by Russell Noga | Updated May 28th, 2025

If you’re searching for information on Medicare Supplement Plans Maine 2026, you’re in the right place. This guide will cover the available Medigap plans, how to enroll, and the factors that can affect your premiums. We aim to help you find the best plan for your healthcare needs.

Key Takeaways

- Medicare Supplement Plans in Maine, or Medigap, help cover out-of-pocket costs from Original Medicare, providing financial predictability and the flexibility to choose any Medicare-accepting healthcare provider.

- Enrollment in Medigap plans has a crucial six-month window starting when an individual turns 65 and enrolls in Medicare Part B, during which they have guaranteed issue rights.

- Popular Medigap options in Maine include Plan F, G, and N, with Plan G gaining traction for its comprehensive benefits and lower premiums compared to Plan F.

Compare 2026 Plans & Rates

Enter Zip Code

Overview of Medicare Supplement Plans in Maine 2026

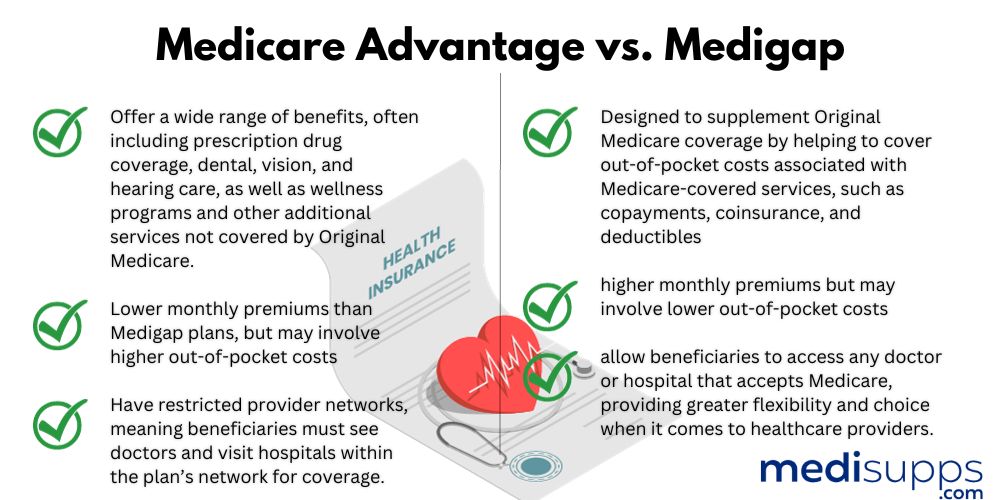

Medicare Supplement Plans, commonly known as Medigap, are designed to help cover additional out-of-pocket costs associated with Original Medicare. These plans supplement Original Medicare by covering expenses not paid by Medicare Parts A and B, such as copayments, coinsurance, and deductibles. For Maine residents, this means fewer unexpected healthcare costs and greater financial predictability.

In Maine, Medigap policies are regulated by the Bureau of Insurance, ensuring consistency and reliability across different carriers. One of the significant advantages of Medicare Supplement Plans is the ability to choose any doctor or hospital that accepts Medicare patients, providing more flexibility compared to Medicare Advantage Plans.

Additionally, the benefits of these plans are standardized, meaning they offer the same coverage regardless of the insurance provider. This uniformity makes it easier for beneficiaries to compare plans and select the one that best meets their needs.

Enrollment in Medicare Supplement Plans in Maine 2026

Enrolling in a Medicare Supplement Plan in Maine begins with a six-month period starting from the first day of the month you turn 65, provided you have enrolled in Medicare Part B. This initial enrollment window is crucial because it offers guaranteed issue rights, meaning you can enroll in any Medigap plan without being denied coverage or charged higher premiums due to pre-existing conditions. To sign up for Medicare, you can apply online, by phone, or in person at a Social Security office. Remember to have documents like proof of birth and health insurance information ready when enrolling.

For those who need assistance, the Maine State Health Insurance Assistance Program (SHIP) offers free and confidential help to Medicare beneficiaries. SHIP counselors provide support for understanding benefits and enrolling in Medicare, Medicare Advantage, and Medigap plans without selling insurance or recommending specific policies.

Missing the initial enrollment period can lead to delayed coverage and potential penalties, so timely enrollment is essential.

Popular Medigap Plans in Maine

In Maine, several Medigap plans have emerged as popular choices among beneficiaries.

Here are the top picks:

- Plan F: This plan has a strong preference among Maine residents with 42,879 enrollees, making it the most popular Medigap plan in the state.

- Plan G: While still a solid option, it is being surpassed in popularity by Plan N among new applicants.

- Plan N: This plan is gaining traction and is becoming increasingly popular among new applicants.

Each plan offers unique benefits that cater to different needs.

The following subsections will delve deeper into each of these plans, exploring their specific benefits, costs, and why they might be the right choice for you.

