vary widely based on the specific plan and the provider.

These factors create diverse pricing options, making it essential for beneficiaries to compare plans and providers carefully. Understanding the elements that affect costs helps beneficiaries make informed decisions about their healthcare coverage.

Benefits of Choosing a Medicare Supplement Plan

Choosing a Medicare Supplement Plan offers comprehensive coverage for out-of-pocket costs compared to Medicare Advantage Plans. These plans cover additional healthcare expenses not paid by Medicare, providing greater financial security.

For those who value flexibility in choosing healthcare providers, Medicare Supplement Plans are appealing due to their lack of network limitations. Unlike Medicare Advantage Plans, which often require prior authorization for certain services, most Supplement Plans do not have these restrictions.

Coverage for Out-of-Pocket Expenses

Medigap plans cover various out-of-pocket expenses like deductibles and coinsurance that Original Medicare does not fully cover. These plans often cover costs like Medicare Part A and B deductibles, coinsurance, and copayments, minimizing unexpected financial burdens.

By covering these expenses, Medigap plans provide peace of mind and financial stability, ensuring healthcare costs do not become overwhelming.

Freedom to Choose Providers

A significant advantage of Medicare Supplement Plans is the freedom to choose any healthcare provider that accepts Medicare, including medicare providers. This flexibility means beneficiaries are not restricted to a specific network of doctors or hospitals, often a limitation with Medicare Advantage Plans.

With Medicare Supplement insurance, beneficiaries can select preferred doctors and hospitals without needing referrals to see specialists. This aspect of Medigap plans ensures access to trusted providers, enhancing overall healthcare experience.

No Network Restrictions

Medigap plans do not impose network limitations, allowing members to seek care from any provider that accepts Medicare. This freedom ensures access to a wider selection of medical providers, beneficial for those requiring specialized care.

Many Medicare Advantage plans impose network restrictions, limiting access to a small number of providers. The absence of such restrictions with Medigap plans offers significant advantages, giving beneficiaries greater control over healthcare choices.

Important Considerations When Selecting a Plan

Several important considerations must be taken into account when selecting a Medicare Supplement Plan. Factors such as age, gender, location, and health status influence the costs of these plans. Insurers may use different rating structures to determine premiums, including community-rated, issue-age-rated, and attained-age-rated methods.

Choosing the right plan can enhance financial security by covering additional healthcare costs not included in Original Medicare and health insurance. Location plays a crucial role in determining premiums, with variations across different states. Carefully evaluating these factors will help beneficiaries make informed decisions about their healthcare coverage.

Compare 2026 Plans & Rates

Enter Zip Code

Summary

In summary, understanding Medicare Supplement Plans in Alabama for 2026 is crucial for making informed healthcare decisions. Key changes, such as the cap on out-of-pocket drug costs and the elimination of the coverage gap, will significantly impact beneficiaries. Top plan options like Plan G, Plan N, and High-Deductible Plan F offer various benefits and cost structures to suit different needs.

By considering eligibility requirements, comparing Medigap and Medicare Advantage Plans, and understanding the enrollment process, beneficiaries can choose the right plan for their needs. The comprehensive coverage, flexibility in provider choice, and lack of network restrictions make Medigap plans a valuable option for many.

Frequently Asked Questions

Can I enroll in both a Medigap plan and a Medicare Advantage plan simultaneously?

You cannot enroll in both a Medigap plan and a Medicare Advantage plan simultaneously, as they are mutually exclusive. This means you must choose one to maintain your Medicare coverage effectively.

What is the new out-of-pocket spending cap for prescription drugs starting in 2025?

Starting in 2025, Medicare will implement a $2,000 cap on out-of-pocket spending for prescription drugs, providing financial relief for beneficiaries.

What are the key differences between Medigap and Medicare Advantage Plans?

The key difference is that Medigap plans offer flexibility with any Medicare-accepting doctor but lack prescription drug coverage, while Medicare Advantage Plans typically include drug coverage and may have network restrictions.

When is the open enrollment period for Medicare Supplement Plans?

The open enrollment period for Medicare Supplement Plans is the first six months after your Medicare Part B coverage begins. It’s important to take advantage of this time to secure the best options available.

What should I consider when selecting a Medicare Supplement Plan?

When selecting a Medicare Supplement Plan, prioritize costs, the financial stability of the provider, and the need to compare various plans to ensure you make an informed choice.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Alabama 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.