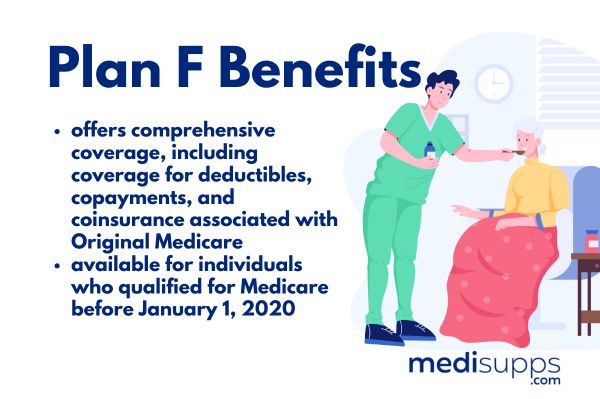

Plan F

Plan F has historically been the most popular Medigap plan due to its comprehensive coverage, including all expenses, extra charges, and temporary nursing home stays. This plan is ideal for those who prefer the security of knowing that virtually all their healthcare costs will be covered.

However, due to recent legislation, Plan F is no longer available to new enrollees after January 1, 2020. Only those who were already enrolled before this date can continue to apply for Plan F in Maine.

For those who missed the enrollment window, Plan F and Plan C are no longer accessible. Despite this, Plan F remains a popular choice for those who were already enrolled, thanks to its extensive benefits and the peace of mind it provides.

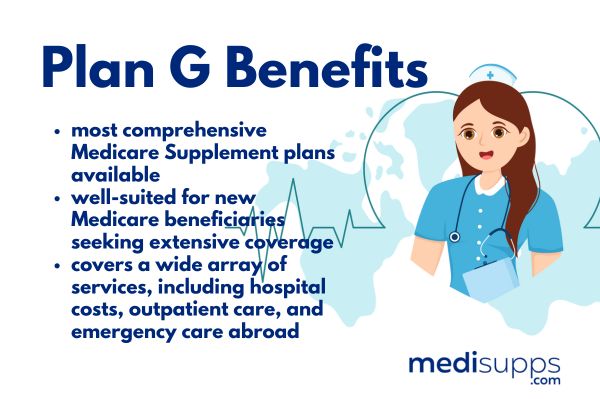

Plan G

Plan G is quickly becoming a favorite among Medicare beneficiaries due to its comprehensive benefits and cost-effectiveness. It covers all the same benefits as Plan F, except for the Medicare Part B deductible. This makes Plan G an attractive option for those who missed the enrollment window for Plan F.

Additionally, Plan G typically has a lower monthly premium compared to Plan F, making it a more affordable option while still providing extensive coverage. Its growing popularity is a testament to its value and the comprehensive protection it offers against unexpected healthcare costs.

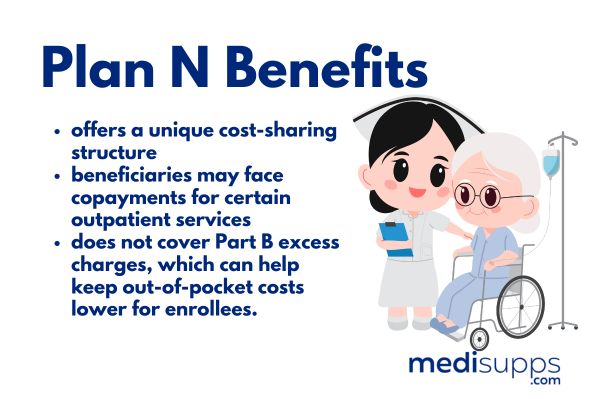

Plan N

Plan N is another excellent option for Medicare beneficiaries in Maine, especially those looking for a balance between comprehensive coverage and affordable premiums. Plan N covers many of the same benefits as Plan G but requires copayments for some services, such as office visits and emergency room visits that do not result in inpatient admission.

For a 65-year-old woman in Maine, Plan N generally has lower premiums compared to Plan F and Plan G, making it an attractive choice for those who are relatively healthy and do not mind paying small copayments in exchange for lower monthly premiums.

Compare Medicare Plans & Rates in Your Area

Factors Affecting Premiums

Several factors can influence the premiums for Medicare Supplement Plans in Maine 2026. These include gender, location, and tobacco use. For instance, premiums can significantly vary depending on whether the beneficiary is male or female, with different rates often applied based on gender.

Location also plays a critical role, as premiums can differ from one area to another within Maine. Additionally, tobacco use is another factor that can lead to higher premiums; those who use tobacco products may face increased costs compared to non-users.

Cost Comparison by Plan

When comparing the costs of different Medigap plans in Maine, it becomes clear that Plan F, Plan G, and Plan N offer varying levels of affordability and coverage. For a 65-year-old female beneficiary, Plan F has the highest premium cost but offers the most comprehensive coverage.

On the other hand, Plan G tends to be the most affordable option, providing extensive benefits at a lower premium compared to Plan F. Plan N, while slightly less comprehensive, offers even lower premiums, making it a cost-effective choice for those willing to pay for some services out-of-pocket.

Affordable Options

For those seeking budget-friendly Medigap plans in Maine, there are several competitive options available. Insurance providers like Anthem and USAA Life are known for offering Medigap plans with premiums below the average market rate.

These cost-effective Medicare Supplement Plans help reduce out-of-pocket expenses for beneficiaries, providing substantial savings on healthcare costs. Exploring these affordable options can lead to significant financial relief, especially for those on a fixed income, particularly when considering Medicare supplement insurance plans.

Medigap vs. Medicare Advantage Plans in Maine

Choosing between Medigap and Medicare Advantage Plans can be challenging, but understanding their differences can help make the decision easier. Medigap plans allow beneficiaries to see any doctor or hospital that accepts Medicare, offering greater flexibility compared to Medicare Advantage Plans, which often have network restrictions.

Medicare Advantage Plans may include additional services like vision and dental care, which are not covered by Original Medicare. However, Medigap plans can cover foreign travel emergencies, typically paying 80% of allowable expenses for medically necessary care outside the U.S.

While Medicare Advantage Plans may seem more cost-effective due to lower or no premiums, switching back to Original Medicare can be complicated and may limit access to Medigap policies without medical underwriting.

Additional Benefits of Medicare Supplement Plans 2026

Medicare Supplement Plans offer several additional benefits that enhance Medicare coverage. For example, some Medigap plans include coverage for Medicare Part B excess charges, ensuring beneficiaries do not have to pay out-of-pocket for costs above Medicare-approved amounts.

Certain Medigap insurers may also offer additional benefits such as coverage for routine cancer screenings, diabetic equipment, and immunizations, which go beyond standard Medicare coverage. These benefits provide added security and peace of mind for beneficiaries, ensuring they receive comprehensive care without unexpected expenses.

How to Choose the Right Medigap Plan in Maine

Selecting the right Medigap plan in Maine involves assessing your specific health needs and financial situation. It’s essential to consider factors such as your current health status, frequency of doctor visits, and any ongoing medical conditions.

Comparing premium rates and benefits from different providers can also help you find the best value. Look for plans that offer the coverage you need at a price you can afford. Consulting with a SHIP counselor or using resources like Medicare.gov can provide valuable guidance during this process.

Resources for Medicare Beneficiaries in Maine 2026

Maine offers several resources to assist Medicare beneficiaries. The Bureau of Insurance regulates Medigap plans, ensuring they meet state standards. Websites like Healthcare.gov and Medicare.gov provide comprehensive information on health insurance options and Medicare services, respectively.

Additionally, the Senior Medicare Patrol (SMP) educates beneficiaries on recognizing and reporting errors, fraud, and abuse in Medicare and MaineCare. Financial assistance programs such as long-term care coverage and Medicare Savings Programs are also available to help manage healthcare costs.

For those with standalone Part D plans, there are over 106,000 beneficiaries in Maine benefiting from this coverage.

Compare 2024 Plans & Rates

Enter Zip Code

Summary

Navigating Medicare Supplement Plans in Maine can seem daunting, but understanding the available options can provide significant benefits. Key takeaways include the importance of enrolling during the initial open enrollment period, the comprehensive coverage offered by popular plans like Plan F, G, and N, and the factors affecting premiums.

By exploring affordable options and utilizing available resources, beneficiaries can find a Medigap plan that meets their needs and budget. Ultimately, the right Medigap plan can offer peace of mind and financial security, ensuring you receive the care you need without unexpected costs.

Frequently Asked Questions

What are Medicare Supplement Plans?

Medicare Supplement Plans, or Medigap, are designed to cover out-of-pocket expenses like copayments, coinsurance, and deductibles that Original Medicare does not fully pay. This helps ensure you have more comprehensive financial protection for your healthcare needs.

When can I enroll in a Medicare Supplement Plan in Maine?

You can enroll in a Medicare Supplement Plan in Maine during a six-month period that begins on the first day of the month in which you turn 65, as long as you are enrolled in Medicare Part B.

What are the most popular Medigap plans in Maine?

The most popular Medigap plans in Maine are Plan F, Plan G, and Plan N. These plans are highly favored due to their comprehensive coverage options.

What factors affect the premiums of Medigap plans in Maine?

The premiums for Medigap plans in Maine are influenced by factors including gender, location, and tobacco use. Understanding these variables can help you anticipate and manage your healthcare costs more effectively.

How do Medigap plans differ from Medicare Advantage Plans?

Medigap plans offer flexibility in choosing providers without network restrictions, whereas Medicare Advantage Plans often have specific networks and may include additional services such as vision and dental care. Consequently, your choice should depend on your healthcare needs and preferences for provider access.

Speak to the Professionals about Medigap Plans and Original Medicare

If you find understanding the benefits involved with Original Medicare and Medigap Plans challenging, you’re not alone. Whether it’s a Medigap plan, or you want to know more about the Medicare Supplement Plans Maine 2026, we can help. Call our team at 1-888-891-0229 for a free consultation or complete the contact form on this site, and an expert will call you back at a convenient time.

We have decades of experience advising our clients on the complexities of Medicare and Medigap plans, the benefits, costs and deductibles. We’ll ensure you get the best rate in your state and advice you can trust.